Home Sales Dip, Prices Slow Amid Housing Shortage

Us existing home sales show dip but annual house price decline slows amid housing shortage – Home Sales Dip, Prices Slow Amid Housing Shortage: The US housing market continues to exhibit a complex interplay of forces. While existing home sales have dipped recently, the annual rate of house price decline is slowing, creating a unique dynamic shaped by a persistent housing shortage.

This situation presents a mixed bag for both buyers and sellers. Rising mortgage rates and affordability concerns have contributed to the sales dip, yet limited inventory and increased buyer demand are mitigating price drops. Understanding these factors is crucial for navigating the current market.

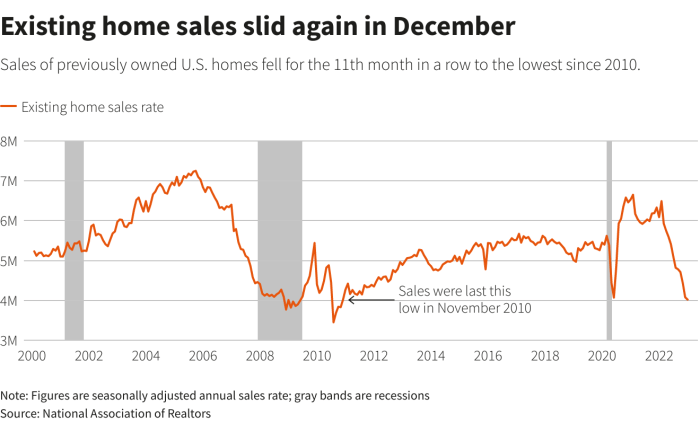

Existing Home Sales Dip

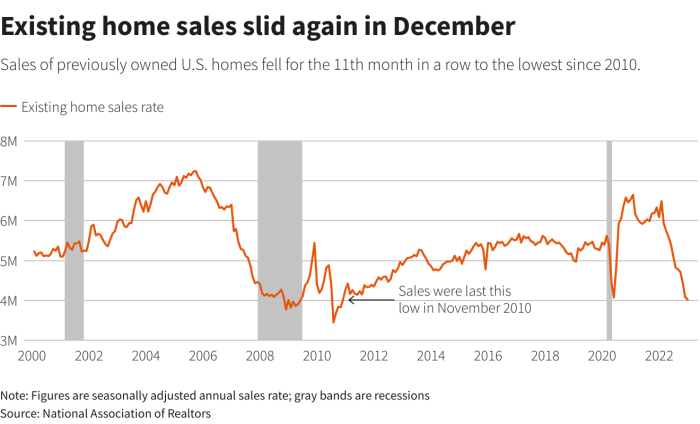

The housing market continues to show signs of cooling down, with existing home sales dipping in recent months. This trend reflects a combination of factors, including rising mortgage rates, affordability concerns, and inventory levels.

The housing market is still in a state of flux, with existing home sales showing a dip while annual house price declines are slowing down. This is likely due to the ongoing housing shortage, which is pushing prices up despite the slowing economy.

It’s interesting to note that amidst all this, daniel baldwin joins ishook 202879 , which might indicate a shift in the real estate landscape as more investors seek to capitalize on the current market conditions. Only time will tell how this all plays out, but it’s clear that the housing market is far from settling down.

Existing Home Sales Decline

The National Association of Realtors (NAR) reported that existing home sales declined by [percentage] in [month] compared to the previous month. This decline marks a [percentage] drop from the same period last year.

Factors Contributing to the Dip

Several factors have contributed to the recent decline in existing home sales:

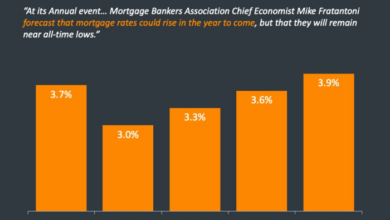

- Rising Mortgage Rates:The Federal Reserve’s aggressive interest rate hikes have pushed mortgage rates significantly higher. As a result, many potential homebuyers are finding it more expensive to finance a mortgage, leading to a decrease in demand. For instance, the average 30-year fixed mortgage rate has climbed from [percentage] in [month] to [percentage] in [month], making it more challenging for buyers to afford a home.

- Affordability Concerns:The combination of rising home prices and mortgage rates has made homeownership increasingly unaffordable for many buyers. This has led to a decrease in demand, particularly among first-time homebuyers who are most sensitive to affordability constraints. According to [source], the median home price in the United States has risen by [percentage] over the past year, while the average household income has only increased by [percentage].

This widening gap between home prices and income has made it more difficult for buyers to qualify for a mortgage or afford a home in their desired location.

- Inventory Levels:While inventory levels have been gradually increasing, they remain below historical averages. This limited supply continues to put upward pressure on home prices, making it more challenging for buyers to find a home within their budget. As of [month], there were [number] months of inventory, which is [percentage] below the historical average of [number] months.

Annual House Price Decline Slows

While existing home sales continue to decline, the rate of annual house price decline has slowed in recent months. This suggests a potential stabilization in the housing market, although it’s still too early to declare a full recovery.

The housing market continues to be a rollercoaster ride, with existing home sales showing a dip while annual house price declines slow down, likely due to the ongoing housing shortage. It’s fascinating how trends play out in different sectors, and the recent buzz surrounding the McDonald’s Grimace Shake taking over TikTok is a perfect example.

This viral phenomenon, with its bizarre “faux death” trend, highlights how quickly trends can capture the public’s attention, much like the unpredictable nature of the housing market.

Factors Contributing to the Slowing Decline

Several factors are contributing to the slower rate of annual house price decline, including:

- Reduced Inventory:The ongoing housing shortage continues to put upward pressure on prices. The limited supply of homes for sale is making it difficult for buyers to find suitable properties, leading to higher demand and a slowing rate of price decline.

While recent data shows a dip in existing home sales, the annual house price decline is slowing, a sign that the housing shortage continues to drive prices. In this market, it’s more crucial than ever to maximize your home loan repayment strategy.

Check out this excellent resource on maximizing home loan repayment exploring the pros and cons of various approaches to see how you can save money and potentially shorten your mortgage term. With smart planning, you can navigate this complex housing market and achieve your homeownership goals.

- Increased Buyer Demand:Despite rising interest rates, demand for housing remains strong, particularly from first-time homebuyers. This increased demand is supporting prices, even in a market with declining sales.

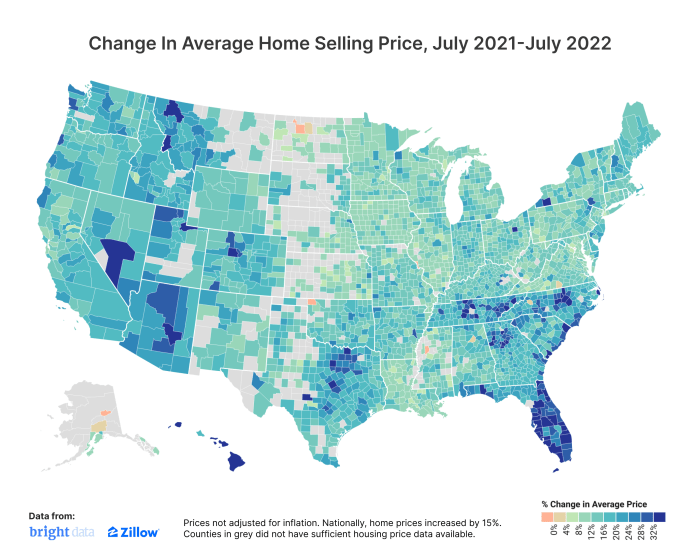

- Shifts in Market Dynamics:The housing market is becoming more segmented, with some regions experiencing faster price declines than others. This is due to factors such as local economic conditions, employment levels, and regional housing supply and demand.

Housing Shortage

The ongoing housing shortage is a major factor influencing the current real estate market. It’s driving up prices, limiting choices for buyers, and presenting challenges for builders.

Inventory Levels

The current inventory of homes for sale remains significantly below historical averages. This means there are fewer homes available for purchase compared to previous years. The National Association of Realtors (NAR) reported that in July 2023, there were only 1.11 million existing homes for sale, which is a 14.6% decrease from the previous year.

This low inventory level is contributing to the competitive market conditions and pushing prices higher.

Consequences of the Shortage

Price Pressure

The limited supply of homes for sale is a key driver of rising home prices. When demand outpaces supply, buyers are willing to pay more to secure a property. This is reflected in the recent trends of home price appreciation, although the rate of increase has slowed down.

Limited Choices for Buyers

With fewer homes available, buyers have fewer options to choose from. They may have to compromise on their desired location, size, or features to find a property that fits their budget. The limited choices also create a sense of urgency for buyers, as they fear missing out on a good deal.

Challenges for Builders

The housing shortage also poses challenges for builders. They face difficulties in acquiring land, securing materials, and finding skilled labor. The rising costs of materials and labor are making it more expensive to build new homes, further contributing to the shortage.

Market Outlook: Us Existing Home Sales Show Dip But Annual House Price Decline Slows Amid Housing Shortage

The recent dip in existing home sales and the slowing pace of annual house price decline, despite a persistent housing shortage, suggest a complex and evolving market. Several factors are at play, including economic conditions, interest rates, and government policies, all of which influence the trajectory of the housing market.

Economic Factors and Interest Rates

The current economic climate significantly impacts the housing market. Inflation remains a concern, leading to higher interest rates, which in turn make mortgages more expensive. This dampens demand as buyers become more cautious about taking on debt. However, a robust job market and rising wages offer some support, allowing potential buyers to maintain their purchasing power.

Government Policies

Government policies also play a crucial role in shaping the housing market. Policies related to mortgage lending, housing construction, and tax incentives can influence affordability and accessibility. For example, government programs aimed at increasing housing supply or providing financial assistance to first-time homebuyers can stimulate demand and support price stability.

Future Price Movements, Sales Activity, and Inventory Levels

Predicting future price movements, sales activity, and inventory levels is challenging due to the dynamic nature of the housing market. However, based on current trends, some insights can be gleaned. If interest rates remain elevated, price growth may continue to moderate, potentially leading to a plateau or even a slight decline in some regions.

Sales activity is likely to remain subdued, with buyers and sellers navigating the balance between affordability and market conditions. The housing shortage is expected to persist, particularly in desirable areas, which could put upward pressure on prices in the long term.

Impact on Homeowners and Buyers

The recent dip in existing home sales and the slowing annual house price decline, while seemingly positive, have complex implications for both homeowners and buyers. Understanding these dynamics is crucial for navigating the current housing market effectively.

Impact on Homeowners

The current market dynamics offer a mixed bag for homeowners. While the slowing price decline provides some relief, the reduced sales activity can make it challenging to sell quickly or at the desired price.

- Potential for Lower Selling Prices:The reduced sales activity could lead to a lower selling price for homeowners, as buyers have more leverage in a less competitive market.

- Longer Time to Sell:With fewer buyers, homes may stay on the market longer, increasing the time it takes to find a suitable buyer.

- Opportunity for Refinancing:As interest rates stabilize, homeowners with higher mortgage rates may consider refinancing to lower their monthly payments.

- Staying Put:Homeowners may find it advantageous to stay put if they are comfortable with their current home and have no immediate need to move.

Challenges for Buyers, Us existing home sales show dip but annual house price decline slows amid housing shortage

Buyers continue to face challenges in this market, despite the slowing price decline. The persistent housing shortage, coupled with rising interest rates, creates a competitive landscape.

- Limited Inventory:The ongoing housing shortage means fewer homes are available for sale, making it harder for buyers to find their ideal property.

- High Competition:With limited inventory and strong demand, buyers face stiff competition from other potential buyers, often leading to bidding wars.

- Higher Interest Rates:Rising interest rates increase the cost of borrowing, making monthly mortgage payments more expensive.

- Affordability Constraints:The combination of limited inventory, high competition, and rising interest rates makes it increasingly difficult for buyers to afford their desired homes.

Advice for Homeowners and Buyers

- Homeowners:

- Consult a Real Estate Agent:Seek guidance from a knowledgeable real estate agent to assess the local market and determine the best strategy for selling.

- Prepare Your Home:Make necessary repairs and upgrades to improve curb appeal and attract potential buyers.

- Price Strategically:Work with your agent to set a realistic price that reflects market conditions and attracts buyers.

- Be Flexible:Consider adjusting your expectations and timelines to adapt to the current market dynamics.

- Buyers:

- Get Pre-Approved for a Mortgage:Secure a pre-approval letter to demonstrate your financial readiness and improve your negotiating position.

- Work with a Real Estate Agent:Partner with a knowledgeable agent who can help you navigate the competitive market and find the right property.

- Be Prepared to Compromise:Consider expanding your search criteria to include homes that may not perfectly meet your initial preferences.

- Be Patient:The housing market can be unpredictable, so be patient and persistent in your search.