Stock Market Cautious: Tesla, Netflix Earnings, Goldman Sachs in Focus

Stock market remains cautious as tesla and netflix earnings awaited goldman sachs in the spotlight – Stock Market Cautious: Tesla, Netflix Earnings, Goldman Sachs in Focus – The stock market is exhibiting a cautious mood, a reflection of the current economic landscape. Investors are navigating a complex environment characterized by lingering inflation, economic uncertainty, and geopolitical tensions.

This cautious sentiment is evident in recent market activity, with investors taking a more measured approach to their portfolios.

Adding to the mix are upcoming earnings reports from tech giants Tesla and Netflix, which are expected to provide insights into the health of the consumer sector and the broader technology industry. Meanwhile, Goldman Sachs is under the spotlight, with its recent performance and strategic direction closely watched by market participants.

Market Sentiment and Cautiousness

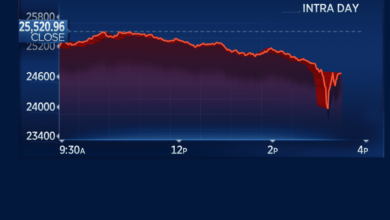

The stock market is currently exhibiting a cautious sentiment, with investors hesitant to make large bets due to a confluence of factors weighing on their minds. This cautiousness is reflected in the subdued trading volumes and the relatively narrow range of price movements in major indices.

Recent Market Activity Reflecting Cautious Sentiment

The cautious market mood is evident in recent market activity. For instance, the S&P 500, a broad measure of U.S. stock market performance, has been trading in a relatively narrow range for the past few months, indicating a lack of strong directional momentum.

The stock market remained cautious, with investors eagerly awaiting earnings reports from Tesla and Netflix, while Goldman Sachs was in the spotlight. However, a surprise boost to the US economy, with surprise job gains in April, adding 253,000 jobs and dropping the unemployment rate to 3.4% , may inject some optimism into the market.

The strong jobs data could signal a resilient economy, potentially offsetting concerns about inflation and interest rate hikes, and providing a much-needed positive note as investors analyze the earnings reports.

Additionally, the volatility index, also known as the VIX, which measures market fear, has been hovering at elevated levels, suggesting that investors are anticipating potential market turbulence.

Factors Contributing to the Cautious Market Mood

Several factors are contributing to the cautious market mood, including:

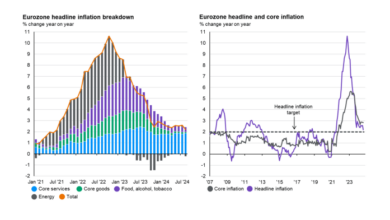

- Economic Uncertainty:The global economy is facing a number of challenges, including rising inflation, supply chain disruptions, and the ongoing war in Ukraine. These factors are creating uncertainty about the future trajectory of economic growth, making investors hesitant to commit significant capital.

- Inflation:Inflation has been running at multi-decade highs in many countries, eroding consumer purchasing power and putting pressure on businesses to raise prices. This has led to concerns about a potential recession, as rising prices can lead to a decline in consumer spending.

- Geopolitical Tensions:The war in Ukraine has heightened geopolitical tensions and created uncertainty about the global political landscape. This uncertainty can make investors nervous about the stability of the global economy and the potential for disruptions to supply chains and trade.

Anticipation of Tesla and Netflix Earnings

The stock market is poised for a week of heightened volatility, with investors eagerly awaiting earnings reports from two of the most closely watched companies: Tesla and Netflix. These reports are expected to provide valuable insights into the performance of these industry giants and their outlook for the future.

The market will be closely scrutinizing these reports for clues about the health of the electric vehicle and streaming industries, as well as the broader economy.

Key Metrics to Watch for in Tesla Earnings

Investors will be keenly focused on several key metrics in Tesla’s earnings report. These include:

- Vehicle Deliveries:Tesla’s ability to maintain its rapid growth in vehicle deliveries will be a key focus. Investors will be looking for evidence that Tesla is able to overcome supply chain challenges and continue to ramp up production. A significant increase in deliveries would likely be viewed positively by the market, while a slowdown could lead to concerns about the company’s growth prospects.

- Revenue and Profitability:Tesla’s revenue and profitability are also crucial metrics. Investors will be looking for evidence that the company is able to maintain its strong revenue growth and improve profitability. The company has faced increasing pressure on its margins due to rising raw material costs and competition.

The stock market remained cautious as investors braced for the earnings reports from Tesla and Netflix, while Goldman Sachs held the spotlight. Amidst the market’s uncertainty, Vitalik Buterin, the co-founder of Ethereum, offered his insights on the future of cryptocurrencies on Bloomberg Studio 10, bloombergs studio 10 ethereum co founder vitalik buterin.

His comments provided a glimmer of hope for the digital asset sector, potentially influencing investor sentiment as they weighed the potential impact of the upcoming earnings releases on the broader market.

A positive surprise in revenue and profitability would likely boost investor confidence in Tesla’s ability to navigate the current economic environment.

- Operating Expenses:Tesla’s operating expenses are also a key focus. Investors will be looking for evidence that the company is effectively managing its expenses and achieving cost efficiencies. A reduction in operating expenses would be seen as a positive sign, indicating that Tesla is committed to improving its profitability.

The stock market remains cautious as Tesla and Netflix earnings loom, with Goldman Sachs also in the spotlight. Adding to the uncertainty, the latest ISM survey revealed sluggish growth in the US services sector, coupled with record low prices paid, suggesting a softening economy.

Read more about the ISM survey insights here. This data reinforces the cautious sentiment, making investors even more eager to see how the big tech earnings play out.

- Guidance:Tesla’s guidance for the upcoming quarter will be closely watched. Investors will be looking for clues about the company’s outlook for the future, including its expectations for vehicle deliveries, revenue, and profitability. Positive guidance would likely be seen as a bullish sign, while negative guidance could lead to concerns about the company’s future prospects.

Key Metrics to Watch for in Netflix Earnings

Netflix’s earnings report is expected to provide insights into the company’s subscriber growth, revenue, and profitability. Here are some key metrics to watch for:

- Subscriber Growth:Netflix’s subscriber growth has slowed in recent quarters, leading to concerns about the company’s ability to attract and retain new subscribers. Investors will be looking for evidence that Netflix is able to reignite subscriber growth and stem the tide of churn.

A significant increase in subscriber growth would likely be viewed positively by the market, while a decline could lead to concerns about the company’s long-term growth prospects.

- Revenue and Profitability:Netflix’s revenue and profitability are also crucial metrics. Investors will be looking for evidence that the company is able to maintain its strong revenue growth and improve profitability. The company has faced increasing competition from other streaming services, which has put pressure on its margins.

A positive surprise in revenue and profitability would likely boost investor confidence in Netflix’s ability to compete in the increasingly crowded streaming market.

- Content Spending:Netflix’s content spending is also a key focus. Investors will be looking for evidence that the company is effectively allocating its content budget and producing high-quality programming that attracts subscribers. A reduction in content spending could be seen as a sign that Netflix is struggling to compete, while an increase in spending could be seen as a sign that the company is confident in its ability to grow its subscriber base.

- Guidance:Netflix’s guidance for the upcoming quarter will be closely watched. Investors will be looking for clues about the company’s outlook for the future, including its expectations for subscriber growth, revenue, and profitability. Positive guidance would likely be seen as a bullish sign, while negative guidance could lead to concerns about the company’s future prospects.

Goldman Sachs in the Spotlight

Goldman Sachs, a Wall Street behemoth, has been thrust into the spotlight amidst a backdrop of market uncertainty. The firm’s recent performance, coupled with its influence within the financial sector, has ignited a wave of speculation regarding its impact on the broader market’s direction.

Goldman Sachs’ Recent Performance and Market Impact

Goldman Sachs’ recent performance has been a mixed bag. While the firm has reported strong earnings in recent quarters, its stock price has lagged behind its peers. This discrepancy can be attributed to a confluence of factors, including concerns about the firm’s exposure to volatile markets and its slowing investment banking business.

Gold’s Role in a Cautious Market

As investors navigate a landscape marked by uncertainty, the allure of gold as a safe-haven asset resurfaces. Gold’s historical performance during times of market volatility has solidified its reputation as a portfolio diversifier.

Gold’s Traditional Role as a Safe Haven

Gold’s traditional role as a safe-haven asset stems from its inherent characteristics. It’s a non-yielding, non-perishable, and readily tradable asset, making it a reliable store of value during economic turmoil. When investors fear inflation, rising interest rates, or geopolitical instability, they often seek refuge in gold, anticipating its ability to preserve wealth.

Current Demand for Gold, Stock market remains cautious as tesla and netflix earnings awaited goldman sachs in the spotlight

The current demand for gold is influenced by a confluence of factors. Inflationary pressures, driven by supply chain disruptions and increased government spending, are prompting investors to seek hedges against eroding purchasing power. Furthermore, geopolitical tensions, particularly the ongoing conflict in Ukraine, are fueling demand for safe-haven assets.

Gold’s Performance Compared to Other Asset Classes

Gold’s performance in a cautious market environment often contrasts with other asset classes. While stocks and bonds may experience volatility during periods of uncertainty, gold’s price tends to hold its value or even rise, providing a degree of stability to portfolios.

For example, during the 2008 financial crisis, the S&P 500 index plummeted by over 50%, while gold prices surged by over 20%.

Investor Strategies in a Cautious Market: Stock Market Remains Cautious As Tesla And Netflix Earnings Awaited Goldman Sachs In The Spotlight

A cautious market environment often calls for a more conservative investment approach. This means focusing on strategies that aim to preserve capital while seeking modest but steady returns.

Strategies for Navigating a Cautious Market

Investors can adopt several strategies to navigate a cautious market. These strategies vary in their risk profiles and potential returns, catering to different investor needs and preferences.

| Strategy | Risk Tolerance | Potential Returns |

|---|---|---|

| Cash and Equivalents | Low | Low |

| Fixed Income Securities | Moderate | Moderate |

| Defensive Stocks | Moderate | Moderate |

| Value Investing | Moderate to High | Moderate to High |

| Diversification | Low to Moderate | Moderate |

Comparing and Contrasting Investment Approaches

Understanding the pros and cons of different investment approaches is crucial for making informed decisions in a cautious market.

| Investment Approach | Risk Tolerance | Potential Returns | Pros | Cons |

|---|---|---|---|---|

| Passive Investing | Low | Moderate | Low cost, simplicity, diversification | Limited potential for outperformance |

| Active Investing | Moderate to High | High | Potential for higher returns, customized portfolios | Higher costs, risk of underperformance |

| Value Investing | Moderate to High | Moderate to High | Focus on undervalued assets, potential for long-term growth | Requires in-depth research and patience |

| Growth Investing | High | High | Potential for significant returns, focus on innovation | Higher risk, volatility, potential for bubbles |

Pros and Cons of Different Investment Strategies

A cautious market environment presents both challenges and opportunities for investors. Understanding the pros and cons of different strategies can help investors make informed decisions.