Gold Surges as ECB Turns Dovish, Bond Yields Retreat

Gold surges on dovish ecb comments bond yield retreat – Gold Surges as ECB Turns Dovish, Bond Yields Retreat: The precious metal has seen a recent surge, driven by a combination of factors including the European Central Bank’s (ECB) dovish stance and a retreat in bond yields. This unexpected shift in the market has caught the attention of investors, leading to a renewed interest in gold as a safe haven asset.

The ECB’s decision to maintain its accommodative monetary policy, despite rising inflation, has sent a clear signal that interest rates are unlikely to rise in the near future. This has fueled speculation that the Eurozone economy may be headed for a period of slower growth, a scenario that often leads investors to seek the safety of gold.

Gold’s Price Surge: Gold Surges On Dovish Ecb Comments Bond Yield Retreat

The recent surge in gold prices has been driven by a confluence of factors, including a dovish stance from the European Central Bank (ECB) and a retreat in bond yields. The ECB’s comments, signaling a potential pause in interest rate hikes, have fueled expectations of looser monetary policy, which historically has been supportive of gold prices.

The Impact of Dovish ECB Comments

The ECB’s dovish comments have had a significant impact on gold prices, as investors seek safe-haven assets amidst uncertainty about the economic outlook. Gold is often seen as a safe-haven asset during times of economic instability or geopolitical tensions. When interest rates are lower, the opportunity cost of holding gold, which does not generate interest income, is reduced, making it more attractive to investors.

Historical Comparison of Gold Price Movements, Gold surges on dovish ecb comments bond yield retreat

Historically, gold prices have tended to rise following similar dovish announcements from the ECB. For example, in 2019, when the ECB announced a more accommodative monetary policy stance, gold prices surged by over 15% within a few months. The current surge in gold prices is consistent with this historical pattern.

ECB’s Dovish Stance

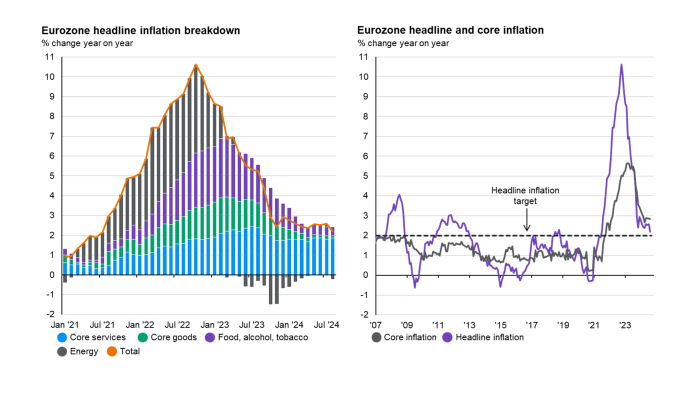

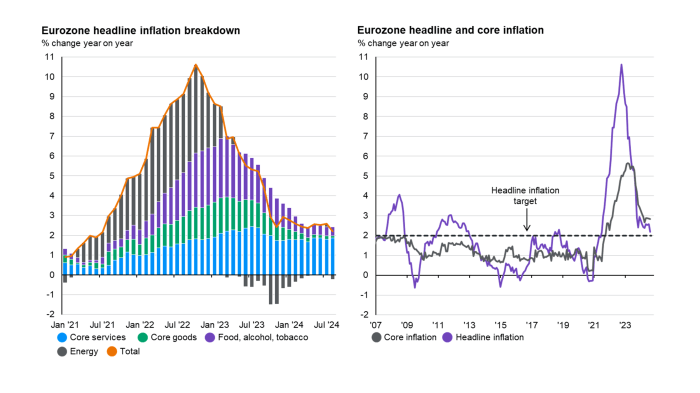

The European Central Bank (ECB) has adopted a dovish stance in recent monetary policy decisions, indicating a less aggressive approach to tackling inflation. This shift has sparked considerable debate among economists and investors, raising questions about the ECB’s strategy and its potential impact on the Eurozone economy.

Impact on Interest Rates and Inflation

The ECB’s dovish stance implies a slower pace of interest rate hikes. The central bank’s primary tool for controlling inflation is adjusting interest rates. Higher interest rates make borrowing more expensive, which can slow down economic activity and curb inflation.

Gold is soaring today, fueled by the European Central Bank’s dovish comments and the retreat in bond yields. It’s a reminder that even amidst economic uncertainty, investors are seeking safe havens. Meanwhile, a stark contrast to the world of finance, a Massachusetts father and son are facing prison time for a massive $20 million lottery scam, as reported by The Venom Blog.

This story highlights the stark realities of financial crime, a world far removed from the fluctuations of the gold market.

However, the ECB’s dovish approach suggests that it is not in a hurry to raise interest rates aggressively, reflecting concerns about the potential negative impact on the Eurozone’s economic recovery.The ECB’s decision to maintain a dovish stance is likely to have a mixed impact on inflation.

While slower interest rate hikes may allow inflation to persist for longer, it also supports economic growth, which can contribute to higher demand and potentially exacerbate inflationary pressures. The ECB’s strategy is based on the belief that a gradual approach to tightening monetary policy will help to balance the need to control inflation while supporting economic growth.

Rationale for Dovish Approach

The ECB’s decision to adopt a dovish approach is driven by several factors. Firstly, the Eurozone economy is facing a number of headwinds, including the ongoing war in Ukraine, persistent energy price volatility, and supply chain disruptions. These factors are weighing on economic growth and increasing the risk of recession.Secondly, inflation in the Eurozone is expected to moderate in the coming months, driven by a slowdown in energy price increases.

Gold prices have been soaring recently, driven by the European Central Bank’s dovish comments and the retreat in bond yields. This shift in sentiment is leading investors to seek safe haven assets, pushing gold higher. It’s also a good time to remind ourselves about the importance of data privacy, which is crucial for safeguarding our financial well-being.

Understanding what is a privacy policy and why is it important can help us navigate the complexities of the digital world. With gold’s recent surge, it’s more important than ever to be mindful of our online security and the value of our personal information.

While inflation remains high, the ECB believes that it will eventually fall back towards its target of 2%.Thirdly, the ECB is concerned about the potential negative impact of aggressive interest rate hikes on the Eurozone’s financial markets. Rapidly rising interest rates can lead to increased borrowing costs for businesses and households, potentially slowing down economic activity and leading to a financial crisis.The ECB’s dovish stance is a delicate balancing act between the need to control inflation and the need to support economic growth.

Gold’s rally continued today, fueled by the European Central Bank’s dovish comments and a retreat in bond yields. This comes on the heels of news that Chinese realty initiatives are set to boost base metals, as reported in this article , which also highlights gold’s surge on a weaker dollar.

With the ECB signaling a more cautious approach to interest rate hikes, and the Chinese government taking steps to stimulate its economy, gold is looking increasingly attractive as a safe haven asset.

The central bank is carefully monitoring the economic situation and is prepared to adjust its monetary policy stance if necessary.

Bond Yield Retreat

The recent retreat in bond yields has been a significant factor driving gold prices higher. Bond yields and gold prices have an inverse relationship, meaning that when bond yields fall, gold prices tend to rise, and vice versa. This relationship is driven by several factors, including the opportunity cost of holding gold and the perception of gold as a safe haven asset.

Reasons for the Recent Retreat in Bond Yields

The recent retreat in bond yields can be attributed to several factors. The most prominent is the dovish stance adopted by central banks, particularly the Federal Reserve and the European Central Bank. These central banks have signaled their intention to slow down or pause interest rate hikes, reflecting concerns about the economic outlook and the potential for inflation to decline.

This has led to a decrease in demand for bonds, pushing yields lower. Another factor contributing to the decline in bond yields is the ongoing uncertainty surrounding the global economic outlook. The war in Ukraine, rising inflation, and supply chain disruptions have created a climate of uncertainty, prompting investors to seek out safe haven assets like gold.

This increased demand for gold has put downward pressure on bond yields, as investors shift their capital away from riskier assets.

Comparison with Previous Periods of Similar Retreat

The current bond yield environment shares similarities with previous periods of similar retreat. For instance, during the global financial crisis of 2008, bond yields plummeted as investors sought safety in government bonds. Similarly, during the COVID-19 pandemic, bond yields fell to record lows as central banks injected massive amounts of liquidity into the financial system.The current retreat in bond yields is notable for its speed and magnitude.

In recent months, bond yields have declined significantly, suggesting that investors are becoming increasingly concerned about the economic outlook and the potential for a recession. This heightened risk aversion has driven investors towards gold, further fueling its price surge.

Gold’s Safe Haven Status

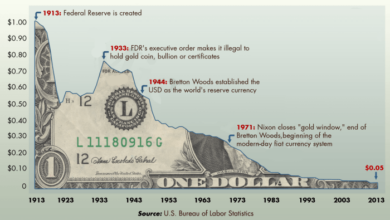

Gold has long been considered a safe haven asset, a financial refuge sought during times of economic uncertainty and market volatility. Its allure stems from its perceived ability to preserve wealth, particularly when traditional assets like stocks and bonds falter.Gold’s appeal as a safe haven asset can be attributed to its unique characteristics.

Its intrinsic value, independent of government policies or economic conditions, makes it a reliable store of wealth. Moreover, gold’s limited supply, unlike fiat currencies, provides a degree of stability and scarcity.

Historical Performance of Gold as a Safe Haven Asset

The historical performance of gold during economic crises underscores its role as a safe haven. Here’s a table showcasing gold’s performance during notable economic events:

| Event | Year | Gold Price Change (%) |

|---|---|---|

| Asian Financial Crisis | 1997-1998 | +25.4 |

| Russian Financial Crisis | 1998 | +28.2 |

| Global Financial Crisis | 2008-2009 | +24.7 |

| European Sovereign Debt Crisis | 2010-2012 | +44.3 |

| COVID-19 Pandemic | 2020 | +24.9 |

During these turbulent periods, gold often outperformed other asset classes, demonstrating its ability to shield investors from market turmoil. While past performance is not indicative of future results, gold’s historical track record reinforces its reputation as a safe haven asset.

Current Economic Climate and Investor Sentiment

The current global economic landscape is marked by rising inflation, geopolitical tensions, and central bank policy shifts. These factors have fueled uncertainty and volatility in financial markets, prompting investors to reassess their portfolio allocations.The ongoing war in Ukraine, coupled with supply chain disruptions and persistent inflationary pressures, has heightened concerns about global economic growth.

This uncertainty has spurred demand for gold as a safe haven asset. Investors seeking to preserve wealth and hedge against potential market downturns are turning to gold.

“Gold is seen as a safe haven asset because it is a store of value that is not tied to any particular currency or economy.”

World Gold Council

However, it’s important to note that gold’s performance is not always predictable. Factors like interest rate movements, inflation expectations, and market sentiment can influence its price trajectory. While gold can provide a hedge against certain risks, it is not a risk-free investment.

Market Outlook for Gold

Gold’s recent surge, driven by the European Central Bank’s dovish stance and retreating bond yields, has sparked renewed interest in the precious metal. Looking ahead, several key factors will influence gold’s price trajectory, presenting both opportunities and risks for investors.

Key Factors Influencing Gold Prices

The following factors will play a significant role in shaping the future of gold prices:

- Interest Rates:Gold is often seen as a hedge against inflation. As central banks raise interest rates, the opportunity cost of holding gold increases, potentially dampening demand. Conversely, a decline in interest rates can make gold more attractive, as its value is not eroded by inflation.

- Economic Growth:A strong global economy tends to favor riskier assets like stocks. In such an environment, gold’s appeal as a safe haven may diminish. However, if economic growth slows or concerns about a recession arise, investors may flock to gold as a safe haven.

- Inflation:Gold is traditionally viewed as an inflation hedge. When inflation is high, the purchasing power of fiat currencies declines, driving up demand for gold. However, the relationship between gold and inflation is complex and can be influenced by other factors, such as interest rates and economic growth.

- Geopolitical Risks:Gold often benefits from geopolitical instability. Events like wars, political turmoil, or trade tensions can lead to increased demand for gold as investors seek a safe haven.

- Dollar Strength:Gold is priced in US dollars. A stronger dollar generally puts downward pressure on gold prices, as it becomes more expensive for investors holding other currencies. Conversely, a weaker dollar can support gold prices.

Upside and Downside Risks

Gold’s potential upside and downside risks are closely linked to the factors discussed above.

- Upside Risks:

- Persistent Inflation:If inflation remains high, gold’s appeal as an inflation hedge could drive prices higher. For example, in the 1970s, gold prices soared during a period of high inflation.

- Recessionary Fears:Concerns about a global economic slowdown could boost demand for gold as a safe haven, potentially leading to price gains.

- Geopolitical Instability:Escalating geopolitical tensions, such as the war in Ukraine or tensions between the US and China, could lead to a flight to safety, driving up gold prices.

- Downside Risks:

- Aggressive Rate Hikes:If central banks aggressively raise interest rates to combat inflation, the opportunity cost of holding gold could increase, potentially weighing on prices.

- Stronger Dollar:A significant strengthening of the US dollar could make gold more expensive for investors holding other currencies, potentially leading to price declines.

- Improved Economic Outlook:If economic growth improves and concerns about a recession subside, investors may shift their focus to riskier assets like stocks, potentially reducing demand for gold.

Forecasts for Gold Prices

Leading financial institutions have varying forecasts for gold prices in the coming quarter. Here’s a table comparing their views: