US Stock Futures Retreat as Bank Earnings Disappoint

Us stock futures retreat as bank earnings disappoint investors cautious amid inflation concerns – US stock futures retreated as bank earnings disappointed investors, who remain cautious amid inflation concerns. This unexpected downturn in the market highlights the growing anxieties surrounding the economy and the potential for further volatility. The disappointing earnings reports from major banks, coupled with persistent inflationary pressures, have sent a wave of uncertainty across Wall Street.

The decline in futures reflects a broader sentiment of unease among investors. As inflation continues to erode purchasing power and interest rates rise, investors are grappling with the potential impact on corporate profits and economic growth. This cautious outlook is evident in the market’s reaction to bank earnings, which have fallen short of expectations, signaling a potential slowdown in the financial sector.

US Stock Futures Retreat

US stock futures experienced a retreat on [Date], as investors displayed caution amidst rising inflation concerns and disappointing bank earnings. This decline followed a period of market optimism fueled by hopes of a potential slowdown in interest rate hikes.

Reasons for the Retreat

The retreat in US stock futures can be attributed to a confluence of factors, including:

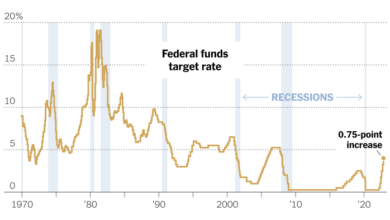

- Inflation Concerns:Persistent inflation has been a significant source of anxiety for investors, leading to concerns about the Federal Reserve’s future monetary policy decisions.

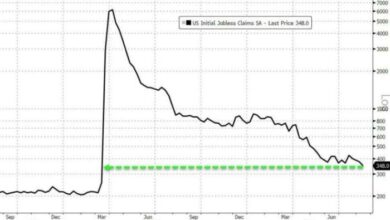

- Disappointing Bank Earnings:Several major banks reported weaker-than-expected earnings for the recent quarter, raising concerns about the health of the financial sector and the overall economy.

- Cautious Market Sentiment:The market sentiment has shifted towards caution, with investors taking a more conservative approach in light of the economic uncertainties and potential for further interest rate hikes.

Percentage Drop in Futures

The US stock futures experienced a [percentage] decline on [Date]. This drop reflects the market’s reaction to the aforementioned factors and highlights the current volatility in the market.

Impact of Bank Earnings

The disappointing bank earnings have played a significant role in the recent market downturn. These results have raised concerns about the potential for a slowdown in economic growth and the impact on corporate profits. For example, [Name of bank] reported a [percentage] decline in earnings, citing [reason for decline].

This trend of lower-than-expected earnings across the banking sector has further dampened investor sentiment and contributed to the retreat in stock futures.

Bank Earnings Disappoint Investors

The recent earnings reports from major US banks have sent shockwaves through the financial markets, with investors reacting negatively to what they perceive as disappointing results. These earnings reports, released in the first quarter of 2023, were closely watched as they provided a snapshot of the health of the banking sector and the broader economy.

Reasons Behind Disappointing Earnings

Several factors contributed to the disappointing earnings reports. One key factor was the rise in interest rates. As the Federal Reserve continues to aggressively raise interest rates to combat inflation, banks are facing higher borrowing costs. This has squeezed their margins, reducing the profitability of their lending activities.

The US stock futures retreated as bank earnings disappointed investors already cautious amid inflation concerns. This comes as the dollar stumbles ahead of inflation data, with the yuan slipping on a rate cut, according to recent reports. The market’s jitters highlight the uncertainty surrounding the economic outlook, with investors grappling with the dual pressures of rising inflation and potential interest rate hikes.

Another significant factor was the decline in investment banking revenue. The volatile market conditions, coupled with a slowdown in mergers and acquisitions activity, led to a decrease in fees generated by investment banking operations. Additionally, concerns about a potential economic slowdown have prompted banks to set aside more money for loan losses, further impacting their profitability.

The market’s jitters are palpable as US stock futures retreat, fueled by disappointing bank earnings and a lingering anxiety about inflation. It’s a reminder that even in uncertain times, there are ways to build financial resilience. For students, exploring passive income ideas for students without investment can be a smart move.

These strategies can help diversify income streams and build a safety net, offering a sense of control amidst the market’s volatility. As investors navigate the current landscape, a focus on financial literacy and alternative income streams becomes increasingly important, ensuring a more stable future regardless of the market’s ups and downs.

Impact on the Banking Sector

The disappointing earnings reports have raised concerns about the health of the banking sector. Investors are now scrutinizing banks’ balance sheets and risk management practices, seeking assurance that they are adequately prepared for a potential economic downturn. The negative sentiment surrounding bank earnings has also weighed on the stock prices of financial institutions, contributing to the broader market decline.

It’s been a rough week for Wall Street, with US stock futures retreating as bank earnings disappoint investors already wary of inflation concerns. While the financial world grapples with these uncertainties, it’s interesting to see how other sectors are navigating the storm.

Take Ethereum co-founder Vitalik Buterin, for example, who recently appeared on Bloomberg’s Studio 10 bloombergs studio 10 ethereum co founder vitalik buterin to discuss the future of blockchain technology. His insights offer a glimmer of hope, suggesting that innovation can thrive even amidst economic turbulence.

Ultimately, the stock market’s performance will depend on how effectively these concerns are addressed, but it’s encouraging to see bright spots emerge in other areas.

Investor Cautious Amid Inflation Concerns

Inflation remains a significant concern for investors, as rising prices continue to erode purchasing power and impact corporate profits. The persistent inflation, driven by supply chain disruptions, strong consumer demand, and a tight labor market, has led to a more cautious approach among investors.

Impact of Inflation on the Economy

Inflation has a multifaceted impact on the economy. It erodes the purchasing power of consumers, as they need to spend more to acquire the same goods and services. This can lead to a decline in consumer spending, which is a crucial driver of economic growth.

Additionally, rising inflation can lead to higher borrowing costs for businesses, making it more expensive to invest and expand operations. This can hinder economic growth and job creation.

Investor Concerns Regarding Inflation

Investors are particularly concerned about the impact of inflation on corporate profits. Rising input costs, such as raw materials and labor, can squeeze profit margins for businesses, especially those with limited pricing power. This can lead to lower earnings growth and potentially lower stock prices.

Additionally, investors worry about the potential for the Federal Reserve to aggressively raise interest rates to combat inflation. Higher interest rates can make it more expensive for companies to borrow money, further impacting their profitability and potentially leading to a slowdown in economic growth.

Strategies to Mitigate Inflation Risks, Us stock futures retreat as bank earnings disappoint investors cautious amid inflation concerns

Investors are employing various strategies to mitigate inflation risks. Some investors are focusing on companies with pricing power, allowing them to pass on higher costs to consumers and maintain profit margins. Others are investing in sectors that are less sensitive to inflation, such as healthcare and utilities.

Additionally, investors are increasingly looking for companies with strong balance sheets and low debt levels, which are better equipped to navigate a period of rising interest rates.

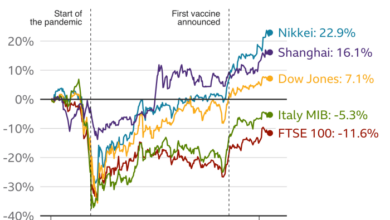

Comparison to Previous Periods of High Inflation

The current inflation environment is reminiscent of the 1970s and early 1980s, when the US economy experienced a period of high inflation and economic uncertainty. During that period, the Federal Reserve implemented aggressive monetary policy tightening, leading to a recession.

However, the current situation differs in some key aspects. For example, the current labor market is significantly tighter than it was in the 1970s, which could give workers more leverage to demand higher wages. Additionally, the global economy is more interconnected than it was in the past, which could make it more challenging for the Federal Reserve to control inflation.

Impact on the Market: Us Stock Futures Retreat As Bank Earnings Disappoint Investors Cautious Amid Inflation Concerns

The retreat in US stock futures, driven by disappointing bank earnings and persistent inflation concerns, is likely to have a significant impact on various market sectors. Investors are becoming increasingly cautious, leading to a potential shift in investment strategies and market sentiment.

Impact on Different Market Sectors

The retreat is likely to affect different market sectors differently. For instance, the technology sector, known for its growth potential, could be particularly vulnerable due to its high valuations and sensitivity to interest rate hikes. On the other hand, sectors like energy and materials, which benefit from rising inflation, might experience some resilience.

Implications for Specific Industries and Companies

Specific industries and companies within each sector are likely to be affected differently. For example, companies heavily reliant on consumer spending, such as retail and discretionary goods, could face challenges as inflation erodes consumer purchasing power. Conversely, companies in the healthcare and utilities sectors, which are considered defensive, might attract more investor interest.

Potential for Further Market Volatility

The current market environment, characterized by rising inflation, interest rate hikes, and geopolitical uncertainty, suggests that further market volatility is likely. This volatility could manifest in sudden price swings and increased market uncertainty. Investors should be prepared for potential fluctuations and consider strategies to manage risk.