China Imposes Export Controls, Escalating Chip War

China imposes export controls on gallium and germanium escalating chip war – China Imposes Export Controls on Gallium and Germanium, Escalating Chip War sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

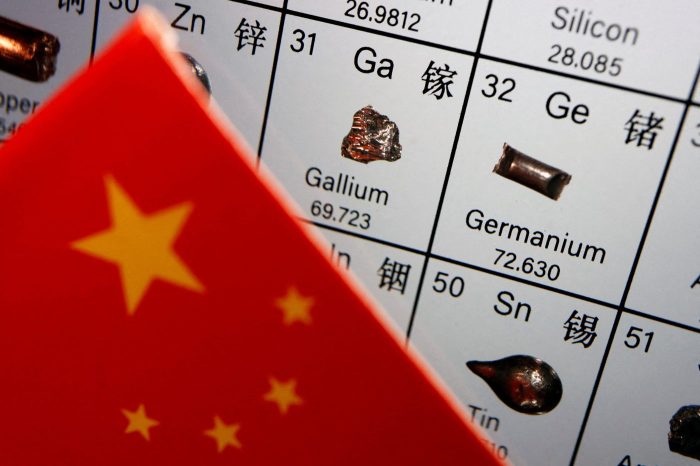

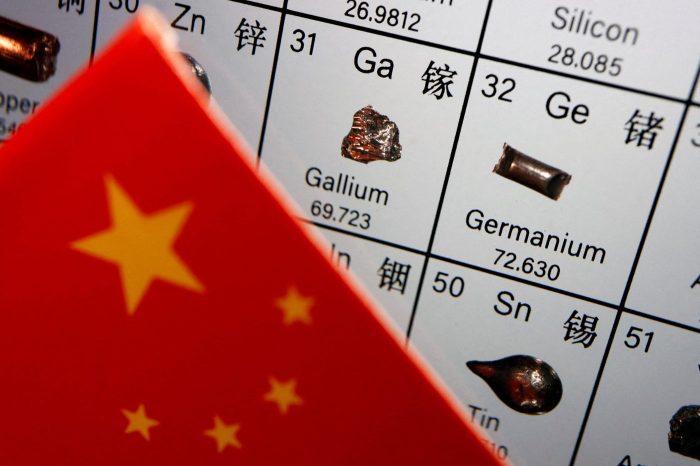

The recent move by China to impose export controls on gallium and germanium, critical components in semiconductor production, has sent shockwaves through the global tech industry. This strategic move, seemingly aimed at the US and its allies, has escalated the ongoing chip war, raising concerns about potential disruptions to global supply chains and the future of technological innovation.

The implications of this bold move are far-reaching, affecting everything from smartphone production to advanced military technologies.

China’s Export Controls

China’s recent imposition of export controls on gallium and germanium has sent shockwaves through the global semiconductor industry, further escalating the ongoing tech rivalry between the US and China. This move is not just about metals; it’s about strategic leverage in a crucial technology domain.

The Strategic Significance of Gallium and Germanium

Gallium and germanium are critical components in the production of semiconductors, particularly for advanced technologies like 5G, artificial intelligence, and high-performance computing. These metals are essential for creating transistors, lasers, and other critical semiconductor components.

“Gallium and germanium are essential for producing advanced semiconductors, and their control could significantly impact the global semiconductor industry.”

China’s recent export controls on gallium and germanium, key materials for semiconductor production, have sent shockwaves through the global chip industry. This move, seen as a direct response to US export restrictions on advanced chips, has fueled concerns about a potential escalation in the “chip war.” While the global markets are grappling with the implications of this move, the US dollar has remained surprisingly steady, buoyed by expectations of further interest rate hikes from the Fed and growing optimism surrounding the debt ceiling negotiations.

This resilience in the US dollar could, however, be short-lived if the escalating chip war further disrupts global supply chains and triggers a wider economic downturn.

[Source]

China’s Role in the Global Chip Market

China has become a major player in the global semiconductor industry, both as a manufacturer and a consumer. It’s the world’s largest semiconductor market, with significant domestic production capabilities.

- China is heavily reliant on imports for advanced chips, particularly from companies like TSMC and Samsung. This dependence has fueled its ambition to achieve self-sufficiency in semiconductor technology.

- The Chinese government has launched ambitious initiatives like the “Made in China 2025” program, aiming to bolster domestic semiconductor production and reduce reliance on foreign suppliers.

Recent Developments in the US-China Technology Rivalry

The US and China have been locked in a fierce technological rivalry for years, marked by escalating trade tensions and export controls. The US has imposed restrictions on exports of advanced chips and chip-making equipment to China, aiming to curb its technological advancement.

China’s recent export controls on gallium and germanium, critical materials for semiconductor production, have sent shockwaves through the global tech industry. This move, widely seen as an escalation of the “chip war,” could have significant implications for the US economy, especially given the strong performance of the US job market as evidenced by the May jobs report, which exceeded expectations by adding 339,000 jobs.

While this positive economic news provides a much-needed boost, the potential disruption to US chip supply chains due to China’s actions could pose a significant challenge in the long run.

- In 2022, the US implemented stringent export controls on advanced chips and chip-making equipment to China, targeting companies like Huawei and SMIC. These measures aimed to restrict China’s access to critical technologies.

- The US has also been pressuring its allies to limit exports of semiconductor technology to China, seeking to build a global coalition against Chinese technological dominance.

Impact of Export Controls on Global Supply Chains: China Imposes Export Controls On Gallium And Germanium Escalating Chip War

China’s recent imposition of export controls on gallium and germanium, key materials used in semiconductor manufacturing, has sparked concerns about potential disruptions to global supply chains. These controls, seen as a countermeasure to US restrictions on Chinese technology, could significantly impact the availability of these critical materials, affecting various sectors and economies worldwide.

Impact on Semiconductor Production

The export controls on gallium and germanium could significantly impact the production of semiconductors, a cornerstone of modern technology. These materials are crucial for the fabrication of various semiconductor components, including transistors, diodes, and integrated circuits. Disruptions in the supply of these materials could lead to:

- Production Delays:Semiconductor manufacturers may face production delays due to limited access to gallium and germanium, leading to shortages and higher prices for chips.

- Supply Chain Bottlenecks:The reliance on China for these materials could create bottlenecks in the global supply chain, making it difficult for companies to procure the necessary materials for semiconductor production.

- Technological Advancements:The controls could hinder technological advancements in the semiconductor industry, as manufacturers may face difficulties in developing new and advanced semiconductor technologies.

Implications for Companies Reliant on Gallium and Germanium

Companies across various sectors, including electronics, automotive, aerospace, and telecommunications, rely heavily on gallium and germanium. The export controls could have significant implications for these companies, leading to:

- Increased Costs:Companies may face higher production costs due to the scarcity of gallium and germanium, leading to price increases for their products.

- Supply Chain Diversification:Companies may be forced to diversify their supply chains to reduce dependence on China for these materials, which could involve finding alternative suppliers or developing new production processes.

- Innovation Challenges:The controls could hinder innovation in these sectors, as companies may face difficulties in developing new technologies that rely on gallium and germanium.

Impact on Different Regions and Economies

The impact of the export controls will vary across different regions and economies, with certain sectors and countries being more vulnerable than others.

- Europe and Japan:These regions are heavily reliant on China for gallium and germanium and could face significant disruptions to their semiconductor and related industries.

- United States:While the US has a domestic semiconductor industry, it still relies on China for some materials, and the controls could affect the production of certain chips.

- Developing Countries:Developing countries, which rely heavily on imported technologies, could face significant challenges in accessing essential semiconductor components, hindering their economic development.

Geopolitical Implications and Strategic Considerations

China’s export controls on gallium and germanium have triggered a wave of geopolitical implications, escalating the global technological rivalry and reshaping the dynamics of international cooperation. This move highlights the growing strategic importance of critical minerals in the semiconductor industry and the potential for leveraging resource control for geopolitical advantage.

China’s recent export controls on gallium and germanium, key materials for semiconductors, have undoubtedly escalated the chip war. This move has sparked a global scramble for alternative sources, and it’s interesting to note that just as the world is grappling with this development, Warren Buffett’s Berkshire Hathaway has finalized the divestment of its TSMC holdings, as reported in this article.

While the reasons for Berkshire Hathaway’s decision remain unclear, it’s hard to ignore the timing, which coincides with heightened geopolitical tensions and a reshaping of the global semiconductor landscape.

Potential Impact on Global Power Dynamics

The export controls have raised concerns about China’s potential to disrupt global supply chains and exert leverage over its trading partners. The strategic importance of gallium and germanium in semiconductor manufacturing, coupled with China’s dominant position in their production, gives Beijing significant leverage.

This move could potentially:

- Shift the balance of power in the semiconductor industry:China’s control over these critical minerals could give it a strategic advantage in the global semiconductor race, potentially enabling it to influence the development and deployment of advanced technologies.

- Increase geopolitical tensions:The export controls could exacerbate existing tensions between China and the West, potentially leading to further trade restrictions and economic decoupling.

- Promote regional alliances:The move could accelerate the formation of regional alliances, such as the US-led “Chip 4” alliance, aimed at securing critical technologies and reducing dependence on China.

Potential Responses from Other Countries and Organizations

The export controls have prompted a range of responses from other countries and organizations. The US, EU, and Japan, among others, are actively considering countermeasures to mitigate the potential impact of China’s actions. These responses could include:

- Diversifying supply chains:Countries are seeking to reduce their dependence on China for critical minerals by diversifying their sourcing and investing in domestic production.

- Imposing counter-sanctions:The US and its allies could impose counter-sanctions on China to deter future actions that threaten global supply chains.

- Strengthening international cooperation:Countries are working together to establish international frameworks for the responsible management of critical minerals and to prevent the use of resource control for geopolitical leverage.

Strategic Implications for China

China’s export controls on gallium and germanium are a strategic move designed to achieve several objectives, including:

- Strengthening its position in the semiconductor industry:By controlling access to critical minerals, China aims to solidify its position as a global leader in semiconductor manufacturing and to secure its long-term technological competitiveness.

- Promoting its technological ambitions:The export controls reflect China’s ambition to become a leading innovator in high-tech sectors and to reduce its reliance on foreign technologies.

- Leveraging its economic clout:China’s export controls are a demonstration of its economic leverage and its willingness to use it to advance its strategic interests.

Economic and Financial Considerations

China’s export controls on gallium and germanium have the potential to significantly impact the global economy, particularly in the technology and manufacturing sectors. The controls could lead to disruptions in supply chains, price fluctuations, and shifts in investment strategies.

Impact on Commodity Prices and Trade Flows

The export controls are likely to have a significant impact on the prices of gallium and germanium. These metals are essential components in various high-tech products, including semiconductors, solar panels, and LEDs. With reduced supply, prices are expected to rise, potentially impacting the cost of production for these goods.

- Increased Prices:The restricted supply of gallium and germanium could lead to a significant increase in their prices, potentially impacting the cost of production for various industries.

- Supply Chain Disruptions:The controls could disrupt global supply chains, as companies scramble to secure alternative sources of these critical materials.

- Trade Diversification:The controls may encourage countries to diversify their supply chains, reducing their reliance on China for these materials.

Implications for Financial Markets and Investment Strategies

The export controls could have significant implications for financial markets and investment strategies. Investors may need to reassess their exposure to companies that rely heavily on gallium and germanium, while seeking opportunities in alternative industries or regions.

- Increased Volatility:The uncertainty surrounding the availability of gallium and germanium could lead to increased volatility in the stock markets, particularly for companies in the semiconductor, solar, and LED sectors.

- Shifting Investment Strategies:Investors may shift their investment strategies to focus on companies less reliant on China for these critical materials or explore alternative investment opportunities in industries less affected by the export controls.

- Potential for New Investment Opportunities:The controls could create new investment opportunities in companies developing alternative technologies or sourcing materials from other regions.

Potential Winners and Losers in the Global Economy, China imposes export controls on gallium and germanium escalating chip war

The export controls are likely to create winners and losers in the global economy. Companies and countries with alternative sources of gallium and germanium or those developing alternative technologies are likely to benefit, while those heavily reliant on China for these materials could face challenges.

- Winners:Companies and countries with alternative sources of gallium and germanium, those developing alternative technologies, and those involved in the production of substitute materials.

- Losers:Companies and countries heavily reliant on China for gallium and germanium, those in industries that rely heavily on these materials, and those operating in regions with limited access to alternative sources.

Potential Solutions and Future Directions

The imposition of export controls on gallium and germanium by China presents significant challenges to the global semiconductor industry. However, it also compels a reassessment of existing strategies and the exploration of innovative solutions to mitigate potential disruptions and ensure the long-term health of the industry.

Diversification of Supply Chains

Diversifying supply chains is crucial to reducing dependence on any single source of critical materials. This involves:

- Expanding Production Capacity:Encouraging domestic production of gallium and germanium in countries outside China, especially in regions with strong semiconductor industries. This can be achieved through government incentives, investment in research and development, and collaboration with private companies.

- Exploring Alternative Materials:Researching and developing alternative materials that can replace gallium and germanium in semiconductor manufacturing. This is a long-term strategy, but advancements in materials science could offer new solutions.

- Strategic Stockpiling:Governments and companies can consider strategic stockpiling of gallium and germanium to ensure access during potential supply disruptions. This would require careful planning and coordination to avoid market distortions.

Technological Innovation

Technological innovation is key to reducing reliance on specific materials and processes. This involves:

- Developing New Semiconductor Technologies:Investing in research and development to create new semiconductor technologies that are less reliant on gallium and germanium. This could include exploring alternative materials, such as silicon carbide or diamond, or developing new fabrication processes.

- Improving Efficiency and Yield:Optimizing semiconductor manufacturing processes to reduce material consumption and increase yield. This would require collaboration between industry, research institutions, and government agencies.

- Developing Recycling Technologies:Improving technologies for recycling and recovering gallium and germanium from existing semiconductor products. This would reduce the need for new material extraction and contribute to a more sustainable industry.

International Cooperation

International cooperation is essential to address the challenges posed by China’s export controls. This can be achieved through:

- Multilateral Dialogue:Establishing a forum for dialogue between major semiconductor-producing countries to discuss the challenges and potential solutions related to export controls. This would allow for sharing of best practices and coordination of policies.

- Joint Research and Development:Encouraging collaborative research projects between countries to develop alternative materials and technologies for semiconductor manufacturing. This would accelerate innovation and reduce reliance on single sources of supply.

- Harmonization of Regulations:Working towards harmonizing regulations related to semiconductor materials and technologies across different countries. This would reduce trade barriers and promote a more level playing field for global semiconductor companies.