Ford & SK On Secure $92 Billion Loan for Battery Production

Ford and sk on joint venture secures 92 billion us government loan for battery production facilities – Ford and SK On, in a joint venture, have secured a staggering $92 billion loan from the US government for the construction of battery production facilities. This partnership, aimed at bolstering American electric vehicle (EV) production, signifies a pivotal moment in the ongoing race to dominate the rapidly growing EV market.

The loan, a testament to the US government’s commitment to supporting domestic EV production, will fuel the construction of state-of-the-art facilities equipped with cutting-edge technology. These facilities are poised to become major hubs for battery production, creating thousands of jobs and boosting the US economy.

The joint venture is strategically positioned to benefit from this government support, leveraging their combined expertise to drive innovation and accelerate the transition to a cleaner, more sustainable future.

The Joint Venture

Ford and SK On have formed a strategic partnership to build a network of battery production facilities in the United States. This joint venture represents a significant investment in the future of electric vehicles (EVs) and underscores the growing importance of battery technology in the automotive industry.

The Partnership

Ford and SK On bring unique strengths to the table, creating a powerful synergy in the battery production sector. Ford, a global automotive giant, possesses extensive experience in vehicle manufacturing, design, and distribution. SK On, a leading South Korean battery manufacturer, boasts cutting-edge technology and expertise in battery cell production.

The combined strengths of these two companies will enable them to produce high-quality, cost-effective EV batteries at scale.

The History

Ford has been actively involved in the EV industry for several years, launching models like the Mustang Mach-E and F-150 Lightning. SK On has also been a key player in the EV battery market, supplying batteries to various automotive manufacturers.

It’s fascinating to see how the government is supporting the shift towards electric vehicles with massive loans like the $92 billion awarded to Ford and SK for battery production facilities. This investment is huge, but it pales in comparison to the recent news that KKR is acquiring PayPal’s buy now pay later loans for nearly $44 billion kkr announces acquisition of paypal buy now pay later loans valued at nearly 44 billion.

This acquisition highlights the growing popularity and investment potential of BNPL, which is a market that could further fuel the adoption of electric vehicles as consumers look for flexible payment options for these expensive purchases.

Their combined experience in the EV industry positions them well to meet the growing demand for EV batteries.

The Rationale

The decision to form a joint venture was driven by a shared vision for the future of EVs. Both companies recognize the crucial role of battery technology in accelerating the transition to a sustainable transportation system. By collaborating, they aim to establish a robust and reliable supply chain for EV batteries in the United States, reducing dependence on foreign suppliers.

This joint venture aligns with the broader goal of achieving energy independence and promoting domestic manufacturing.

The Loan and Its Significance: Ford And Sk On Joint Venture Secures 92 Billion Us Government Loan For Battery Production Facilities

The US government’s decision to provide a $9.2 billion loan to the Ford and SK joint venture signifies a substantial investment in the future of electric vehicles (EVs) in the United States. This loan is not just a financial injection; it’s a strategic move to bolster domestic battery production and reduce reliance on foreign suppliers.

Impact on the Joint Venture

The loan will be used to build a massive battery production facility in Kentucky, a crucial step in the joint venture’s ambitious plan to manufacture EV batteries for Ford vehicles. This investment will significantly boost the venture’s capabilities, enabling them to scale up production and meet the growing demand for EVs.

Implications for the US EV Industry

The loan’s impact extends far beyond the joint venture. It represents a clear signal of the US government’s commitment to supporting the domestic EV industry. By incentivizing battery production within the US, the government aims to create a robust domestic supply chain, reducing reliance on foreign suppliers like China, which currently dominates the global battery market.

This strategy is crucial for ensuring the long-term sustainability and competitiveness of the US EV industry.

Comparison with Other Countries

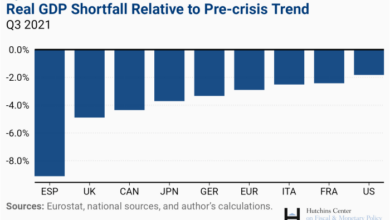

The US government’s support for EV battery production is in line with similar initiatives in other countries. For instance, the European Union has launched a multi-billion euro program to promote battery production within its borders. China, already a leader in the battery market, continues to invest heavily in research and development to maintain its dominance.

This global competition highlights the importance of government support in fostering a thriving EV battery industry.

Battery Production Facilities

The Ford and SK joint venture plans to establish a network of battery production facilities across the United States, aiming to significantly boost domestic battery production and contribute to the nation’s clean energy goals. These facilities are expected to be state-of-the-art, employing advanced technologies and processes to produce high-quality batteries for electric vehicles.

The news of Ford and SK’s joint venture securing a massive $92 billion loan from the US government for battery production facilities is exciting, especially considering the current energy landscape. While the auto industry is shifting towards electric vehicles, the news of significant price declines in gasoline, natural gas, and other energy sources might seem contradictory.

However, this could actually be a positive sign for the future of electric vehicles, as it suggests a more stable and competitive energy market overall. With this investment, Ford and SK are poised to play a major role in the transition to a cleaner, more sustainable transportation future.

Location and Capacity

The joint venture has identified several potential locations for its battery production facilities, with a focus on regions with access to key resources, skilled labor, and strong infrastructure. These locations are expected to be strategically chosen to minimize transportation costs and ensure efficient distribution of batteries to Ford’s assembly plants and other customers.

It’s interesting to see how government funding is being allocated, with Ford and SK securing a massive loan for battery production facilities. Meanwhile, a Massachusetts father and son are facing jail time for a 20 million dollar lottery scam.

The contrast highlights the importance of responsible investment and the consequences of illegal activities. Hopefully, the Ford and SK venture will create jobs and contribute to a greener future, unlike the actions of the convicted scammers.

The facilities are expected to have a significant production capacity, capable of producing millions of battery cells per year. This scale of production will be crucial in meeting the rapidly growing demand for electric vehicle batteries, both domestically and internationally.

Technologies and Processes

The battery production facilities will employ advanced technologies and processes to ensure high efficiency, quality, and sustainability. These include:

- High-throughput manufacturing:This involves automating key production steps, enabling faster production cycles and higher output. This approach will be crucial in meeting the projected demand for EV batteries.

- Advanced materials and chemistries:The facilities will utilize innovative battery chemistries, such as nickel-cobalt-manganese (NCM) and lithium iron phosphate (LFP), to enhance battery performance, reduce costs, and increase sustainability.

- Digitalization and data analytics:Integrating digital technologies and data analytics will optimize production processes, improve quality control, and enhance overall efficiency.

- Recycling and closed-loop systems:The facilities will incorporate recycling and closed-loop systems to recover valuable materials from end-of-life batteries, reducing waste and promoting sustainability.

Economic and Environmental Benefits

The battery production facilities are expected to bring significant economic and environmental benefits to the communities where they are located. These include:

- Job creation:The facilities are expected to create thousands of high-skilled jobs in manufacturing, engineering, and other related fields. This will contribute to economic growth and revitalization in the targeted regions.

- Reduced carbon emissions:By producing batteries for electric vehicles, the facilities will play a key role in reducing carbon emissions from transportation, contributing to the nation’s climate goals.

- Increased energy independence:The facilities will help reduce the reliance on foreign suppliers for critical battery components, enhancing national energy security.

Impact on the EV Market

The joint venture between Ford and SK On, backed by a substantial US government loan, is poised to significantly impact the global EV market. This partnership, combined with the financial support, will boost battery production capacity, potentially influencing the availability and affordability of electric vehicles.

Increased Battery Production and its Impact

The increased battery production capacity resulting from this venture will have a direct impact on the availability of EVs. As more batteries become available, automakers can scale up their EV production, leading to a wider selection of models and a more competitive market.

This, in turn, could drive down prices for consumers, making EVs more accessible to a broader range of buyers.

Benefits and Challenges for Ford and SK On, Ford and sk on joint venture secures 92 billion us government loan for battery production facilities

This joint venture presents both benefits and challenges for Ford and SK On in the increasingly competitive EV market.

Benefits

- Enhanced Market Position:This partnership will strengthen Ford’s position in the rapidly growing EV market. By securing a reliable source of high-quality batteries, Ford can accelerate its EV production and compete more effectively with other established and emerging EV players.

- Cost Reduction:The large-scale battery production facility will help Ford reduce its dependence on external battery suppliers, potentially leading to lower production costs and more competitive pricing for its EVs.

- Technological Advancements:The collaboration with SK On will provide Ford access to cutting-edge battery technologies, enabling it to develop and launch EVs with enhanced range, performance, and charging capabilities.

Challenges

- Competition:The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share. Ford and SK On will need to navigate this competitive landscape effectively to ensure the success of their joint venture.

- Supply Chain Challenges:The global supply chain for EV components, including batteries, is facing disruptions and uncertainties. Ford and SK On will need to manage these challenges effectively to ensure a consistent and reliable supply of batteries.

- Market Volatility:The EV market is subject to fluctuations in demand and government policies. Ford and SK On will need to adapt their strategies to navigate these market dynamics.

Future Prospects and Challenges

The Ford and SK joint venture, backed by a substantial US government loan, holds significant promise for the future of electric vehicle (EV) battery production. This collaboration has the potential to drive innovation, create jobs, and bolster the US EV market.

However, navigating the complexities of this rapidly evolving industry will require careful planning and strategic execution.

Potential for Growth and Expansion

The joint venture has a clear path for growth and expansion. The massive investment in battery production facilities, coupled with the strong partnership between Ford and SK, creates a solid foundation for future success. Here are some key aspects:* Increased Production Capacity:The new facilities will significantly increase the production capacity of EV batteries, enabling Ford to meet the growing demand for its electric vehicles.

Technological Advancements

The joint venture is committed to research and development, ensuring that its battery technology remains competitive in the rapidly evolving EV market.

Market Expansion

The joint venture can leverage its resources and expertise to expand into new markets, both domestically and internationally.

Job Creation

The construction and operation of the battery production facilities will create numerous jobs, contributing to economic growth in the US.

Challenges Facing the Joint Venture

Despite the promising prospects, the joint venture will face a number of challenges:* Competition:The EV battery market is becoming increasingly competitive, with established players and new entrants vying for market share.

Technological Advancements

The rapid pace of technological advancements in the EV battery industry requires constant innovation to maintain competitiveness.

Market Fluctuations

The EV market is subject to fluctuations in demand, economic conditions, and government policies, which can impact the joint venture’s profitability.

Supply Chain Disruptions

Global supply chain disruptions, such as those caused by the COVID-19 pandemic, can affect the availability of raw materials and components for battery production.

Strategies for Navigating Challenges

The joint venture can mitigate these challenges through strategic planning and proactive measures:* Innovation and Differentiation:Continuously invest in research and development to create innovative battery technologies that offer superior performance, cost-effectiveness, and sustainability.

Strategic Partnerships

Collaborate with other companies, research institutions, and government agencies to share knowledge, resources, and expertise.

Diversification

Explore opportunities to diversify its product portfolio and enter new markets to reduce reliance on a single market or technology.

Resilient Supply Chains

Establish robust supply chains with multiple sources for raw materials and components to mitigate disruptions.

Environmental Sustainability

Implement sustainable practices throughout the production process to minimize environmental impact and meet evolving regulatory requirements.