Luxury Goods Stocks: Ken Fishers Picks & Top Analyst Favored Companies

Investing in luxury goods stocks billionaire ken fishers recommendations and top analyst favored companies – Investing in luxury goods stocks billionaire Ken Fisher’s recommendations and top analyst favored companies, is a captivating topic that explores the world of high-end brands and their potential for investment growth. The luxury goods market is a fascinating arena where consumer desires for exclusivity and prestige meet the savvy investment strategies of seasoned investors.

This article delves into the insights of Ken Fisher, a renowned investment expert, and examines the top luxury goods companies favored by leading analysts. We’ll uncover the driving forces behind the growth of this sector, analyze the investment considerations for luxury goods stocks, and explore different portfolio strategies for incorporating these assets into your investment portfolio.

From the iconic handbags of Louis Vuitton to the coveted timepieces of Rolex, the luxury goods industry has consistently demonstrated resilience and growth, even amidst economic fluctuations. This article aims to provide a comprehensive overview of the key factors influencing the luxury goods market, including macroeconomic trends, consumer behavior, and competitive dynamics.

We’ll also explore the investment strategies of Ken Fisher and other prominent analysts, providing valuable insights into their preferred luxury goods stocks and their rationale for these selections.

Luxury Goods Market Overview

The global luxury goods market is a dynamic and ever-evolving sector, characterized by high-value products, strong brand recognition, and a discerning clientele. This market has consistently demonstrated resilience and growth, even in the face of economic uncertainties.The luxury goods market is driven by a confluence of factors, including rising disposable incomes in emerging economies, increasing urbanization, and a growing desire for exclusivity and experiences.

While I’m fascinated by the potential of investing in luxury goods stocks, following billionaire Ken Fisher’s recommendations and top analyst-favored companies, I can’t help but be drawn to the incredible advancements happening in the world of neurotechnology. It’s mind-blowing to consider the possibilities of unveiling the future Neuralink’s quest to enable mind-controlled computers ! Perhaps one day, we’ll be able to control our investments with our thoughts, making luxury goods even more accessible.

Until then, I’ll stick to researching the best luxury brands and keeping an eye on the market trends.

Consumers in these regions are increasingly seeking out luxury goods as a means of expressing their status, individuality, and success.

Major Players and Market Share

The luxury goods market is dominated by a handful of global players, each with a distinct portfolio of brands and a significant market share. These companies are known for their expertise in design, craftsmanship, marketing, and distribution. Here are some of the key players and their estimated market share:

- LVMH (Louis Vuitton Moët Hennessy): LVMH is the world’s largest luxury goods conglomerate, with a portfolio of over 75 brands across various categories, including fashion, jewelry, wine, and spirits. Its estimated market share is around 15%.

- Kering: Kering is another major luxury goods group, known for its brands like Gucci, Saint Laurent, and Bottega Veneta. Its market share is estimated to be around 7%.

- Richemont: Richemont is a Swiss luxury goods company that owns brands like Cartier, Van Cleef & Arpels, and Montblanc. Its market share is estimated to be around 6%.

- Hermès: Hermès is a French luxury goods company known for its leather goods, scarves, and perfumes. Its market share is estimated to be around 3%.

- Estée Lauder Companies: Estée Lauder is a leading cosmetics and fragrance company, with a portfolio of luxury brands including MAC, Clinique, and La Mer. Its market share is estimated to be around 3%.

Ken Fisher’s Investment Philosophy

Ken Fisher, the founder and chairman of Fisher Investments, is a renowned investor and author known for his contrarian investment approach. His philosophy emphasizes identifying undervalued assets, focusing on fundamentals, and avoiding the herd mentality that often drives market sentiment.

Fisher’s approach to investing in luxury goods aligns with his broader investment philosophy, where he looks for companies with strong fundamentals and potential for long-term growth.

Rationale for Investing in Luxury Goods

Fisher believes that luxury goods companies, especially those with strong brand recognition and a loyal customer base, are well-positioned to weather economic downturns and benefit from long-term economic growth. He argues that these companies have a unique ability to command premium pricing and maintain strong margins, even during challenging economic periods.

Ken Fisher’s Luxury Goods Stock Recommendations

Fisher has recommended investments in a range of luxury goods companies over the years, with a focus on those with a proven track record of success and a strong potential for future growth. His recommendations have often included:

- LVMH (LVMH.PA): The world’s largest luxury goods conglomerate, LVMH owns a diverse portfolio of luxury brands, including Louis Vuitton, Dior, and Moët & Chandon. Fisher has consistently highlighted LVMH’s strong brand portfolio, global reach, and ability to generate consistent growth.

- Hermès International (RMS.PA): Known for its high-quality leather goods, accessories, and fragrances, Hermès has a strong reputation for craftsmanship and exclusivity. Fisher has praised Hermès’s ability to maintain its brand prestige and consistently deliver high-quality products.

- Richemont (CFR.SW): A Swiss luxury goods conglomerate, Richemont owns a portfolio of brands, including Cartier, Montblanc, and Van Cleef & Arpels. Fisher has noted Richemont’s strong brand portfolio and its exposure to the growing Asian luxury market.

Top Analyst Favored Companies: Investing In Luxury Goods Stocks Billionaire Ken Fishers Recommendations And Top Analyst Favored Companies

Analysts often provide valuable insights into the potential of luxury goods companies. They assess factors like financial performance, brand strength, and market trends to determine which companies are poised for growth. Their recommendations can be a valuable resource for investors seeking to capitalize on the luxury market.

Leading Luxury Goods Companies

Analysts typically rate companies based on their financial performance, growth prospects, and competitive advantages. These factors help determine a company’s overall attractiveness as an investment. Here are some of the top-rated luxury goods companies favored by analysts:

- LVMH (LVMH.PA): The world’s largest luxury goods conglomerate, LVMH boasts a diverse portfolio of brands across various categories, including fashion, jewelry, and spirits. Analysts are impressed by its strong brand portfolio, global reach, and consistent profitability. They cite LVMH’s ability to adapt to changing consumer preferences and its strategic acquisitions as key drivers of growth.

- Hermès International (RMS.PA): Renowned for its leather goods, particularly its iconic Birkin bags, Hermès is known for its exclusivity and craftsmanship. Analysts appreciate the company’s strong brand equity, high pricing power, and controlled distribution strategy. They see potential for continued growth driven by increasing demand for luxury goods, particularly in emerging markets.

- Kering (KER.PA): Kering owns a portfolio of luxury brands including Gucci, Saint Laurent, and Bottega Veneta. Analysts highlight the company’s focus on innovation and its ability to appeal to younger generations. They are optimistic about Kering’s growth prospects, driven by its strong brand portfolio and its expanding presence in key markets.

- Richemont (CFR.SW): A leading player in the luxury watch and jewelry sector, Richemont owns brands such as Cartier, Van Cleef & Arpels, and Montblanc. Analysts note the company’s strong brand portfolio, its focus on craftsmanship, and its strategic acquisitions. They believe Richemont’s growth will be driven by increasing demand for luxury watches and jewelry, particularly in Asia.

- Burberry (BRBY.L): A British luxury fashion house, Burberry is known for its iconic trench coats and its focus on heritage and craftsmanship. Analysts appreciate the company’s efforts to revitalize its brand and its focus on digital innovation. They see potential for growth driven by the increasing popularity of luxury fashion and Burberry’s strong presence in key markets.

While I’m fascinated by the world of luxury goods stocks and the recommendations from billionaires like Ken Fisher, I’m also drawn to the potential of cryptocurrencies. Understanding the differences between platforms like Bitcoin and Ethereum is crucial for any investor.

For example, Ethereum is more than just a digital currency; it’s a platform that enables smart contracts and decentralized applications, a concept explored in detail in this article: how ethereum is different from bitcoin. But back to luxury goods, I’m particularly interested in companies that are tapping into the growing demand for sustainable and ethical products, a trend that could drive significant growth in the coming years.

Financial Performance and Growth Prospects

These companies have demonstrated strong financial performance in recent years, with revenue and profit growth consistently exceeding industry averages.

- LVMHhas consistently reported strong earnings growth, driven by its diverse portfolio of brands and its global reach. The company has also demonstrated a strong track record of strategic acquisitions, which have helped to expand its market share and drive revenue growth.

- Hermèshas a history of strong organic growth, driven by its brand equity and its controlled distribution strategy. The company has also been able to maintain high margins, reflecting its pricing power and its commitment to craftsmanship.

- Keringhas benefited from the growing popularity of its brands, particularly Gucci, which has experienced significant growth in recent years. The company has also been successful in expanding its presence in key markets, such as China.

- Richemonthas seen strong growth in its watch and jewelry businesses, driven by increasing demand in Asia and other emerging markets. The company has also been successful in expanding its portfolio of luxury brands through strategic acquisitions.

- Burberryhas been undergoing a turnaround under its new CEO, with a focus on revitalizing its brand and improving its profitability. The company has been investing in digital innovation and expanding its presence in key markets.

Competitive Advantages

These companies have a number of competitive advantages that contribute to their success.

Investing in luxury goods stocks can be a smart move, especially when you consider the recommendations of billionaire Ken Fisher and top analysts. It’s all about identifying the right brands and companies that are poised for growth. And speaking of growth, the IPL is a prime example of how a sport can become a financial powerhouse, as detailed in this article about the money game of Indian cricket.

Just like the IPL, luxury goods brands are riding the wave of increased consumer spending and a desire for high-quality, aspirational products.

- Strong brand equity: These companies have built strong brands over decades, which gives them pricing power and a loyal customer base.

- Exclusive distribution: Many of these companies have a controlled distribution strategy, which helps to maintain the exclusivity of their products and drive demand.

- Focus on craftsmanship: These companies are known for their commitment to quality and craftsmanship, which helps to differentiate them from competitors.

- Global reach: These companies have a global presence, which gives them access to a large and growing market for luxury goods.

- Innovation: These companies are constantly innovating to stay ahead of the competition and appeal to new generations of consumers.

Investment Thesis

Analysts believe that these companies are well-positioned for continued growth, driven by several factors:

- Growing demand for luxury goods: The global demand for luxury goods is expected to continue to grow in the coming years, driven by factors such as rising disposable incomes and increasing urbanization.

- Shifting consumer preferences: Consumers are increasingly seeking out experiences and products that offer exclusivity and craftsmanship, which plays into the strengths of these companies.

- Emerging markets: These companies are well-positioned to benefit from the growth of emerging markets, such as China and India, which are experiencing rapid economic growth and a rising demand for luxury goods.

- Digital innovation: These companies are investing in digital innovation to reach new customers and improve their efficiency.

- Strong financial performance: These companies have a track record of strong financial performance, which suggests they are well-managed and have the resources to invest in future growth.

Comparison and Contrast

While these companies share some commonalities, there are also key differences in their investment theses.

- LVMHis a diversified conglomerate with a broad portfolio of brands, making it a more conservative investment than some of its peers.

- Hermèsis known for its exclusivity and its focus on craftsmanship, which gives it a premium valuation but also limits its growth potential.

- Keringis more focused on fashion and has a higher growth potential but also faces more competition.

- Richemontis a leading player in the watch and jewelry sector, which is expected to experience strong growth in the coming years.

- Burberryis undergoing a turnaround and has the potential to outperform its peers but also faces challenges in revitalizing its brand.

Investment Considerations for Luxury Goods Stocks

Investing in luxury goods stocks presents both significant opportunities and inherent risks. Understanding these factors is crucial for making informed investment decisions.

Macroeconomic Factors, Investing in luxury goods stocks billionaire ken fishers recommendations and top analyst favored companies

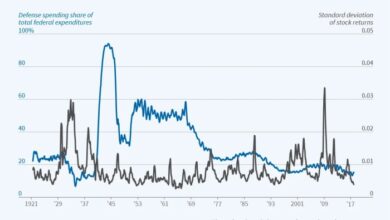

The luxury goods sector is highly sensitive to macroeconomic conditions. Economic growth, consumer confidence, and disposable income levels directly impact demand for luxury products.

- Economic Growth:During periods of strong economic growth, consumers are more likely to spend on discretionary items, including luxury goods. Conversely, economic downturns or recessions often lead to reduced demand for luxury products as consumers prioritize essential spending. For example, during the 2008 financial crisis, sales of luxury goods declined significantly.

- Consumer Confidence:Consumer confidence plays a vital role in influencing spending patterns. When consumers are optimistic about the economy, they are more likely to spend on luxury items. Conversely, low consumer confidence can lead to a decrease in luxury spending.

- Disposable Income:Luxury goods are typically considered discretionary purchases. Therefore, changes in disposable income, which is the amount of income remaining after essential expenses, directly affect demand for luxury products. Rising disposable income can lead to increased luxury spending, while declining disposable income may result in reduced demand.

Key Metrics

Evaluating luxury goods stocks requires careful consideration of several key metrics. These metrics provide insights into the financial health, growth prospects, and profitability of luxury brands.

- Revenue Growth:A consistent track record of revenue growth indicates strong demand for the brand’s products and services. Analyzing revenue growth trends over time can help assess the brand’s market share and potential for future growth.

- Profitability:Luxury goods companies typically aim for high profit margins due to the premium pricing of their products. Key profitability metrics to consider include gross margin, operating margin, and net profit margin. These metrics indicate the company’s ability to control costs and generate profits.

- Brand Value:Brand value is a crucial intangible asset for luxury goods companies. A strong brand reputation, exclusivity, and desirability contribute to high prices and loyal customer base. Metrics such as brand awareness, brand loyalty, and brand perception can help assess the strength of a luxury brand.

- Inventory Management:Effective inventory management is essential for luxury goods companies. Excess inventory can lead to markdowns and lower profit margins, while insufficient inventory can result in lost sales opportunities. Analyzing inventory turnover ratios and days of inventory on hand can provide insights into the company’s inventory management efficiency.

Portfolio Strategies for Luxury Goods Investments

Investing in luxury goods stocks can be a lucrative endeavor, but it requires a thoughtful approach. Understanding different portfolio strategies and implementing appropriate allocation techniques can help investors navigate this dynamic market.

Core-Satellite Strategy

The core-satellite strategy is a popular approach for diversifying portfolios. In this strategy, investors allocate a larger portion of their capital to a core portfolio of low-risk, diversified assets like index funds or ETFs. This provides a stable foundation for the portfolio.

The remaining portion is allocated to satellite portfolios, which hold higher-risk, potentially higher-reward assets, such as luxury goods stocks. This allows investors to capture potential upside while managing overall risk.

Growth-Focused Strategy

Investors seeking high growth potential might favor a growth-focused strategy. This strategy prioritizes companies with strong growth prospects and a track record of exceeding market expectations. Examples of companies that might be included in a growth-focused portfolio include luxury brands with a strong presence in emerging markets or those expanding into new product categories.

Value-Oriented Strategy

Value-oriented investors seek out undervalued companies with strong fundamentals but whose stock prices may be depressed due to market conditions or other factors. This approach involves identifying luxury goods companies that are trading at a discount to their intrinsic value, based on factors like earnings, assets, or cash flow.

Sector Rotation Strategy

Sector rotation involves adjusting portfolio holdings based on market cycles and economic trends. This strategy can be beneficial for luxury goods investments as the sector is often influenced by factors like consumer spending, global economic growth, and currency fluctuations. By identifying trends and shifting allocations accordingly, investors can potentially capitalize on sector-specific opportunities.

Allocation Strategies

The allocation of capital within a luxury goods portfolio depends on several factors, including the investor’s risk tolerance, investment goals, and time horizon. Here are some considerations:

- Risk Tolerance:Investors with a higher risk tolerance might allocate a larger percentage of their portfolio to luxury goods stocks, while those with a lower risk tolerance may prefer a smaller allocation.

- Investment Goals:The specific investment goals, such as capital appreciation or income generation, will influence allocation decisions.

- Time Horizon:A longer time horizon allows for more flexibility and potential for higher returns, while a shorter time horizon may necessitate a more conservative approach.

Diversification

Diversification is crucial for managing risk in any investment portfolio, and luxury goods investments are no exception. Diversifying across different luxury goods categories, such as fashion, jewelry, and accessories, can help mitigate risk by reducing exposure to any single sector or company.

Additionally, diversifying geographically by investing in companies with a global presence can further reduce portfolio volatility.