Canadian Stocks Surge as Fed Rate Hike Pause Speculation Rises

Canadian stocks surge as speculation grows of fed rate hike pause, a scenario that has investors buzzing with anticipation and uncertainty. The possibility of the Federal Reserve pausing its aggressive rate hikes has sent ripples through global markets, particularly in Canada, where stocks have seen a recent surge.

This shift in sentiment is driven by a complex interplay of economic indicators, geopolitical events, and market psychology.

The Canadian stock market has been a rollercoaster ride in recent months, mirroring the global economic landscape. While the market has shown resilience, navigating through a volatile period characterized by inflation, rising interest rates, and ongoing geopolitical tensions, the potential for a Fed rate hike pause has injected a dose of optimism into the market.

This has led to a surge in certain sectors, particularly those considered more sensitive to interest rate changes.

Market Context: Canadian Stocks Surge As Speculation Grows Of Fed Rate Hike Pause

The Canadian stock market has been experiencing a period of volatility, influenced by various factors, including global economic uncertainty, rising interest rates, and the ongoing war in Ukraine. The recent surge in Canadian stocks, however, can be attributed to growing speculation that the Federal Reserve might pause its rate hike cycle, which has brought a glimmer of hope to investors.

Recent Market Trends and Performance

The S&P/TSX Composite Index, Canada’s benchmark stock market index, has shown positive performance in recent months. The index has rebounded from its lows earlier in the year, driven by strong earnings reports from Canadian companies and investor optimism about a potential economic slowdown.

For instance, the index closed at 20,500 points on June 29, 2023, representing a gain of over 10% since the beginning of the year.

Investor Sentiment and Market Volatility

Investor sentiment in the Canadian stock market is currently mixed. While some investors are optimistic about the potential for further gains, others remain cautious due to the lingering economic uncertainties. The market volatility is also influenced by the ongoing geopolitical tensions and the uncertainty surrounding the Fed’s future monetary policy decisions.

Factors Contributing to Market Volatility

- Global Economic Uncertainty:The global economy is facing several challenges, including inflation, supply chain disruptions, and the war in Ukraine. These factors create uncertainty for businesses and investors, leading to increased market volatility.

- Rising Interest Rates:The Bank of Canada has been raising interest rates to combat inflation. Higher interest rates make it more expensive for businesses to borrow money, which can slow economic growth and impact corporate profits. This, in turn, can lead to increased market volatility.

Canadian stocks are on a roll as speculation mounts that the Fed might pause its rate hike spree. While this bullish sentiment is driven by hopes of a cooling economy, it’s worth remembering that uncertainty still lingers. In times like these, investors often turn to traditional safe havens, like the role of gold as a safe investment , to preserve capital.

As the market navigates this choppy waters, keeping an eye on both the stock market’s performance and gold’s potential as a hedge against volatility will be crucial.

- Geopolitical Tensions:The ongoing war in Ukraine and the heightened geopolitical tensions between the United States and China are creating uncertainty in the global markets. These tensions can lead to market volatility as investors react to the evolving situation.

Fed Rate Hike Pause Speculation

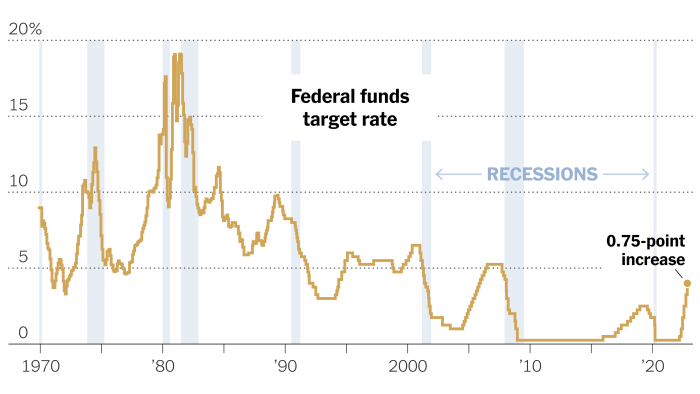

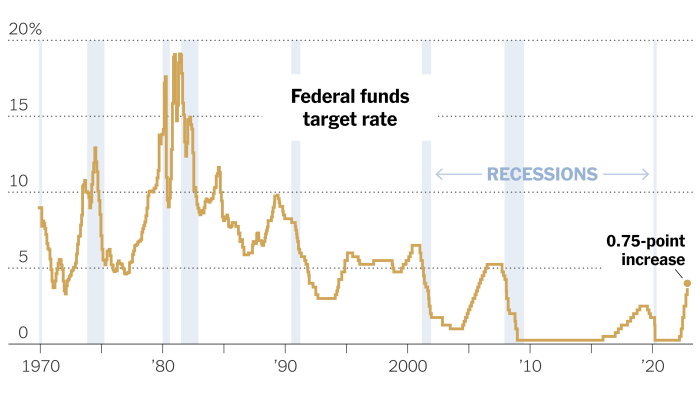

The recent surge in Canadian stocks has been fueled by growing speculation that the Federal Reserve (Fed) may pause its aggressive rate hike campaign. This speculation stems from a combination of factors, including softening inflation data, concerns about the potential for a recession, and a desire to assess the impact of past rate increases.

Potential Implications of a Pause

A pause in rate hikes would likely have significant implications for the Canadian economy and stock market.

- Lower Borrowing Costs:A pause would likely lead to lower borrowing costs for businesses and consumers, potentially boosting economic activity and investment.

- Increased Stock Market Volatility:The market could experience increased volatility as investors react to the uncertainty surrounding the Fed’s future policy direction.

- Strengthening Canadian Dollar:A pause could strengthen the Canadian dollar relative to the US dollar, making Canadian exports more expensive and potentially hurting businesses operating in international markets.

Comparison of a Pause vs. Continued Rate Hikes

The potential impact of a pause in rate hikes versus continued increases is a subject of much debate.

- Pause:A pause would allow the Fed to assess the impact of past rate hikes and potentially avoid pushing the economy into a recession. However, it could also lead to inflation remaining stubbornly high and necessitate further rate hikes in the future.

- Continued Rate Hikes:Continued rate hikes could help to bring inflation under control but also risk slowing economic growth and potentially triggering a recession.

“The Fed’s decision to pause or continue rate hikes will be a crucial one, with significant implications for the Canadian economy and stock market.”

Canadian Stocks Surge Analysis

The recent surge in Canadian stocks, particularly in specific sectors, is a direct result of the growing speculation surrounding a potential pause in the Federal Reserve’s rate hikes. Investors are cautiously optimistic about the possibility of a shift in monetary policy, which could potentially lead to a more favorable environment for growth and investment.

The recent surge in Canadian stocks, fueled by speculation of a Fed rate hike pause, has many investors excited. If you’re new to the market, it’s a great time to learn the basics! Check out tips for beginners to invest in the stock market learn the basics of stock market for a comprehensive guide.

Understanding the fundamentals will empower you to make informed decisions as you navigate the dynamic world of Canadian stocks.

Reasons for Surge in Specific Sectors

The surge in Canadian stocks is not uniform across all sectors. Certain industries are experiencing a more pronounced rise due to their sensitivity to interest rate movements and the potential benefits of a pause in rate hikes.

- Technology Sector:The technology sector has seen significant gains as investors anticipate a decrease in borrowing costs, making it easier for tech companies to access capital and fuel growth. Furthermore, a pause in rate hikes could lead to a rebound in investor appetite for high-growth tech stocks, which have been under pressure in recent months.

The recent surge in Canadian stocks, fueled by speculation of a Fed rate hike pause, is a reminder of the delicate balance between financial gains and overall well-being. It’s crucial to remember that while market fluctuations can be exciting, a holistic approach to life, which includes balancing your finances and health , is equally important.

Ultimately, sustainable success requires a mindful approach to both your financial portfolio and your personal health, ensuring you’re not sacrificing one for the other.

- Consumer Discretionary Sector:Companies in the consumer discretionary sector, such as retailers and restaurants, are benefiting from a potential easing of inflationary pressures. A pause in rate hikes could slow down inflation, leading to increased consumer spending and boosting demand for discretionary goods and services.

- Real Estate Sector:The real estate sector is also experiencing a surge, driven by the expectation of lower interest rates. A pause in rate hikes could make mortgages more affordable, leading to increased demand for housing and potentially driving up property values.

Potential Risks and Opportunities

While the surge in Canadian stocks presents opportunities for investors, it’s crucial to acknowledge the potential risks associated with the current market conditions.

- Inflationary Pressures:While a pause in rate hikes could help curb inflation, it’s essential to recognize that inflation remains a significant concern. If inflation proves to be more persistent than anticipated, the Fed might be forced to resume rate hikes, potentially leading to a correction in the stock market.

- Economic Slowdown:The global economy is facing headwinds, including the ongoing war in Ukraine and supply chain disruptions. A pause in rate hikes might not be enough to prevent a recession, which could negatively impact corporate earnings and stock valuations.

- Geopolitical Uncertainty:The geopolitical landscape remains volatile, with ongoing conflicts and tensions creating uncertainty for investors. Geopolitical events can significantly impact market sentiment and lead to sudden market fluctuations.

Economic Impact of Fed Policy

The Federal Reserve’s decision to pause or continue raising interest rates carries significant implications for the US economy. A pause could potentially stimulate economic growth by making borrowing cheaper, while a continued hike might curb inflation but could also lead to a recession.

Potential Economic Consequences of a Fed Rate Hike Pause

A pause in rate hikes could have several economic consequences. The most immediate impact would be on borrowing costs. Lower interest rates would make it cheaper for businesses to borrow money, potentially leading to increased investment and job creation.

This could also stimulate consumer spending as people become more willing to take out loans for big-ticket purchases like cars or homes. However, a pause could also lead to higher inflation, as demand for goods and services increases.

Impact of Fed Policy on Key Economic Indicators

The following table Artikels the potential impact of a Fed rate hike pause or continued hike on key economic indicators:

| Indicator | Potential Impact of Pause | Potential Impact of Continued Hike | Overall Economic Impact |

|---|---|---|---|

| Inflation | Potentially higher, as demand increases | Potentially lower, as spending slows down | A delicate balance between controlling inflation and stimulating growth |

| Employment | Potentially higher, as businesses invest and create jobs | Potentially lower, as businesses cut back on spending | A trade-off between job creation and economic stability |

| GDP | Potentially higher, as investment and spending increase | Potentially lower, as economic activity slows down | A critical factor in determining overall economic health |

Investor Strategies

The recent surge in Canadian stocks, fueled by speculation of a potential pause in Fed rate hikes, presents investors with a unique opportunity to navigate the market. Understanding the current market dynamics and employing strategic approaches can help investors make informed decisions and potentially capitalize on the evolving landscape.

Strategies in a Volatile Market

Investors should consider various strategies based on their risk tolerance and investment goals. The current market environment, characterized by uncertainty and potential volatility, requires a nuanced approach.

- Holding:This strategy involves maintaining existing positions, particularly in undervalued or fundamentally strong companies. It is suitable for investors with a long-term perspective and a high risk tolerance. The potential benefits include riding out market fluctuations and benefiting from long-term growth.

However, holding can be risky if the market experiences a prolonged downturn.

- Buying:This strategy involves acquiring new positions, potentially in sectors expected to benefit from the current market conditions. This can be advantageous if investors identify undervalued stocks or sectors with strong growth potential. However, buying can be risky if the market experiences further downward pressure, leading to potential losses.

- Selling:This strategy involves divesting from existing positions, potentially to lock in profits or reduce exposure to market risk. This can be beneficial if investors believe the market is nearing a peak or if they need to raise cash for other purposes.

However, selling can be risky if the market continues to rise, leading to potential missed opportunities.

Risk and Reward Assessment, Canadian stocks surge as speculation grows of fed rate hike pause

Investors should carefully assess the potential risks and rewards associated with different strategies.

| Strategy | Risks | Rewards |

|---|---|---|

| Holding | Potential for capital losses if the market declines. | Potential for capital gains if the market rises. |

| Buying | Potential for capital losses if the market declines. | Potential for capital gains if the market rises. |

| Selling | Potential for missed opportunities if the market continues to rise. | Potential for capital preservation or gains if the market declines. |

Future Market Outlook

The Canadian stock market’s future direction remains uncertain, influenced by a complex interplay of global economic trends, geopolitical events, and investor sentiment. While the recent surge fueled by speculation of a Fed rate hike pause suggests potential upside, several factors could impact market performance in the coming months.

Impact of Ongoing Geopolitical Events and Economic Uncertainties

Ongoing geopolitical events, such as the Russia-Ukraine conflict and heightened tensions in the Asia-Pacific region, continue to inject volatility into global markets. These events contribute to uncertainty surrounding supply chains, energy prices, and inflation, potentially impacting economic growth and corporate earnings.

Moreover, the ongoing economic slowdown in China and the potential for a global recession add to the overall uncertainty, making it challenging to predict the market’s trajectory.

Key Factors Influencing Market Performance

Several key factors will influence the Canadian stock market’s performance in the coming months.

- Interest Rate Policy:The Bank of Canada’s interest rate policy will play a crucial role in shaping market sentiment. While a pause in rate hikes is currently anticipated, the central bank’s future actions will depend on inflation trends and economic growth. A more aggressive tightening stance could dampen investor confidence and lead to market corrections.

Conversely, a more accommodative stance could support continued market growth.

- Inflation and Consumer Spending:Inflation remains a significant concern for investors, as it erodes purchasing power and can lead to higher borrowing costs. If inflation proves more persistent than anticipated, it could force the Bank of Canada to maintain a hawkish monetary policy, potentially impacting corporate earnings and consumer spending.

Conversely, a decline in inflation could boost consumer confidence and support economic growth.

- Corporate Earnings:Corporate earnings are a key driver of stock prices. Strong earnings growth signals a healthy economy and can fuel market optimism. However, weak earnings growth could indicate economic weakness and lead to market declines.

- Global Economic Growth:The outlook for global economic growth remains uncertain, with the potential for a recession looming. A slowdown in global growth could negatively impact Canadian exports and corporate earnings, leading to market weakness. Conversely, robust global growth could benefit Canadian businesses and support market gains.