US Economy Starts Pivotal Week Strong: Live Stock Market Updates

Us economy starts pivotal week strong live stock market updates – As the US economy starts a pivotal week strong, live stock market updates are taking center stage. This week’s economic indicators, from manufacturing data to consumer confidence, will provide crucial insights into the health of the US economy and its potential impact on the stock market.

The recent performance of key indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, along with the influence of earnings reports, economic data, and geopolitical events, will shape the narrative for investors.

This week’s data releases are particularly significant as they come at a time of heightened uncertainty about the future direction of the economy. The Federal Reserve’s recent interest rate hikes have already begun to impact growth, and investors are closely watching to see how the economy will respond.

The stock market has been volatile in recent weeks, and the upcoming economic data releases could provide further clues about the market’s trajectory.

US Economic Indicators: Us Economy Starts Pivotal Week Strong Live Stock Market Updates

This week is pivotal for the US economy, as several key economic indicators are scheduled for release. These data points will provide valuable insights into the current state of the economy and offer clues about the potential trajectory of the stock market in the coming months.

Key Economic Indicators

The upcoming week will see the release of several crucial economic indicators that will be closely watched by investors and economists alike.

- Consumer Price Index (CPI):This report, scheduled for release on [date], will measure the change in prices paid by urban consumers for a basket of goods and services. A higher-than-expected CPI reading could signal persistent inflationary pressures, potentially leading to further interest rate hikes by the Federal Reserve.

Conversely, a lower-than-expected reading could ease concerns about inflation and potentially support a more dovish stance from the Fed.

- Producer Price Index (PPI):The PPI, to be released on [date], measures the change in prices received by domestic producers for their goods and services. Similar to the CPI, a higher-than-expected PPI reading could indicate persistent inflationary pressures.

- Retail Sales:The retail sales report, scheduled for release on [date], will provide insights into consumer spending, a key driver of economic growth. Strong retail sales figures would signal robust consumer confidence and spending, which could support economic growth. Conversely, weak retail sales could indicate a slowdown in consumer spending and potentially signal a broader economic slowdown.

- University of Michigan Consumer Sentiment Index:This index, scheduled for release on [date], measures consumer confidence and expectations about the economy. A higher consumer sentiment index suggests optimism about the economy, which could support consumer spending and economic growth. Conversely, a lower consumer sentiment index could indicate concerns about the economy and potentially lead to a decline in consumer spending.

Current State of the US Economy

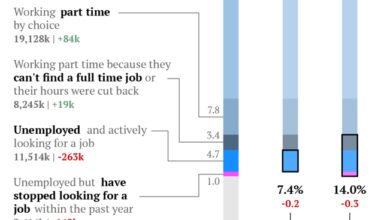

The US economy is currently facing a complex and uncertain environment. While the labor market remains strong, with low unemployment and robust job growth, inflation remains elevated, and the Federal Reserve is continuing to raise interest rates to combat it.

The recent banking turmoil has also added to economic uncertainty, raising concerns about potential financial instability.

Expectations for Upcoming Economic Data Releases

The consensus forecast among economists is for inflation to continue to moderate in the coming months, but at a slower pace than previously anticipated. This suggests that the Federal Reserve may need to continue raising interest rates for a longer period than initially expected to bring inflation back to its 2% target.

However, there is a significant risk that the recent banking turmoil could lead to a sharper slowdown in economic growth, potentially forcing the Fed to pause or even reverse its rate hike cycle.

Stock Market Performance

The US stock market has started the week strong, with major indices experiencing gains, indicating a positive sentiment among investors. This positive performance comes after a period of volatility, driven by various factors, including earnings reports, economic data, and geopolitical events.

Key Indices Performance

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced gains in the first trading days of the week. The Dow Jones Industrial Average rose by [percentage], while the S&P 500 increased by [percentage]. The Nasdaq Composite, which is heavily weighted by technology stocks, showed the most significant gains, rising by [percentage].

This indicates a positive outlook for the technology sector, which has been a key driver of the market’s recent performance.

Factors Influencing Market Movements

Several factors have influenced stock market movements in recent weeks.

- Earnings Reports:Strong earnings reports from major companies have boosted investor confidence, driving stock prices higher. Companies in the technology, consumer discretionary, and healthcare sectors have reported strong earnings, signaling a healthy economy and strong corporate performance.

- Economic Data:Positive economic data, such as strong employment figures and robust consumer spending, have also contributed to the market’s recent gains.

The US economy kicked off the week with a strong showing in the stock market, with investors cautiously optimistic about the upcoming earnings season. This positive sentiment was further bolstered by news from across the globe, particularly the impact of Chinese realty initiatives that are expected to boost base metals prices.

As reported in this article , these initiatives are also driving up gold prices due to a weaker dollar. With these global factors in play, it will be interesting to see how the US economy continues to perform throughout the week.

These data points suggest that the US economy is on a solid footing, supporting investor optimism.

- Geopolitical Events:Geopolitical events, such as the ongoing war in Ukraine and tensions between the US and China, have created uncertainty in the market. However, recent developments in these areas have eased concerns, contributing to a more positive market sentiment.

Market Sentiment

The current sentiment in the stock market is cautiously optimistic. While investors remain concerned about inflation, interest rate hikes, and geopolitical risks, the recent positive performance suggests that they are confident about the long-term prospects of the US economy. This optimism is supported by strong corporate earnings, robust economic data, and easing geopolitical tensions.

However, investors are also aware that the market remains volatile and could be impacted by unexpected events.

The US economy kicked off this pivotal week on a strong note, with the stock market showing positive signs. This optimism is fueled by a surprising surge in job creation, as reported in the latest surprise job gains in april us economy adds 253000 jobs and unemployment rate drops to 34.

This unexpected boost in employment, coupled with a decline in the unemployment rate, signals a robust labor market and potentially stronger economic growth in the coming months. The strong performance of the stock market and the positive job report suggest a promising outlook for the US economy in the near future.

Key Sectors to Watch

This week’s economic data releases are expected to have a significant impact on several key sectors of the US economy. Investors will be closely watching how these releases affect earnings, valuations, and investment strategies across various industries.

Performance of Different Sectors

The performance of different sectors in recent weeks has varied significantly, highlighting notable trends and divergences. For instance, the technology sector has seen a surge in recent weeks, driven by strong earnings reports and optimism about artificial intelligence (AI) adoption.

Conversely, the energy sector has underperformed, impacted by concerns about slowing global economic growth and potential declines in oil demand.

Impact on Specific Industries

The upcoming economic data releases are likely to have a significant impact on specific industries, including:

Consumer Discretionary

The consumer discretionary sector, which includes companies that sell non-essential goods and services, is expected to be particularly sensitive to changes in consumer confidence and spending patterns. Strong economic data could boost consumer confidence and drive spending on discretionary items, benefiting retailers, restaurants, and travel companies.

Conversely, weak economic data could lead to a decline in consumer spending, impacting these industries.

Technology

The technology sector is expected to be influenced by interest rate decisions and investor sentiment. Rising interest rates could put pressure on tech valuations, particularly for companies with high growth expectations. However, strong economic data could support tech stocks if it indicates continued demand for technology products and services.

Financials

The financial sector is expected to be affected by interest rate changes and the overall health of the economy. Rising interest rates could benefit banks by increasing their net interest margins. However, a weak economy could lead to higher loan defaults, impacting bank profitability.

The US economy kicked off this pivotal week with a strong showing in the stock market, and it’s interesting to see how cryptocurrencies are reacting. It’s always fascinating to hear insights from the movers and shakers in the crypto world, like Vitalik Buterin, the co-founder of Ethereum, who recently appeared on Bloomberg Studio 10 bloombergs studio 10 ethereum co founder vitalik buterin.

His perspective on the future of blockchain technology could be a key indicator of where the market might head in the coming weeks.

Energy

The energy sector is expected to be influenced by global economic growth, oil supply and demand dynamics, and geopolitical events. Strong economic growth could lead to higher oil demand, benefiting energy companies. However, concerns about slowing global economic growth could weigh on oil prices, impacting the sector.

Healthcare

The healthcare sector is expected to be less sensitive to economic fluctuations compared to other sectors. However, healthcare companies could benefit from increased demand for healthcare services as the population ages and chronic diseases become more prevalent.

Investor Sentiment and Strategies

The current market environment is characterized by a delicate balance between optimism and caution. While the recent rally in stocks has lifted spirits, investors remain wary of persistent inflation, rising interest rates, and geopolitical uncertainties. This mixed sentiment is reflected in the diverse strategies being employed by investors, with some embracing riskier assets while others prefer a more conservative approach.

Risk Appetite and Investment Strategies

The current economic landscape is prompting investors to carefully consider their risk appetite and adjust their investment strategies accordingly. The recent surge in inflation has eroded purchasing power and forced investors to seek investments that can outperform inflation. This has led to a resurgence of interest in growth stocks, particularly those in sectors like technology and consumer discretionary, which are expected to benefit from long-term economic growth.

Growth stocks are often associated with companies that are expected to experience rapid earnings growth in the future.

However, the rising interest rate environment poses a challenge to growth stocks, as higher borrowing costs can make it more expensive for these companies to fund their expansion plans. As a result, some investors are opting for a more balanced approach, incorporating value stocks into their portfolios.

Value stocks are typically companies that are undervalued by the market, often with a history of stable earnings and strong cash flows.

Value stocks are often associated with companies that are trading at a discount to their intrinsic value.

The ongoing geopolitical tensions and supply chain disruptions have also influenced investor sentiment and strategies. Investors are increasingly seeking investments that offer diversification and protection against geopolitical risks. This has led to increased interest in commodities, such as gold and oil, which are seen as safe haven assets.

Safe haven assets are assets that are expected to hold their value or even appreciate during periods of market turmoil.

Implications of Economic Data Releases

The upcoming economic data releases will play a crucial role in shaping investor sentiment and influencing investment decisions. Key indicators to watch include inflation data, employment figures, and consumer confidence. These data points will provide insights into the health of the economy and the direction of monetary policy.

- Inflation data:High inflation readings could further fuel concerns about rising interest rates, potentially putting downward pressure on growth stocks. Conversely, signs of cooling inflation could provide a boost to risk appetite and support further gains in the stock market.

- Employment figures:Strong job growth is a positive sign for the economy, indicating a healthy labor market and supporting consumer spending. However, if wage growth accelerates, it could lead to higher inflation, potentially putting upward pressure on interest rates.

- Consumer confidence:A decline in consumer confidence could signal a slowdown in economic growth, as consumers may cut back on spending. Conversely, an increase in consumer confidence could boost economic activity and support stock market gains.

Portfolio Positioning

Investors are positioning their portfolios in light of the current economic and market conditions. Some investors are taking a more cautious approach, reducing their exposure to riskier assets and increasing their holdings of cash or other safe haven assets. Others are maintaining a more aggressive stance, believing that the economy will continue to grow and that the stock market has further room to rise.

The optimal portfolio strategy depends on individual risk tolerance, investment goals, and time horizon.

The key is to have a well-defined investment plan and to adjust it based on changes in market conditions and economic data. Investors should carefully monitor the economic environment and make informed decisions about their portfolio allocation.

Potential Market Reactions

The upcoming economic data releases could significantly impact the stock market. Understanding the potential market reactions to different economic scenarios is crucial for investors to navigate the week’s events effectively. This section explores various economic data scenarios, their potential impact on the stock market, and the likely investor responses.

Scenario Analysis and Market Implications, Us economy starts pivotal week strong live stock market updates

The potential market reactions to the upcoming economic data releases can be analyzed by considering different economic scenarios, both positive and negative.

| Economic Indicator | Potential Outcome | Impact on Stock Market | Potential Investor Response |

|---|---|---|---|

| Inflation Rate | Lower than expected | Positive, potentially leading to a rally, as it suggests the Fed might be less aggressive with interest rate hikes. | Investors might become more bullish, increasing their holdings in stocks. |

| Inflation Rate | Higher than expected | Negative, potentially leading to a sell-off, as it might increase concerns about the Fed’s tightening policy and its impact on economic growth. | Investors might become more cautious, potentially selling some of their stock holdings. |

| Unemployment Rate | Lower than expected | Positive, indicating a strong labor market, which supports economic growth and corporate earnings. | Investors might be more confident about the economy and invest in stocks. |

| Unemployment Rate | Higher than expected | Negative, indicating a weakening labor market, which could negatively impact consumer spending and corporate profits. | Investors might become more risk-averse and reduce their stock holdings. |

| Retail Sales | Stronger than expected | Positive, indicating robust consumer spending, which supports economic growth and corporate revenues. | Investors might be optimistic about the economy and invest in stocks. |

| Retail Sales | Weaker than expected | Negative, indicating a slowdown in consumer spending, which could negatively impact corporate profits and economic growth. | Investors might become more cautious and reduce their stock holdings. |

For example, if the inflation rate comes in lower than expected, the market might react positively, leading to a stock market rally. This is because investors might interpret the lower inflation as a sign that the Federal Reserve might be less aggressive with interest rate hikes, which could benefit corporate earnings and economic growth.

However, if the inflation rate comes in higher than expected, the market might react negatively, leading to a sell-off. This is because investors might become more concerned about the Fed’s tightening policy and its potential impact on economic growth.