Chinese Realty Initiatives Boost Base Metals, Gold Surges

Chinese realty initiatives set to boost base metals gold surges on weaker dollar – this is the headline that’s capturing the attention of investors and market analysts alike. The Chinese government is actively implementing measures to revitalize its real estate sector, with the goal of boosting economic growth and stimulating demand for key commodities.

This move is anticipated to have a significant impact on the global market, particularly for base metals like copper, aluminum, and nickel, as construction activity is expected to increase.

The weaker US dollar, a major factor driving gold prices higher, is another crucial element in this complex equation. As the dollar weakens, gold becomes more attractive as a safe haven asset, leading to increased demand and higher prices. The interplay of these factors presents a fascinating scenario for investors, who are carefully watching how these trends unfold and their potential impact on their portfolios.

Chinese Realty Initiatives

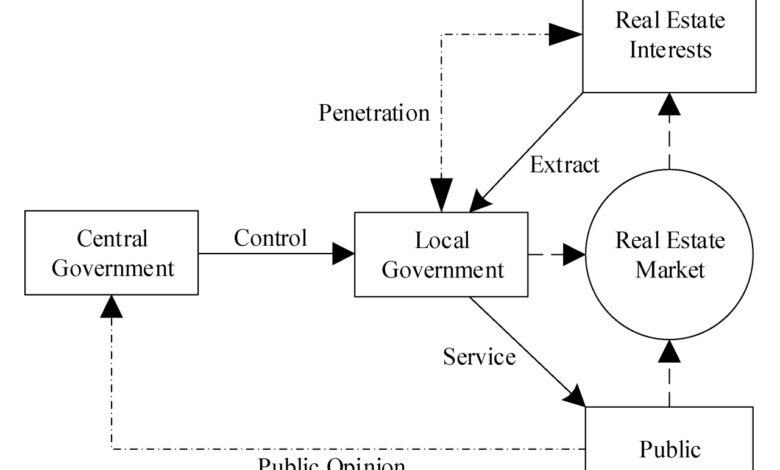

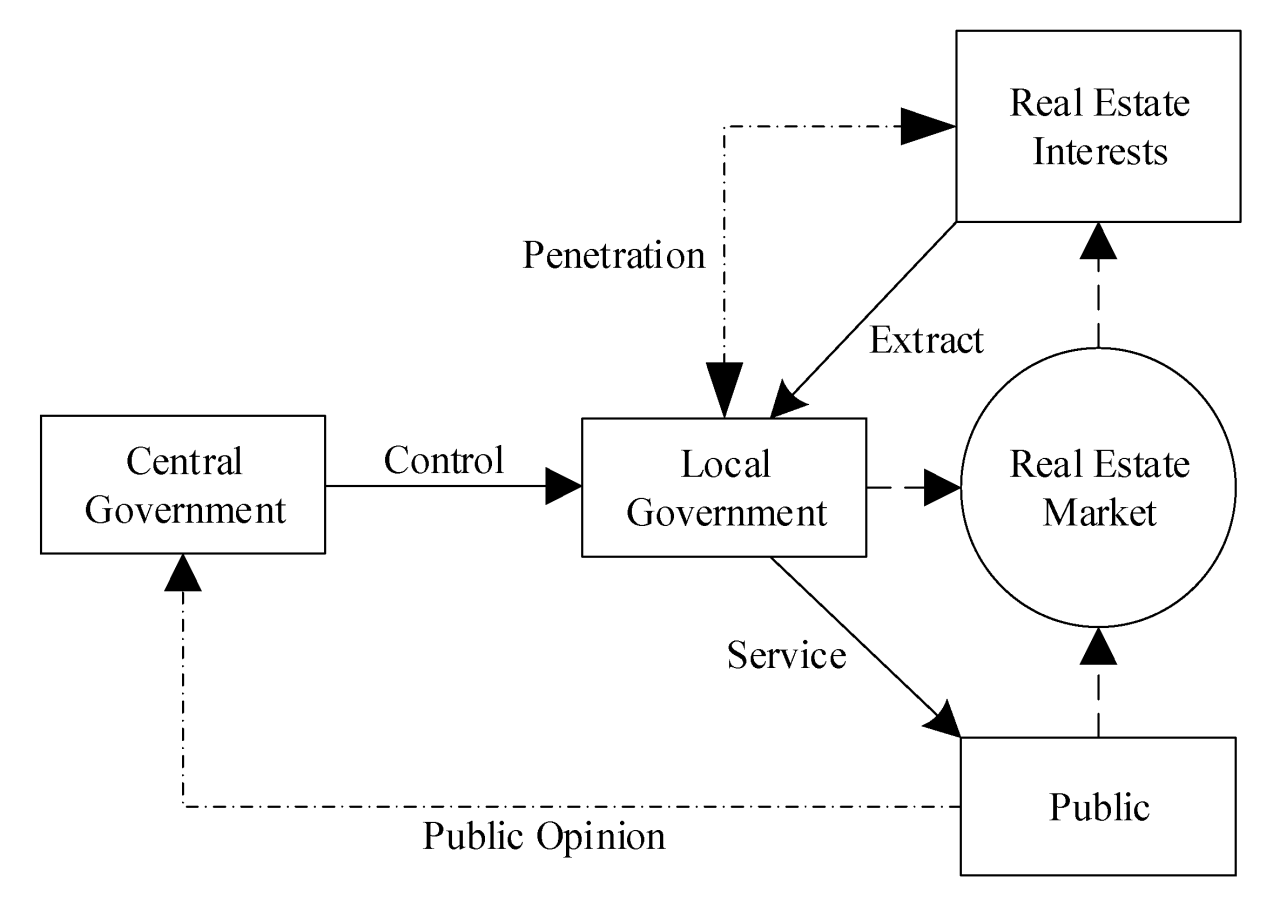

China’s real estate sector has been a major driver of economic growth for decades, but in recent years, it has faced significant challenges, including a slowdown in demand, rising debt levels, and concerns about property bubbles. To address these issues and revive the sector, the Chinese government has implemented a series of initiatives aimed at stimulating growth and ensuring stability.

These initiatives have the potential to impact not only the Chinese economy but also the global market.

The recent surge in gold prices, driven by a weaker dollar and Chinese realty initiatives aimed at boosting base metals demand, has added an interesting twist to the global economic landscape. This comes alongside the surprising news of a robust US job market, with the economy adding a whopping 253,000 jobs in April and the unemployment rate dropping to 3.4% ( surprise job gains in april us economy adds 253000 jobs and unemployment rate drops to 34 ).

This strong US performance, coupled with China’s economic recovery, paints a picture of a global economy navigating a complex path, with both potential challenges and opportunities emerging simultaneously.

Impact on the Chinese Economy

These initiatives are expected to have a significant impact on the Chinese economy, both positive and negative. On the positive side, they could lead to increased investment and construction activity, boosting economic growth and creating jobs. Increased consumer confidence in the property market could also lead to higher spending, further stimulating the economy.

However, there are also potential downsides. The government’s efforts to stimulate the market could lead to renewed speculation and price bubbles, which could ultimately be unsustainable and lead to another downturn. Additionally, if the government’s measures are not carefully implemented, they could create moral hazard, where developers become overly reliant on government support and fail to address underlying structural issues in the sector.

Specific Policies and Their Anticipated Effects

The Chinese government has implemented a range of policies to stimulate the real estate sector, each with its own anticipated effects. Here are some examples:

- Lowering mortgage rates:Lowering mortgage rates can make it more affordable for people to buy homes, potentially increasing demand and supporting property prices. This could also encourage more people to enter the market, leading to higher construction activity.

- Relaxing restrictions on property purchases:Relaxing restrictions on property purchases, such as reducing down payment requirements or lifting purchase limits, could also boost demand and support property prices. This could also encourage more people to enter the market, leading to higher construction activity.

- Providing financial support to developers:Providing financial support to developers, such as loans or subsidies, can help them complete projects and avoid defaults. This could help stabilize the market and prevent a sharp decline in property prices.

- Increasing infrastructure investment:Increasing infrastructure investment can create jobs and stimulate economic growth, which can indirectly support the real estate sector. Improved infrastructure can also make certain areas more attractive to live and work in, potentially boosting demand for property in those areas.

The impact of these policies on the Chinese economy and the global market will depend on several factors, including the effectiveness of the implementation, the response of the market, and the overall economic environment. However, it is clear that the Chinese government is committed to stabilizing the real estate sector and ensuring its continued contribution to economic growth.

China’s renewed focus on real estate development is expected to give a much-needed boost to base metal demand, with gold prices also rising on a weaker dollar. This positive trend is further reinforced by the IMF’s recent prediction of resilient economic growth for India in FY23, as highlighted in this article.

The combination of these factors suggests a strong outlook for the global economy, potentially driving further demand for commodities and pushing gold prices even higher.

Base Metals Demand and Supply

China’s ambitious realty initiatives are poised to significantly impact the demand for base metals. As the world’s largest consumer of these materials, China’s construction boom is expected to drive up demand for key metals like copper, aluminum, zinc, and nickel.

With Chinese realty initiatives set to boost base metals, gold is surging on a weaker dollar. This comes amidst a positive economic outlook, as the recent May jobs report exceeded expectations, adding 339,000 jobs and boosting the US economy.

This strong economic performance further strengthens the case for gold as a safe haven asset, particularly as investors seek protection against potential inflation and geopolitical uncertainty.

The Relationship Between Chinese Realty Initiatives and Base Metals Demand

China’s realty initiatives aim to revitalize the property sector, which has been facing challenges in recent years. These initiatives involve government support for infrastructure projects, affordable housing initiatives, and urban renewal programs. These initiatives are expected to lead to increased construction activity, boosting demand for base metals.

Key Base Metals Expected to Benefit

- Copper: Copper is a critical component in electrical wiring, plumbing, and other construction applications. Increased construction activity will likely lead to a surge in copper demand.

- Aluminum: Aluminum is widely used in construction materials, such as window frames, roofing, and siding. The expansion of infrastructure projects and housing construction will increase the demand for aluminum.

- Zinc: Zinc is a key component in galvanizing steel, which is widely used in construction to prevent corrosion. Increased construction activity will likely drive up zinc demand.

- Nickel: Nickel is used in stainless steel, which is a popular material for construction applications due to its durability and corrosion resistance. The growth in construction projects will likely increase demand for nickel.

Current Supply and Demand Dynamics and Potential Price Fluctuations

The current supply and demand dynamics for these metals will play a crucial role in determining their price fluctuations. While China’s increased demand is expected to push prices upward, other factors like global economic conditions, supply chain disruptions, and alternative materials will also influence price trends.

- Copper: The global copper market is expected to face a supply deficit in the coming years, with demand exceeding supply. China’s increased demand will likely exacerbate this deficit, potentially driving copper prices higher.

- Aluminum: The aluminum market is expected to be more balanced, with supply and demand closely aligned. However, China’s increased demand could lead to a tightening of supply, potentially pushing prices upward.

- Zinc: The zinc market is currently experiencing a surplus, with supply exceeding demand. However, China’s increased construction activity could absorb some of this surplus, potentially leading to price stabilization or even an increase.

- Nickel: The nickel market is expected to face a supply deficit in the coming years, with demand exceeding supply. China’s increased demand for stainless steel will likely further tighten supply, potentially driving nickel prices higher.

Gold Price Movement

Gold, often considered a safe-haven asset, has a complex relationship with the US dollar. Understanding this connection is crucial for investors seeking to capitalize on gold’s price fluctuations.

The Inverse Relationship Between Gold and the US Dollar

Gold prices typically move inversely to the US dollar. This means that when the dollar weakens, gold prices tend to rise, and vice versa. This relationship is rooted in several factors:

- Gold as a Hedge Against Inflation:When the dollar weakens, inflation often rises, eroding the purchasing power of the currency. Gold, being a tangible asset, can act as a hedge against inflation, preserving wealth. As investors seek to protect their holdings from inflation, demand for gold increases, driving up its price.

- Gold as an Alternative Currency:A weaker dollar can make gold more attractive as an alternative currency. When the dollar loses value, investors may choose to hold gold, which is seen as a more stable store of value.

- Interest Rate Differentials:When the US Federal Reserve lowers interest rates, it can weaken the dollar. Lower interest rates make it less attractive to hold dollar-denominated assets, as they offer lower returns. This can lead to investors seeking higher returns in other assets, including gold.

Recent Gold Price Surge and the Weakening Dollar

In recent months, the US dollar has weakened significantly, contributing to a surge in gold prices. Several factors have contributed to the dollar’s decline, including:

- Aggressive Monetary Policy:The Federal Reserve’s aggressive interest rate hikes to combat inflation have raised concerns about a potential recession. These concerns have led to a decrease in demand for the dollar.

- Geopolitical Tensions:Ongoing geopolitical tensions, such as the war in Ukraine, have created uncertainty in global markets, making investors seek safe-haven assets like gold.

- Increased Inflation:Persistent inflation in the US has eroded the dollar’s purchasing power, prompting investors to seek alternative assets, such as gold.

Impact of Chinese Realty Initiatives on Gold Demand

China’s recent initiatives to stimulate its real estate sector have the potential to impact gold demand and prices. While the exact impact is difficult to predict, it is worth considering the following:

- Increased Investment in Real Estate:If Chinese realty initiatives lead to increased investment in real estate, it could potentially divert capital away from gold, potentially leading to a decrease in gold demand.

- Boost to the Chinese Economy:If the initiatives successfully stimulate the Chinese economy, it could lead to increased demand for commodities, including gold, as economic growth typically drives demand for precious metals.

- Currency Strength:If the initiatives boost the Chinese economy, it could strengthen the Chinese yuan, potentially leading to a weaker US dollar. A weaker dollar could, in turn, boost gold demand.

Market Implications: Chinese Realty Initiatives Set To Boost Base Metals Gold Surges On Weaker Dollar

The confluence of Chinese realty initiatives, base metal demand, and gold price movements has significant implications for various sectors and industries. Understanding the interplay of these factors is crucial for investors, policymakers, and businesses to navigate the evolving market landscape.

Impact on Sectors and Industries, Chinese realty initiatives set to boost base metals gold surges on weaker dollar

The combined impact of these factors can be analyzed by considering their potential influence on different sectors and industries. The following table presents a comprehensive overview of the potential impact on demand, prices, and overall market dynamics.