US Housing Market Shows Resilience: Home Prices Rise for Second Month

Us housing market shows resilience home prices rise for second consecutive month – US Housing Market Shows Resilience: Home Prices Rise for Second Month. The housing market, a bellwether of the broader economy, continues to defy expectations, exhibiting remarkable resilience. Despite ongoing economic uncertainties, home prices have climbed for the second consecutive month, a trend that has surprised many experts.

This unexpected uptick begs the question: what forces are driving this resurgence in the housing market?

A confluence of factors is contributing to this resilient performance. Low inventory, fueled by a persistent shortage of new construction, continues to exert upward pressure on prices. Furthermore, strong demand from a growing population and a preference for homeownership are further bolstering the market.

While rising interest rates have dampened affordability for some buyers, the overall demand remains robust, pushing prices higher.

Housing Market Resilience: Us Housing Market Shows Resilience Home Prices Rise For Second Consecutive Month

The US housing market has shown remarkable resilience in recent months, defying expectations of a significant downturn. Home prices have risen for the second consecutive month, signaling a surprising strength in the market despite ongoing economic uncertainties. This unexpected trend raises questions about the underlying factors driving this resilience and its implications for the broader economy.

Factors Contributing to Housing Market Resilience

The resilience of the housing market can be attributed to a confluence of factors.

- Strong Demand:The demand for housing remains robust, driven by a combination of factors, including a limited supply of homes for sale, a growing population, and a desire for more space due to the pandemic’s impact on lifestyles. This sustained demand continues to support home prices, even in the face of rising interest rates.

- Limited Supply:The supply of homes for sale remains constrained, contributing to the strong demand. Construction activity has slowed, and many homeowners are reluctant to sell due to low inventory and high prices. This imbalance between supply and demand continues to fuel upward pressure on home prices.

It’s encouraging to see the US housing market showing resilience with home prices rising for the second month in a row. This stability might make some think about diversifying their investments. If you’re new to the world of finance, check out these tips for beginners to invest in the stock market and learn the basics.

Understanding the stock market can be a valuable tool for building long-term wealth, and with a bit of research and planning, you can make informed decisions about your financial future. Whether you’re a seasoned investor or just starting out, keeping an eye on the housing market can offer valuable insights into the overall economic climate.

- Strong Labor Market:The US economy continues to exhibit strong job growth, with low unemployment rates. This robust labor market provides confidence to potential homebuyers, enabling them to secure financing and enter the housing market.

- Mortgage Rate Adjustments:While interest rates have risen, they have stabilized in recent months, providing some relief to potential buyers. The Federal Reserve has signaled a potential pause in interest rate hikes, which could further support the housing market.

Implications for the Broader Economy

The resilience of the housing market has significant implications for the broader economy.

- Consumer Spending:The housing market is a significant driver of consumer spending, as homeownership and home improvement projects represent substantial expenditures. A healthy housing market can support broader economic growth by boosting consumer spending.

- Job Creation:The housing market generates jobs across various sectors, including construction, real estate, and related industries. A robust housing market can contribute to overall job growth and economic stability.

- Economic Confidence:A resilient housing market can foster economic confidence among consumers and businesses, as it signals a healthy and stable economy. This confidence can encourage investment and spending, further stimulating economic growth.

Home Price Increases

The recent surge in home prices is a significant development in the housing market. After a period of modest growth, prices have seen a noticeable upward trend over the past two months.

Extent of Home Price Increases

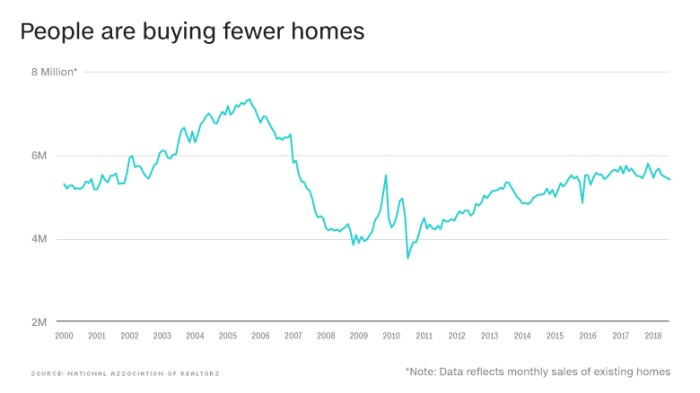

Home prices have risen for two consecutive months, signaling a potential shift in the market. According to the latest data from the National Association of Realtors (NAR), the median home price in the United States increased by 1.7% in June 2023 compared to May 2023.

This follows a 1.1% increase in May 2023 from April 2023.

Comparison with Historical Trends

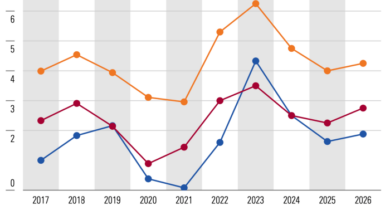

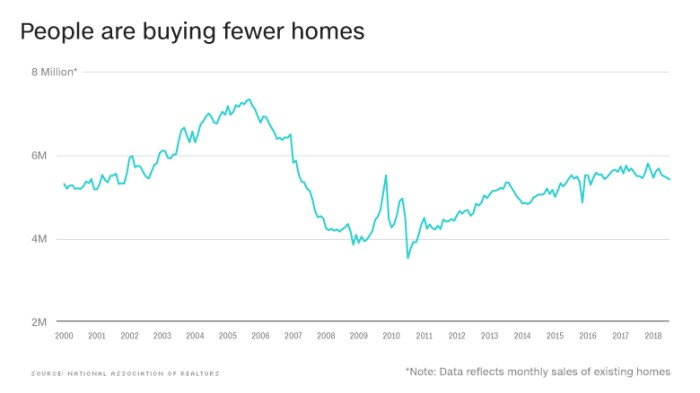

The current home price growth rate is relatively modest compared to the rapid appreciation seen in 2021 and 2022. However, it is noteworthy that prices are still rising despite economic uncertainties and rising interest rates. Historically, home prices have tended to rise during periods of economic growth and low interest rates.

However, the current increase is happening in a different economic climate, with inflation and interest rate hikes posing challenges.

Factors Driving Recent Home Price Increases

Several factors are contributing to the recent home price increases:

- Limited Inventory:The housing market continues to grapple with a shortage of available homes for sale. This limited inventory is driving competition among buyers and pushing prices upward.

- Strong Buyer Demand:Despite rising interest rates, buyer demand remains relatively strong, fueled by factors like low unemployment and a desire for homeownership.

- Shifting Demographics:The aging population and growing number of millennials entering the housing market are contributing to demand for homes, particularly in desirable locations.

- Mortgage Rate Volatility:The recent fluctuations in mortgage rates have created uncertainty for buyers, prompting some to accelerate their purchase decisions before rates rise further.

Market Dynamics

The current housing market is shaped by a complex interplay of factors that influence both supply and demand. Understanding these dynamics is crucial for discerning the trajectory of home prices and market trends.

The housing market is a dynamic system driven by the interaction of supply and demand. When demand for homes exceeds the available supply, prices tend to rise. Conversely, when supply outpaces demand, prices may fall. The current housing market is characterized by a delicate balance between these forces, with several factors influencing both supply and demand.

Supply and Demand

The supply of housing is influenced by factors such as construction activity, inventory levels, and the availability of land for development. Demand for housing is driven by factors such as population growth, household formation, and affordability. The interplay between these forces determines the overall health of the housing market.

It’s a mixed bag of news today. On one hand, the US housing market is showing resilience with home prices rising for the second consecutive month, a positive sign for the economy. But on a sadder note, we’ve lost a talented actor, Ray Stevenson, who passed away at 58.

Known for his roles in films like “Punisher: War Zone”, “RRR”, and the “Thor” franchise, Stevenson’s career was marked by his commanding presence and versatility. Despite this loss, the housing market’s continued strength offers a glimmer of hope amidst the sadness.

- Construction Activity:The rate of new home construction plays a significant role in determining the supply of housing. Factors such as the cost of materials, labor availability, and regulatory approvals can impact the pace of construction.

- Inventory Levels:The number of homes available for sale, known as inventory, directly impacts supply. Low inventory levels indicate a seller’s market, where competition for homes is high, and prices tend to rise. High inventory levels, on the other hand, indicate a buyer’s market, where prices may be more favorable.

It’s fascinating to see the US housing market showing resilience, with home prices rising for the second consecutive month. It makes me wonder how these trends compare to the volatile world of cryptocurrencies, where understanding value is crucial. You can delve deeper into decoding crypto prices and understanding how cryptocurrencies are valued to see the stark differences in how these markets function.

While the housing market seems to be finding its footing, the crypto world continues to be a rollercoaster of unpredictable price swings.

- Population Growth:As populations grow, the demand for housing increases. This can lead to higher prices and a tightening of the market.

- Household Formation:The formation of new households, such as young adults moving out of their parents’ homes or couples getting married, also contributes to housing demand.

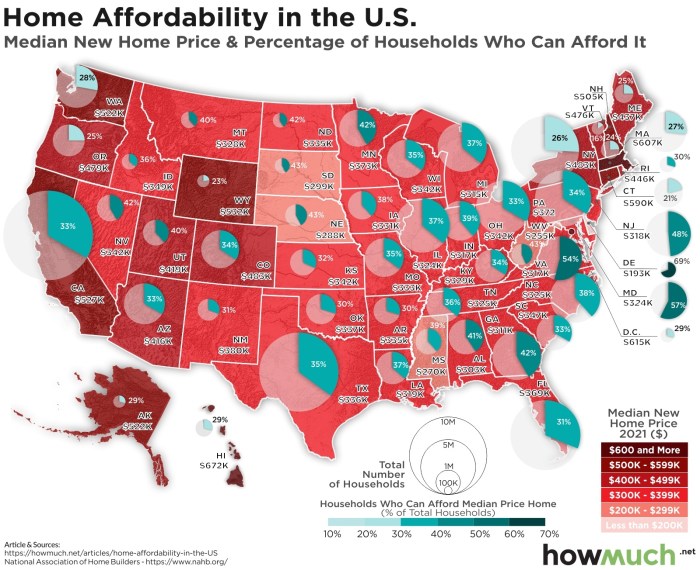

- Affordability:The affordability of housing is a key driver of demand. Factors such as interest rates, income levels, and property taxes can influence how many people can afford to buy a home.

Interest Rates

Interest rates play a crucial role in determining home affordability. Higher interest rates increase the cost of borrowing money for a mortgage, making homes less affordable for many buyers. Conversely, lower interest rates make it more affordable to purchase a home, which can stimulate demand.

- Mortgage Rates:Mortgage rates fluctuate based on various economic factors, including inflation and the Federal Reserve’s monetary policy. When interest rates rise, monthly mortgage payments increase, reducing the purchasing power of buyers. For example, a 1% increase in interest rates can significantly impact the affordability of a home, especially for those with lower incomes.

- Impact on Affordability:Higher interest rates can make it difficult for some buyers to qualify for a mortgage or to afford the monthly payments. This can lead to a decrease in demand and a slowdown in the housing market.

Regional Variations

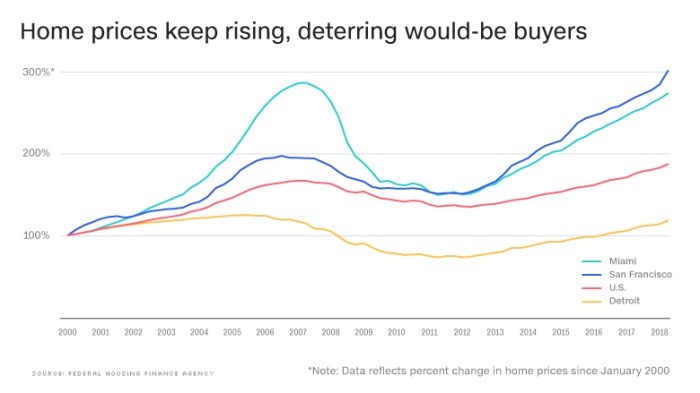

While the national housing market exhibits resilience, regional variations paint a more nuanced picture. Home price changes are not uniform across the country, with some areas experiencing significant growth while others see more moderate or even declining prices. Understanding these regional differences is crucial for investors, buyers, and sellers alike.

Regional Home Price Changes

The following table presents a snapshot of home price changes across different regions of the US, highlighting the disparities in market performance.

| Region | Home Price Change (Year-over-Year) |

|---|---|

| Northeast | +4.5% |

| Midwest | +3.2% |

| South | +6.1% |

| West | +2.8% |

Metropolitan Area Performance

Major metropolitan areas exhibit diverse housing market dynamics. For example, cities like Phoenix and Miami have seen significant price appreciation in recent months, fueled by strong population growth and robust job markets. In contrast, cities like San Francisco and Seattle have experienced more moderate price growth, reflecting factors such as high housing costs and a cooling tech sector.

Factors Driving Regional Differences, Us housing market shows resilience home prices rise for second consecutive month

Several factors contribute to the regional variations in home price trends:* Economic Growth and Job Market:Regions with strong economic growth and robust job markets typically experience higher demand for housing, driving up prices.

Population Growth Areas experiencing significant population growth, particularly from migration, often see increased housing demand, leading to price increases.

Inventory Levels Low inventory levels in certain regions can create a seller’s market, leading to higher prices. Conversely, high inventory levels can lead to price stagnation or even declines.

Interest Rates Rising interest rates can impact affordability and slow down home price growth, especially in regions with high housing costs.

Local Regulations Zoning regulations, building codes, and other local policies can influence housing supply and affordability, impacting home price trends.

Future Outlook

The recent uptick in home prices has sparked renewed interest in the trajectory of the US housing market. While the market has demonstrated resilience, several factors will shape its future course. Understanding these influences can help both buyers and sellers navigate the evolving landscape.

Factors Influencing Future Home Price Trends

Several factors will likely influence future home price trends.

- Interest Rates:The Federal Reserve’s monetary policy plays a significant role in shaping mortgage rates. Higher interest rates make borrowing more expensive, potentially slowing demand and putting downward pressure on prices. Conversely, lower rates could fuel demand and drive prices upward.

For example, the recent increase in interest rates has already started to cool demand in some markets.

- Economic Growth:A strong economy typically translates to job growth and higher incomes, supporting housing demand. Conversely, economic downturns can lead to job losses and reduced purchasing power, potentially impacting home prices. The current economic outlook, with concerns about inflation and potential recession, introduces uncertainty into the housing market.

- Inventory Levels:The availability of homes for sale is a key driver of prices. Limited inventory can lead to bidding wars and price increases. Conversely, an oversupply of homes can lead to price declines. While the current inventory remains low, some experts anticipate a potential increase in the coming months.

- Consumer Confidence:Consumer sentiment about the economy and their financial well-being can impact housing decisions. High confidence levels tend to support demand, while low confidence can lead to hesitation in purchasing homes. The current economic climate, with rising inflation and concerns about recession, could dampen consumer confidence and impact housing demand.