US Dollar Steady Amid Fed Rate Hikes and Debt Ceiling Optimism

Us dollar holds steady in forex market amid fed rate hike expectations and debt ceiling optimism – The US dollar has held its ground in the forex market, a surprising feat given the current climate of rising interest rates and ongoing debt ceiling negotiations. This stability might seem counterintuitive, but a closer look reveals a complex interplay of factors driving the greenback’s performance.

While the Federal Reserve is poised to raise interest rates, a move that typically strengthens a currency, the market seems to be anticipating these hikes, already factoring them into the dollar’s value. The optimism surrounding the debt ceiling negotiations also plays a role, as a potential default would have catastrophic consequences for the US economy and the dollar.

US Dollar Strength in the Forex Market: Us Dollar Holds Steady In Forex Market Amid Fed Rate Hike Expectations And Debt Ceiling Optimism

The US dollar has been displaying a resilient stance in the forex market, holding its ground amidst a confluence of economic factors, including the Federal Reserve’s anticipated interest rate hikes and optimism surrounding the resolution of the US debt ceiling crisis.

Factors Contributing to Dollar Stability

The dollar’s strength can be attributed to a combination of factors:

- The Fed’s Monetary Policy:The Federal Reserve’s aggressive stance on interest rate hikes, aimed at curbing inflation, has boosted the dollar’s appeal. Higher interest rates generally attract foreign investors seeking higher returns, increasing demand for the dollar. This dynamic has been a key driver of the dollar’s recent strength.

- Safe-Haven Status:The US dollar is often perceived as a safe-haven asset during times of global economic uncertainty. As investors seek refuge from volatility, they tend to flock to the dollar, further strengthening its position in the forex market.

- Economic Resilience:The US economy has shown resilience despite global headwinds, with a robust labor market and strong consumer spending. This underlying strength provides a foundation for the dollar’s stability.

Impact of Fed Rate Hike Expectations

The Fed’s rate hike expectations have had a significant impact on the dollar’s performance. Each rate hike announcement or indication of further tightening has typically been met with a strengthening of the dollar. Investors anticipate that higher interest rates will make the dollar more attractive, leading to increased demand and a rise in its value.

The US dollar held steady in the forex market today, buoyed by optimism surrounding the debt ceiling negotiations and expectations of another Fed rate hike. It’s interesting to see how the markets are reacting to these events, especially when you consider the broader picture.

For example, Vitalik Buterin, the co-founder of Ethereum, recently discussed the future of blockchain technology on Bloomberg’s Studio 10. While these are separate events, they both highlight the growing influence of technology and economic policy on global markets. The US dollar’s stability, in this context, is a testament to its resilience in the face of these complex dynamics.

Other Currency Performance

The US dollar’s strength has had a ripple effect on other currencies. For instance, the euro, which has been struggling with its own economic challenges, has weakened against the dollar. Similarly, emerging market currencies have also faced pressure as investors seek safer havens in the US dollar.

Federal Reserve Rate Hike Expectations

The Federal Reserve, the central bank of the United States, is widely anticipated to raise interest rates in the coming months. This move aims to combat persistent inflation and stabilize the economy.

The US dollar is holding its ground in the forex market, buoyed by expectations of a Fed rate hike and optimism surrounding the debt ceiling. While the market is focused on these macro factors, it’s also a good time for students to explore ways to build financial independence.

Check out passive income ideas for students without investment for inspiration on how to earn money without relying on traditional jobs. With a little creativity and effort, students can set themselves up for financial success while navigating the current economic climate.

Impact of Rate Hikes on the US Economy

The Federal Reserve’s rate hikes influence the US economy in various ways. Increasing interest rates makes borrowing more expensive for businesses and consumers, potentially slowing down economic growth. This can impact investment, consumer spending, and overall economic activity. However, rate hikes can also help to control inflation by reducing demand and making it more expensive to borrow money.

Comparison with Previous Rate Hikes

The current rate hike cycle is not unprecedented. The Federal Reserve has implemented numerous rate hikes in the past to address inflation and economic challenges. For instance, in the early 2000s, the Fed raised rates aggressively to combat inflation, which eventually led to a recession.

The current situation, however, presents a unique set of challenges, including the ongoing war in Ukraine, supply chain disruptions, and a tight labor market.

Potential Impact on Inflation

The primary goal of the Federal Reserve’s rate hikes is to curb inflation. By increasing borrowing costs, the Fed aims to reduce demand and cool down the economy, ultimately leading to lower prices. However, the effectiveness of this strategy depends on various factors, including the level of inflation, consumer confidence, and the overall economic environment.

The US dollar held steady in the forex market today, buoyed by expectations of a Fed rate hike and optimism surrounding the debt ceiling negotiations. While the financial world focuses on these macro trends, a recent study reveals a surprising new hotspot for remote work: new research reveals the surprising no 1 city for remote jobs defying new york and san francisco.

This unexpected development could influence global economic trends, potentially impacting the value of the US dollar in the long run.

The current inflation rate, driven by factors like supply chain issues and rising energy prices, poses a significant challenge for the Fed.

Debt Ceiling Optimism

The US dollar has also been buoyed by recent optimism surrounding the debt ceiling negotiations. While the situation remains precarious, with the deadline for avoiding a default looming, recent talks have shown signs of progress. This has led to a sense of relief in the markets, contributing to the US dollar’s strength.

Impact of Debt Ceiling Optimism on the US Dollar, Us dollar holds steady in forex market amid fed rate hike expectations and debt ceiling optimism

The potential for a US default on its debt obligations would be a catastrophic event for the global economy. Such a scenario could lead to a sharp decline in the US dollar’s value, as investors would lose confidence in the US economy and its ability to repay its debts.

The resulting uncertainty and risk aversion would likely drive investors away from US assets, further weakening the dollar. Therefore, any positive developments in the debt ceiling negotiations, such as the recent signs of progress, are likely to be viewed favorably by investors and bolster the US dollar’s value.

Potential Consequences of Failure to Raise the Debt Ceiling

The consequences of a failure to raise the debt ceiling would be severe and far-reaching.

- Economic Recession:A default on US debt would trigger a loss of confidence in the US economy, leading to a sharp decline in investment and consumer spending, ultimately pushing the country into a recession.

- Higher Interest Rates:The risk of default would make it more expensive for the US government to borrow money, leading to higher interest rates on government bonds and potentially impacting borrowing costs for businesses and individuals.

- Global Market Volatility:A US default would create significant uncertainty in the global financial markets, leading to increased volatility and potentially triggering a global financial crisis.

- Reduced Confidence in US Treasury Securities:The safe-haven status of US Treasury securities could be eroded, leading to a decline in demand for these assets and potentially impacting their value.

Relationship Between Debt Ceiling and US Dollar Value

The debt ceiling and the US dollar’s value are inextricably linked.

- Confidence in US Economy:The debt ceiling negotiations reflect the US government’s ability to manage its finances and meet its obligations. A failure to raise the debt ceiling would signal a lack of fiscal discipline and undermine confidence in the US economy, leading to a weakening of the US dollar.

- Risk Aversion:A potential default on US debt would increase risk aversion among investors, leading them to seek safer assets and potentially driving them away from US assets, further weakening the US dollar.

- Investor Sentiment:Positive developments in the debt ceiling negotiations, such as signs of progress in talks, would boost investor confidence in the US economy and strengthen the US dollar.

Economic Factors Influencing the Dollar

The US dollar’s value is influenced by a complex interplay of economic factors. These factors impact investor sentiment, trade flows, and overall economic stability, ultimately determining the dollar’s strength or weakness in the foreign exchange market.

Key Economic Indicators

Understanding the relationship between economic indicators and the US dollar is crucial for investors and traders. These indicators provide insights into the health of the US economy, influencing investor confidence and, consequently, the dollar’s value. Here’s a table highlighting some key economic indicators and their potential impact on the US dollar:

| Indicator | Current Value | Historical Trend | Potential Impact on the Dollar |

|---|---|---|---|

| Gross Domestic Product (GDP) | [Insert current GDP value] | [Insert historical trend data] | A strong GDP growth rate typically strengthens the dollar, indicating a healthy economy and attracting foreign investment. Conversely, a weak GDP growth rate can weaken the dollar. |

| Inflation Rate | [Insert current inflation rate] | [Insert historical trend data] | High inflation erodes purchasing power and can weaken the dollar. Conversely, low and stable inflation strengthens the dollar, as it indicates a healthy economy with stable prices. |

| Interest Rates | [Insert current interest rate] | [Insert historical trend data] | Higher interest rates attract foreign investment, as investors seek higher returns. This increased demand for the dollar strengthens its value. Conversely, lower interest rates can weaken the dollar. |

| Unemployment Rate | [Insert current unemployment rate] | [Insert historical trend data] | A low unemployment rate indicates a strong economy and can strengthen the dollar. Conversely, a high unemployment rate can weaken the dollar, as it suggests a weakening economy. |

| Trade Balance | [Insert current trade balance] | [Insert historical trend data] | A trade surplus (exports exceeding imports) strengthens the dollar, as it indicates a strong domestic economy. Conversely, a trade deficit (imports exceeding exports) can weaken the dollar. |

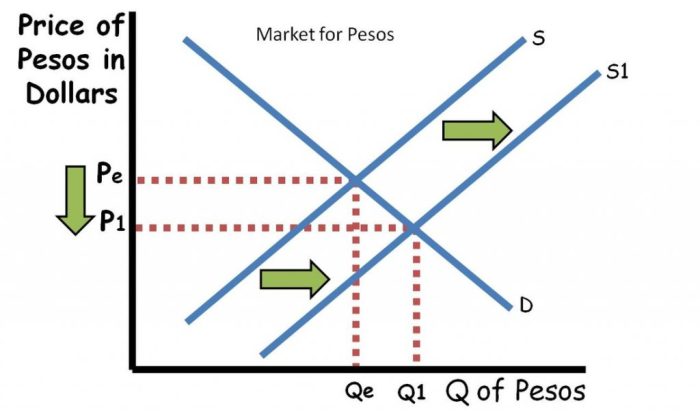

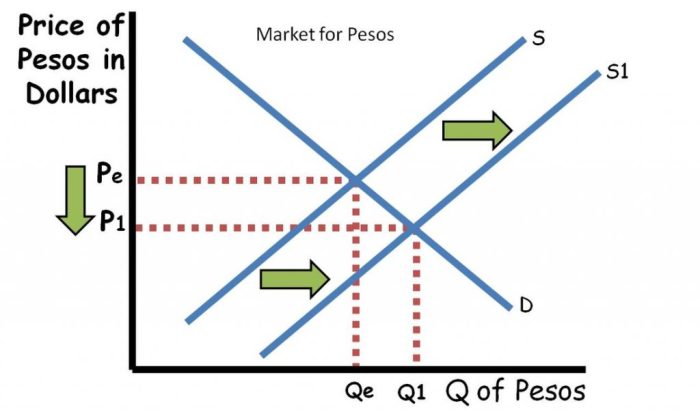

Visual Representation

[Insert visual representation of the correlation between the US dollar’s value and key economic indicators. This could be a chart, graph, or diagram demonstrating the relationship between the dollar’s value and indicators like GDP, inflation, interest rates, and unemployment.]

Examples of Economic Factors Influencing Currency Fluctuations

Interest Rate Differentials When the Federal Reserve raises interest rates, it attracts foreign investment, increasing demand for the US dollar and strengthening its value. For example, in 2022, the Federal Reserve’s aggressive rate hikes led to a significant appreciation of the US dollar against other major currencies.

Economic Growth A robust economy with strong GDP growth attracts foreign investment, increasing demand for the US dollar and boosting its value. Conversely, a slowdown in economic growth can weaken the dollar, as investors may lose confidence in the US economy.

Political Stability Political instability or uncertainty can negatively impact investor confidence, weakening the US dollar. For example, during periods of political turmoil, investors may move their funds to more stable currencies, leading to a decline in the dollar’s value.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior play a crucial role in influencing currency movements, including the US dollar’s performance in the forex market. Understanding these dynamics helps traders and investors make informed decisions.

The Impact of Market Sentiment on the US Dollar

Market sentiment reflects the overall prevailing attitude towards the US dollar among investors and traders. Positive sentiment indicates optimism about the US economy and the dollar’s prospects, leading to increased demand and appreciation. Conversely, negative sentiment, fueled by concerns about economic weakness or policy uncertainties, can weaken the dollar.For instance, during periods of global risk aversion, investors tend to seek safe haven assets like the US dollar, driving its value higher.

This is because the US dollar is considered a safe haven currency due to its stability, deep liquidity, and the US economy’s relative strength. Conversely, during periods of risk appetite, investors may favor higher-yielding currencies, potentially leading to a decline in the US dollar’s value.

Investor Behavior and Currency Movements

Investor behavior significantly influences currency movements. Investors’ decisions, driven by various factors such as economic data, political events, and market sentiment, directly impact currency demand and supply.

- Risk Aversion:When investors are risk-averse, they tend to move away from riskier assets and seek safe haven investments, often favoring the US dollar. This increased demand for the US dollar drives its value higher.

- Risk Appetite:Conversely, when investors are risk-seeking, they may favor higher-yielding currencies, potentially leading to a decline in the US dollar’s value. This is because they are willing to take on more risk for potentially higher returns.

- Herding Behavior:Investors often engage in herding behavior, following the actions of others. If a large group of investors starts selling the US dollar, others may follow suit, further driving its value down. Conversely, if investors see a strong upward trend in the US dollar, they may jump on the bandwagon, pushing the dollar even higher.

Examples of Market Sentiment and Investor Behavior Impacting the Forex Market

Several real-world examples demonstrate the influence of market sentiment and investor behavior on the forex market:

- Global Trade Wars:During periods of heightened trade tensions, investors often become risk-averse, seeking safe haven assets like the US dollar. This increased demand for the dollar drives its value higher.

- Economic Data Releases:Positive economic data releases, such as strong employment figures or robust GDP growth, can boost market sentiment towards the US dollar, leading to its appreciation. Conversely, negative data releases can trigger risk aversion and weaken the dollar.

- Central Bank Policy Decisions:The Federal Reserve’s monetary policy decisions, such as interest rate changes, can significantly impact market sentiment and the US dollar’s value. For example, if the Fed raises interest rates, it can attract foreign investment and strengthen the dollar.

Potential Future Scenarios

Predicting the future of the US dollar is a complex task, influenced by a multitude of factors. While the current situation suggests strength, the path ahead could be subject to various scenarios, each with its own set of implications for the dollar’s performance.

Potential Scenarios for the US Dollar

The following table Artikels potential scenarios for the US dollar in the near future, highlighting their likelihood, key factors, and potential impact on the dollar:

| Scenario | Likelihood | Key Factors | Potential Impact on the Dollar |

|---|---|---|---|

| Continued Strength | Moderate | Sustained economic growth, aggressive Fed rate hikes, robust consumer spending, and geopolitical uncertainty | Dollar continues to appreciate against other major currencies, attracting foreign investment and boosting US exports |

| Moderate Appreciation | High | Economic growth slows, Fed rate hikes moderate, inflation eases, and geopolitical tensions ease | Dollar experiences a more gradual appreciation, driven by relative economic stability and a safe-haven appeal |

| Volatility and Fluctuations | Moderate | Economic uncertainties, market volatility, global economic slowdown, and unpredictable geopolitical events | Dollar experiences significant fluctuations, driven by market sentiment and risk aversion, making it difficult to predict its overall direction |

| Depreciation | Low | Recessionary pressures, aggressive rate cuts by the Fed, weakening consumer spending, and global economic turmoil | Dollar depreciates against other major currencies, as investors seek alternative investments and the US economy weakens |

Impact of Geopolitical Events

Geopolitical events can significantly impact the US dollar’s performance. For instance, the ongoing conflict in Ukraine has increased uncertainty and risk aversion, leading investors to seek safe-haven assets like the US dollar.

A surge in global tensions can boost demand for the US dollar as a safe-haven currency, leading to its appreciation.

Conversely, a resolution to geopolitical conflicts could reduce demand for the dollar, potentially leading to its depreciation.

Influence of Global Economic Conditions

Changes in global economic conditions can also influence the dollar’s performance. For example, a global economic slowdown could lead to reduced demand for US goods and services, potentially weakening the dollar.

A global recession could negatively impact the US economy, leading to a depreciation of the US dollar.

On the other hand, a strong global economy could boost demand for US goods and services, strengthening the dollar.