US Debt Ceiling: White House & Republicans Seek Agreement

White house and republicans aim to reach agreement on us debt ceiling as deadline approaches – As the White House and Republicans aim to reach agreement on the US debt ceiling as the deadline approaches, the nation holds its breath. The looming threat of default on US debt obligations casts a long shadow over financial markets, businesses, and everyday Americans.

The current situation is a culmination of years of political gridlock and partisan maneuvering, with both sides holding firm to their positions.

The debt ceiling, a legal limit on the amount of money the US government can borrow, has become a recurring point of contention in Washington. This time, the stakes are higher than ever, as the potential consequences of exceeding the limit could be devastating.

The clock is ticking, and the pressure is mounting for both sides to find common ground before the deadline arrives.

The Debt Ceiling Crisis

The United States is facing a critical moment as the government approaches its debt ceiling, the legal limit on the amount of money the government can borrow. This issue has become a recurring political drama, with the potential for severe economic consequences if the ceiling is not raised or suspended.

The Current State of the Debt Ceiling

The debt ceiling is a statutory limit on the amount of money the U.S. Treasury can borrow to pay for the government’s existing obligations. It’s not a limit on how much the government can spend, but rather a constraint on how it can finance those expenditures.

When the debt ceiling is reached, the government is technically unable to borrow any more money, potentially leading to a default on its financial obligations.

The debt ceiling is not a limit on how much the government can spend, but rather a constraint on how it can finance those expenditures.

The White House and Republicans are racing against the clock to reach an agreement on the US debt ceiling before the deadline, but amidst the high-stakes negotiations, the economy throws a curveball. The surprise job gains in April, with the US economy adding 253,000 jobs and the unemployment rate dropping to 3.4% , adds another layer of complexity to the debt ceiling discussions.

With the economy showing unexpected strength, the pressure on both sides to find a solution intensifies, as the consequences of defaulting on the nation’s debt are too dire to ignore.

The current debt ceiling is $31.4 trillion, a figure that was reached in January 2023. The Treasury Department has been using extraordinary measures to avoid exceeding the ceiling, but these measures are expected to run out by early June 2023.

If Congress fails to raise or suspend the debt ceiling by then, the U.S. government could be forced to default on its financial obligations, including payments to Social Security recipients, military personnel, and bondholders.

Potential Consequences of Exceeding the Debt Ceiling

The potential consequences of exceeding the debt ceiling are significant and could have a ripple effect throughout the global economy.

- Default on Financial Obligations:The most immediate consequence would be a default on the government’s financial obligations. This could include payments to Social Security recipients, military personnel, and bondholders. Such a default would damage the U.S.’s credit rating, making it more expensive to borrow money in the future.

- Economic Recession:A default on government debt could trigger a financial crisis, leading to a sharp decline in stock prices, a rise in interest rates, and a decrease in economic activity. This could lead to a recession, characterized by widespread job losses, business failures, and a decline in consumer spending.

- Global Financial Instability:A U.S. default could have a significant impact on the global financial system. The U.S. dollar is the world’s reserve currency, and a default could undermine confidence in the dollar and lead to a flight to safer assets, potentially destabilizing global markets.

The White House and Republicans are locked in a high-stakes game of chicken as the US debt ceiling deadline looms. While the political drama unfolds, the economic landscape is also shifting. It seems even strong revenue isn’t enough to buoy some companies, as evidenced by Amazon’s stock falling despite strong revenue due to slowing cloud growth.

It’s a reminder that the economic outlook is complex, and even with a potential debt ceiling agreement, the market remains volatile.

>Historical Context of Debt Ceiling Negotiations

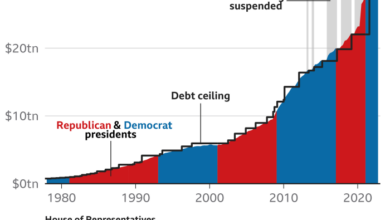

The debt ceiling has been a recurring issue in U.S. politics since its inception in 1917. Historically, raising or suspending the debt ceiling has been a routine process, often done with bipartisan support. However, in recent years, the debt ceiling has become a tool for political leverage, with Republicans and Democrats using it to advance their own agendas.

Timeline of Key Events Leading Up to the Current Deadline

- January 2023:The U.S. Treasury reached the debt ceiling of $31.4 trillion.

- February 2023:The Treasury Department began using extraordinary measures to avoid exceeding the debt ceiling, such as delaying certain payments.

- March 2023:President Biden and House Speaker Kevin McCarthy began negotiations on raising or suspending the debt ceiling.

- April 2023:Negotiations between the White House and Republicans stalled, raising concerns about a potential default.

- May 2023:The Treasury Department warned that it would run out of extraordinary measures to avoid exceeding the debt ceiling by early June 2023.

- June 2023:The deadline for raising or suspending the debt ceiling is rapidly approaching, with the potential for severe economic consequences if no agreement is reached.

Republican Demands and Negotiating Positions

The Republican party’s stance on the debt ceiling has become a major point of contention in the ongoing negotiations with the Biden administration. Their demands and negotiating positions have raised concerns about the potential for a default on U.S. debt, with far-reaching consequences for the global economy.

Republican Demands

The Republican party has presented a list of demands in exchange for their support to raise the debt ceiling. These demands are largely focused on spending cuts and changes to government programs.

- Spending Cuts:Republicans have called for significant reductions in federal spending, targeting programs like social safety nets and environmental regulations. They argue that these cuts are necessary to address the growing national debt.

- Work Requirements for Welfare Programs:Republicans have pushed for stricter work requirements for programs like SNAP (food stamps) and Medicaid. They believe this will encourage recipients to seek employment and reduce dependence on government assistance.

- Energy Policy Changes:Republicans have advocated for policies that promote domestic energy production, including fossil fuels. They argue that this will reduce reliance on foreign energy sources and lower energy prices.

- Regulatory Rollbacks:Republicans have sought to roll back regulations across various industries, arguing that they stifle economic growth and job creation. They aim to streamline regulatory processes and reduce the burden on businesses.

Comparison with Previous Positions

The Republican party’s current stance on the debt ceiling is similar to its previous positions, with a focus on reducing government spending and promoting fiscal responsibility. However, there are some notable differences:

- Increased Emphasis on Spending Cuts:While Republicans have historically advocated for spending cuts, their current demands are more aggressive and seek deeper reductions in government programs.

- Focus on Specific Programs:Republicans have targeted specific programs, such as social safety nets and environmental regulations, for cuts, whereas in the past, they have taken a more general approach to spending reductions.

- Increased Leverage:With a divided Congress, Republicans have more leverage in negotiations this time, allowing them to push for more concessions from the Democrats.

Political Motivations

The Republican party’s approach to the debt ceiling is driven by a combination of political and ideological motivations:

- Electoral Strategy:Republicans see the debt ceiling negotiations as an opportunity to advance their political agenda and score points with their base. By pushing for spending cuts and policy changes, they can demonstrate their commitment to fiscal conservatism and appeal to voters who are concerned about government spending.

- Ideological Beliefs:Republicans hold a strong belief in limited government and free markets. They see the debt ceiling as a leverage point to force the government to shrink its role in the economy and reduce spending on social programs.

- Opposition to the Biden Administration:Republicans are opposed to the Biden administration’s policies and see the debt ceiling negotiations as an opportunity to block or modify them. They are willing to use the threat of a default to extract concessions from the Democrats.

White House Response and Negotiating Strategy

The White House has responded to the Republican demands with a mixture of defiance and negotiation. President Biden has stated that he will not negotiate over the debt ceiling, calling it a “non-negotiable” obligation of the United States. However, the administration has also signaled a willingness to engage in discussions about spending cuts and other fiscal matters.

This approach reflects the political and economic pressures facing the White House.

Areas of Compromise and Points of Contention

The potential areas of compromise and points of contention between the White House and Republicans center around the scope and nature of spending cuts. The White House is open to discussions about reducing spending, but it is unwilling to accept cuts that would harm essential programs like Social Security and Medicare.

Republicans, on the other hand, are pushing for significant cuts to these programs, as well as to other discretionary spending. The White House is also resistant to Republican demands for changes to environmental regulations and other policy areas. The administration views these demands as politically motivated and unrelated to the issue of the debt ceiling.

Political and Economic Factors Influencing the White House’s Approach

The White House’s approach to the debt ceiling negotiations is influenced by a number of political and economic factors. * Political:The White House is facing pressure from Democrats to stand firm against Republican demands. Democrats are concerned that any concessions on spending cuts would weaken their position in the upcoming election.

The White House is also mindful of the need to avoid a default on the nation’s debt, which would have severe consequences for the economy.

The White House and Republicans are locked in a tense standoff over the US debt ceiling, with the deadline looming. While this critical issue demands immediate attention, it’s important to remember the recent federal reserve report on svb collapse highlights mismanagement and supervisory failures , a stark reminder of the need for robust financial oversight.

The report highlights the urgent need for a comprehensive approach to addressing both immediate and long-term financial stability concerns, making the debt ceiling negotiations even more crucial.

Economic The White House is also concerned about the potential economic consequences of a default. A default could lead to a rise in interest rates, a decline in the value of the dollar, and a loss of confidence in the US economy.The White House is attempting to navigate these competing pressures by signaling a willingness to negotiate while also drawing a line in the sand on key issues.

Potential Economic Impacts

A US default on its debt obligations would have severe and far-reaching consequences for the American economy and the global financial system. It would trigger a cascade of negative events, impacting financial markets, businesses, and consumers alike, potentially leading to a global economic crisis.

Impact on Financial Markets

A US debt default would send shockwaves through global financial markets. Investors, fearing the loss of their investments, would likely sell off US Treasury bonds, leading to a sharp increase in interest rates. This would make it more expensive for businesses to borrow money, hindering economic growth and potentially leading to a recession.

The decline in the value of US Treasury bonds could also trigger a broader sell-off in financial markets, impacting stocks, corporate bonds, and other assets.

Impact on Businesses, White house and republicans aim to reach agreement on us debt ceiling as deadline approaches

Businesses rely heavily on access to credit for operations, investments, and expansion. A US debt default would significantly increase borrowing costs, making it more challenging for businesses to secure loans. This could lead to a decline in investment, job creation, and economic activity.

Furthermore, businesses operating in global markets could face disruptions due to uncertainty and potential financial instability caused by the default.

Impact on Consumers

Consumers would also face significant challenges in a US debt default scenario. Higher interest rates would make it more expensive to borrow money for mortgages, auto loans, and credit cards. This would reduce disposable income and limit consumer spending, further impacting economic growth.

The default could also lead to job losses and wage stagnation, further eroding consumer confidence and spending power.

Impact on Global Financial Stability

The US is the world’s largest economy and a major player in global financial markets. A US debt default would have significant repercussions for the global financial system. It could lead to a loss of confidence in the US dollar as a reserve currency, potentially triggering a currency crisis.

The default could also trigger a global recession, as businesses and investors worldwide would face increased uncertainty and risk.

Public Opinion and Political Implications: White House And Republicans Aim To Reach Agreement On Us Debt Ceiling As Deadline Approaches

The debt ceiling negotiations have become a focal point of public attention, with citizens closely watching the unfolding drama and its potential impact on their lives. Public opinion polls reveal a mixed bag of sentiments, with varying levels of concern and understanding regarding the complex issue.

Public Opinion on Debt Ceiling Negotiations

Public opinion on the debt ceiling negotiations is shaped by a multitude of factors, including political affiliation, economic circumstances, and individual understanding of the issue. Polls conducted during these negotiations reveal a significant degree of concern among the public, with a majority expressing worry about the potential consequences of defaulting on the nation’s debt.

- A recent poll by the Pew Research Center found that 62% of Americans are “very” or “somewhat” worried about the possibility of the U.S. defaulting on its debt.

- The same poll revealed that a significant majority of Americans (71%) believe that Congress should raise the debt ceiling, regardless of their political affiliation.

While the public is generally concerned about the potential consequences of default, there is a notable partisan divide in perceptions of the negotiations.

- Republicans are more likely to support using the debt ceiling as leverage to achieve policy goals, while Democrats are more likely to prioritize raising the debt ceiling without any attached conditions.

- This partisan divide is reflected in the public’s perception of the negotiators’ actions, with Republicans generally viewing their party’s tactics as more justified and Democrats viewing their party’s approach as more responsible.

Political Implications of the Negotiations

The debt ceiling negotiations have significant political implications for both parties, potentially impacting their standing in the eyes of voters and influencing the upcoming elections.

- For Republicans, the negotiations present an opportunity to showcase their commitment to fiscal responsibility and to pressure Democrats into making concessions on spending.

- However, there is a risk that the negotiations could backfire if the public perceives Republicans as holding the country hostage or prioritizing partisan gains over the national interest.

- For Democrats, the negotiations are a test of their ability to manage the government effectively and to protect the country from economic instability.

- A successful resolution of the crisis could strengthen their position ahead of the upcoming elections, while a failure to reach an agreement could damage their credibility and erode public trust.

Potential Impact on Upcoming Elections and Political Discourse

The outcome of the debt ceiling negotiations could have a significant impact on the upcoming elections and the broader political discourse.

- If the negotiations result in a last-minute deal that avoids default but fails to address underlying fiscal challenges, it could fuel voter dissatisfaction and contribute to a more polarized political climate.

- On the other hand, a successful and bipartisan resolution could signal a willingness to compromise and work together, potentially fostering a more constructive political environment.

- The negotiations are likely to shape the political conversation in the months leading up to the elections, with both parties seeking to capitalize on the issue to mobilize their base and sway undecided voters.

Alternative Solutions and Proposals

The debt ceiling crisis has highlighted the need for long-term solutions to address the nation’s fiscal challenges. While negotiations between the White House and Republicans continue, alternative proposals have emerged, offering different approaches to resolving the issue.

Short-Term Extensions and Budget Cuts

These solutions focus on delaying the crisis and reducing spending. They aim to provide immediate relief, but they do not address the underlying structural issues.

- Short-Term Extensions:This involves raising the debt ceiling for a limited period, postponing the crisis and allowing further negotiations. It provides temporary relief but doesn’t solve the long-term fiscal challenges.

- Budget Cuts:This involves reducing government spending to address the debt ceiling issue. However, it can lead to cuts in essential programs, impacting vital services and potentially exacerbating economic hardship.

Debt Limit Suspension

This proposal aims to remove the debt ceiling entirely, allowing the government to borrow freely without facing the threat of default.

- Pros:It eliminates the political gridlock and uncertainty associated with the debt ceiling debate, enabling the government to focus on addressing long-term fiscal challenges. It can foster economic stability by removing the risk of default, boosting investor confidence and reducing borrowing costs.

- Cons:Critics argue that removing the debt ceiling can lead to excessive borrowing and a lack of fiscal discipline. It could also weaken the government’s ability to control spending and potentially lead to inflation.

Fiscal Reform and Spending Cuts

These solutions aim to address the root causes of the debt ceiling crisis by reforming the budget process and reducing government spending.

- Budget Reform:This involves enacting reforms to the budget process, such as requiring balanced budgets or limiting spending growth. These reforms can promote fiscal responsibility and long-term sustainability.

- Spending Cuts:This involves reducing government spending across various programs, including discretionary spending, entitlement programs, and tax expenditures. This approach aims to reduce the deficit and national debt.

Tax Increases

This solution focuses on raising revenue through tax increases to address the debt ceiling crisis.

- Progressive Tax Increases:This involves raising taxes on high-income earners and corporations, potentially through higher marginal tax rates or closing tax loopholes. It aims to distribute the burden of debt reduction more equitably.

- Broad-Based Tax Increases:This involves increasing taxes on a wider range of individuals and businesses, such as raising income tax rates or introducing new taxes. It aims to raise revenue but can impact economic growth and consumer spending.

Combination of Approaches

Many experts advocate for a combination of solutions, addressing both short-term and long-term fiscal challenges. This could involve a temporary debt ceiling increase combined with reforms to the budget process, spending cuts, and tax increases.

Historical Comparisons and Lessons Learned

The current debt ceiling negotiations are not unprecedented. The United States has faced similar situations in the past, with lawmakers grappling with the issue of raising the nation’s borrowing limit. Examining these historical episodes can provide valuable insights into the dynamics of debt ceiling negotiations and the potential consequences of inaction.

Past Debt Ceiling Crises and Their Outcomes

Past debt ceiling crises have often been characterized by political gridlock and brinkmanship. These episodes highlight the potential for economic and financial instability when political disagreements over fiscal policy lead to delays in raising the borrowing limit.

- 1995-1996:A standoff between President Bill Clinton and the Republican-controlled Congress led to a partial government shutdown. The crisis was ultimately resolved with a compromise that included spending cuts and tax increases. This event underscored the potential for political gridlock to disrupt government operations and negatively impact the economy.

- 2011:A similar impasse between President Barack Obama and the Republican-controlled House of Representatives resulted in a downgrade of the United States’ credit rating for the first time in history. This episode demonstrated the serious consequences of failing to raise the debt ceiling, including damage to the country’s creditworthiness and financial stability.

- 2013:A last-minute deal averted a potential default on the nation’s debt, but the near-miss underscored the risks of brinkmanship and the need for responsible fiscal policy. This episode highlighted the importance of reaching a compromise to avoid economic turmoil and maintain the country’s financial reputation.

Lessons Learned from Past Crises

Historical comparisons reveal several key lessons about the debt ceiling negotiations:

- Political Gridlock Can Have Severe Consequences:Past crises demonstrate that political gridlock can lead to economic instability, damage the country’s credit rating, and disrupt government operations. This underscores the need for compromise and responsible fiscal policy to avoid these negative outcomes.

- Last-Minute Deals Are Risky:Delaying action until the last minute increases the risk of a default, which could have devastating consequences for the economy and financial markets. This highlights the importance of timely and proactive negotiations to avoid brinkmanship and maintain financial stability.

- Public Opinion Can Influence Outcomes:Public opinion can play a significant role in shaping the outcome of debt ceiling negotiations. In past crises, public pressure has helped to push lawmakers towards compromise and avoid a default. This suggests that public engagement and awareness are crucial in ensuring responsible fiscal policy.