Debt Defaults, Tornadoes, Crypto: Surprising Connections

Surprising factors propel debt default deadline tornadoes crypto and mudslides take center stage – Debt Defaults, Tornadoes, Crypto: Surprising Connections sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The world is a complex place, and the unexpected ways in which different events intertwine can be both fascinating and alarming.

This blog post will explore the surprising connections between debt defaults, natural disasters, and the cryptocurrency market, highlighting how seemingly unrelated factors can converge and create significant challenges.

We’ll delve into the unexpected factors that are contributing to the rise in debt defaults, exploring the impact of these factors on individuals, businesses, and economies. We’ll also analyze the significance of debt default deadlines and their implications for borrowers and lenders, and examine the potential consequences of missing these deadlines.

Beyond financial matters, we’ll investigate the surprising relationship between natural disasters like tornadoes and the cryptocurrency market, discussing how events like tornadoes can impact crypto prices and trading activity. Finally, we’ll explore the potential risks that mudslides pose to financial stability, discussing the economic and social consequences of mudslides, including infrastructure damage and disruptions to supply chains.

Surprising Factors in Debt Defaults: Surprising Factors Propel Debt Default Deadline Tornadoes Crypto And Mudslides Take Center Stage

Debt defaults, once considered a niche financial concern, have emerged as a significant threat to individuals, businesses, and economies worldwide. While traditional factors like economic downturns and high interest rates contribute to default rates, recent trends reveal a growing influence of surprising and often overlooked factors.

Impact of Surprising Factors on Debt Defaults

The rise of surprising factors driving debt defaults has significant implications for individuals, businesses, and economies.

- Individuals: Unexpected job losses, medical emergencies, or natural disasters can strain household budgets, leading to missed payments and eventual default on loans.

- Businesses: Unexpected supply chain disruptions, changes in consumer demand, or regulatory changes can negatively impact business operations, leading to financial strain and potential default on loans and other obligations.

- Economies: High debt default rates can weaken financial institutions, disrupt credit markets, and slow economic growth. This can lead to a vicious cycle where declining economic activity further increases default rates, creating a challenging environment for recovery.

Examples of Surprising Factors Leading to Debt Defaults

Here are some specific cases where unexpected factors have played a crucial role in debt defaults:

- The COVID-19 pandemic: The global health crisis caused widespread economic disruption, leading to job losses, business closures, and a surge in defaults on loans, mortgages, and credit cards.

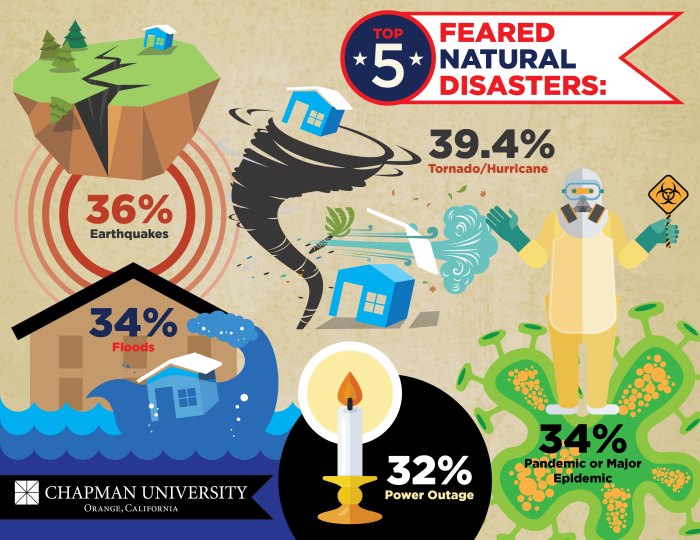

- Climate change: Increasing frequency and severity of natural disasters, such as hurricanes, floods, and wildfires, can lead to significant property damage and financial losses, contributing to debt defaults.

- Technological disruptions: Rapid advancements in technology can disrupt industries, leading to job displacement and economic uncertainty, potentially increasing default rates.

- Geopolitical events: Wars, political instability, and trade tensions can create economic uncertainty and volatility, leading to increased default risk.

Debt Default Deadlines and Their Consequences

Debt default deadlines are crucial elements in the financial world, acting as critical points where borrowers face significant consequences if they fail to meet their obligations. These deadlines signify the moment when a borrower is officially deemed in default, triggering a cascade of repercussions for both the borrower and the lender.

Debt Default Deadlines: How They Are Established and Enforced, Surprising factors propel debt default deadline tornadoes crypto and mudslides take center stage

Debt default deadlines are established during the initial loan agreement, outlining the specific terms and conditions for repayment. These deadlines are typically defined in the loan contract, specifying the due dates for each payment installment. The enforcement of debt default deadlines relies on a combination of legal and contractual mechanisms.

* Legal Framework:National and international legal frameworks establish the foundation for debt default deadlines and their consequences. These laws provide the legal basis for enforcing contracts and addressing breaches of agreement.

It’s a wild world out there! We’re juggling debt default deadlines, navigating the volatile crypto market, and dodging metaphorical tornadoes of economic uncertainty. And while we’re on the topic of unexpected twists and turns, it seems like even our fitness routines are getting a shake-up.

Peloton’s recent recall of 2.2 million bikes over injury and fall concerns reminds us that sometimes, the most unexpected factors can throw us off course. But hey, maybe we can all find a little humor in the chaos – after all, what’s life without a little adrenaline rush?

Contractual Terms Loan agreements contain detailed provisions outlining the specific terms of the debt, including payment schedules, interest rates, and default clauses. These clauses specify the consequences of missing payments, including penalties, legal actions, and potential asset seizure.

Credit Reporting Agencies

It’s a wild world out there! From debt default deadlines to crypto crashes and mudslides, it seems like we’re constantly bombarded with surprising events. But amidst the chaos, there’s a sense of stability in the world of real estate.

For those looking for a deeper understanding of the market, exploring real estate in the United States state by state, analyzing both residential and commercial properties , can provide valuable insights. Understanding the intricacies of the real estate market can help us navigate these turbulent times and make informed decisions about our financial futures.

Consequences of Missing Debt Default Deadlines

Failing to meet debt default deadlines can have severe consequences for borrowers. These consequences can range from financial penalties to legal actions and damage to credit scores. * Financial Penalties:Late payment fees, increased interest rates, and other financial penalties are common consequences of missing deadlines.

These penalties can significantly increase the overall cost of borrowing.

Legal Actions

It’s wild how the world throws curveballs. One day it’s surprising factors propelling debt default deadlines, and the next, tornadoes, crypto, and mudslides take center stage. But amidst the chaos, it’s important to remember our own financial goals. That’s why I recently dove into maximizing home loan repayment exploring the pros and cons of various approaches , seeking strategies to navigate the current economic landscape and secure our future.

After all, while the world spins, we need to ensure our financial foundation is strong, no matter what unexpected twists and turns come our way.

Credit Score Damage A missed debt payment can severely impact a borrower’s credit score, making it more difficult to obtain future loans or credit cards.

Reputational Damage Defaulting on debt can damage a borrower’s reputation within the financial community, making it challenging to secure future financing or business opportunities.

Tornadoes and Crypto

The world of finance, especially the volatile realm of cryptocurrency, is often considered to be driven by complex algorithms, market sentiment, and global economic events. However, a surprising factor that can influence crypto markets is something far less predictable and more destructive: natural disasters, particularly tornadoes.

While the connection may seem unlikely, tornadoes can have a significant impact on the crypto market, affecting prices, trading activity, and even the availability of digital assets.

Tornadoes and Crypto Market Volatility

Tornadoes can disrupt the crypto market in a number of ways. The most direct impact is on infrastructure. Crypto exchanges and mining operations rely on electricity and internet connectivity to function. Tornadoes can cause power outages and internet disruptions, which can halt trading and prevent miners from verifying transactions.

This disruption can lead to price fluctuations as supply and demand are affected. For example, in 2022, a tornado struck a data center in Texas, which housed several crypto mining operations. The outage resulted in a temporary drop in the Bitcoin hashrate, which in turn impacted the price of Bitcoin.

Mudslides and Their Impact on Financial Stability

Mudslides, often triggered by heavy rainfall or seismic activity, pose significant risks to financial stability, particularly in regions prone to such events. These natural disasters can cause widespread infrastructure damage, disrupt supply chains, and lead to economic losses, impacting businesses, individuals, and the overall financial system.

Economic and Social Consequences of Mudslides

Mudslides have far-reaching economic and social consequences. The destruction of infrastructure, including roads, bridges, and buildings, can disrupt transportation networks, hindering the movement of goods and people. This disruption can lead to supply chain disruptions, affecting the availability of essential goods and services, potentially driving up prices.

Additionally, damage to critical infrastructure, such as power grids and communication networks, can cripple economic activity and disrupt essential services, impacting businesses, households, and government operations. The social consequences of mudslides are equally profound. Displacement of populations due to damaged homes and infrastructure can lead to overcrowding in temporary shelters, straining resources and creating social unrest.

The loss of livelihoods, due to damaged businesses and agricultural land, can lead to increased poverty and inequality.

Mitigating the Risks of Mudslides

Governments and financial institutions can play a crucial role in mitigating the risks associated with mudslides.

- Investing in Infrastructure Resilience:Strengthening infrastructure, such as roads, bridges, and buildings, to withstand the forces of mudslides can significantly reduce the impact of these events. This includes incorporating resilient design features, using appropriate materials, and implementing effective drainage systems.

- Early Warning Systems:Implementing robust early warning systems that can detect and predict mudslide events can provide crucial time for evacuation and preparedness measures. This can minimize the loss of life and property damage.

- Land Use Planning:Proper land use planning can help prevent or mitigate mudslide risks. Avoiding development in high-risk areas, promoting sustainable land management practices, and implementing reforestation programs can significantly reduce the vulnerability to mudslides.

- Financial Preparedness:Governments and financial institutions can play a vital role in ensuring financial preparedness for mudslide events. This includes developing disaster insurance schemes, providing financial assistance to affected individuals and businesses, and establishing disaster relief funds.

The Intersection of Unexpected Events

The world is increasingly interconnected, and this interconnectedness can amplify the impact of unexpected events. Surprising factors like natural disasters, debt defaults, and volatility in the cryptocurrency market can interact in complex ways, creating unforeseen challenges and cascading effects across various sectors.

Understanding these interconnections is crucial for effective risk management and informed decision-making.

Debt Defaults and Natural Disasters

Natural disasters can significantly exacerbate existing financial vulnerabilities, potentially triggering debt defaults. For instance, a major earthquake or hurricane could disrupt economic activity, damage infrastructure, and lead to a surge in insurance claims. This, in turn, could strain the financial resources of businesses and individuals, making it difficult to meet debt obligations.

The resulting defaults could have a ripple effect throughout the financial system, potentially leading to a credit crunch and economic downturn.

Cryptocurrency Volatility and Debt Defaults

The cryptocurrency market is known for its high volatility, and unexpected events can trigger sharp price fluctuations. A sudden drop in the value of cryptocurrencies could impact individuals and institutions holding these assets, potentially leading to losses and even insolvency.

In cases where cryptocurrencies are used as collateral for loans, a significant price decline could trigger margin calls and force borrowers to sell assets at a loss, potentially leading to defaults.

The Impact of Unexpected Events on Financial Stability

The confluence of unexpected events can pose a significant threat to financial stability. For example, a combination of natural disasters, debt defaults, and cryptocurrency volatility could create a perfect storm, leading to widespread economic disruption. This could result in a decline in asset values, a tightening of credit markets, and a loss of investor confidence.

Governments and financial institutions need to be prepared for these scenarios and have robust mechanisms in place to mitigate their impact.