Investing in the US Stock Market: A Global Investors Guide

Investing in the us stock market a comprehensive guide for global investors – Investing in the US stock market: a comprehensive guide for global investors – the very idea might seem daunting, but it holds immense potential for international investors seeking growth and diversification. The US stock market, with its history of innovation and robust economy, has consistently offered attractive opportunities for global investors.

This guide will take you on a journey, exploring the intricacies of this market, empowering you to make informed decisions and navigate the path to success.

From understanding the structure and key components of the US stock market to exploring different investment strategies, this guide will cover all the essential aspects. We’ll delve into the advantages and disadvantages of investing in US stocks for global investors, addressing crucial topics like currency risk, tax implications, and ethical considerations.

By the end, you’ll have a solid understanding of the US stock market and be equipped to confidently embark on your investment journey.

Understanding the US Stock Market

The US stock market is a complex and dynamic system that plays a vital role in the global economy. It provides a platform for companies to raise capital and for investors to invest in a wide range of businesses. Understanding the structure and key components of the US stock market is essential for global investors seeking to participate in this vast and influential market.

Types of US Stock Exchanges

Stock exchanges are organized marketplaces where buyers and sellers of securities meet to trade. The US has several major stock exchanges, each with its unique characteristics and trading rules. The two most prominent exchanges are the New York Stock Exchange (NYSE) and the Nasdaq Stock Market (Nasdaq).

- New York Stock Exchange (NYSE):The NYSE is the world’s largest stock exchange by market capitalization. It is known for its traditional, auction-based trading system where specialists match buyers and sellers. The NYSE primarily lists large, established companies with a strong track record of profitability.

- Nasdaq Stock Market (Nasdaq):Nasdaq is a global electronic marketplace that operates as a dealer network. It is known for listing technology companies, as well as smaller and emerging companies. Nasdaq’s electronic trading system allows for faster and more efficient transactions compared to the NYSE’s auction-based system.

Other notable US stock exchanges include the American Stock Exchange (AMEX) and the Chicago Board Options Exchange (CBOE). These exchanges offer a diverse range of trading opportunities, including options contracts and exchange-traded funds (ETFs).

History of the US Stock Market

The US stock market has a long and rich history, dating back to the early colonial period.

- Early Beginnings:The first organized stock exchange in the US was the Philadelphia Stock Exchange, established in 1790. This marked the beginning of a formal marketplace for trading securities.

- The 19th Century:The 19th century saw the rise of major stock exchanges, including the New York Stock Exchange (NYSE) in 1817 and the American Stock Exchange (AMEX) in 1849. The Industrial Revolution and the growth of railroads fueled significant investment activity and market expansion.

- The 20th Century:The 20th century witnessed the emergence of the Nasdaq Stock Market (Nasdaq) in 1971, revolutionizing trading with its electronic system. The Great Depression and the two World Wars had significant impacts on the market, but it ultimately recovered and continued to grow.

- The 21st Century:The 21st century has seen the rise of online brokerage platforms, making stock market participation more accessible to individual investors. The market has also become increasingly globalized, with international investors playing a significant role in trading activity.

The US stock market has evolved over time, adapting to technological advancements and economic shifts. It has played a crucial role in the growth and development of the US economy, offering opportunities for investors and companies alike.

Why Invest in the US Stock Market?

The US stock market is often seen as a beacon of opportunity for global investors. Its size, liquidity, and diversity offer a compelling case for international participation. But what are the specific advantages that make the US market so attractive?

This section explores the key benefits of investing in the US stock market for global investors.

Economic and Political Stability

The US market is generally considered to be stable, with a robust economy and a well-established legal framework. This stability is a major draw for investors seeking to minimize risk and maximize returns.

- The US economy is the largest in the world, boasting a diverse range of industries and a strong consumer base.

- The US government is relatively stable, with a well-defined system of checks and balances, making it less susceptible to sudden political shifts.

- The US has a long history of protecting investor rights, with strong regulatory bodies like the Securities and Exchange Commission (SEC) ensuring market integrity.

This combination of factors creates a favorable environment for long-term investment, allowing investors to focus on growth and returns rather than political turmoil or economic uncertainty.

Wide Range of Investment Opportunities

The US stock market is home to a vast array of companies, representing various sectors and industries. This diversity provides investors with a wide range of options to choose from, allowing them to build diversified portfolios that align with their risk tolerance and investment goals.

- The US stock market features over 5,000 publicly traded companies, spanning sectors like technology, healthcare, finance, consumer goods, and energy.

- This diversity allows investors to access companies of all sizes, from established giants like Apple and Amazon to promising startups with high growth potential.

- Investors can also choose from various investment vehicles, including individual stocks, mutual funds, exchange-traded funds (ETFs), and options, providing flexibility and tailoring investment strategies to specific needs.

This vast selection allows investors to build portfolios that match their individual preferences and investment horizons.

Access to Innovation and Growth

The US is a global leader in innovation and technological advancement. Investing in the US stock market allows global investors to participate in this growth and benefit from the development of new technologies and industries.

- The US is home to numerous tech giants like Google, Microsoft, and Facebook, which are driving innovation in fields like artificial intelligence, cloud computing, and e-commerce.

- The US stock market is a key source of funding for startups and emerging companies, allowing investors to capitalize on the potential of disruptive technologies and new business models.

- Investing in US companies that are at the forefront of innovation can provide investors with the opportunity to generate significant returns over the long term.

The US market’s focus on innovation and growth presents a unique opportunity for global investors to participate in the future of the global economy.

Investing in the US stock market can be a great way to diversify your portfolio, but it’s important to understand the risks involved. One factor to consider is the future of transportation, which is rapidly evolving with the rise of electric vehicles.

If you’re considering investing in the automotive industry, it’s crucial to understand the potential impact of this shift. Check out this insightful article on gas vs electric vehicles which is a better deal know the experts suggestions to get a better grasp on the trends shaping the future of mobility.

This understanding can help you make more informed investment decisions in the US stock market.

Getting Started with US Stock Market Investing

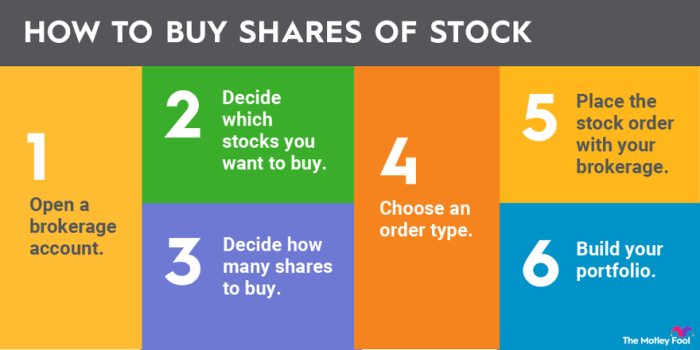

Before you can start investing in the US stock market, you need to open a brokerage account. This is a crucial step, as it allows you to buy and sell securities and manage your investments. While the process may seem daunting, especially for international investors, it’s relatively straightforward.

Here’s a comprehensive guide to help you navigate the process.

Opening a Brokerage Account for International Investors

Opening a brokerage account for international investors involves a few key steps. First, you’ll need to choose a brokerage firm that caters to international clients. Many reputable firms offer accounts for non-US residents, but it’s important to compare their fees, features, and investment options before making a decision.

Once you’ve chosen a brokerage firm, you’ll need to provide them with certain documentation. This typically includes:

- Proof of identity (passport or driver’s license)

- Proof of address (utility bill or bank statement)

- Tax identification number (TIN) or social security number (SSN) if applicable

You may also need to complete a Know Your Customer (KYC) form and provide information about your financial situation and investment experience. After your application is reviewed and approved, you’ll be able to fund your account and start investing.

Types of Brokerage Accounts

Brokerage accounts come in different types, each with its own features and benefits. Understanding these differences is essential for choosing the right account for your investment needs. Here are some common types of brokerage accounts:

- Cash Accounts:These accounts allow you to trade securities only with the funds you have available in your account. You can’t borrow money to buy stocks, so your potential losses are limited to your initial investment.

- Margin Accounts:Margin accounts allow you to borrow money from your brokerage firm to buy stocks. This can amplify your potential gains, but it also increases your risk.

- Retirement Accounts:These accounts are specifically designed for saving for retirement. There are different types of retirement accounts, including individual retirement accounts (IRAs) and 401(k)s. These accounts often offer tax advantages and can help you grow your savings over time.

Choosing the Right Brokerage Account

Choosing the right brokerage account depends on your individual circumstances and investment goals. Here are some factors to consider:

- Fees:Brokerage firms charge different fees for trading, account maintenance, and other services. Compare the fees of different firms to find one that fits your budget.

- Investment Options:Make sure the brokerage firm offers the types of investments you want to buy. Some firms offer a wider range of investment options than others.

- Research Tools:Some brokerage firms provide research tools and educational resources to help you make informed investment decisions.

- Customer Support:Choose a brokerage firm with responsive and helpful customer support.

- Security:Make sure the brokerage firm has strong security measures in place to protect your account and personal information.

Understanding US Stock Market Investments

Investing in the US stock market can be a rewarding experience, but it’s crucial to understand the different types of investments available and how they work. This section delves into the intricacies of US stock market investments, exploring the diverse range of investment options and strategies.

Types of US Stocks

Understanding the various types of stocks available in the US market is essential for informed investing. Two primary categories of stocks are common stocks and preferred stocks, each possessing unique characteristics and investment implications.

- Common Stock: Represents ownership in a company, giving holders voting rights and the potential to share in profits through dividends. Common stockholders have a claim on the company’s assets after creditors and preferred stockholders in case of liquidation.

- Preferred Stock: Offers a fixed dividend payment and priority over common stockholders in receiving dividends and assets in liquidation. However, preferred stockholders typically lack voting rights.

Investment Strategies for the US Stock Market

Numerous investment strategies can be employed to navigate the US stock market, each tailored to specific risk tolerances and investment goals. These strategies range from passive to active approaches, each with its own set of advantages and drawbacks.

- Passive Investing: Involves buying and holding a diversified portfolio of stocks over the long term, aiming to match the performance of a specific market index. This strategy minimizes trading costs and relies on market growth for returns. Index funds and exchange-traded funds (ETFs) are popular tools for passive investing.

- Active Investing: Entails actively selecting and managing individual stocks, seeking to outperform the market by identifying undervalued companies or market trends. This approach requires significant research, analysis, and market knowledge. Mutual funds managed by professional fund managers are a common avenue for active investing.

- Value Investing: Focuses on identifying stocks with intrinsic value that is currently undervalued by the market. Value investors look for companies with strong fundamentals, solid financials, and potential for future growth.

- Growth Investing: Prioritizes stocks of companies expected to experience rapid growth in earnings and revenue, often in emerging industries or sectors. Growth investors seek companies with high innovation, strong market share, and potential for future expansion.

US Stock Market Sectors and Industries

The US stock market comprises a diverse range of industries, each representing a specific sector of the economy. Understanding these sectors and their respective characteristics is crucial for identifying investment opportunities and managing portfolio risk.

- Technology: Encompasses companies involved in software development, hardware manufacturing, internet services, and other technology-related industries. This sector is known for its high growth potential and innovation but can also be volatile.

- Healthcare: Includes companies involved in pharmaceutical manufacturing, medical device production, healthcare services, and biotechnology. This sector benefits from a growing aging population and advancements in medical technology.

- Financials: Covers companies in banking, insurance, investment management, and real estate. This sector is sensitive to economic conditions and interest rate fluctuations.

- Consumer Discretionary: Consists of companies selling non-essential goods and services, such as automobiles, apparel, restaurants, and entertainment. This sector is highly influenced by consumer confidence and economic growth.

- Energy: Encompasses companies involved in oil and gas exploration, production, refining, and distribution. This sector is cyclical and vulnerable to commodity price fluctuations and geopolitical events.

Research and Analysis Tools: Investing In The Us Stock Market A Comprehensive Guide For Global Investors

Making informed investment decisions in the US stock market requires thorough research and analysis. Understanding a company’s financial health and market position is crucial for determining its potential for growth and profitability. Two key approaches to stock analysis are fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, management, industry, and overall economic environment. This approach aims to identify companies that are undervalued by the market and have the potential to generate strong returns over time.

Key Financial Statements and Ratios

- Income Statement: The income statement, also known as the profit and loss statement, summarizes a company’s revenues and expenses over a specific period, revealing its profitability. Key metrics include revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income.

Investing in the US stock market can be a great way to diversify your portfolio and potentially earn higher returns. But navigating the complexities of this market can be daunting, especially for global investors. To stay up-to-date on current market trends, check out live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors , which provides insights on key market movements.

Understanding these trends can help you make informed decisions about your investment strategy and potentially maximize your returns in the US stock market.

- Balance Sheet: The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps understand a company’s financial position, including its liquidity, solvency, and capital structure.

- Statement of Cash Flows: The statement of cash flows tracks the movement of cash into and out of a company over a specific period. It reveals how a company generates cash, how it uses cash, and how much cash it has available for future investments.

Financial Ratios

- Profitability Ratios: Profitability ratios measure a company’s ability to generate profits from its operations. Examples include gross profit margin, operating profit margin, and net profit margin.

- Liquidity Ratios: Liquidity ratios assess a company’s ability to meet its short-term financial obligations. Examples include current ratio, quick ratio, and cash ratio.

- Solvency Ratios: Solvency ratios measure a company’s ability to meet its long-term financial obligations. Examples include debt-to-equity ratio, times interest earned ratio, and debt-to-asset ratio.

- Valuation Ratios: Valuation ratios compare a company’s market value to its fundamental value. Examples include price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio.

Technical Analysis

Technical analysis focuses on identifying trends and patterns in historical stock price data and trading volume to predict future price movements. It assumes that past price movements and trading activity can provide insights into future price trends.

Key Technical Indicators

- Moving Averages: Moving averages smooth out price fluctuations and identify trends. Common moving averages include 50-day, 100-day, and 200-day moving averages.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, while an RSI below 30 is considered oversold.

- MACD (Moving Average Convergence Divergence): The MACD identifies trend changes and potential buy or sell signals by comparing two moving averages.

Resources and Tools for Research and Analysis

Financial News and Data Providers

- Bloomberg: Bloomberg provides comprehensive financial news, data, and analytics for investors and professionals. Its terminal offers real-time market data, company financials, and research reports.

- Reuters: Reuters is another major financial news and data provider that offers real-time market data, news, and analysis.

- Yahoo Finance: Yahoo Finance offers free access to financial news, stock quotes, company profiles, and financial data.

- Google Finance: Google Finance provides a user-friendly interface for accessing financial news, stock quotes, and company information.

Online Brokerage Platforms

- TD Ameritrade: TD Ameritrade offers a robust platform with advanced research tools, including real-time market data, charting capabilities, and access to analyst reports.

- E*TRADE: E*TRADE provides a user-friendly platform with access to research reports, charting tools, and real-time market data.

- Fidelity: Fidelity offers a comprehensive platform with access to research reports, analyst recommendations, and portfolio analysis tools.

Financial Websites and Research Platforms

- Morningstar: Morningstar provides in-depth company research, stock ratings, and portfolio analysis tools.

- Seeking Alpha: Seeking Alpha offers a platform for investment research and analysis, featuring articles, commentary, and analyst ratings.

- The Motley Fool: The Motley Fool provides investment advice, stock recommendations, and educational resources for individual investors.

Managing Risk and Diversification

The stock market is inherently volatile, and investors must be prepared to manage risk to protect their investments. Risk management is essential for global investors as it helps mitigate potential losses and ensures long-term investment success. This section delves into effective risk management strategies and how to diversify your portfolio within the US stock market.

Risk Management Strategies for Global Investors

Effective risk management involves understanding the various risks associated with investing in the US stock market and implementing strategies to mitigate them.

- Diversification:Spreading your investments across different asset classes, sectors, and geographies reduces the impact of any single investment’s performance on your overall portfolio. Diversification helps to mitigate the risk of losing a significant portion of your capital due to a single investment’s failure.

- Asset Allocation:Carefully allocating your capital across different asset classes, such as stocks, bonds, real estate, and commodities, is crucial for managing risk. The allocation should align with your investment goals, risk tolerance, and time horizon.

- Dollar-Cost Averaging:This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. By averaging your purchase price over time, dollar-cost averaging helps reduce the impact of market volatility and minimizes the risk of buying high and selling low.

- Stop-Loss Orders:These orders automatically sell a security when it reaches a predetermined price, limiting potential losses. Stop-loss orders can be helpful in managing risk, but they should be used strategically and with a clear understanding of their limitations.

- Rebalancing:Regularly reviewing and adjusting your portfolio to maintain your desired asset allocation is essential for managing risk. As asset prices fluctuate, your portfolio’s allocation can drift from your original plan, requiring rebalancing to restore the desired balance.

Diversifying Your US Stock Market Portfolio

Diversification within the US stock market can be achieved by investing in various sectors, industries, and company sizes.

- Sector Diversification:Investing in different sectors, such as technology, healthcare, energy, and financials, can reduce the impact of sector-specific risks on your portfolio. For example, investing in both technology and healthcare sectors can help mitigate the risk of a downturn in one sector.

- Industry Diversification:Investing in different industries within a sector can further diversify your portfolio. For example, within the technology sector, you can invest in software, hardware, and semiconductor companies. This approach helps to reduce the impact of industry-specific risks.

- Company Size Diversification:Investing in companies of different sizes, such as large-cap, mid-cap, and small-cap, can further reduce risk. Large-cap companies are generally considered less risky than small-cap companies, but they may also offer lower growth potential.

- Geographic Diversification:While focusing on the US stock market, you can diversify your portfolio by investing in companies operating in different regions of the US. This helps mitigate the risk of economic downturns in specific regions.

Examples of Diversification, Investing in the us stock market a comprehensive guide for global investors

Here are some examples of how to diversify your US stock market portfolio:

- Investment in ETFs:Exchange-traded funds (ETFs) offer a convenient way to diversify your portfolio. For example, the Vanguard S&P 500 ETF (VOO)provides exposure to the 500 largest companies in the US, while the Vanguard Total Stock Market ETF (VTI)offers exposure to the entire US stock market. These ETFs offer diversification across various sectors, industries, and company sizes.

- Mutual Funds:Mutual funds provide diversification through a portfolio of stocks managed by professional fund managers. For example, the Fidelity Magellan Fund (FMAGX)invests in a diversified portfolio of large-cap stocks, while the Schwab Total Stock Market Index (SWTSX)provides exposure to the entire US stock market.

- Direct Stock Investments:You can also diversify your portfolio by investing in individual stocks across different sectors and industries. For example, you can invest in technology giants like Apple (AAPL)and Microsoft (MSFT), healthcare companies like Johnson & Johnson (JNJ)and UnitedHealth Group (UNH), and consumer staples companies like Coca-Cola (KO)and Procter & Gamble (PG).

“Diversification is key to managing risk in any investment portfolio. It helps to reduce the impact of any single investment’s performance on your overall portfolio.”

Warren Buffett

Investment Strategies for Global Investors

Investing in the US stock market offers global investors a chance to diversify their portfolios and potentially earn higher returns. However, navigating the US market comes with its own set of challenges, particularly for those outside the US. Understanding the nuances of currency risk, tax implications, and investment strategies tailored for global investors is crucial for maximizing returns and mitigating potential risks.

Advantages and Disadvantages of Investing in US Stocks

Investing in US stocks offers several advantages for global investors:* Access to a Large and Diverse Market:The US stock market is the largest and most liquid in the world, providing investors with a vast array of investment options across various sectors and industries. This diversity allows for better portfolio diversification and potential for higher returns.

Strong Economic Fundamentals The US economy is generally considered stable and robust, with a strong track record of growth and innovation. This stability can provide investors with greater confidence in their investments.

Opportunities for Long-Term Growth Many US companies are global leaders in their respective industries, with strong potential for long-term growth and value creation. Investing in these companies can provide investors with exposure to global trends and innovation.However, investing in US stocks also comes with certain disadvantages:* Currency Risk:Fluctuations in exchange rates between the US dollar and the investor’s home currency can impact the overall returns.

A weakening of the investor’s home currency against the US dollar can reduce the value of their investment.

Tax Implications Global investors may face different tax regulations and reporting requirements depending on their country of residence. Understanding these complexities is crucial for avoiding potential penalties and maximizing after-tax returns.

Higher Investment Costs

Investing in the US stock market can be a great way to diversify your portfolio, but it can be tricky to navigate the complexities of a foreign market. It’s important to stay up-to-date on industry news and developments, like the recent announcement that daniel baldwin joins ishook 202879 , which could have significant implications for the tech sector.

By staying informed and understanding the nuances of US market dynamics, global investors can make more informed decisions about their investment strategies.

Mitigating Currency Risk and Tax Implications

Global investors can employ various strategies to mitigate currency risk and tax implications:* Currency Hedging:This involves using financial instruments like forward contracts or options to lock in a specific exchange rate, reducing the impact of currency fluctuations on the investment.

Investing in US Dollar-Denominated Funds Investing in mutual funds or exchange-traded funds (ETFs) that are denominated in US dollars can help reduce currency risk. These funds invest in US stocks and are priced in US dollars, minimizing the impact of exchange rate fluctuations.

Tax Planning Global investors should consult with a tax advisor to understand the tax implications of investing in US stocks. This includes understanding the tax treaties between their home country and the US, as well as the reporting requirements for foreign investments.

Choosing Tax-Efficient Investment Vehicles Some investment vehicles, like tax-advantaged accounts, can help reduce the tax burden on investment returns. For example, US investors can utilize Individual Retirement Accounts (IRAs) or 401(k) plans to shelter investment income from taxes.

Investment Strategies Tailored for Global Investors

Global investors can choose from a variety of investment strategies based on their individual risk tolerance, investment goals, and time horizon:* Passive Investing:This approach involves investing in low-cost index funds or ETFs that track broad market indices, like the S&P 500.

This strategy provides diversified exposure to the US market at a low cost.

Active Investing This strategy involves actively selecting individual stocks or mutual funds based on research and analysis. Active investors aim to outperform the market by identifying undervalued stocks or sectors with high growth potential.

Sector-Specific Investing This approach involves focusing on specific sectors of the US economy, such as technology, healthcare, or consumer goods. Global investors can identify sectors with strong growth prospects or those that align with their investment goals.

Dividend Investing This strategy focuses on investing in companies that pay regular dividends to shareholders. Dividends can provide a steady stream of income and potentially enhance overall returns.

Growth Investing This approach involves investing in companies with high growth potential, often in emerging industries or technologies. Growth investors seek to capitalize on rapid expansion and innovation.

Value Investing This strategy involves identifying undervalued companies with strong fundamentals and potential for future growth. Value investors aim to buy stocks at a discount to their intrinsic value and hold them for the long term.

“It’s important for global investors to remember that investing in the US stock market is a long-term game. Don’t get caught up in short-term market fluctuations. Instead, focus on building a diversified portfolio that aligns with your investment goals and risk tolerance.”

Tax Considerations for Global Investors

Investing in the US stock market from outside the United States can come with unique tax implications. Understanding these implications is crucial for maximizing your returns and ensuring compliance with tax regulations.

Tax Implications for Non-US Residents

Non-US residents are generally subject to US taxation on income derived from US sources, including dividends and capital gains from US stock investments. This taxation can vary depending on your country of residence and the specific tax treaty in place.

Tax Treaties

Tax treaties are agreements between countries that aim to prevent double taxation. These treaties can significantly impact your tax obligations on US investments. They often include provisions that:* Reduce or eliminate withholding taxes:Withholding taxes are taxes deducted at source on dividends and interest payments.

Tax treaties can lower these rates, making your investments more attractive.

Provide for reciprocal tax treatment This means that if a US resident invests in a foreign country, they may be subject to similar tax rules as foreign investors in the US.

Define the allocation of taxing rights Tax treaties clarify which country has the primary right to tax certain types of income.

Managing Tax Obligations

Here are some tips for managing your tax obligations related to US stock investments:

- Understand your residency status:Your residency status is crucial in determining your tax obligations. If you are considered a non-resident alien for tax purposes, you may be subject to different rules than a resident alien.

- Seek professional advice:Consulting a tax advisor specializing in international taxation can help you navigate the complexities of US tax laws and understand your specific obligations.

- Keep accurate records:Maintaining detailed records of your US stock investments, including purchase dates, sale dates, and income received, is essential for filing accurate tax returns.

- File necessary tax forms:Non-US residents may need to file specific tax forms, such as Form 1040-NR, to report their US-source income.

- Consider using a tax-efficient investment structure:Depending on your individual circumstances, certain investment structures, such as a foreign trust, may help you manage tax obligations more effectively.

Ethical and Sustainable Investing

The US stock market is increasingly embracing ethical and sustainable investing practices, reflecting a growing global awareness of environmental, social, and governance (ESG) factors. Investors are recognizing that companies with strong ethical practices can contribute to a more sustainable future and deliver long-term value.

ESG Factors to Consider

ESG factors encompass a wide range of considerations that investors can use to evaluate companies’ ethical and sustainable practices. These factors are interconnected and can influence a company’s financial performance, reputation, and long-term viability.

- Environmental Factors:This includes a company’s impact on the environment, such as its greenhouse gas emissions, water usage, and waste management practices. For example, investors might consider companies that are committed to reducing their carbon footprint, investing in renewable energy, or promoting sustainable agriculture.

- Social Factors:This involves a company’s social responsibility, including its treatment of employees, customers, and communities. Investors may prefer companies with fair labor practices, ethical sourcing, and diversity and inclusion initiatives.

- Governance Factors:This relates to a company’s corporate governance structure, including its board of directors, executive compensation, and transparency. Investors might seek companies with strong corporate governance practices that promote accountability and ethical decision-making.

Investing in Companies with Strong Ethical Practices

There are several ways to invest in companies with strong ethical practices. One approach is to invest in ESG-focused funds, which specifically invest in companies that meet certain ESG criteria. These funds typically use a combination of quantitative and qualitative analysis to assess a company’s ESG performance.Another option is to directly invest in individual companiesthat align with your ethical values.

You can research companies using ESG rating agencies, which provide independent assessments of companies’ ESG performance. These agencies use a variety of data sources and methodologies to evaluate companies’ environmental, social, and governance practices. Some popular ESG rating agencies include:

- MSCI ESG Ratings:MSCI provides ESG ratings for thousands of companies worldwide.

- Sustainalytics:Sustainalytics offers ESG ratings and research, focusing on sustainability risks and opportunities.

- RepRisk:RepRisk provides ESG data and risk assessments, focusing on environmental and social issues.

Resources for Ethical and Sustainable Investing

There are several resources available to help investors learn more about ethical and sustainable investing. These resources can provide insights into ESG factors, investment strategies, and company performance. Some helpful resources include:

- The United Nations Principles for Responsible Investment (UN PRI):The UN PRI is a global framework for investors to incorporate ESG factors into their investment decisions.

- Global Reporting Initiative (GRI):GRI provides a framework for companies to report on their sustainability performance.

- The Sustainability Accounting Standards Board (SASB):SASB develops industry-specific sustainability accounting standards for companies to use in their financial reporting.