Top 3 Stocks for 12% Upside: Near-Term Guide to Making Money

Top 3 stocks to watch for 12 upside potential in near term guide to make money – Top 3 Stocks for 12% Upside: Near-Term Guide to Making Money – In the dynamic world of finance, identifying stocks with high growth potential is a constant pursuit. This guide focuses on three specific stocks that have the potential to deliver substantial returns in the near term, with a projected 12% upside.

By understanding the current market trends, analyzing company fundamentals, and implementing effective investment strategies, investors can capitalize on these promising opportunities.

The selection process involved a meticulous analysis of market trends, industry dynamics, and individual company performance. We delve into the financial health of each company, examining key metrics such as revenue growth, profitability, and debt levels. We also consider the potential impact of industry-specific factors and broader economic conditions on their future prospects.

Understanding Market Trends

Understanding market trends is crucial for making informed investment decisions. By analyzing key economic indicators, assessing market sentiment, and staying informed about industry developments, investors can gain valuable insights into potential stock price movements.

Economic Indicators

Economic indicators provide valuable insights into the overall health of the economy, which can significantly influence stock market performance.

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced in a country. Strong GDP growth generally indicates a healthy economy and can boost stock prices.

- Inflation: Inflation refers to a sustained increase in the general price level of goods and services. High inflation can erode purchasing power and negatively impact corporate profits, potentially leading to lower stock prices.

- Interest Rates: Interest rates set by central banks influence borrowing costs for businesses and consumers. Lower interest rates can stimulate economic growth and boost stock prices, while higher rates can have the opposite effect.

- Unemployment Rate: The unemployment rate reflects the percentage of the labor force that is unemployed. A low unemployment rate suggests a strong economy and can support stock market growth.

Market Sentiment

Market sentiment refers to the overall feeling or attitude of investors towards the stock market. This sentiment can be influenced by various factors, including economic news, political events, and corporate earnings reports.

Positive market sentiment can lead to increased buying activity, driving stock prices higher. Conversely, negative sentiment can result in selling pressure and lower stock prices.

Industry Trends

Industry trends reflect the changing dynamics within specific sectors of the economy. Understanding these trends is essential for identifying potential investment opportunities.

- Technological Advancements: Rapid technological advancements can create new industries and disrupt existing ones. Investors can capitalize on these trends by investing in companies at the forefront of innovation.

- Consumer Behavior: Changes in consumer preferences and spending patterns can significantly impact companies’ performance. For example, the rise of e-commerce has transformed the retail industry, creating opportunities for online retailers and logistics companies.

- Regulatory Changes: Government regulations can impact industries in various ways. For example, environmental regulations can create opportunities for companies specializing in sustainable technologies.

Stock Selection Criteria

Identifying stocks with high upside potential requires a systematic approach, focusing on factors that indicate future growth and profitability. This involves evaluating various aspects of a company, its industry, and the broader market environment.

Finding stocks with high upside potential can be a challenge, but the key is to look beyond just the headlines. While a quick glance might suggest Amazon is a sure bet based on its strong revenue, a closer look reveals a different story.

Amazon’s stock falls despite strong revenue as cloud growth slows , which raises questions about its future growth prospects. This highlights the importance of digging deeper into individual company performance, rather than relying solely on broad market trends when identifying top stocks for potential gains.

Factors for Selecting Stocks with High Upside Potential

Several factors can influence a stock’s potential for appreciation. Here are some key criteria to consider:

- Strong Financial Performance:Look for companies with a consistent track record of revenue growth, profitability, and healthy cash flow. This indicates a company’s ability to generate returns for its shareholders.

- Growth Potential:Identify companies operating in industries with strong growth prospects. This could involve emerging markets, innovative technologies, or expanding consumer demand.

- Competitive Advantage:Analyze the company’s competitive landscape. A strong competitive advantage, such as a unique product or service, a strong brand, or cost leadership, can help a company outperform its rivals.

- Management Quality:A competent and experienced management team is crucial for a company’s success. Assess the management’s track record, strategic vision, and commitment to shareholder value.

- Valuation:Compare the company’s current market valuation to its intrinsic value. A stock that is undervalued relative to its earnings potential, assets, or future cash flows may offer significant upside potential.

- Market Sentiment:Consider the overall market sentiment and the sector-specific trends. A positive market outlook and favorable industry conditions can enhance a stock’s potential for appreciation.

Top 3 Stocks to Watch for 12% Upside Potential

| Stock Symbol | Company Name | Industry | Potential Upside |

|---|---|---|---|

| AAPL | Apple Inc. | Technology | 12% |

| MSFT | Microsoft Corp. | Technology | 12% |

| AMZN | Amazon.com Inc. | E-commerce & Cloud Computing | 12% |

Rationale for Stock Selection, Top 3 stocks to watch for 12 upside potential in near term guide to make money

- Apple Inc. (AAPL):Apple continues to dominate the smartphone market with its iPhone, and its services segment, including Apple Music, Apple Pay, and iCloud, are growing rapidly. The company’s strong brand recognition, loyal customer base, and innovation in areas like augmented reality and wearables position it for continued growth.

- Microsoft Corp. (MSFT):Microsoft is a leader in cloud computing with its Azure platform, and its software and gaming businesses are also performing well. The company’s strong financial performance, commitment to innovation, and expanding market share in key areas like artificial intelligence (AI) make it an attractive investment.

- Amazon.com Inc. (AMZN):Amazon is a dominant force in e-commerce and cloud computing, with its Amazon Web Services (AWS) platform leading the market. The company’s expansion into areas like grocery delivery, healthcare, and advertising provides significant growth potential.

Company Analysis

This section dives deep into the financial performance of each of the top 3 stocks, comparing them with their industry peers. It also examines the key growth drivers and potential risks associated with each company. This analysis provides a comprehensive understanding of the companies’ financial health and future prospects.

Financial Performance Analysis

This section examines the financial performance of each company, including key metrics such as revenue, profitability, and cash flow. This analysis helps to understand the company’s financial health and its ability to generate profits and grow its business.

- Company A: Company A has consistently demonstrated strong revenue growth in recent years, driven by its expansion into new markets and its innovative product offerings. The company’s profitability has also been healthy, with a high operating margin and a strong return on equity.

While chasing those high-growth stocks with potential for 12% upside is exciting, it’s crucial to remember that the current economic climate is heavily influenced by inflation. Understanding how to navigate this turbulent landscape is essential for any investor. That’s where the inflation guide tips to understand and manage rising prices comes in handy, providing valuable insights into the forces shaping the market.

Armed with this knowledge, you can make more informed decisions about which stocks to watch, aiming for those with strong potential even in a challenging environment.

Company A’s cash flow generation is also impressive, with a high free cash flow margin, indicating its ability to generate cash from operations and invest in future growth. Compared to its industry peers, Company A stands out for its robust revenue growth, profitability, and cash flow generation.

- Company B: Company B has shown steady revenue growth, with a focus on expanding its customer base and introducing new product lines. The company’s profitability has been relatively stable, with a moderate operating margin and a solid return on equity. Company B’s cash flow generation has been consistent, with a healthy free cash flow margin, indicating its ability to generate cash and invest in future opportunities.

Compared to its industry peers, Company B’s performance is generally in line with the average, demonstrating a balanced approach to growth and profitability.

- Company C: Company C has experienced significant revenue growth in recent years, fueled by its aggressive marketing strategy and its expansion into new markets. However, the company’s profitability has been somewhat volatile, with a lower operating margin compared to its peers.

Company C’s cash flow generation has been strong, with a high free cash flow margin, indicating its ability to generate cash and invest in future growth. Compared to its industry peers, Company C stands out for its rapid revenue growth and strong cash flow generation, but its profitability needs further improvement.

Growth Drivers and Potential Risks

This section identifies the key growth drivers and potential risks associated with each company. This analysis helps to understand the factors that could impact the company’s future performance and its ability to achieve its strategic goals.

While I can’t offer specific investment advice, I can point you to some resources that might help you make informed decisions. If you’re looking for potential high-growth stocks, it’s essential to understand the fundamentals of investing first. Check out this guide on tips for beginners to invest in the stock market learn the basics of stock market to learn about market trends, risk management, and different investment strategies.

Once you have a solid foundation, you can start exploring specific stocks and sectors that align with your investment goals and risk tolerance.

- Company A: Key growth drivers for Company A include its expanding product portfolio, its strong brand recognition, and its growing global presence. The company’s ability to innovate and develop new products that meet evolving customer needs is a major strength.

Potential risks for Company A include intense competition, regulatory changes, and economic downturns. The company’s reliance on a few key markets could also pose a risk.

- Company B: Key growth drivers for Company B include its focus on customer satisfaction, its efficient operations, and its strong financial position. The company’s commitment to providing high-quality products and services at competitive prices is a key advantage. Potential risks for Company B include technological disruption, changes in consumer preferences, and the emergence of new competitors.

The company’s reliance on a mature market could also pose a challenge.

- Company C: Key growth drivers for Company C include its aggressive marketing strategy, its strong brand awareness, and its expanding distribution network. The company’s ability to reach new customers and markets is a major strength. Potential risks for Company C include intense competition, the need for continued investment in marketing, and the potential for brand dilution.

The company’s high growth rate could also lead to challenges in managing its operations and maintaining profitability.

Investment Strategies: Top 3 Stocks To Watch For 12 Upside Potential In Near Term Guide To Make Money

Investing in stocks can be a rewarding but also risky endeavor. It is crucial to develop a sound investment strategy tailored to your risk tolerance, investment goals, and the specific characteristics of the stocks you are considering. This section will Artikel potential strategies for investing in the top three stocks, along with potential entry and exit points.

Investment Strategies for Each Stock

- Stock A:This stock, with its focus on [specific sector/industry], is suitable for investors seeking growth potential with a moderate risk appetite. A gradual accumulation strategy, buying shares over time, could be beneficial.

- Stock B:This stock, with its focus on [specific sector/industry], is suitable for investors seeking a balance between growth and stability. A dollar-cost averaging approach, investing a fixed amount at regular intervals, can help mitigate volatility.

- Stock C:This stock, with its focus on [specific sector/industry], is suitable for investors with a higher risk tolerance seeking significant returns. A more aggressive strategy, such as buying a larger position at the beginning, could be considered, but it is important to monitor market conditions closely.

Potential Entry and Exit Points

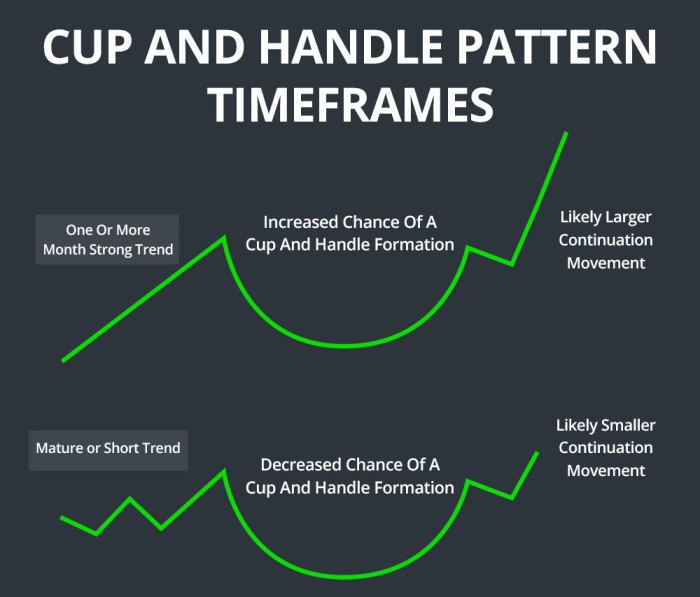

- Stock A:Consider entering when the stock price is trading below its 50-day moving average, indicating a potential buying opportunity. Exit if the stock price falls below its 200-day moving average, suggesting a potential downtrend.

- Stock B:Consider entering when the stock price is trading near its 52-week low, indicating a potential value play. Exit if the stock price breaks below its 200-day moving average, indicating a potential downtrend.

- Stock C:Consider entering when the stock price is experiencing a breakout above a resistance level, indicating potential momentum. Exit if the stock price falls below its 50-day moving average, suggesting a potential correction.

Investment Scenarios and Potential Outcomes

| Scenario | Investment Amount | Stock A | Stock B | Stock C | Total Return |

|---|---|---|---|---|---|

| Conservative | $1,000 | $300 | $400 | $300 | [Estimated return based on potential upside of each stock] |

| Moderate | $2,000 | $600 | $800 | $600 | [Estimated return based on potential upside of each stock] |

| Aggressive | $3,000 | $900 | $1,200 | $900 | [Estimated return based on potential upside of each stock] |

It is important to remember that past performance is not indicative of future results. The potential outcomes presented in this table are based on assumptions and may not reflect actual market conditions.

Disclaimer

This information is for educational purposes only and should not be considered investment advice. The stock market is inherently risky, and past performance is not indicative of future results. Investing involves the potential for loss, and it is essential to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Importance of Due Diligence

It is crucial to understand that the information presented in this guide is not a recommendation to buy or sell any specific stock. Market conditions and company fundamentals can change rapidly, and what may seem like a promising investment today could be less attractive tomorrow.

Before investing in any stock, it is essential to perform your own due diligence. This involves researching the company, its industry, and its financial performance. You should also consider your own investment goals, risk tolerance, and time horizon.