Your Guide to Navigating the Competitive Housing Market: Smart Decisions for Buying or Renting

Your guide to navigating the competitive housing market tips for making smart decisions when buying or renting a home – Your Guide to Navigating the Competitive Housing Market: Smart Decisions for Buying or Renting sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The current housing market is a dynamic landscape, presenting both exciting opportunities and formidable challenges for those seeking to buy or rent a home. Whether you’re a first-time buyer, a seasoned investor, or a renter navigating a tight market, understanding the intricacies of this competitive landscape is crucial for making informed decisions and achieving your housing goals.

This guide will equip you with the knowledge and strategies you need to navigate this complex market successfully. We’ll delve into the factors influencing market competitiveness, explore essential planning steps for homeownership, and guide you through the intricacies of the home search and negotiation processes.

We’ll also provide insights into the rental market dynamics, helping you find suitable rental properties and secure a lease that aligns with your needs. From understanding affordability to navigating legal complexities, this guide will empower you to make confident and strategic choices in the housing market.

Understanding the Competitive Housing Market

The current housing market is incredibly competitive, with many factors driving this trend. It’s important to understand the dynamics at play to make informed decisions when buying or renting.

Factors Influencing Market Competitiveness

The current housing market is a complex interplay of forces, with supply and demand playing a crucial role. Here are some of the key factors contributing to the competitiveness:

- Low Inventory:The number of homes available for sale or rent is significantly lower than the number of buyers and renters, creating a seller’s or landlord’s market. This limited supply is driven by various factors, including the lingering effects of the 2008 financial crisis, the ongoing pandemic, and limited construction activity.

- High Demand:Fueled by a strong economy, low interest rates, and population growth, the demand for housing remains robust. Many buyers and renters are competing for a limited number of properties, pushing prices higher and making it difficult to secure a desirable home.

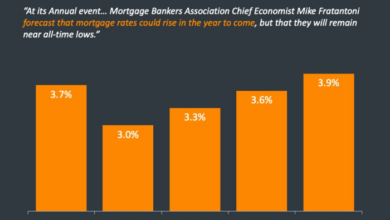

- Interest Rates:While interest rates have been rising, they remain historically low, making borrowing more affordable for many. However, the rising rates have also made it more expensive to purchase a home, impacting affordability for some buyers.

- Economic Conditions:The overall economic climate plays a significant role in the housing market. A strong economy typically translates to increased demand for housing, as people have more disposable income and confidence to make significant purchases. However, economic downturns can lead to decreased demand and lower prices.

Challenges Faced by Buyers and Renters

The competitive housing market presents challenges for both buyers and renters:

- Higher Prices:The limited supply and high demand drive up prices, making it more expensive to buy or rent a home. This can be particularly challenging for first-time buyers and those with limited budgets.

- Competitive Bidding Wars:With multiple buyers vying for the same property, bidding wars are common. This can result in homes selling for significantly over asking price, putting pressure on buyers to offer more than they initially planned.

- Limited Inventory:Finding available properties can be difficult, especially in desirable areas. This can lead to frustration and a sense of urgency, as buyers and renters feel pressured to make quick decisions.

- Difficult Rental Market:The high demand for rentals also creates a competitive environment. Landlords may be more selective in choosing tenants, and rental rates can be higher than in less competitive markets.

Strategic Planning for Home Buying

Navigating the competitive housing market requires a strategic approach to home buying. Before jumping into the market, it’s essential to plan meticulously, ensuring financial preparedness and a clear understanding of your goals. This involves setting realistic expectations, managing your finances effectively, and making informed decisions.

Determining Affordability

It’s crucial to understand your financial capabilities before starting your home search. This involves assessing your income, expenses, and debt obligations to determine a realistic budget for your home purchase.

- Calculate your monthly income:Subtract your monthly expenses, including debt payments, from your gross income to determine your net income. This will give you a clearer picture of how much you can afford to spend on housing.

- Use a mortgage calculator:Online mortgage calculators allow you to estimate your monthly mortgage payments based on your desired loan amount, interest rate, and loan term. These calculators can help you determine the maximum amount you can comfortably afford to borrow.

- Consider your debt-to-income ratio (DTI):Your DTI is a measure of your debt payments relative to your gross income. Lenders typically prefer a DTI below 43%, but a lower DTI generally makes you a more attractive borrower.

Managing Debt

High levels of debt can significantly impact your ability to qualify for a mortgage and obtain favorable terms. It’s wise to prioritize paying down existing debt before embarking on a home purchase.

- Create a debt reduction plan:Identify your highest-interest debt and prioritize paying it down as quickly as possible. Consider using strategies like debt consolidation or balance transfers to lower interest rates and simplify payments.

- Minimize new debt:Avoid taking on new debt, especially high-interest credit card debt, as this can negatively affect your credit score and affordability.

- Maintain a good credit score:A good credit score is essential for obtaining a mortgage with favorable terms. Paying your bills on time and keeping your credit utilization low can help you build a strong credit history.

Saving for a Down Payment, Your guide to navigating the competitive housing market tips for making smart decisions when buying or renting a home

A down payment is typically required for a mortgage, and a larger down payment often results in lower monthly payments and interest rates. Start saving early and consistently to accumulate the necessary funds.

- Set a savings goal:Determine the amount of down payment you need based on the type of mortgage and the price range of homes you’re considering. Consider the 20% down payment often recommended to avoid private mortgage insurance (PMI).

- Automate your savings:Set up automatic transfers from your checking account to your savings account on a regular basis. This will help you save consistently without having to manually transfer funds.

- Explore additional savings strategies:Consider taking on a side hustle, reducing unnecessary expenses, or investing in a high-yield savings account to accelerate your savings.

Pre-Approval for a Mortgage

Obtaining pre-approval for a mortgage before starting your home search is crucial for several reasons.

- Demonstrate financial readiness:Pre-approval shows sellers that you’re a serious buyer with the financial capacity to purchase their home.

- Negotiate effectively:Knowing your pre-approved loan amount gives you leverage when negotiating the purchase price and terms with sellers.

- Avoid wasted time:Pre-approval helps you narrow your search to homes within your budget, preventing you from falling in love with a home you can’t afford.

Navigating the Home Search Process

The home search process can be exciting but also overwhelming. With so many options available, it’s crucial to have a strategy in place to ensure you find the right property that meets your needs and budget.

Working with a Real Estate Agent

A real estate agent can be an invaluable asset in your home search journey. They possess extensive knowledge of the local market, including current trends, pricing strategies, and available properties. Their expertise can save you time, money, and frustration.

- Market Expertise:Real estate agents have access to a vast network of listings, including those not yet publicly available, giving you a wider range of options to choose from.

- Negotiation Skills:They are skilled negotiators who can advocate for your best interests during the purchase or rental process, ensuring you get the best possible deal.

- Local Knowledge:They are familiar with the neighborhoods, schools, and community amenities, helping you find the right fit for your lifestyle and preferences.

- Legal and Paperwork Assistance:They guide you through the complex legal and paperwork aspects of the transaction, minimizing potential risks and ensuring a smooth process.

Thorough Neighborhood Research

Before embarking on your home search, it’s essential to research potential neighborhoods thoroughly. This includes understanding the area’s demographics, crime rates, school quality, and proximity to amenities.

- Online Resources:Utilize websites like Zillow, Redfin, and NeighborhoodScout to access detailed information on property values, crime statistics, and school ratings.

- Community Websites:Explore local community websites and forums to gain insights from residents about their experiences, neighborhood events, and local businesses.

- Local Newspapers and Publications:Read local newspapers and publications to stay informed about current events, development projects, and community initiatives in the area.

- Drive Through the Neighborhood:Visit the neighborhood during different times of day to get a feel for the traffic, noise levels, and overall ambiance.

Viewing Properties and Making Informed Decisions

Once you have a shortlist of potential properties, it’s time to schedule viewings. Be prepared to ask questions, take detailed notes, and carefully assess the condition of each property.

- Prepare a Checklist:Create a checklist of essential features and considerations, such as square footage, number of bedrooms and bathrooms, kitchen appliances, and outdoor space.

- Ask Relevant Questions:During viewings, ask questions about the property’s history, recent renovations, and any known issues. Don’t hesitate to inquire about neighborhood amenities, schools, and transportation options.

- Assess the Condition:Carefully inspect the property for any signs of damage, wear and tear, or potential maintenance issues. Pay attention to the foundation, roof, plumbing, electrical systems, and overall structural integrity.

- Consider Future Needs:Think about your future needs and lifestyle changes, such as expanding your family or working from home. Ensure the property can accommodate your future plans.

Making Smart Offers and Negotiating: Your Guide To Navigating The Competitive Housing Market Tips For Making Smart Decisions When Buying Or Renting A Home

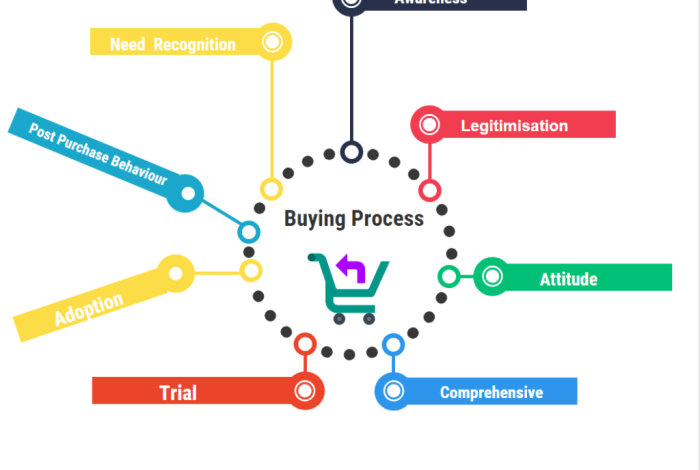

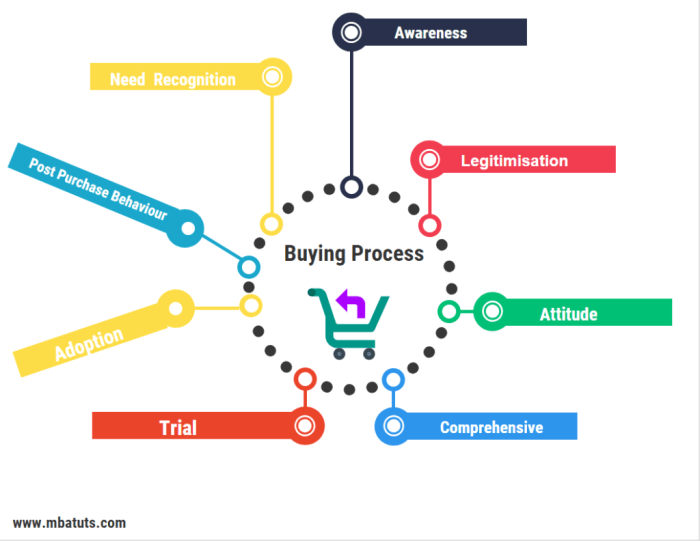

In the competitive housing market, making a smart offer and negotiating effectively can be the difference between securing your dream home and losing out to another buyer. Understanding market values, setting realistic offer prices, and employing strategic negotiation tactics are crucial for success.

Understanding Market Values and Setting Realistic Offer Prices

Before making an offer, it’s essential to thoroughly research and understand the current market conditions in your desired area. This involves analyzing recent sales data, comparing similar properties, and consulting with a real estate agent. A well-informed buyer can determine a realistic offer price that aligns with market values and their budget.

Negotiating Effectively with Sellers

Negotiation is a key aspect of the home buying process, and it requires a balance of assertiveness and flexibility. Effective negotiation involves understanding the seller’s motivations, identifying potential areas of compromise, and presenting a compelling offer.

Contingencies

Contingencies are conditions that must be met before the purchase agreement becomes final. They provide protection for buyers and can be used as leverage during negotiations. Common contingencies include financing, inspection, and appraisal.

For example, a buyer might include a financing contingency that allows them to withdraw from the agreement if they are unable to secure a mortgage loan.

Closing Costs

Closing costs are expenses associated with finalizing the purchase of a home. They can be negotiated with the seller, with buyers typically asking for a contribution towards these costs.

Finding the right home in this competitive market can be a challenge, but with smart strategies, you can navigate the process successfully. Understanding market trends is key, and that includes keeping an eye on industry leaders like Gavin Wood, whose insights on chain mergers and acquisitions gavin wood chain mergers and acquisitions can provide valuable context for the evolving real estate landscape.

Armed with this knowledge, you can make informed decisions about buying or renting, ensuring you find the perfect place to call home.

For example, a buyer might request that the seller pay for a portion of the closing costs, such as title insurance or transfer taxes.

Common Negotiation Tactics

Lowball Offers

A lowball offer is a significantly lower price than the asking price. While it can be tempting to make a low offer, it’s important to consider the potential for rejection and the impact on your reputation with the seller.

Counteroffers

Counteroffers are responses to initial offers, typically involving adjustments to the price, contingencies, or closing costs. Counteroffers are a common part of the negotiation process and can lead to a mutually agreeable agreement.

Walking Away

In some cases, it may be necessary to walk away from a negotiation if the terms are not acceptable. This can be a difficult decision, but it’s important to remember that it’s better to walk away than to commit to an agreement that you are not comfortable with.

Understanding Rental Market Dynamics

Navigating the rental market can be as challenging as buying a home, especially in competitive areas. Understanding the factors influencing rental prices and availability is crucial for finding a suitable and affordable place to live.

Factors Influencing Rental Prices and Availability

Rental prices and availability are influenced by a complex interplay of factors, including:

- Local Economy:Strong economic growth in an area typically leads to higher demand for rental properties, driving up prices. Conversely, areas experiencing economic downturns might have lower rental prices and higher vacancy rates.

- Population Growth:Rapid population growth, particularly in desirable locations, increases the demand for housing, including rentals, contributing to higher prices.

- Interest Rates:When interest rates are low, it becomes more affordable to buy a home, potentially reducing demand for rentals. Conversely, higher interest rates can make buying less attractive, driving more people towards renting.

- Inventory Levels:The number of available rental properties in an area directly impacts prices and availability. A low inventory, often seen in popular areas, leads to higher competition and prices. Conversely, a surplus of available rentals can lead to lower prices and more options.

- Amenities and Location:Rental properties with desirable amenities, such as in-building gyms, swimming pools, or parking, often command higher prices. Location also plays a significant role, with properties in desirable neighborhoods with good schools, access to public transportation, and proximity to amenities typically commanding higher prices.

Finding Suitable Rental Properties

Finding a suitable rental property requires careful consideration of factors such as location, amenities, and lease terms:

- Location:Consider your commute, access to amenities, proximity to schools, and personal preferences when evaluating potential locations. Balance your desired lifestyle with your budget and prioritize your needs.

- Amenities:Identify the amenities you consider essential, such as in-unit laundry, parking, a balcony, or a pet-friendly environment. Prioritize your needs and budget accordingly, understanding that more amenities typically translate to higher rental costs.

- Lease Terms:Carefully review the lease agreement, paying attention to the length of the lease, renewal options, security deposits, and any other clauses. Understand the terms and conditions to avoid surprises and ensure a comfortable rental experience.

Conducting Thorough Background Checks

Before committing to a rental property, it’s crucial to conduct thorough background checks on both the landlord and the property:

- Landlord Background Check:Research the landlord’s reputation, history, and any previous complaints. Online platforms like Yelp or Google Reviews can provide insights. Contact local tenant organizations or the Better Business Bureau to check for any reported issues.

- Property Inspection:Conduct a thorough inspection of the property, noting any existing damage or issues. Take photos or videos to document the condition before moving in to protect yourself from potential disputes later.

- Review Lease Agreement:Carefully review the lease agreement, paying attention to the length of the lease, renewal options, security deposits, and any other clauses. Ensure you understand the terms and conditions before signing.

Securing a Rental Property

In today’s competitive rental market, securing a property can feel like a race against time. It’s essential to be prepared, organized, and proactive to increase your chances of success. This section will guide you through the process of applying for a rental property, negotiating lease terms, and understanding your rights and responsibilities as a tenant.

Navigating the housing market can be daunting, especially with rising interest rates, but it’s crucial to be aware of red flags beyond just the cost of financing. Experts warn homebuyers of red flags beyond climbing interest rates, like potential foundation issues or hidden maintenance costs , so it’s essential to conduct thorough inspections and research.

By staying informed and making smart decisions, you can navigate the competitive housing market and find the perfect home for you.

Submitting Applications and Providing Documentation

Once you’ve identified a rental property that meets your needs and budget, the next step is to submit an application. This typically involves providing personal information, employment history, rental history, and financial information. Be prepared to provide the following documents:

- Completed rental application form

- Photo identification (driver’s license, passport)

- Proof of income (pay stubs, tax returns, bank statements)

- Rental history (previous landlord references, lease agreements)

- Credit report (you may need to authorize a credit check)

- Pet information (if applicable, including breed, age, and vaccination records)

It’s important to review the application thoroughly and ensure all information is accurate and complete. Any inaccuracies or omissions could delay the processing of your application or even disqualify you from consideration.

Negotiating Lease Terms

Once your application is approved, you’ll be presented with a lease agreement. This document Artikels the terms and conditions of your tenancy, including rent, security deposit, utilities, and other important details. Don’t be afraid to negotiate lease terms that are favorable to you.

- Rent: While the advertised rent is usually a starting point, you may be able to negotiate a lower rate, especially if you’re willing to sign a longer lease term or pay several months’ rent upfront.

- Security Deposit: The security deposit is typically equal to one or two months’ rent and is intended to cover any damages to the property.

You may be able to negotiate a lower security deposit if you have a strong rental history or are willing to pay a higher rent.

- Pet Policies: If you have pets, be sure to discuss pet policies and any associated fees or restrictions.

- Utilities: Clarify which utilities are included in the rent and which are your responsibility.

- Lease Duration: Negotiate a lease term that works for you, whether it’s a short-term lease or a longer-term lease.

Remember to be respectful and professional during negotiations. Explain your reasoning for requesting changes, and be prepared to compromise.

Understanding Tenant Rights and Responsibilities

It’s crucial to understand your rights and responsibilities as a tenant. This will help you navigate any potential issues that may arise during your tenancy.

Navigating the housing market can feel like a rollercoaster, especially when you’re trying to make smart decisions about buying or renting. It’s essential to stay informed about market trends, and that includes keeping an eye on the stock market, which can often reflect broader economic sentiment.

For instance, check out these live updates on share market movement , where the Nifty crossed 17650 with a focus on HCL Tech and Tata Motors. This kind of information can give you a better understanding of the overall economic landscape and how it might impact your housing decisions.

- Right to Privacy: Landlords generally cannot enter your rental unit without your consent, except in cases of emergency or to perform necessary repairs.

- Right to a Safe and Habitable Living Environment: Landlords are obligated to provide a safe and habitable living environment, which includes working plumbing, heating, and electrical systems.

- Right to Make Minor Modifications: You may be able to make minor modifications to the rental unit, such as painting or installing shelves, but you’ll need to obtain your landlord’s permission first.

- Right to Withhold Rent: In some cases, you may have the right to withhold rent if your landlord fails to make necessary repairs or otherwise violates the lease agreement.

- Responsibilities: As a tenant, you are responsible for paying rent on time, maintaining the property in a clean and sanitary condition, and complying with the terms of the lease agreement.

It’s a good idea to review your local tenant laws and regulations to ensure you are fully informed of your rights and responsibilities.

Essential Tips for Homeownership

Owning a home is a significant investment, and it comes with its own set of responsibilities. Understanding the ins and outs of homeownership can help you navigate the journey smoothly and protect your investment. This section will cover essential tips for maintaining your home, managing financial risks, and maximizing its value.

Routine Home Maintenance

Regular maintenance is crucial for preserving the value and longevity of your home. It helps identify potential problems early, preventing costly repairs down the line.

- Regular Inspections:Schedule annual inspections for major systems like HVAC, plumbing, and electrical wiring. This allows professionals to detect any issues before they escalate.

- Preventative Measures:Implement preventive measures like cleaning gutters, sealing cracks in the foundation, and inspecting the roof regularly. This can significantly reduce the risk of costly repairs.

- Landscaping:Maintaining your landscaping not only enhances the curb appeal but also protects your property. Regular trimming, weeding, and watering help prevent pests and disease.

Insurance and Financial Protection

Insurance plays a vital role in safeguarding your home and finances. It provides financial protection against unexpected events like fires, natural disasters, and theft.

- Homeowners Insurance:This is essential for covering damage to your home and personal belongings. It also offers liability protection in case someone gets injured on your property.

- Flood Insurance:If your home is in a flood-prone area, flood insurance is crucial. Standard homeowners insurance typically does not cover flood damage.

- Other Insurance Options:Depending on your specific needs, you might consider additional insurance like earthquake insurance or personal property insurance.

Maximizing Property Value

Increasing your home’s value not only benefits you financially but also prepares you for a smooth future sale.

- Upgrades and Renovations:Strategic upgrades and renovations can significantly enhance your home’s value. Focus on projects that add functionality and appeal to potential buyers, such as kitchen and bathroom updates.

- Energy Efficiency:Investing in energy-efficient appliances and upgrades can reduce your utility bills and attract buyers who value sustainability.

- Curb Appeal:Maintaining a well-kept exterior with landscaping, fresh paint, and a clean driveway creates a positive first impression and increases the likelihood of a higher selling price.

Resources and Support for Homebuyers and Renters

Navigating the housing market can be overwhelming, especially when you’re dealing with financial hurdles or unfamiliar processes. Fortunately, numerous resources and support systems exist to help you through every step of the journey, from finding the perfect home to securing financing.

Whether you’re a first-time buyer, a seasoned renter, or facing financial challenges, there are organizations and programs designed to provide guidance, assistance, and financial aid.

Government Programs and Financial Assistance

Government programs play a crucial role in making homeownership more accessible. They offer a variety of financial assistance options, including down payment assistance, tax credits, and low-interest loans.

- FHA Loans:The Federal Housing Administration (FHA) offers mortgage insurance that helps borrowers with lower credit scores or down payments qualify for a loan. This program makes homeownership possible for individuals who might not otherwise meet conventional lending requirements.

- VA Loans:The Department of Veterans Affairs (VA) offers home loans with no down payment requirement and competitive interest rates to eligible veterans, active-duty military personnel, and surviving spouses. These loans are designed to reward those who have served our country.

- USDA Loans:The United States Department of Agriculture (USDA) offers low-interest loans and grants to eligible borrowers in rural areas. These programs aim to promote economic development and affordable housing in rural communities.

- Down Payment Assistance Programs:Many states and local governments offer down payment assistance programs to help first-time homebuyers overcome the financial barrier of a large down payment. These programs often come with specific eligibility requirements and may be offered in the form of grants or forgivable loans.

- Tax Credits:The government provides tax credits to homeowners, such as the Energy Efficient Home Improvement Credit, which can help offset the cost of energy-saving renovations.