Personal Finance FAQs: Top 10 Most Googled Questions Answered by Experts

Personal finance faqs top 10 most googled questions answered by experts – Ever wondered what everyone’s searching for when it comes to managing their money? We’ve delved into the world of personal finance to uncover the top 10 most Googled questions, and we’re bringing you the answers straight from the experts.

Whether you’re just starting out or looking to level up your financial game, this guide is packed with practical tips and insights to help you navigate the complexities of personal finance with confidence.

From budgeting basics and debt management strategies to investing for the future and understanding financial products, we’ll explore each topic in detail, offering real-world examples and actionable advice to help you make informed decisions about your money. Get ready to demystify personal finance and gain the knowledge you need to achieve your financial goals.

Budgeting & Saving

Managing your finances effectively is crucial for achieving financial stability and reaching your goals. Budgeting and saving are fundamental components of a healthy financial plan, allowing you to control your spending, build wealth, and prepare for unexpected events.

The 50/30/20 Budgeting Rule

This rule is a simple yet effective way to allocate your income. It suggests dividing your after-tax income into three categories:

50% for Needs

Essential expenses like housing, utilities, groceries, transportation, and healthcare.

30% for Wants

Non-essential items like dining out, entertainment, travel, and hobbies.

20% for Savings & Debt Repayment

Includes emergency funds, retirement savings, and paying off debt.

- Example 1:A person earns $4,000 per month after taxes. According to the 50/30/20 rule, they should allocate $2,000 for needs, $1,200 for wants, and $800 for savings and debt repayment.

- Example 2:A family with an after-tax income of $6,000 per month would allocate $3,000 for needs, $1,800 for wants, and $1,200 for savings and debt repayment.

Creating a Realistic Personal Budget

Creating a budget involves tracking your income and expenses, and then allocating your income to different categories.

- Track Your Spending:Monitor your expenses for a few months to understand your spending habits and identify areas where you can cut back. Use budgeting apps, spreadsheets, or notebooks to track your spending.

- Set Financial Goals:Define your short-term and long-term financial goals, such as saving for a down payment on a house, paying off debt, or investing for retirement. Having clear goals will help you stay motivated and make informed decisions.

- Allocate Your Income:After tracking your expenses and setting goals, allocate your income to different categories based on your priorities. Prioritize needs, allocate a reasonable amount for wants, and ensure you are saving enough for your goals.

- Review and Adjust:Regularly review your budget to make adjustments as needed. Your financial circumstances and priorities may change over time, so it’s essential to adapt your budget accordingly.

Strategies for Saving Money Effectively

Saving money is crucial for financial security and achieving your goals. Here are some effective strategies:

- Emergency Fund:Having an emergency fund of 3-6 months’ worth of living expenses can help you navigate unexpected events like job loss, medical emergencies, or car repairs without going into debt.

- Automate Savings:Set up automatic transfers from your checking account to your savings account on a regular basis. This ensures that you save consistently without having to manually transfer funds.

- Negotiate Bills:Negotiate lower rates for your utilities, internet, and insurance. Many companies are willing to lower rates for loyal customers.

- Cut Unnecessary Expenses:Identify and eliminate unnecessary expenses like subscriptions, memberships, or dining out too frequently. This can free up significant funds for saving.

- Shop Smart:Compare prices, use coupons, and look for sales to save money on groceries, clothes, and other purchases. Consider buying generic brands or using discount stores.

- Invest for Long-Term Goals:Investing your savings in a diversified portfolio of stocks, bonds, or real estate can help your money grow over time. Consider consulting a financial advisor to create an investment strategy that aligns with your goals and risk tolerance.

Debt Management

Debt is a common part of life, whether it’s from credit cards, student loans, or mortgages. Understanding different types of debt and how to manage them effectively is crucial for achieving financial stability.

Types of Debt

Different types of debt have varying interest rates, repayment terms, and implications for your credit score. Understanding these differences is crucial for making informed financial decisions.

- Credit Card Debt:This is often considered high-interest debt, with rates that can fluctuate based on market conditions. It’s typically unsecured, meaning it’s not backed by collateral. Overspending on credit cards can quickly lead to significant debt accumulation.

- Student Loans:These loans are typically taken out to finance education and can be either subsidized or unsubsidized. Subsidized loans do not accrue interest while you’re in school, whereas unsubsidized loans do. Interest rates on student loans are generally lower than credit card rates but higher than mortgage rates.

- Mortgages:This type of debt is secured by your home, meaning the lender can seize your property if you fail to make payments. Mortgage interest rates are typically lower than credit card or student loan rates, but the total amount borrowed is usually significantly higher.

Creating a Debt Repayment Plan

Developing a strategic debt repayment plan is essential for getting out of debt and achieving financial freedom. Two popular methods include the snowball and avalanche methods.

- Snowball Method:This method involves paying off the smallest debt first, regardless of interest rate. The satisfaction of eliminating a debt quickly can motivate you to continue paying down the rest. While it may take longer to pay off the overall debt, it can provide a sense of accomplishment and momentum.

- Avalanche Method:This method focuses on paying off the debt with the highest interest rate first. This approach can save you money on interest charges in the long run, but it may be less motivating than the snowball method since you’re tackling the larger debts first.

Credit Scores and Their Importance

Your credit score is a numerical representation of your creditworthiness, reflecting your ability to manage debt responsibly. It plays a crucial role in various financial decisions, such as obtaining loans, mortgages, and even renting an apartment.

From budgeting basics to investing strategies, personal finance FAQs are constantly evolving. But one question that pops up time and time again is, “How do I protect my financial information?” This is where understanding what is a privacy policy and why is it important comes in.

By being aware of how companies collect and use your data, you can make informed decisions about your financial security and keep your hard-earned money safe.

- Factors Influencing Credit Score:Your credit score is calculated based on various factors, including payment history, credit utilization ratio, length of credit history, new credit, and types of credit.

- Improving Your Credit Score:You can improve your credit score by making payments on time, keeping credit utilization low, avoiding unnecessary credit inquiries, and diversifying your credit mix.

Credit Utilization Ratio:This is the percentage of your available credit that you’re currently using. Keeping this ratio below 30% is generally recommended for maintaining a good credit score.

Investing & Retirement

Investing and saving are crucial for building a secure financial future. While both involve setting aside money, they differ in their goals, risk levels, and potential returns.

Investing vs. Saving

Saving is about setting aside money for short-term goals, such as an emergency fund or a down payment on a house. It involves keeping your money in low-risk, low-return options like savings accounts or certificates of deposit (CDs). The goal of saving is to preserve your capital and earn a small, steady return over time.Investing, on the other hand, is about putting money into assets with the potential to grow over the long term.

This typically involves higher risk, but also the possibility of higher returns. Examples of investments include stocks, bonds, and real estate. The goal of investing is to grow your wealth over time, potentially outpacing inflation.

Benefits of Investing and Saving

- Savingprovides peace of mind and financial security. It allows you to handle unexpected expenses, achieve short-term goals, and build a foundation for future investments.

- Investinghas the potential to generate significant wealth over time. It can help you reach long-term financial goals, such as retirement or buying a home, and potentially outpace inflation.

Beginner’s Guide to Investing

Investing can seem daunting, but it’s simpler than you might think. Here’s a beginner’s guide to investing in stocks, bonds, and mutual funds:

Stocks

Stocks represent ownership in a company. When you buy stock, you become a shareholder and have a claim on the company’s profits. Stocks can be bought and sold on stock exchanges, and their prices fluctuate based on market conditions and company performance.

Bonds

Bonds are essentially loans you make to a company or government. When you buy a bond, you lend money to the issuer and receive interest payments over a set period. Bonds are generally considered less risky than stocks, but they also offer lower returns.

Mutual Funds

Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. They offer a convenient way to invest in a variety of assets without having to buy them individually. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Retirement Savings Plan

A retirement savings plan is a crucial step in securing your financial future. Here’s a basic framework for creating a retirement savings plan:

Determine Your Retirement Goals

Start by defining your desired retirement lifestyle. How much income will you need? How long do you plan to live in retirement? What are your retirement aspirations?

Estimate Your Savings Needs

Based on your retirement goals, calculate the amount of money you’ll need to save. There are many online retirement calculators that can help you estimate your savings needs.

Choose a Retirement Savings Vehicle

There are several options for saving for retirement, including 401(k)s, Roth IRAs, and traditional IRAs. Each has its own advantages and disadvantages, so choose the one that best suits your needs and financial situation.

Determine Your Risk Tolerance

Your risk tolerance is your ability to handle fluctuations in your investment portfolio. A younger investor with a longer time horizon can afford to take on more risk, while an older investor with a shorter time horizon may prefer a more conservative approach.

Develop a Savings Strategy

Once you’ve determined your savings goals, risk tolerance, and chosen a retirement savings vehicle, develop a savings strategy. This could involve contributing a fixed amount each month, increasing your contributions over time, or investing in a mix of stocks and bonds.

Monitor and Adjust Your Plan

Regularly review your retirement savings plan to ensure it’s still on track. You may need to adjust your savings strategy as your financial situation changes, your risk tolerance evolves, or your retirement goals shift.

Banking & Financial Products

Navigating the world of banking and financial products can seem overwhelming, but understanding the different options available can help you make informed decisions about your money. Let’s explore some common bank accounts, payment methods, and financial products that can help you manage your finances effectively.

Bank Accounts

Choosing the right bank account depends on your individual needs and financial goals. Here’s a comparison of common bank account types:

- Checking Accounts: These accounts are designed for everyday transactions, such as paying bills, writing checks, and making deposits. They typically offer debit cards for ATM withdrawals and point-of-sale purchases. Checking accounts usually have lower interest rates than savings accounts.

- Savings Accounts: Savings accounts are designed for storing money that you want to save for future goals, such as a down payment on a house or retirement. They generally offer higher interest rates than checking accounts, but they may have restrictions on withdrawals.

- Money Market Accounts (MMAs): MMAs offer a higher interest rate than savings accounts, but they may have higher minimum balance requirements. They often allow you to write a limited number of checks each month.

Payment Methods

Understanding the pros and cons of different payment methods can help you choose the most suitable option for your needs:

- Credit Cards: Credit cards allow you to borrow money to make purchases and pay it back later, often with interest. They offer benefits like rewards programs, purchase protection, and fraud protection. However, carrying a balance can lead to high interest charges and debt.

While figuring out how to manage your finances can feel overwhelming, the good news is that there are tons of resources available. From understanding the basics of budgeting to navigating the complexities of investing, the top 10 most googled personal finance FAQs offer a great starting point.

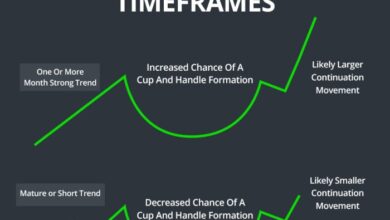

And if you’re looking for a pulse on the current market, check out live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors for insights into the latest trends. Once you have a grasp on the fundamentals, you can dive deeper into specific areas that are relevant to your financial goals.

- Debit Cards: Debit cards deduct money directly from your checking account when you make purchases. They offer convenience and security but do not build credit.

- Prepaid Cards: Prepaid cards are loaded with a specific amount of money and can be used like debit cards. They are often used for budgeting and can help prevent overspending. Prepaid cards typically have fees associated with loading, reloading, and ATM withdrawals.

Financial Products

Financial products can provide a safety net and help you achieve your financial goals. Here’s an overview of some common products:

- Loans: Loans allow you to borrow money for various purposes, such as buying a car, financing education, or consolidating debt. Loan terms and interest rates vary depending on the lender and your creditworthiness.

- Mortgages: Mortgages are loans specifically for purchasing a home. They are typically long-term loans with fixed or adjustable interest rates.

- Insurance: Insurance provides financial protection against unexpected events, such as accidents, illnesses, or property damage. There are different types of insurance, including health, auto, home, and life insurance.

Financial Planning & Goals

Financial planning is the process of setting financial goals and creating a plan to achieve them. It involves assessing your current financial situation, identifying your goals, and developing strategies to reach those goals. A well-defined financial plan can help you make informed decisions about your money, prioritize your needs, and achieve your financial aspirations.

Importance of Setting Financial Goals

Setting financial goals provides a clear direction for your financial journey. It helps you understand where you want to be financially and motivates you to take the necessary steps to reach your objectives. Goals can be short-term, such as saving for a vacation, or long-term, such as retirement planning.

Strategies for Managing Personal Finances Throughout Different Life Stages

Personal financial management evolves as you navigate different life stages. Your financial priorities and needs change as you transition from starting a family to retirement.

Starting a Family

- Increase savings:The arrival of a child often brings additional expenses. Start saving early for your child’s education, healthcare, and future needs.

- Review insurance coverage:Ensure you have adequate life insurance, health insurance, and disability insurance to protect your family.

- Consider childcare costs:Factor in the cost of childcare and plan accordingly.

Retirement Planning

- Start saving early:The earlier you start saving for retirement, the more time your money has to grow through compounding.

- Choose the right retirement plan:Explore options like 401(k)s, IRAs, and Roth IRAs, and choose the one that best suits your needs and financial situation.

- Diversify your investments:Spread your retirement savings across different asset classes to mitigate risk.

Common Financial Mistakes

Financial mistakes can derail your financial progress. Understanding common pitfalls can help you avoid them.

Overspending

Overspending is a common mistake that can lead to debt accumulation. Track your spending, create a budget, and stick to it.

Not Saving Enough

Failing to save for retirement, emergencies, or future goals can create financial stress. Set realistic savings goals and prioritize saving regularly.

Carrying High-Interest Debt

High-interest debt, such as credit card debt, can quickly spiral out of control. Pay down high-interest debt as quickly as possible.

Not Investing Wisely

Investing your money is essential for long-term financial growth. However, investing without proper research and understanding can lead to losses.

Ignoring Financial Planning

Many individuals postpone financial planning until it’s too late. Procrastination can lead to missed opportunities and financial challenges.

Taxes & Financial Aid

Taxes and financial aid are crucial aspects of personal finance, impacting your income and education. Understanding how they work can help you make informed decisions about your finances.

Personal Income Tax

Personal income tax is a tax levied on your earnings. The amount you pay depends on your taxable income, which is calculated by subtracting deductions and credits from your gross income.

From how to budget effectively to the best ways to save for retirement, personal finance FAQs are constantly evolving. But in today’s market, one question keeps popping up: how to navigate the housing market. While rising interest rates are a major concern, experts warn homebuyers of red flags beyond climbing interest rates.

This article delves into these red flags, offering valuable insights that can help you make informed decisions and avoid potential pitfalls.

Deductions

Deductions reduce your taxable income, lowering your tax liability. Some common deductions include:

- Standard deduction: A fixed amount that you can claim instead of itemizing deductions.

- Itemized deductions: Specific expenses that you can deduct, such as mortgage interest, charitable contributions, and medical expenses.

- Homeownership deductions: Deductions for mortgage interest and property taxes.

Credits

Credits directly reduce your tax liability, offering a dollar-for-dollar reduction in the amount you owe. Some common credits include:

- Earned Income Tax Credit (EITC): A tax credit for low-to-moderate-income working individuals and families.

- Child Tax Credit: A tax credit for families with children.

- American Opportunity Tax Credit: A tax credit for eligible students enrolled in college.

Financial Aid for Students

Financial aid helps students pay for college expenses. It can come in the form of grants, scholarships, loans, and work-study programs.

Types of Financial Aid

- Grants: Free money that you don’t have to repay. Grants are often based on financial need.

- Scholarships: Free money awarded based on academic merit, athletic ability, or other criteria.

- Loans: Money that you must repay with interest. Federal student loans often have lower interest rates and more flexible repayment options than private loans.

- Work-study programs: Part-time jobs on campus that help students earn money to pay for college expenses.

Tax-Advantaged Savings Accounts

Tax-advantaged savings accounts allow you to save for retirement or other financial goals while enjoying tax benefits.

Types of Tax-Advantaged Savings Accounts

- 401(k): A retirement savings plan offered by employers. Contributions are often pre-tax, meaning you pay taxes on the money when you withdraw it in retirement.

- Individual Retirement Account (IRA): A retirement savings plan that individuals can open. Contributions may be tax-deductible, and withdrawals are taxed in retirement.

- Roth IRA: A retirement savings plan where contributions are made after taxes, meaning withdrawals in retirement are tax-free.

Financial Literacy & Education: Personal Finance Faqs Top 10 Most Googled Questions Answered By Experts

Financial literacy is the ability to understand and manage your finances effectively. It’s a crucial skill for everyone, regardless of age or income level. Being financially literate empowers you to make informed decisions about your money, plan for your future, and achieve your financial goals.

The Importance of Financial Literacy

Financial literacy is essential for individuals and society as a whole. It helps individuals make informed financial decisions, avoid debt traps, and build a secure future. For society, it promotes economic stability, reduces financial inequality, and fosters responsible financial behavior.

Resources for Learning More

There are many resources available to help you enhance your financial literacy. These include:

- Online Courses:Platforms like Coursera, edX, and Khan Academy offer free or affordable courses on personal finance, investing, and other related topics.

- Books and Articles:Numerous books and articles provide valuable insights into financial management, budgeting, investing, and retirement planning. Popular authors include Robert Kiyosaki, Dave Ramsey, and Suze Orman.

- Financial Institutions:Many banks and credit unions offer free financial education workshops, seminars, and online resources for their customers.

- Government Agencies:The Consumer Financial Protection Bureau (CFPB) and the Securities and Exchange Commission (SEC) provide information and resources on consumer finance, investing, and fraud prevention.

- Non-Profit Organizations:Organizations like the National Endowment for Financial Education (NEFE) and the Jump$tart Coalition for Personal Financial Literacy offer educational programs and resources to promote financial literacy.

Key Financial Concepts

Understanding fundamental financial concepts is crucial for making sound financial decisions. Here’s a table summarizing some key concepts:

| Concept | Description | Example |

|---|---|---|

| Compound Interest | Interest earned on both the principal amount and the accumulated interest. | If you invest $1,000 at a 5% annual interest rate, after one year you’ll earn $50 in interest. In the second year, you’ll earn interest on the initial $1,000 plus the $50 in interest, resulting in a higher interest earning. |

| Inflation | A general increase in the prices of goods and services over time. | If the inflation rate is 3%, a product that cost $100 last year will cost $103 this year. |

| Diversification | Spreading investments across different asset classes to reduce risk. | Instead of investing all your money in stocks, you can diversify by investing in a mix of stocks, bonds, real estate, and other assets. |

Teaching Children About Money Management

It’s never too early to teach children about money management and financial responsibility. Here are some tips:

- Start Early:Introduce basic financial concepts like saving, spending, and earning at an early age.

- Use Age-Appropriate Methods:Use games, stories, and real-life examples to make learning fun and engaging.

- Set a Good Example:Children learn by observing their parents. Demonstrate responsible financial habits and discuss your own financial decisions with them.

- Involve Them in Financial Decisions:Allow children to participate in age-appropriate financial decisions, such as choosing a birthday gift or saving for a specific goal.

- Provide Opportunities for Earning:Encourage children to earn money through chores or part-time jobs, teaching them the value of work and saving.

Financial Scams & Fraud

Financial scams and fraud are unfortunately prevalent, and understanding how they work is crucial to protect yourself and your hard-earned money. It’s essential to be vigilant and take proactive measures to avoid falling victim to these schemes.

Common Financial Scams

It’s important to be aware of the common tactics employed by scammers to deceive unsuspecting individuals. Here are some of the most prevalent financial scams:

- Phishing Scams:These scams involve emails, texts, or phone calls that appear to be from legitimate organizations, such as banks or government agencies. They often try to trick you into revealing sensitive personal information, such as your Social Security number, bank account details, or credit card information.

- Investment Scams:Scammers may promise unrealistic returns on investments, often targeting individuals seeking quick and easy profits. They may use high-pressure sales tactics or create elaborate fake websites and investment opportunities to lure victims.

- Romance Scams:These scams involve online relationships where individuals pretend to be someone they’re not to gain your trust and affection. They may eventually ask for money for various reasons, such as travel expenses or medical emergencies.

- Tech Support Scams:Scammers may contact you claiming to be from a tech support company, often stating that your computer has been infected with a virus or needs immediate attention. They may then attempt to remotely access your computer and steal your information or charge you for unnecessary services.

- Charity Scams:Scammers may create fake charities or impersonate legitimate organizations to solicit donations. They may use emotional appeals or claim to be working on a specific cause to gain your trust and extract money.

Protecting Personal Financial Information

Safeguarding your personal financial information is paramount to preventing identity theft and financial fraud. Here are some key measures to take:

- Be Cautious Online:Avoid clicking on suspicious links in emails or text messages. Verify the authenticity of websites before entering any personal information. Look for secure connections (https://) and trusted website seals.

- Use Strong Passwords:Create unique and strong passwords for all your online accounts. Avoid using the same password for multiple accounts. Consider using a password manager to help you manage your passwords securely.

- Monitor Your Accounts Regularly:Check your bank statements, credit card bills, and credit reports for any unauthorized transactions or suspicious activity. Report any discrepancies immediately to the relevant institutions.

- Shred Sensitive Documents:Dispose of documents containing personal information, such as bank statements, credit card receipts, and tax forms, securely by shredding them before discarding them.

- Be Aware of Your Surroundings:Be cautious when using ATMs or public Wi-Fi networks. Shield your PIN when entering it, and avoid using public computers for sensitive transactions.

Reporting Financial Fraud

If you suspect you have been a victim of financial fraud, it’s crucial to take immediate action to mitigate the damage and seek assistance. Here are some resources for reporting financial fraud:

- Federal Trade Commission (FTC):The FTC is a government agency that investigates and takes action against fraudulent and deceptive business practices. You can report fraud to the FTC online or by phone.

- Internet Crime Complaint Center (IC3):The IC3 is a partnership between the FBI and the National White Collar Crime Center. It provides a centralized platform for reporting internet-related crimes, including financial fraud.

- Your Financial Institution:Report any unauthorized transactions or suspicious activity to your bank or credit card company immediately. They can help you dispute the charges and protect your account.

- Credit Reporting Agencies:If your identity has been stolen, you should contact the three major credit reporting agencies (Equifax, Experian, and TransUnion) to place a fraud alert or freeze your credit. This will prevent unauthorized individuals from opening new accounts in your name.

Financial Technology (FinTech)

The rise of technology has dramatically impacted personal finance, transforming how we manage our money, invest, and plan for the future. From mobile banking apps to sophisticated robo-advisors, FinTech tools are revolutionizing the way we interact with financial services.

Mobile Banking

Mobile banking apps have made it incredibly convenient to manage finances on the go. These apps allow users to check account balances, transfer funds, pay bills, and even deposit checks using their smartphones.

- Convenience:Mobile banking apps eliminate the need for physical bank visits, allowing users to manage their finances anytime, anywhere.

- Accessibility:These apps provide 24/7 access to accounts, making it easy to stay on top of transactions and manage finances efficiently.

- Security:Most mobile banking apps use advanced security measures, such as multi-factor authentication and encryption, to protect user data.

Online Investing

Online investment platforms have made investing more accessible to individuals of all income levels. These platforms allow users to buy and sell stocks, bonds, ETFs, and other investments online.

- Lower Costs:Online brokers often charge lower fees than traditional brokerage firms, making investing more affordable.

- Accessibility:Online platforms allow users to invest in a wide range of assets from anywhere with an internet connection.

- Research Tools:Many platforms provide research tools, educational resources, and portfolio management features to support investors.

Budgeting Apps

Budgeting apps are designed to help users track their income and expenses, create budgets, and achieve their financial goals.

- Expense Tracking:These apps automatically track spending using bank account connections or manual entries, providing a clear picture of where money is going.

- Budgeting Tools:Users can set budget categories, track progress toward financial goals, and receive personalized recommendations for managing their finances.

- Financial Insights:Many budgeting apps provide insights into spending patterns, identify areas for improvement, and offer tips for saving money.

FinTech Tools and Services

The FinTech landscape is constantly evolving, with a wide range of tools and services available.

- Robo-Advisors:These automated investment platforms use algorithms to create and manage investment portfolios based on user risk tolerance and financial goals.

- Personal Finance Management (PFM) Apps:These apps combine features from budgeting apps, online banking, and investment platforms, providing a comprehensive view of personal finances.

- Cryptocurrency Trading Platforms:These platforms allow users to buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum.

- Peer-to-Peer (P2P) Lending Platforms:These platforms connect borrowers and lenders, bypassing traditional financial institutions.

Benefits and Risks of FinTech

FinTech offers numerous benefits, but it’s essential to be aware of potential risks.

- Benefits:

- Increased accessibility to financial services

- Lower costs and fees

- Improved convenience and efficiency

- Personalized financial advice and tools

- Risks:

- Security breaches and data privacy concerns

- Lack of regulation in some areas of FinTech

- Potential for scams and fraudulent activities

- Over-reliance on technology and lack of human interaction

Financial Wellness

Financial wellness goes beyond simply having money; it’s about having a sense of control and security over your finances, which significantly impacts your overall well-being. It allows you to live a life free from financial stress, pursue your goals, and enjoy peace of mind.

Managing Financial Stress

Financial stress can manifest in various ways, affecting your physical and mental health. It can lead to anxiety, sleeplessness, and even relationship problems. Here are some practical tips to manage stress related to your personal finances:

- Create a Budget:A well-structured budget helps you track your income and expenses, giving you a clear picture of your financial situation and allowing you to identify areas where you can save.

- Prioritize Your Needs:Differentiate between your needs and wants. Focus on essential expenses like housing, food, and healthcare, while reducing or eliminating non-essential spending.

- Seek Professional Help:If you feel overwhelmed by debt or financial stress, don’t hesitate to seek professional help from a financial advisor or counselor. They can provide guidance and strategies tailored to your specific situation.

- Practice Mindfulness:Engaging in mindfulness techniques like meditation or deep breathing can help you manage stress and gain perspective on your financial situation.

- Focus on the Positive:Acknowledge your progress and celebrate small victories, even if it’s just saving a few dollars each month. This helps maintain a positive outlook and encourages you to continue on your financial journey.

Seeking Financial Counseling and Support, Personal finance faqs top 10 most googled questions answered by experts

Many resources are available to help you navigate financial challenges and achieve financial wellness. Here are some options to consider:

- Credit Counseling Agencies:These agencies offer free or low-cost counseling services to help individuals manage debt, improve credit scores, and develop better financial habits.

- Non-Profit Organizations:Several non-profit organizations provide financial literacy programs, workshops, and resources to empower individuals to make informed financial decisions.

- Financial Advisors:For more complex financial situations, consider consulting with a certified financial advisor. They can provide personalized guidance on investments, retirement planning, and other financial matters.

- Online Resources:Numerous websites and apps offer financial education, budgeting tools, and other resources to support your financial wellness journey.