The Case for a 22% S&P 500 Drop: A Financial Strategists Analysis

The case for a 22 percent drop in sp 500 know financial strategist analysis – The case for a 22 percent drop in the S&P 500, a scenario explored by astute financial strategists, raises serious concerns about the potential for a significant market downturn. While the stock market has experienced periods of growth and prosperity, understanding the factors that could trigger such a decline is crucial for investors seeking to navigate the complexities of the financial landscape.

This analysis delves into the intricacies of the current market environment, examining key economic indicators, industry trends, and investor behavior. It seeks to unravel the potential catalysts for a substantial market correction and provide insights into how investors can prepare for such an eventuality.

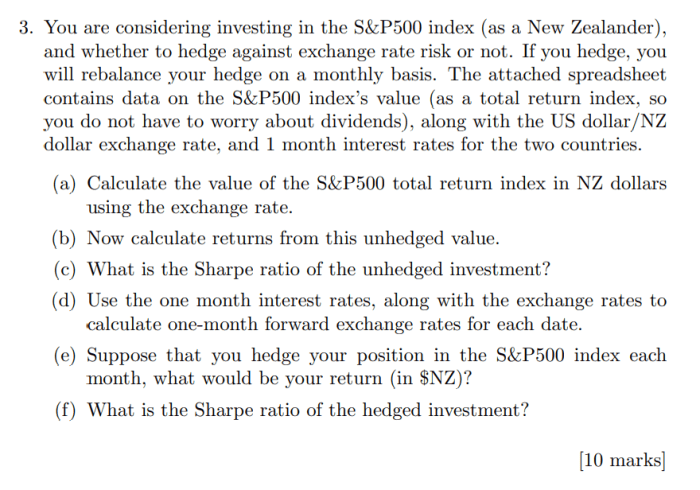

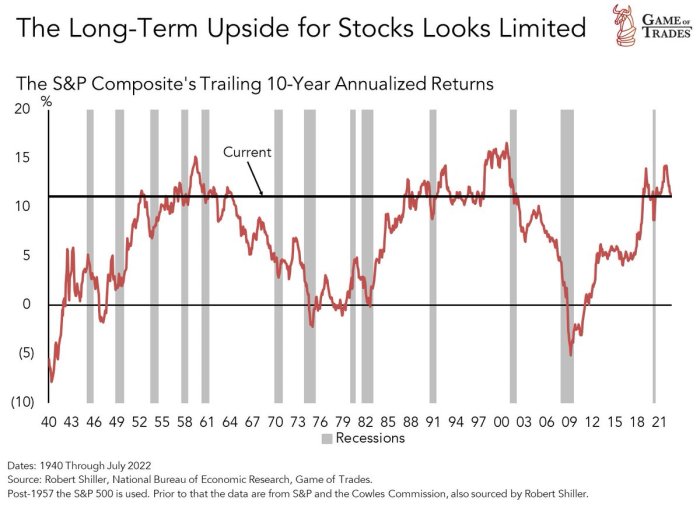

Market Context

The S&P 500, a benchmark index representing the performance of 500 large-cap U.S. companies, has experienced significant volatility in recent months. While it has recovered from the sharp decline of 2022, concerns remain about the trajectory of the index amidst rising interest rates, inflation, and a potential recession.

Understanding the current market context is crucial for investors seeking to navigate this turbulent landscape. The recent performance of the S&P 500 has been influenced by a confluence of factors. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, have dampened investor sentiment and slowed economic growth.

Inflation, at its highest level in decades, has eroded corporate profits and increased consumer costs, further impacting the stock market. Additionally, the ongoing geopolitical tensions, including the war in Ukraine, have added to market uncertainty.

Historical Market Drops

Understanding historical market drops provides valuable context for evaluating the current situation. The 2008 financial crisis, triggered by the collapse of the housing market and the subsequent credit crunch, led to a 57% decline in the S&P 500. The dot-com bubble burst of 2000 resulted in a 49% drop, driven by the rapid growth and subsequent collapse of internet companies.

Comparison to Previous Downturns

The current situation bears some resemblance to previous market downturns, particularly the 2008 financial crisis. Both events involved a combination of factors, including rising interest rates, inflation, and a weakening economy. However, there are also key differences. The current inflationary environment is more pronounced, with a wider range of factors contributing to price increases.

Additionally, the Federal Reserve’s response to inflation has been more aggressive, raising interest rates at a faster pace than in 2008.

Economic Factors

A significant drop in the S&P 500, like the 22% decline being discussed, is often a symptom of broader economic challenges. Several key economic indicators can contribute to such a market downturn, and understanding their potential impact is crucial for investors.

The case for a 22 percent drop in the S&P 500 is a bold prediction, but it’s backed by some serious financial strategist analysis. While I’m not a financial expert myself, I found it interesting that Vitalik Buterin, the co-founder of Ethereum, discussed this possibility on Bloomberg’s Studio 10, which you can check out here.

Whether or not this prediction comes true remains to be seen, but it’s definitely a conversation worth having, especially given the current economic climate.

Inflation and Interest Rates, The case for a 22 percent drop in sp 500 know financial strategist analysis

Inflation, the rate at which prices for goods and services rise, can have a profound impact on the stock market. When inflation is high, companies face increased costs for production and operations, which can lead to lower profit margins. This, in turn, can discourage investment and potentially trigger a stock market decline.

The Federal Reserve, in response to high inflation, often raises interest rates to curb economic growth and cool down inflation. Higher interest rates can make borrowing more expensive for businesses and consumers, potentially slowing down economic activity and further impacting stock prices.

Geopolitical Events

Geopolitical events, such as wars, trade disputes, or political instability, can create significant uncertainty in the global economy. These events can disrupt supply chains, increase volatility in commodity prices, and lead to investor risk aversion, all of which can contribute to a decline in the stock market.

The recent Russia-Ukraine conflict, for example, has already led to significant disruptions in global energy markets and supply chains, causing uncertainty and volatility in financial markets.

Economic Uncertainty and Volatility

Economic uncertainty, driven by factors like inflation, interest rate hikes, or geopolitical events, can significantly impact investor sentiment and market behavior. When investors are uncertain about the future economic outlook, they tend to become more risk-averse and may choose to sell their stocks, leading to market declines.

Volatility in the stock market, characterized by rapid price fluctuations, can also be a sign of economic uncertainty and can further exacerbate market declines.

Industry Analysis: The Case For A 22 Percent Drop In Sp 500 Know Financial Strategist Analysis

A 22% drop in the S&P 500 would significantly impact various industries, with some sectors more vulnerable than others. This analysis delves into the potential effects of such a decline, focusing on industries that might experience heightened challenges.

Impact on Different Industry Segments

A 22% market decline would likely trigger a ripple effect across various industry segments, influencing their financial performance and future prospects.

The case for a 22 percent drop in the S&P 500 is a serious one, with financial strategists pointing to a number of factors that could contribute to such a decline. One area of concern is the housing market, where rising interest rates are already making it more difficult for buyers to afford homes.

Experts warn homebuyers of red flags beyond climbing interest rates , including potential for price drops and a slowing of the market, which could further impact the broader economy and contribute to a stock market downturn. While the future is uncertain, understanding the interconnectedness of these factors is crucial for investors navigating the current market landscape.

- Technology:The technology sector, known for its high valuations and growth potential, could experience a disproportionate decline. A market downturn might lead to a reduction in investment, slower growth rates, and potential layoffs.

- Consumer Discretionary:Industries like retail, travel, and hospitality, heavily reliant on consumer spending, are sensitive to economic downturns. A 22% market drop could dampen consumer confidence, leading to reduced spending and lower demand.

- Financials:The financial sector, including banks and insurance companies, could face increased loan defaults and a decline in asset values. A market decline might also lead to tighter lending standards and reduced financial market activity.

Risk Profiles of Industries

Different industries possess varying risk profiles, making them more or less susceptible to market downturns.

- Growth-Oriented Industries:Companies in sectors like technology, biotechnology, and renewable energy are often characterized by high valuations and growth potential. While these industries offer the potential for significant returns, they also carry higher risk, making them more vulnerable to market corrections.

- Value-Oriented Industries:Industries like energy, materials, and industrials tend to be more value-oriented, with lower valuations and steadier earnings. These industries might be less affected by market fluctuations, as their earnings are less dependent on rapid growth.

- Defensive Industries:Industries like healthcare, consumer staples, and utilities are considered defensive, as their demand remains relatively stable during economic downturns. These industries are less susceptible to market volatility, providing a degree of stability during periods of uncertainty.

Vulnerability of Specific Industries

Certain industries might be particularly vulnerable to a 22% market decline, facing significant challenges due to their unique characteristics.

The case for a 22 percent drop in the S&P 500 is certainly a bold prediction, and while financial strategists often disagree, it’s worth considering the potential for market volatility. It’s interesting to note how Gavin Wood’s vision of blockchain mergers and acquisitions, as discussed in this article , could potentially reshape the financial landscape.

This kind of disruptive innovation could easily contribute to market fluctuations, especially if we see a surge in consolidation within the blockchain industry.

- Semiconductors:The semiconductor industry, critical to various technological advancements, is highly cyclical and susceptible to economic downturns. A market decline could lead to reduced demand for chips, affecting production and profitability.

- Real Estate:The real estate sector, heavily influenced by interest rates and economic conditions, could experience a decline in property values and reduced demand. A market downturn might also lead to increased mortgage delinquencies and a slowdown in new construction.

- Luxury Goods:The luxury goods industry, reliant on discretionary spending, is particularly vulnerable to economic downturns. A market decline could dampen consumer confidence, leading to reduced demand for luxury items.

Investor Behavior

When faced with a significant market drop, like the 22% decline in the S&P 500, investors often react with fear and uncertainty. This can lead to a range of behaviors, some rational and others driven by emotion. Understanding these behaviors is crucial for navigating market volatility and making informed investment decisions.

Panic Selling and Risk Aversion

Panic selling is a common response to market downturns. Investors, driven by fear of further losses, rush to sell their assets, often without considering the long-term implications. This behavior can exacerbate market declines as selling pressure intensifies, creating a downward spiral.

Risk aversion also increases during market drops, as investors become more cautious and less willing to take on new investments. This can lead to a decrease in liquidity and further depress stock prices.

Investor Psychology and Herd Behavior

Investor psychology plays a significant role in market fluctuations. The “herd mentality” can amplify market swings as investors follow the actions of others, often without conducting independent analysis. This can lead to irrational exuberance during bull markets and panic selling during bear markets.

Confirmation bias, where investors seek out information that confirms their existing beliefs, can also contribute to herd behavior.

Impact of Investor Confidence and Market Sentiment

Investor confidence and market sentiment have a direct impact on stock prices. When investors are optimistic about the economy and the future prospects of companies, they are more likely to invest, driving up prices. Conversely, pessimism and negative sentiment can lead to selling pressure and declining stock prices.

Market sentiment can be influenced by a variety of factors, including economic data, political events, and news headlines.

Strategies for Managing Risk

A 22% drop in the S&P 500 is a significant event that can cause substantial financial losses. While it’s impossible to predict the future, investors can implement strategies to mitigate the impact of such a downturn and protect their portfolios.

This section delves into various investment strategies that can help navigate market volatility and manage risk effectively.

Diversification

Diversification is a fundamental principle of investment management that involves spreading investments across different asset classes, sectors, and geographies. This strategy aims to reduce overall portfolio risk by minimizing the impact of any single investment’s performance on the overall portfolio.

For example, instead of investing solely in stocks, a diversified portfolio might include bonds, real estate, commodities, and alternative investments.

Asset Allocation

Asset allocation involves determining the proportion of a portfolio that should be invested in different asset classes. This strategic decision depends on an investor’s risk tolerance, investment goals, and time horizon. A well-defined asset allocation strategy helps investors balance risk and return by allocating a larger proportion of their portfolio to riskier assets like stocks during their younger years and gradually shifting towards less risky assets like bonds as they approach retirement.

Risk Management Techniques

Investors can employ several risk management techniques to protect their portfolios during periods of market volatility.

Stop-Loss Orders

Stop-loss orders are pre-programmed instructions to sell a security when its price falls below a predetermined level. This technique helps limit potential losses by automatically exiting a position if the price declines significantly.

Hedging

Hedging involves taking a position in a financial instrument that offsets the risk of another investment. For example, an investor holding a stock portfolio might buy put options to protect against potential price declines. Put options give the holder the right, but not the obligation, to sell a stock at a specific price, limiting potential losses.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the average purchase price over time, potentially mitigating the impact of market volatility.

Rebalancing

Rebalancing involves adjusting the asset allocation of a portfolio to maintain the desired proportions over time. As asset prices fluctuate, the initial allocation can become skewed. Rebalancing helps restore the intended balance and ensures the portfolio remains aligned with the investor’s risk tolerance and investment goals.

Potential Implications of a 22% Drop

A 22% decline in the S&P 500, a benchmark index representing the performance of 500 large-cap US companies, would have far-reaching consequences, impacting not just the financial markets but also the broader economy and society. The ripple effects of such a significant drop would be felt across various sectors and industries, potentially leading to a period of economic uncertainty and volatility.

Impact on Consumer Confidence and Spending

A substantial drop in the S&P 500 would likely erode consumer confidence, as individuals may perceive their investments to be at risk and their future financial security uncertain. This could lead to a decline in consumer spending, as people become more cautious with their money and prioritize saving over spending.

Reduced consumer spending could have a significant impact on businesses, especially those in sectors reliant on discretionary spending, such as retail, hospitality, and entertainment.

Impact on Business Investment and Economic Growth

A stock market downturn can also negatively impact business investment. Companies may become hesitant to invest in expansion or new projects due to increased uncertainty and concerns about future profitability. Reduced business investment can slow economic growth, as it reduces the creation of new jobs and businesses.

Impact on Different Sectors and Industries

The impact of a 22% drop in the S&P 500 would not be uniform across all sectors and industries. Some sectors, such as technology and consumer discretionary, may be more susceptible to the decline, while others, such as utilities and healthcare, might be more resilient.

The specific impact on each sector would depend on factors such as its exposure to the broader economy, its dependence on consumer spending, and its financial leverage.