Bitcoin, Michael Saylor, and the Orange Pill – A Tucker Carlson Interview Recap

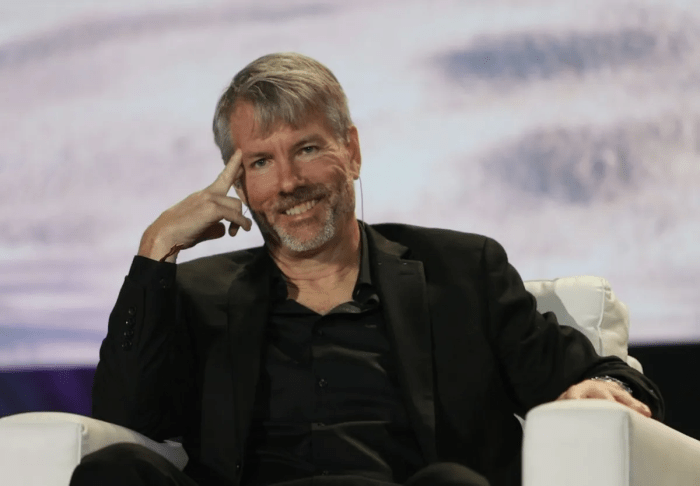

Bitcoin michael saylor orange pills tucker carlson interview recap 120955 – Bitcoin, Michael Saylor, Orange Pills, Tucker Carlson Interview Recap 120955 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Michael Saylor, a prominent Bitcoin advocate, sat down with Tucker Carlson to discuss the potential of Bitcoin and its implications for the future of finance.

The interview, which aired on [Insert Date] on [Insert Platform], delved into Saylor’s fervent belief in Bitcoin as a store of value and digital gold, exploring both its potential and the challenges it faces.

The interview covered a wide range of topics, from Saylor’s personal investment strategy and his company’s massive Bitcoin holdings to the concept of the “orange pill” – a metaphorical awakening to the transformative power of Bitcoin. Saylor presented a compelling argument for Bitcoin’s potential to revolutionize the global financial system, while also acknowledging the criticisms and challenges it faces.

Michael Saylor’s Bitcoin Advocacy

Michael Saylor, the CEO of MicroStrategy, has become a prominent figure in the Bitcoin community, known for his unwavering belief in the cryptocurrency’s potential as a store of value and a revolutionary technology. He has consistently advocated for Bitcoin adoption, influencing many individuals and organizations to consider Bitcoin as a part of their investment portfolio.

Public Statements and Actions

Saylor’s public statements and actions have been instrumental in raising awareness and promoting Bitcoin adoption. He has frequently appeared on mainstream media platforms, including podcasts, interviews, and conferences, sharing his insights on Bitcoin’s value proposition. Saylor’s outspoken advocacy has challenged traditional financial institutions and investors to reconsider their views on Bitcoin, sparking debates and discussions about its potential as a digital gold.

Saylor’s unwavering belief in Bitcoin, even amidst the recent market volatility, was a key takeaway from his interview with Tucker Carlson. While his “orange pills” might be a bit extreme, his perspective on Bitcoin as a hedge against inflation is one that resonates with many.

It’s a reminder that even with rising interest rates, which experts warn homebuyers about in this article, experts warn homebuyers of red flags beyond climbing interest rates , the potential for long-term gains with Bitcoin is still a powerful draw for investors.

- Regularly Discussing Bitcoin’s Potential:Saylor has actively participated in numerous interviews and podcasts, engaging in discussions about Bitcoin’s value proposition, technological advancements, and potential as a store of value. He has consistently presented his views on Bitcoin’s long-term growth potential, highlighting its limited supply, decentralized nature, and resistance to inflation.

- Hosting Conferences and Events:Saylor has organized and hosted conferences and events focused on Bitcoin and blockchain technology. These events have brought together experts, investors, and enthusiasts to discuss the latest developments, explore potential use cases, and foster a sense of community around Bitcoin.

- Encouraging Bitcoin Adoption:Saylor has actively encouraged individuals and organizations to adopt Bitcoin as a part of their investment portfolio. He has shared his personal investment strategy, emphasizing the importance of allocating a significant portion of assets to Bitcoin as a hedge against inflation and economic uncertainty.

Investment Strategy and Company Holdings

Saylor’s investment strategy is centered around Bitcoin, with MicroStrategy, his company, holding a substantial amount of Bitcoin as a treasury reserve asset. He believes that Bitcoin is a superior store of value compared to traditional assets like gold and bonds, and that it offers a hedge against inflation and economic uncertainty.

- Bitcoin as a Treasury Reserve Asset:MicroStrategy has been actively acquiring Bitcoin since 2020, accumulating a significant amount of Bitcoin as a treasury reserve asset. This strategy reflects Saylor’s belief in Bitcoin’s long-term value and its potential to preserve wealth.

- Diversifying Investment Portfolio:Saylor’s investment strategy has influenced other companies and individuals to consider Bitcoin as a part of their diversified investment portfolio. He has argued that Bitcoin can provide a hedge against inflation and economic instability, offering a different perspective on risk management.

Michael Saylor’s recent appearance on Tucker Carlson’s show was a whirlwind of Bitcoin, orange pills, and passionate arguments. It got me thinking about the larger picture of blockchain innovation, and how it might play out in the future. Gavin Wood’s vision of chain mergers and acquisitions, as outlined in this insightful article , offers a fascinating perspective on the potential evolution of the blockchain ecosystem.

This type of consolidation could be the key to unlocking the true potential of Bitcoin and other decentralized technologies, and it’s something we should all be keeping an eye on as the crypto landscape continues to evolve.

- Long-Term Perspective:Saylor’s investment strategy emphasizes a long-term perspective on Bitcoin, believing that its value will continue to appreciate over time. He has consistently encouraged investors to hold Bitcoin for the long term, avoiding short-term market fluctuations and focusing on its fundamental value.

Tucker Carlson Interview Context

The interview between Michael Saylor, the CEO of MicroStrategy, and Tucker Carlson, a prominent television host, took place on October 26, 2022, on Fox News’s “Tucker Carlson Tonight” program. The interview garnered significant attention due to the prominent personalities involved and the controversial nature of the topics discussed.

Main Topics Discussed

The interview focused on Bitcoin, with Saylor passionately advocating for its adoption as a form of digital gold and a hedge against inflation. The interview delved into various aspects of Bitcoin, including:

- Bitcoin’s potential as a safe haven asset: Saylor emphasized Bitcoin’s ability to protect against inflation, arguing that its limited supply and decentralized nature make it a more reliable store of value than traditional fiat currencies.

- Bitcoin’s role in the global financial system: Saylor discussed how Bitcoin can potentially revolutionize the financial system, offering a more efficient and transparent alternative to traditional banking institutions.

- Bitcoin’s environmental impact: Saylor addressed the concerns regarding Bitcoin’s energy consumption, arguing that its energy usage is offset by its economic benefits and that the mining process is becoming increasingly sustainable.

- Bitcoin’s regulatory landscape: Saylor highlighted the challenges and opportunities presented by government regulation of Bitcoin, advocating for a more favorable regulatory environment to foster innovation and growth.

Bitcoin’s Potential and Challenges: Bitcoin Michael Saylor Orange Pills Tucker Carlson Interview Recap 120955

Michael Saylor, a prominent figure in the Bitcoin community, has been a vocal advocate for the cryptocurrency, arguing that it possesses immense potential as a store of value and digital gold. His views, often expressed in interviews like the one with Tucker Carlson, have sparked considerable discussion and debate regarding Bitcoin’s future.

This section delves into the arguments supporting Bitcoin’s potential while also examining the challenges and criticisms it faces.

Bitcoin as a Store of Value, Bitcoin michael saylor orange pills tucker carlson interview recap 120955

Saylor’s central argument is that Bitcoin, with its limited supply and decentralized nature, serves as a hedge against inflation and a reliable store of value. He compares Bitcoin to gold, highlighting its inherent scarcity and resistance to manipulation. Unlike traditional currencies, Bitcoin’s supply is fixed, with only 21 million coins ever to be created.

This finite supply, according to Saylor, makes Bitcoin a superior alternative to fiat currencies, which are susceptible to inflationary pressures.

Michael Saylor’s recent interview with Tucker Carlson was a whirlwind of Bitcoin talk, orange pills, and conspiracy theories. It got me thinking about the evolution of cryptocurrencies and the future of decentralized finance. It’s interesting to see how Vitalik Buterin, the co-founder of Ethereum, views the space in comparison to Saylor’s more bullish approach.

In a recent interview on Bloomberg Studio 10, Buterin discussed the potential of Ethereum and the challenges it faces. It’s a fascinating contrast to Saylor’s all-in Bitcoin stance, and it’s definitely worth exploring the different perspectives on the future of crypto.

Bitcoin’s Challenges and Criticisms

Despite the optimistic outlook presented by Saylor, Bitcoin faces numerous challenges and criticisms. One major concern is its volatility, as Bitcoin’s price has experienced significant fluctuations throughout its history. Critics argue that this volatility makes it an unsuitable investment for the average person, especially those seeking stability and long-term value.Another challenge is the energy consumption associated with Bitcoin mining.

The process of verifying transactions and creating new Bitcoin requires significant computational power, which consumes large amounts of electricity. Environmentalists argue that this energy consumption is unsustainable and detrimental to the environment.

Comparison to Traditional Assets

Comparing Bitcoin to traditional financial assets like gold and the US dollar reveals both similarities and differences. Like gold, Bitcoin is considered a scarce asset, with a limited supply that cannot be inflated. However, unlike gold, Bitcoin is a digital asset, making it easier to store, transfer, and trade.Bitcoin also differs from the US dollar in its decentralized nature.

The US dollar is controlled by the Federal Reserve, a central bank that can manipulate its supply and value. Bitcoin, on the other hand, is decentralized, meaning it is not subject to the control of any single entity.

“Bitcoin is the hardest money ever invented. It is the only asset that has a fixed supply, is censorship-resistant, and is not subject to inflation.”

Michael Saylor

Bitcoin’s Potential and Challenges

While Bitcoin offers potential as a store of value and digital gold, it also faces challenges and criticisms. Its volatility, energy consumption, and regulatory uncertainty are factors that need to be considered. Comparing Bitcoin to traditional assets like gold and the US dollar highlights its unique characteristics and potential advantages.

The “Orange Pill” and Bitcoin Adoption

The term “orange pill” has become a popular metaphor in the Bitcoin community, representing a shift in perspective towards understanding Bitcoin’s potential to revolutionize the global financial system. Michael Saylor, a prominent Bitcoin advocate, frequently uses this analogy to describe the transition from a traditional, centralized financial system to one based on Bitcoin’s decentralized, immutable, and transparent blockchain technology.

The “Orange Pill” Concept

The “orange pill” metaphor draws inspiration from the “red pill” concept popularized in the movie “The Matrix.” In the movie, taking the red pill symbolizes a choice to see the world as it truly is, even if it’s a harsh reality.

Similarly, the “orange pill” represents a decision to embrace Bitcoin’s potential to disrupt the existing financial order, even if it challenges conventional wisdom and established institutions.

Bitcoin Adoption’s Impact on the Global Financial System

Bitcoin’s widespread adoption could have a profound impact on the global financial system. Here are some key areas where it could bring about significant changes:

1. Decentralization and Transparency

- Bitcoin’s decentralized nature removes the need for intermediaries, such as banks and financial institutions, in transactions. This can reduce transaction costs and increase efficiency.

- The transparent nature of the Bitcoin blockchain allows anyone to view all transactions, enhancing accountability and reducing fraud.

2. Financial Inclusion

- Bitcoin can provide access to financial services for individuals and communities currently excluded from the traditional banking system.

- This can empower people in developing countries and underserved populations by giving them control over their finances.

3. Monetary Policy

- Bitcoin’s fixed supply of 21 million coins creates a deflationary monetary policy, potentially mitigating inflation and preserving purchasing power over time.

- This contrasts with traditional fiat currencies, which are subject to inflation and devaluation due to government policies.

4. Cross-Border Payments

- Bitcoin’s global reach and fast transaction speeds can facilitate efficient and cost-effective cross-border payments.

- This can reduce reliance on traditional banking systems and their associated fees and delays.

Comparing Traditional and Bitcoin-Based Systems

The following table highlights key differences between the traditional financial system and a Bitcoin-based system:

| Feature | Traditional Financial System | Bitcoin-Based System |

|---|---|---|

| Centralization | Centralized, controlled by institutions | Decentralized, controlled by the network |

| Transparency | Limited transparency, information controlled by institutions | Fully transparent, all transactions publicly viewable |

| Security | Vulnerable to hacking, fraud, and manipulation | Secure and tamper-proof due to cryptography |

| Access | Limited access for certain individuals and communities | Accessible to anyone with an internet connection |

| Fees | High transaction fees, especially for cross-border payments | Lower transaction fees, particularly for small amounts |

| Monetary Policy | Subject to inflation and devaluation due to government policies | Deflationary, with a fixed supply of coins |

Bitcoin’s Future and Implications

The future of Bitcoin is a subject of much debate and speculation. While its current value and adoption are significant, the potential for widespread adoption and its implications for society and the global economy are vast. This section explores a timeline of potential milestones in Bitcoin’s future development, the societal and economic implications of widespread adoption, and the potential impact of Bitcoin on governments and central banks.

Potential Milestones in Bitcoin’s Future Development

The future of Bitcoin is likely to be characterized by significant technological advancements, increased adoption, and regulatory clarity. This section Artikels a timeline of potential milestones in Bitcoin’s future development.

- Increased Institutional Adoption:More institutional investors, including hedge funds, pension funds, and corporations, are likely to adopt Bitcoin as an asset class. This will lead to increased liquidity and price stability.

- Regulatory Clarity:Governments around the world are likely to develop clear regulations for Bitcoin and other cryptocurrencies.

This will provide much-needed legal certainty for investors and businesses.

- Lightning Network Expansion:The Lightning Network is a layer-2 scaling solution that can significantly increase Bitcoin’s transaction throughput. Its widespread adoption will make Bitcoin more suitable for everyday transactions.

- Bitcoin as a Global Reserve Currency:In the long term, Bitcoin could potentially become a global reserve currency, replacing the US dollar.

This would have significant implications for the global financial system.

Societal and Economic Implications of Widespread Bitcoin Adoption

The widespread adoption of Bitcoin would have significant societal and economic implications. These include:

- Increased Financial Inclusion:Bitcoin can provide access to financial services for people who are currently unbanked or underbanked. This could empower individuals and promote economic development.

- Reduced Transaction Costs:Bitcoin transactions are typically cheaper than traditional bank transfers, especially for cross-border transactions. This could lead to significant cost savings for businesses and individuals.

- Increased Privacy:Bitcoin transactions are pseudonymous, which means they are not directly linked to the user’s identity. This can provide greater privacy for individuals and businesses.

- Decentralized Finance:Bitcoin and other cryptocurrencies are enabling the development of decentralized finance (DeFi), which could disrupt the traditional financial system.

Impact of Bitcoin on Governments and Central Banks

The rise of Bitcoin has challenged the traditional role of governments and central banks. Its decentralized nature and potential to disrupt the existing financial system have raised concerns and prompted responses from policymakers around the world.

- Competition with Central Bank Digital Currencies (CBDCs):The emergence of Bitcoin has spurred central banks to consider issuing their own digital currencies, known as CBDCs. These digital currencies would compete with Bitcoin and other cryptocurrencies.

- Challenges to Monetary Policy:Bitcoin’s fixed supply and decentralized nature could make it difficult for central banks to control inflation and manage monetary policy.

- Taxation and Regulation:Governments are grappling with how to tax and regulate Bitcoin and other cryptocurrencies. These issues are complex and evolving.