Cryptos Future: Expert Predictions on Digital Currencies

The future of crypto experts predict whats next for digital currencies, a landscape brimming with potential and uncertainty. As the world grapples with the implications of decentralized finance, blockchain technology, and the rise of cryptocurrencies, a chorus of experts offer their insights into what lies ahead for this burgeoning sector.

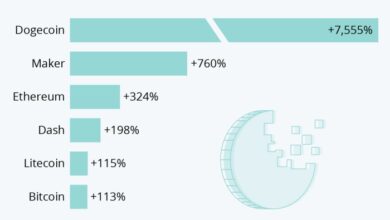

From the meteoric rise of Bitcoin and Ethereum to the burgeoning adoption of DeFi and NFTs, the crypto landscape is constantly evolving, driven by technological innovation, regulatory developments, and shifting investor sentiment.

This exploration delves into the predictions of leading crypto experts, examining their views on adoption, regulation, technological advancements, and market trends. We’ll navigate the complex interplay between cryptocurrencies and traditional finance, explore the potential impact of central bank digital currencies (CBDCs), and analyze the opportunities and risks associated with crypto investments.

Join us as we uncover the potential future of crypto and its implications for the global financial system, the metaverse, and beyond.

The Current State of Cryptocurrencies

The world of cryptocurrencies is constantly evolving, with new trends emerging and established players navigating a complex landscape. The current state of the crypto market reflects a blend of growth, volatility, and ongoing development.

Market Capitalization and Adoption

The total market capitalization of cryptocurrencies has experienced significant fluctuations in recent years. As of [insert current date], the total market cap stands at approximately [insert current market cap] billion USD. Bitcoin, the original cryptocurrency, remains the dominant player, accounting for a substantial portion of the market capitalization.

Ethereum, the second-largest cryptocurrency, has gained significant traction due to its role in the development of decentralized applications (dApps) and smart contracts.

Key Trends Shaping the Crypto Landscape

Several key trends are shaping the crypto landscape, influencing its future trajectory:

- Regulatory Developments:Governments worldwide are grappling with how to regulate cryptocurrencies. Some countries have implemented comprehensive frameworks, while others are still in the early stages of developing regulatory guidelines. The regulatory landscape is constantly evolving, and its impact on the crypto industry is significant.

- Institutional Adoption:Institutional investors, including hedge funds, pension funds, and corporations, are increasingly exploring opportunities in the crypto space. This growing interest has led to the development of institutional-grade platforms and services, further legitimizing the crypto market.

- DeFi Growth:Decentralized Finance (DeFi) has emerged as a major trend within the crypto space. DeFi protocols enable users to access financial services, such as lending, borrowing, and trading, without relying on traditional intermediaries. The growth of DeFi has attracted significant investment and user adoption.

Prominent Crypto Use Cases

Cryptocurrencies are finding applications across various sectors, including:

- Payments:Cryptocurrencies are being used as a means of payment for goods and services, particularly in online marketplaces and international transactions. The adoption of crypto payments is growing, with some companies accepting Bitcoin and other cryptocurrencies as payment methods.

- Investment:Cryptocurrencies are considered an alternative asset class by many investors. The potential for high returns and the decentralized nature of cryptocurrencies have attracted investors seeking diversification and exposure to new technologies.

- Supply Chain Management:Cryptocurrencies and blockchain technology are being used to enhance transparency and efficiency in supply chains. By tracking goods and materials through blockchain, companies can reduce fraud and improve traceability.

- Identity Management:Cryptocurrencies can be used to create secure and verifiable digital identities. Blockchain technology enables the storage and management of identity data in a decentralized and tamper-proof manner.

Expert Predictions for the Future of Crypto

Predicting the future of any technology is a complex task, and the rapidly evolving world of cryptocurrencies is no exception. However, leading crypto experts have offered their insights into what they believe lies ahead for digital currencies. Their predictions span a range of aspects, from adoption and regulation to technological advancements and market trends.

Adoption of Cryptocurrencies

Cryptocurrency adoption has been steadily increasing, and experts believe this trend will continue. Some experts predict that mainstream adoption of crypto will be driven by factors like increasing financial inclusion, the desire for greater financial control, and the growing popularity of decentralized finance (DeFi).

- Increased Financial Inclusion:Experts believe that cryptocurrencies can play a crucial role in expanding financial access to underserved populations. For example, individuals in developing countries with limited access to traditional banking services can leverage crypto to send and receive money more easily and affordably.

- Greater Financial Control:Cryptocurrencies offer users more control over their finances compared to traditional banking systems. With crypto, users can manage their own funds without relying on intermediaries, potentially leading to greater financial autonomy.

- Growth of Decentralized Finance (DeFi):DeFi applications built on blockchain technology are gaining popularity, providing users with access to a range of financial services like lending, borrowing, and trading without the need for centralized institutions.

This growth is expected to drive further adoption of cryptocurrencies.

Regulation of Cryptocurrencies

Regulation of cryptocurrencies is a crucial aspect that will shape the future of the industry. Experts anticipate that regulatory frameworks will continue to evolve as governments and regulatory bodies seek to strike a balance between fostering innovation and mitigating risks.

- Clearer Regulatory Frameworks:As crypto adoption grows, governments worldwide are working on developing clearer regulatory frameworks for the industry. These frameworks are expected to address issues like consumer protection, anti-money laundering (AML), and taxation.

- Increased Scrutiny of Stablecoins:Stablecoins, cryptocurrencies pegged to fiat currencies like the US dollar, are facing increased scrutiny from regulators.

Experts anticipate that regulatory frameworks will be developed to address concerns about the stability and transparency of stablecoins.

- Potential for Central Bank Digital Currencies (CBDCs):Many central banks are exploring the development of their own digital currencies, known as CBDCs. These CBDCs could potentially coexist with or even replace existing cryptocurrencies, impacting the future landscape of digital money.

Technological Advancements in Crypto, The future of crypto experts predict whats next for digital currencies

Technological advancements are constantly pushing the boundaries of the crypto space, leading to new possibilities and applications. Experts anticipate that advancements in areas like scalability, privacy, and interoperability will play a significant role in shaping the future of crypto.

- Improved Scalability:Blockchain scalability is a critical issue that needs to be addressed for widespread adoption. Experts believe that advancements in scaling solutions like layer-2 networks and sharding will enable blockchains to handle more transactions efficiently.

- Enhanced Privacy:Privacy concerns are often raised regarding the transparency of blockchain transactions.

Experts predict that advancements in privacy-enhancing technologies like zero-knowledge proofs and homomorphic encryption will provide greater privacy for users.

- Interoperability Between Blockchains:The current fragmented landscape of blockchains presents challenges for interoperability. Experts anticipate that advancements in cross-chain communication protocols will enable seamless interaction between different blockchains, facilitating the flow of value and information.

Market Trends in Crypto

The cryptocurrency market is known for its volatility and rapid changes. Experts anticipate that certain market trends will continue to shape the future of the industry.

- Increased Institutional Investment:Institutional investors are increasingly showing interest in cryptocurrencies. This trend is expected to bring greater stability and liquidity to the market, contributing to further growth.

- Emergence of New Use Cases:Experts predict that new use cases for cryptocurrencies will emerge beyond traditional financial applications.

While crypto experts debate the future of digital currencies, it’s important to remember that the real world still exists. Right now, homebuyers are facing a new set of challenges, as experts warn homebuyers of red flags beyond climbing interest rates.

This means that even as we speculate on the potential of blockchain technology, we must also be aware of the current economic realities. Ultimately, the future of crypto and the housing market are both intertwined with broader global trends, and it’s crucial to stay informed about both.

These use cases could include areas like supply chain management, identity verification, and digital voting.

- Integration with Traditional Finance:Experts anticipate greater integration between cryptocurrencies and traditional financial systems. This integration could involve the development of hybrid financial products that combine aspects of both worlds.

Potential Technological Advancements in Crypto

The crypto landscape is constantly evolving, driven by technological advancements that aim to address existing limitations and unlock new possibilities. Emerging technologies are paving the way for a more scalable, secure, and user-friendly crypto ecosystem.

Blockchain Scalability Solutions

Scalability remains a critical challenge for blockchain networks, particularly as adoption grows. Existing blockchains struggle to handle a high volume of transactions, leading to congestion and increased transaction fees. Several solutions are being developed to address this challenge.

- Sharding:This technique divides the blockchain into smaller, more manageable shards, allowing for parallel processing of transactions. This significantly increases transaction throughput, as multiple shards can handle transactions simultaneously. Ethereum, for example, is implementing sharding as part of its transition to Ethereum 2.0.

- Layer-2 Scaling Solutions:These solutions operate on top of existing blockchains, offloading transaction processing to separate networks. This reduces the burden on the main chain, enhancing scalability. Examples include Lightning Network for Bitcoin and Polygon for Ethereum.

- Rollups:Rollups are a type of layer-2 scaling solution that bundles multiple transactions into a single transaction on the main chain, reducing the number of transactions processed and improving efficiency. Optimistic rollups and zero-knowledge rollups are two prominent types of rollups gaining popularity.

Privacy-Enhancing Techniques

Privacy concerns are a significant obstacle to wider crypto adoption. Traditional blockchains are transparent, meaning all transactions are publicly visible. Privacy-enhancing techniques aim to address these concerns by obscuring transaction details while maintaining security.

- Zero-Knowledge Proofs (ZKPs):ZKPs allow users to prove they possess certain information without revealing the information itself. This enables privacy-preserving transactions by verifying the validity of a transaction without disclosing sensitive details. ZKPs are being implemented in projects like Zcash and are gaining traction in other privacy-focused blockchains.

- Homomorphic Encryption:This technique allows computations to be performed on encrypted data without decrypting it. This enables secure data processing without compromising privacy, which is particularly relevant for applications like decentralized finance (DeFi).

- CoinJoin:This technique mixes multiple transactions together, making it difficult to track the origin and destination of individual funds. This approach enhances privacy by obfuscating transaction patterns.

Cross-Chain Interoperability

The fragmented nature of the crypto ecosystem, with numerous independent blockchains, hinders interoperability and limits the potential for collaboration. Cross-chain interoperability solutions aim to bridge these gaps, allowing for seamless communication and asset transfer between different blockchains.

- Inter-Blockchain Communication (IBC):IBC is a protocol that enables communication and asset transfer between blockchains that use the Cosmos SDK. It facilitates interoperability within the Cosmos ecosystem, allowing for the creation of a decentralized internet of blockchains.

- Cross-Chain Bridges:These bridges connect different blockchains, enabling the transfer of assets and data between them. Examples include Wormhole, Chainlink, and Avalanche Bridge.

- Decentralized Exchanges (DEXs):DEXs allow users to trade cryptocurrencies directly without relying on centralized intermediaries. Cross-chain DEXs enable trading across multiple blockchains, facilitating interoperability and expanding trading opportunities.

Impact of Technological Advancements on the Crypto Ecosystem

| Technology | Impact on Scalability | Impact on Privacy | Impact on Interoperability | Impact on Security | Impact on User Experience |

|---|---|---|---|---|---|

| Blockchain Scalability Solutions | Increased transaction throughput, reduced congestion, lower transaction fees | Limited impact | Limited impact | Potential for improved security through increased decentralization | Improved user experience due to faster and more efficient transactions |

| Privacy-Enhancing Techniques | Limited impact | Enhanced privacy, protection of sensitive data | Limited impact | Potential for increased security through obfuscation of transaction patterns | Improved user confidence and trust |

| Cross-Chain Interoperability Solutions | Limited impact | Limited impact | Increased connectivity, seamless asset transfer between blockchains | Potential for improved security through increased decentralization | Enhanced user experience through greater access to different blockchain ecosystems |

Regulatory Landscape and Its Influence

The regulatory landscape for cryptocurrencies is constantly evolving, with governments worldwide grappling with how to best manage this nascent industry. While some jurisdictions have embraced a more progressive approach, others have taken a more cautious stance, leading to a patchwork of regulations across the globe.

Understanding the current regulatory landscape and its potential impact is crucial for both investors and businesses operating in the crypto space.

Current Regulatory Landscape

The current regulatory landscape for cryptocurrencies varies significantly across different jurisdictions.

- United States:The US has adopted a fragmented approach to crypto regulation, with different agencies responsible for different aspects of the industry. The Securities and Exchange Commission (SEC) oversees the issuance and trading of digital assets that qualify as securities, while the Commodity Futures Trading Commission (CFTC) regulates crypto derivatives.

The Financial Crimes Enforcement Network (FinCEN) focuses on anti-money laundering and know-your-customer (KYC) regulations. This fragmented approach can create confusion for businesses and investors, leading to uncertainty about regulatory compliance.

- European Union:The EU has taken a more coordinated approach to crypto regulation, with the Markets in Crypto-assets (MiCA) regulation expected to come into effect in 2024. MiCA will provide a comprehensive framework for crypto assets, including licensing requirements for crypto service providers and consumer protection measures.

Crypto experts are buzzing about the future of digital currencies, with many predicting a shift towards interoperability and cross-chain solutions. One key figure in this space is Gavin Wood, whose vision for the future of blockchain technology includes a focus on chain mergers and acquisitions to create a more interconnected and efficient ecosystem.

This strategy could play a significant role in shaping the future of crypto, paving the way for greater adoption and innovation.

This unified approach aims to create a more predictable and stable environment for crypto businesses in the EU.

- China:China has taken a strict stance on cryptocurrencies, banning all crypto-related activities within its borders. This includes prohibiting cryptocurrency exchanges and initial coin offerings (ICOs). The Chinese government views cryptocurrencies as a potential threat to financial stability and has taken a strong stance against them.

- Japan:Japan has adopted a relatively progressive approach to crypto regulation, recognizing Bitcoin as a legal form of payment in 2017. The country has implemented strict KYC and AML regulations for crypto exchanges, aiming to create a safe and transparent environment for investors.

This approach has helped to foster innovation and growth in the Japanese crypto industry.

Influence on Crypto Adoption and Innovation

Evolving regulations have a significant impact on the future of crypto adoption and innovation.

- Increased Legitimacy:Clear and comprehensive regulations can help to legitimize the crypto industry in the eyes of investors and businesses. This can lead to increased institutional investment and broader adoption of cryptocurrencies.

- Consumer Protection:Regulations that focus on consumer protection, such as KYC and AML requirements, can help to build trust in the crypto ecosystem and reduce the risk of fraud and scams.

- Innovation and Growth:While regulations can sometimes stifle innovation, they can also provide a framework for responsible growth and development. Clear rules can create a more predictable environment for businesses, encouraging investment and innovation in the crypto space.

- Potential Barriers:Overly restrictive regulations can create barriers to entry for businesses and investors, hindering innovation and adoption. Striking a balance between regulation and innovation is crucial for the long-term growth of the crypto industry.

Impact of Different Regulatory Approaches

Different regulatory approaches can have varying impacts on the crypto industry.

- Progressive Regulation:Jurisdictions with progressive regulations, such as Japan, have seen significant growth in their crypto industries. These regulations provide a clear framework for businesses and investors, fostering innovation and attracting investment.

- Restrictive Regulation:Jurisdictions with restrictive regulations, such as China, have seen a decline in crypto activity. These regulations can create uncertainty and discourage investment, hindering the growth of the industry.

- Fragmented Regulation:Fragmented regulation, such as in the US, can create confusion and complexity for businesses and investors. This can lead to inconsistencies in regulatory compliance and hinder the development of a unified and stable market.

The Role of Central Bank Digital Currencies (CBDCs)

Central bank digital currencies (CBDCs) are emerging as a potential game-changer in the world of digital finance. These are digital forms of a country’s fiat currency, issued and regulated by the central bank. While still in their early stages of development, CBDCs have the potential to significantly impact the future of cryptocurrencies and the financial landscape as a whole.

Potential Benefits of CBDCs

The potential benefits of CBDCs are numerous and could revolutionize the way we interact with money. Here are some key advantages:

- Enhanced Efficiency and Security:CBDCs can facilitate faster and more secure transactions, potentially reducing costs and improving efficiency in the financial system. Transactions would be processed directly through the central bank, eliminating the need for intermediaries and reducing the risk of fraud.

- Improved Financial Inclusion:CBDCs could offer greater financial inclusion by providing access to financial services for those who are currently unbanked or underbanked. This could be particularly beneficial in developing countries where access to traditional banking services is limited.

- Enhanced Monetary Policy Control:CBDCs could give central banks more direct control over monetary policy. This could allow for more targeted and effective implementation of policies to manage inflation and stimulate economic growth.

- Innovation in Financial Services:CBDCs could enable the development of new and innovative financial services. For example, programmable money features could allow for automated payments and conditional transactions, potentially revolutionizing areas like micropayments, smart contracts, and supply chain finance.

Potential Challenges of CBDCs

While CBDCs hold great promise, there are also potential challenges that need to be addressed before widespread adoption:

- Privacy Concerns:The potential for increased surveillance and tracking of transactions is a significant concern. Central banks need to carefully consider privacy implications and implement robust measures to protect user data.

- Cybersecurity Risks:CBDCs would be a prime target for cyberattacks, requiring robust security measures and a well-defined response plan. The potential for large-scale disruptions to the financial system is a major concern.

- Impact on Commercial Banks:The introduction of CBDCs could potentially disrupt the traditional role of commercial banks, leading to changes in their business models and potential job losses. This could have significant implications for the financial sector.

- Regulatory Framework:Establishing a clear and comprehensive regulatory framework for CBDCs is crucial. This would need to address issues such as anti-money laundering, consumer protection, and financial stability.

Interaction Between CBDCs and Cryptocurrencies

The relationship between CBDCs and cryptocurrencies is complex and evolving. While CBDCs are essentially digital versions of fiat currencies, cryptocurrencies are decentralized and operate independently of central banks. Here are some potential scenarios for their interaction:

- Coexistence:CBDCs and cryptocurrencies could coexist, with each fulfilling different roles in the financial ecosystem. CBDCs could serve as a stable and widely accepted form of digital money, while cryptocurrencies could continue to innovate in areas like decentralized finance (DeFi) and tokenization.

- Competition:CBDCs could potentially compete with cryptocurrencies for market share, particularly in areas like payments and financial services. This could lead to increased innovation and competition in the digital finance space.

- Integration:CBDCs and cryptocurrencies could be integrated in various ways. For example, CBDCs could be used as collateral for stablecoins, or cryptocurrencies could be used to facilitate cross-border payments through CBDC networks. This integration could create new opportunities for innovation and collaboration.

CBDCs and the Future of Digital Payments

CBDCs have the potential to significantly shape the future of digital payments. They could offer faster, more efficient, and more secure transactions, potentially reducing costs and improving access to financial services.

- Increased Adoption of Digital Payments:CBDCs could drive increased adoption of digital payments, leading to a decline in the use of cash. This could have significant implications for businesses and consumers, as well as for the broader financial system.

- New Payment Models:CBDCs could enable the development of new payment models, such as programmable money features that allow for automated payments and conditional transactions. This could revolutionize areas like micropayments, smart contracts, and supply chain finance.

- Cross-Border Payments:CBDCs could facilitate faster and cheaper cross-border payments by eliminating the need for intermediaries and reducing transaction costs. This could have significant implications for international trade and investment.

The Future of Crypto Investments

The world of cryptocurrencies is constantly evolving, presenting both exciting opportunities and significant risks for investors. As we look ahead, understanding the potential investment avenues and associated risks is crucial for navigating this dynamic landscape. This section explores the future of crypto investments, examining emerging trends and strategies, while providing insights into the evolving landscape of crypto investment strategies, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

Crypto Investment Strategies: Exploring the Landscape

The crypto investment landscape is becoming increasingly sophisticated, offering a wide range of strategies for investors with varying risk appetites. Here are some key trends shaping the future of crypto investing:

Decentralized Finance (DeFi)

DeFi, or decentralized finance, has emerged as a transformative force in the crypto world, offering a range of financial services built on blockchain technology. DeFi protocols allow users to access services such as lending, borrowing, trading, and yield farming without relying on traditional financial institutions.

The future of crypto is a hot topic, with experts predicting everything from mass adoption to regulatory crackdowns. It’s fascinating to hear insights from key players like Vitalik Buterin, the co-founder of Ethereum, who recently appeared on Bloomberg Studio 10.

In the interview , Buterin discussed the potential for Ethereum to become a global financial system, highlighting the importance of scalability and security in achieving this goal. His thoughts on the future of crypto are definitely worth considering, especially as we navigate the ever-evolving landscape of digital currencies.

- Lending and Borrowing:DeFi platforms enable users to lend their crypto assets and earn interest, or borrow crypto assets by providing collateral. This opens up opportunities for both lenders and borrowers to access financial services in a decentralized manner.

- Yield Farming:Yield farming involves providing liquidity to DeFi protocols and earning rewards in the form of tokens or interest. This strategy can generate substantial returns but also carries inherent risks, such as impermanent loss and smart contract vulnerabilities.

- Decentralized Exchanges (DEXs):DEXs allow users to trade cryptocurrencies directly with each other without intermediaries, offering greater privacy and control over their assets. While DEXs provide increased decentralization, they may also have lower liquidity compared to centralized exchanges.

Non-Fungible Tokens (NFTs)

NFTs, or non-fungible tokens, are unique digital assets that represent ownership of digital or physical items. NFTs have gained immense popularity in recent years, revolutionizing industries such as art, gaming, and collectibles.

- Digital Art and Collectibles:NFTs have enabled the creation of digital art markets, allowing artists to sell their work directly to collectors and bypass traditional galleries. This has also led to the emergence of NFT marketplaces where collectors can buy and sell unique digital assets.

- Gaming:NFTs are being integrated into video games, allowing players to own and trade in-game assets such as characters, weapons, and virtual land. This creates a new level of ownership and value for gamers.

- Real-World Assets:NFTs can be used to represent ownership of real-world assets, such as real estate, vehicles, and even intellectual property. This opens up possibilities for fractional ownership and alternative investment strategies.

Crypto Investment Risks

Investing in cryptocurrencies involves significant risks, and it is essential to understand these risks before making any investment decisions.

- Volatility:Cryptocurrencies are known for their high volatility, with prices fluctuating rapidly. This makes it challenging to predict future price movements and can lead to significant losses.

- Regulation:The regulatory landscape for cryptocurrencies is constantly evolving, and changes in regulations can impact the value of crypto assets. This uncertainty can create challenges for investors.

- Security:Cryptocurrencies are susceptible to security risks, such as hacking and theft. Investors need to be aware of these risks and take appropriate measures to protect their assets.

- Scams and Fraud:The crypto space is unfortunately prone to scams and fraud. Investors should be cautious and conduct thorough research before investing in any cryptocurrency project.

Comparing Crypto Investment Strategies

The following table compares the risks and potential returns of different crypto investment strategies:

| Strategy | Potential Returns | Risks |

|---|---|---|

| Buying and Holding | High potential for long-term growth | High volatility, market manipulation, regulatory uncertainty |

| Trading | Potential for short-term gains | High risk of losses, market volatility, technical analysis skills required |

| Decentralized Finance (DeFi) | Potential for high yields | Smart contract vulnerabilities, impermanent loss, regulatory uncertainty |

| Non-Fungible Tokens (NFTs) | Potential for high returns on rare or sought-after NFTs | Market volatility, liquidity issues, potential for scams |

The Impact of Crypto on the Global Financial System

Cryptocurrencies have the potential to revolutionize the global financial system, challenging traditional institutions and opening new avenues for innovation. The decentralized nature of crypto, coupled with its ability to facilitate cross-border transactions, poses both opportunities and challenges for the existing financial order.

Disruption of Traditional Financial Models

The rise of cryptocurrencies has the potential to disrupt traditional financial models in several ways. Firstly, cryptocurrencies can act as a decentralized alternative to traditional banking systems, offering users greater control over their funds and reducing reliance on intermediaries. This could lead to increased competition and pressure on banks to innovate and adapt to meet the evolving needs of customers.

Secondly, cryptocurrencies can enable the development of new financial products and services, such as decentralized finance (DeFi) applications, which can provide access to financial services to individuals and businesses that are traditionally underserved.

Opportunities for Innovation

Cryptocurrencies can foster innovation in various aspects of the financial system. The emergence of blockchain technology, the underlying technology behind cryptocurrencies, has created new possibilities for secure and transparent record-keeping, enabling the development of innovative solutions in areas such as supply chain management, identity verification, and voting systems.

Moreover, the use of smart contracts, self-executing agreements on the blockchain, can streamline processes and reduce transaction costs, leading to increased efficiency in financial transactions.

Implications for International Trade, Remittances, and Cross-Border Payments

Cryptocurrencies can significantly impact international trade, remittances, and cross-border payments. The ability of cryptocurrencies to facilitate fast and low-cost transactions across borders can reduce reliance on traditional payment systems, which are often slow, expensive, and subject to regulations. For instance, cryptocurrencies can enable businesses to settle international transactions more efficiently, reducing transaction fees and improving liquidity.

Similarly, remittances, the transfer of money from one country to another, can become faster and cheaper through cryptocurrencies, benefiting migrant workers and their families.

The Future of Crypto and the Metaverse: The Future Of Crypto Experts Predict Whats Next For Digital Currencies

The metaverse, a collective term for immersive virtual worlds, is poised to become a significant part of our lives. With its potential for work, entertainment, and social interaction, the metaverse presents a unique opportunity for cryptocurrencies to play a crucial role in its development and adoption.

Cryptocurrency as a Payment Method in the Metaverse

The metaverse will require a robust and efficient payment system to facilitate transactions between users. Cryptocurrencies, with their decentralized and secure nature, can offer a viable solution for seamless and transparent payments within virtual worlds.

- Cryptocurrencies like Ethereum and Solana, with their fast transaction speeds and low fees, can enable users to purchase virtual goods, services, and experiences within the metaverse.

- Decentralized exchanges (DEXs) can facilitate peer-to-peer transactions, eliminating the need for centralized intermediaries and promoting financial inclusion.

- Stablecoins, pegged to fiat currencies, can provide price stability and reduce volatility, making them suitable for everyday transactions within the metaverse.

Cryptocurrency for Asset Ownership and Governance in the Metaverse

Cryptocurrencies can be used to represent ownership of digital assets within the metaverse. NFTs (Non-Fungible Tokens) are unique digital assets that can represent ownership of virtual land, avatars, and other digital items.

- NFTs can be traded on marketplaces, enabling users to buy, sell, and trade virtual assets with ease.

- Cryptocurrency can also be used for governance within metaverse platforms. Decentralized Autonomous Organizations (DAOs) can empower users to participate in decision-making processes, such as voting on platform upgrades and development.

- DAOs can also manage the distribution of rewards and incentives within the metaverse, promoting a fair and transparent ecosystem.

The Impact of the Metaverse on Crypto Adoption

The metaverse has the potential to accelerate the adoption of cryptocurrencies by creating a real-world use case for digital assets.

- As the metaverse gains traction, the demand for cryptocurrencies as a means of payment and asset ownership will increase.

- The metaverse can also serve as a testing ground for new crypto technologies and applications, fostering innovation and development within the crypto space.

- The rise of the metaverse could lead to the creation of new cryptocurrencies and decentralized platforms specifically designed for virtual worlds.