Elon Musk Value Per User: A Deep Dive

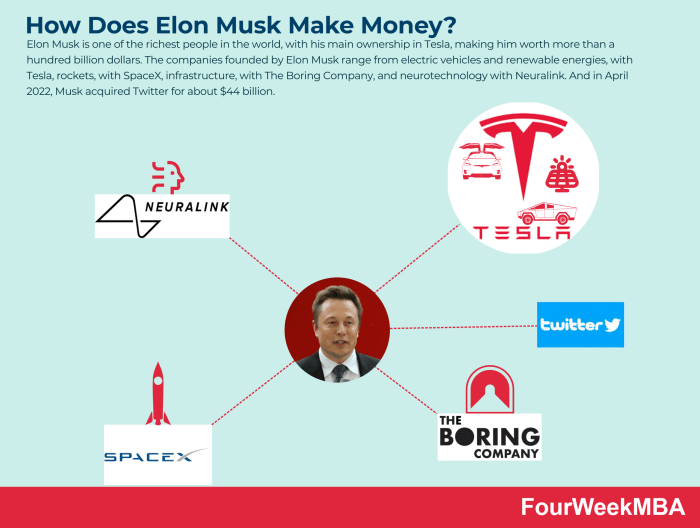

Elon Musk Value Per User: It’s a phrase that sparks curiosity. We’re all familiar with Elon Musk’s groundbreaking ventures like Tesla, SpaceX, and Twitter, but what’s the real value he extracts from each user? Is it simply about revenue, or is there something more nuanced at play?

In this blog post, we’ll dive into the complexities of calculating user value across Elon Musk’s diverse portfolio, exploring how factors like brand reputation, user engagement, and product innovation contribute to his companies’ success.

We’ll examine the different methods used to calculate value per user, taking into account the unique characteristics of each company. We’ll also consider the impact of user demographics, usage patterns, and market dynamics on the overall value proposition. Ultimately, this analysis will provide a comprehensive understanding of how Elon Musk’s companies leverage their user base to drive growth and innovation.

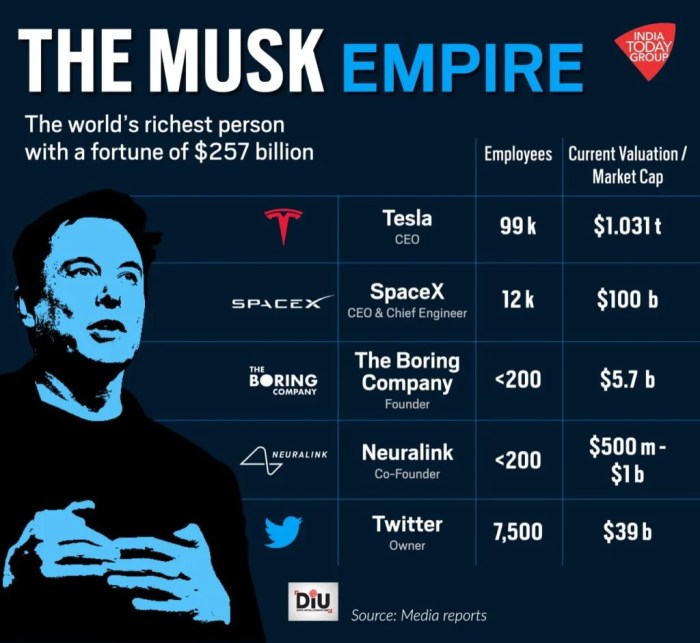

Understanding Elon Musk’s Companies and User Base

Elon Musk, a visionary entrepreneur, has built a diverse portfolio of companies across various industries. Each company caters to a distinct user base, with unique demographics and usage patterns. Understanding these differences is crucial for comprehending the reach and impact of Musk’s ventures.

Elon Musk’s value per user is a fascinating metric, especially when compared to other platforms. It’s interesting to see how his approach to user engagement, like the recent integration of Twitter into X, compares to the strategy of blockchain entrepreneurs like Gavin Wood, who’s actively pursuing chain mergers and acquisitions, as detailed in this insightful article: gavin wood chain mergers and acquisitions.

Ultimately, both Musk and Wood are pushing boundaries in their respective fields, and their approaches offer valuable insights into the future of technology and user engagement.

User Base Breakdown Across Elon Musk’s Companies

The following table provides an overview of the user base for major companies owned by Elon Musk:

| Company | Primary User Base | Number of Users | Demographics | Key Usage Patterns |

|---|---|---|---|---|

| Tesla | Electric vehicle owners and enthusiasts | Over 1.3 million | Primarily affluent, tech-savvy individuals interested in sustainability and innovation. | Daily commutes, long-distance travel, charging infrastructure, and access to Tesla’s software features. |

| SpaceX | Government agencies, commercial satellite operators, and researchers | Limited direct user base, but indirectly impacts millions through satellite internet services. | Government agencies, commercial businesses, and research institutions. | Space exploration, satellite communication, and launch services. |

| Social media users, news consumers, and public figures | Over 450 million monthly active users | Diverse demographics, ranging from teenagers to senior citizens, with varying interests and political affiliations. | News consumption, social interaction, and sharing opinions and information. | |

| Neuralink | Patients with neurological conditions, researchers, and technology enthusiasts | Limited user base currently, but potential for widespread adoption in the future. | Individuals with neurological disorders, researchers in the field of neurotechnology, and individuals interested in brain-computer interfaces. | Treatment of neurological conditions, brain-computer interfaces, and research on human cognition. |

| The Boring Company | Commuters, residents, and businesses in urban areas | Limited user base currently, but potential for widespread adoption in the future. | Urban dwellers, commuters, and businesses seeking faster and more efficient transportation options. | Underground transportation systems, tunnels, and high-speed transportation. |

Comparing and Contrasting User Bases

While each company serves a distinct user base, there are some commonalities and differences:* Tech-Savvy Users:Tesla, SpaceX, and Neuralink attract users who are generally tech-savvy and interested in cutting-edge technology.

Sustainability Focus Tesla’s focus on electric vehicles appeals to environmentally conscious consumers.

Global Reach Twitter’s user base is global, with users from diverse backgrounds and cultures.

Limited User Base SpaceX, Neuralink, and The Boring Company currently have limited user bases, but their potential for future growth is significant.

Calculating Value Per User: Elon Musk Value Per User

Understanding the value each user brings to Elon Musk’s companies is crucial for evaluating their performance and future growth. While revenue is a key indicator, it doesn’t capture the complete picture. To truly understand the value of each user, we need to delve deeper into metrics that reflect user engagement, loyalty, and potential future contributions.

Methods for Calculating Value Per User

Different methods can be used to calculate value per user, each providing a unique perspective on user contribution.

- Revenue Per User: This is the most straightforward method, simply dividing total revenue by the number of users. While easy to calculate, it only reflects current revenue generation and doesn’t account for potential future contributions or user engagement.

- Customer Lifetime Value (CLTV): This metric measures the total revenue a company expects to generate from a single user over their entire relationship with the company. It considers factors like purchase frequency, average order value, and customer churn rate. CLTV provides a more holistic view of user value, considering their potential future contributions.

- User Engagement Metrics: These metrics measure how actively users interact with a company’s products or services. Examples include website visits, app usage time, social media interactions, and content consumption. User engagement metrics provide insights into user interest and potential for future revenue generation.

Challenges and Limitations

Calculating value per user can be challenging, especially for companies with diverse business models like those owned by Elon Musk.

It’s fascinating to compare Elon Musk’s approach to value per user with Gavin Wood’s vision of chain mergers and acquisitions, as described in Gavin Wood: Chain Mergers &. While Musk focuses on building ecosystems with vast user bases, Wood envisions a more interconnected blockchain landscape, where chains can merge and optimize for efficiency.

Both strategies aim to create lasting value, but their paths to achieving that goal diverge significantly.

- Diverse Business Models: Companies like Tesla, SpaceX, and Neuralink operate in different industries with varying revenue streams and user engagement patterns. Calculating value per user across these diverse businesses requires considering specific metrics relevant to each sector.

- Long-Term Value: Some companies, like SpaceX, focus on long-term goals with potentially high future returns. Measuring value per user in such cases can be challenging as immediate revenue may be limited while long-term potential is significant.

- Data Availability and Accuracy: Accurately calculating value per user requires access to reliable and comprehensive user data. This can be challenging for companies with complex user bases and data collection systems.

Value per user is not a single, static metric. It requires careful consideration of different factors, including revenue, engagement, and long-term potential.

Factors Influencing Value Per User

Elon Musk’s companies are known for their innovative products and services, but what truly drives their success is the value they provide to their users. Understanding the factors that influence value per user is crucial for analyzing the financial performance of these companies and predicting their future growth.

Product Features, Elon musk value per user

The core products and services offered by Elon Musk’s companies play a significant role in determining value per user. For example, Tesla’s electric vehicles are known for their performance, range, and advanced technology features, which contribute to a higher perceived value compared to traditional gasoline-powered cars.

Similarly, SpaceX’s satellite internet service, Starlink, offers high-speed internet access to remote areas, creating value for users who would otherwise have limited connectivity.

Brand Reputation

Elon Musk’s companies have cultivated strong brand reputations, which significantly impact user perception and value. Tesla’s brand is associated with innovation, sustainability, and luxury, attracting a loyal customer base willing to pay a premium for its products. SpaceX’s brand is synonymous with ambitious space exploration and technological advancement, drawing in users who value its contribution to scientific progress.

User Experience

The user experience across Elon Musk’s companies is another key factor influencing value per user. Tesla’s vehicles are designed with a focus on user-friendliness and intuitive interfaces, enhancing the overall driving experience. SpaceX’s Starlink service provides a seamless and reliable internet connection, ensuring user satisfaction and promoting continued usage.

Elon Musk’s companies often boast high user engagement, but when you look at the value per user, the picture can be different. It’s interesting to compare this to the decentralized approach of Ethereum, where the value is distributed across the entire network.

For a deeper dive into the world of Ethereum, check out this article on Vitalik Buterin’s appearance on Bloomberg Studio 10: bloombergs studio 10 ethereum co founder vitalik buterin. Ultimately, the value per user is just one metric to consider, and it’s important to look at the bigger picture when evaluating the success of a company or technology.

Market Position

The market position of Elon Musk’s companies also contributes to value per user. Tesla holds a leading position in the electric vehicle market, enabling it to command higher prices and generate significant revenue. SpaceX’s Starlink service is rapidly expanding its coverage, providing it with a competitive advantage in the satellite internet market.

Table of Factors

The following table summarizes the key factors influencing value per user for Elon Musk’s companies:

| Company | Factor | Impact on Value Per User |

|---|---|---|

| Tesla | Product Features (performance, range, technology) | Higher perceived value, premium pricing |

| Tesla | Brand Reputation (innovation, sustainability, luxury) | Loyal customer base, premium pricing |

| Tesla | User Experience (user-friendliness, intuitive interfaces) | Enhanced driving experience, customer satisfaction |

| Tesla | Market Position (leading electric vehicle manufacturer) | Commanding higher prices, significant revenue |

| SpaceX | Product Features (high-speed internet, global coverage) | Value for users in remote areas, premium pricing |

| SpaceX | Brand Reputation (space exploration, technological advancement) | User loyalty, strong brand appeal |

| SpaceX | User Experience (seamless connectivity, reliable service) | User satisfaction, continued usage |

| SpaceX | Market Position (rapidly expanding satellite internet service) | Competitive advantage, potential for market dominance |

Comparative Analysis of Value Per User

Now that we have a good understanding of how to calculate value per user and the factors that influence it, let’s compare the value per user across Elon Musk’s companies. This will help us understand the relative performance of each company and identify any key trends.

Value Per User Comparison Across Companies

The value per user across Elon Musk’s companies varies significantly, reflecting the different business models, target markets, and strategic initiatives of each company.

Factors Driving Differences

Several factors contribute to the differences in value per user across Elon Musk’s companies, including:

- Industry Dynamics:Different industries have varying levels of competition, customer acquisition costs, and profit margins. For example, the electric vehicle market is highly competitive, while the space exploration industry has limited competition.

- Competitive Landscape:The competitive landscape also influences value per user. Companies with a dominant market share often enjoy higher value per user due to economies of scale and pricing power.

- Strategic Initiatives:Companies can use various strategic initiatives to increase value per user, such as product innovation, customer loyalty programs, and strategic partnerships.

Comparative Analysis Table

The following table summarizes the value per user for Elon Musk’s companies:

| Company | Industry | Value Per User (Estimated) | Factors Influencing Value Per User |

|---|---|---|---|

| Tesla | Electric Vehicle Manufacturing | $10,000

|

High product price, premium brand, strong customer loyalty, and potential for future software and services revenue. |

| SpaceX | Space Exploration | $100,000

|

High-value government and commercial contracts, limited competition, and potential for future space tourism and satellite internet services. |

| Social Media | $10

|

Large user base, advertising revenue model, and potential for monetization through subscription services and e-commerce. | |

| Neuralink | Brain-Computer Interface | N/A (Early Stage) | High potential for future revenue generation from medical and consumer applications, but currently in early stages of development. |

| The Boring Company | Infrastructure | $100

|

Potential for future revenue generation from tunneling and transportation services, but currently in early stages of development. |

Note:The value per user estimates are based on publicly available information and industry analysis. The actual value per user may vary depending on the specific methodology used and the assumptions made.

Implications for Future Growth

The value per user metric holds significant implications for the future growth of Elon Musk’s companies. A higher value per user indicates that each customer contributes more to the company’s revenue and profitability, which can fuel expansion, innovation, and overall success.

Strategies to Increase Value Per User

Increasing value per user is a key strategy for enhancing revenue and market share. This can be achieved through various methods, such as:

- Product Enhancements:Introducing new features, functionalities, or upgrades that provide greater value to users. This can encourage existing users to spend more and attract new users who are willing to pay for premium services. For example, Tesla’s Autopilot and Full Self-Driving features offer significant value to customers, increasing their willingness to pay a premium for Tesla vehicles.

- Subscription Models:Implementing subscription-based models can ensure a consistent revenue stream and incentivize users to remain engaged with the product or service. SpaceX’s Starlink satellite internet service operates on a subscription model, generating recurring revenue from its user base.

- Personalized Experiences:Tailoring user experiences to individual preferences can lead to increased engagement and loyalty. For example, Tesla’s software updates can be customized to meet specific user needs, such as adjusting driving modes or navigation settings.

- Cross-Selling and Upselling:Offering complementary products or services to existing users can increase their overall value to the company. For instance, Tesla’s solar panels and Powerwall battery storage systems are marketed to existing Tesla vehicle owners, providing additional revenue streams and enhancing the overall value proposition.

Impact on User Acquisition

A higher value per user can also influence user acquisition strategies. By demonstrating the value proposition of their products and services, Elon Musk’s companies can attract new customers who are willing to pay a premium for the benefits offered.

This can lead to faster user growth and a more robust customer base.