OPEC+ Considers Major Oil Cut to Boost Prices

Opec plus considering major production cut to prop up oil prices – OPEC+ Considers Major Oil Cut to Boost Prices: The global oil market is in a state of flux, with prices fluctuating wildly due to geopolitical tensions, supply chain disruptions, and the ongoing energy transition. In this volatile environment, OPEC+ – the alliance of oil-producing nations led by Saudi Arabia and Russia – is considering a significant production cut, a move that could send shockwaves through the global economy.

This potential cut, aimed at propping up oil prices, is being debated amidst a complex web of factors. While some argue that it’s necessary to stabilize the market and ensure energy security, others warn of the potential for higher inflation and economic hardship.

The decision to cut production, or not, will have far-reaching consequences, impacting everything from consumer spending to geopolitical stability.

OPEC+ Production Cuts

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known collectively as OPEC+, are considering a significant production cut to support oil prices. This decision comes amidst a backdrop of global economic uncertainty and fluctuating oil prices.

Background and Context

The global oil market is currently experiencing a complex interplay of factors. On one hand, demand for oil is recovering from the COVID-19 pandemic, as economies reopen and travel resumes. However, this recovery is being tempered by concerns about global inflation, rising interest rates, and potential recessions in major economies.

OPEC+ considering a major production cut to prop up oil prices is a move that’s sure to send ripples through the global economy. It’s a reminder of the complex dynamics at play in the energy sector, and how even seemingly small changes can have a major impact.

This situation also brings to mind Gavin Wood’s insightful thoughts on “Chain Mergers & Acquisitions,” as outlined in his blog post Gavin Wood: Chain Mergers &. While Wood focuses on the blockchain space, his analysis of consolidation and strategic partnerships can be applied to understand the evolving landscape of the oil industry as well.

The OPEC+ decision underscores the importance of navigating these shifting dynamics, and finding ways to achieve stability and growth in an increasingly interconnected world.

On the other hand, supply is constrained by geopolitical tensions, particularly the ongoing conflict in Ukraine, which has disrupted Russian oil production and exports. This confluence of factors has led to volatile oil prices, creating a challenging environment for producers and consumers alike.

Historical Context for OPEC+ Production Cuts

OPEC+ has a history of using production cuts to influence oil prices. The group, which includes major oil producers like Saudi Arabia, Russia, and the United Arab Emirates, has often intervened in the market to stabilize prices or to respond to supply and demand imbalances.

For instance, in 2020, OPEC+ implemented a historic production cut in response to the sharp decline in oil demand caused by the COVID-19 pandemic.

Motivations Behind the Potential Cut

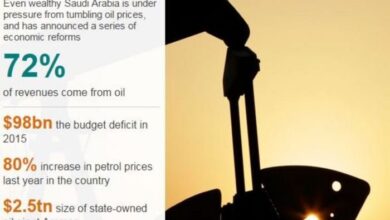

The primary motivation behind the potential production cut is to prop up oil prices. OPEC+ members, particularly Saudi Arabia, are seeking to ensure stable and profitable oil prices to support their economies. They also aim to discourage investment in alternative energy sources, which could eventually erode their market share.

Potential Impact of the Cut on Oil Prices

A significant production cut by OPEC+ would likely lead to a surge in oil prices. The reduction in supply would outpace demand, creating a supply shortage and driving prices higher. The magnitude of the price increase would depend on the size of the cut and the overall market conditions.

“A significant production cut by OPEC+ would likely lead to a surge in oil prices. The reduction in supply would outpace demand, creating a supply shortage and driving prices higher.”

Potential Impacts of Production Cuts: Opec Plus Considering Major Production Cut To Prop Up Oil Prices

OPEC+ production cuts, while aiming to bolster oil prices, will have a multifaceted impact on both oil-producing and consuming nations. The extent of these impacts will depend on the severity of the cuts and the duration of their implementation. A deeper analysis of these potential consequences reveals a complex interplay of economic, geopolitical, and social factors.

OPEC+ is considering a major production cut to prop up oil prices, which could have a significant impact on global energy markets. This kind of move is reminiscent of the strategic acquisitions and mergers seen in the blockchain space, particularly with Gavin Wood’s chain mergers and acquisitions , where consolidation and strategic partnerships are key to gaining dominance.

While the oil industry operates on a different scale, the underlying principles of market manipulation and control remain similar, making the OPEC+ decision a fascinating case study in global economics.

Economic Implications for Oil-Producing and Consuming Nations

The economic implications of production cuts are significant and will vary based on a nation’s status as an oil producer or consumer. Oil-producing nations stand to benefit from higher oil prices, which can lead to increased government revenues, improved balance of payments, and potentially, increased investment in the oil sector.

OPEC+ is considering a major production cut to prop up oil prices, a move that could have significant ripple effects on the global economy. It’s a complex situation, and it’s fascinating to see how this decision might impact other markets, like cryptocurrency.

I recently watched an interview with Vitalik Buterin, the co-founder of Ethereum, on Bloomberg Studio 10 bloombergs studio 10 ethereum co founder vitalik buterin , and his insights on the future of finance were really thought-provoking. It’s interesting to think about how events in the energy sector might influence the evolution of blockchain technology and the broader financial landscape.

However, the positive impact on individual producers depends on factors like the country’s production capacity, cost of production, and the level of government control over the oil industry. For oil-consuming nations, higher oil prices present a challenge. They can lead to increased energy costs, which can translate into higher inflation, reduced consumer spending, and a decline in economic growth.

These nations might also face a trade deficit if they import more oil at higher prices.

Impact on Inflation and Consumer Spending

Higher oil prices directly impact inflation, as they raise the cost of transportation, energy, and various goods and services. This can lead to a decrease in consumer spending, as households face higher costs for necessities, leaving less disposable income for discretionary spending.

This can create a vicious cycle, where reduced consumer spending further dampens economic growth.

For example, during the 2008 oil price surge, inflation in the United States reached 3.8%, while consumer spending declined significantly.

Effects on Energy Security and Geopolitical Stability

Production cuts can have significant implications for energy security and geopolitical stability. By reducing oil supply, they can exacerbate existing tensions and create new ones, especially in regions reliant on imported oil.

For instance, the 1973 oil crisis, triggered by an OPEC oil embargo, led to a global energy crisis, highlighting the vulnerability of consuming nations to supply disruptions.

Additionally, production cuts can create an uneven playing field, potentially giving oil-producing nations greater leverage in international affairs. This can lead to increased competition for resources and influence, creating geopolitical instability.

Consequences of Different Cut Levels

The severity of the production cuts will directly influence the magnitude of the impacts. Deeper cuts will likely result in more significant price increases, leading to greater economic challenges for oil-consuming nations and more significant geopolitical ramifications. However, smaller cuts might be more manageable, allowing for a more gradual adjustment in oil markets and mitigating some of the negative consequences.

Market Reactions and Responses

The decision by OPEC+ to significantly cut oil production will undoubtedly send ripples through the global energy market. This move is expected to trigger a range of reactions from key players, including oil companies, investors, consuming countries, and even the alternative energy sector.

Understanding these responses is crucial to predicting the overall impact of the production cuts on the oil market and the global economy.

Reactions of Oil Companies and Investors

Oil companies, particularly those involved in production, are likely to welcome the production cuts. Reduced supply typically translates into higher oil prices, boosting their profits. This could lead to increased investment in exploration and production activities, particularly in regions with high potential.

Investors, on the other hand, may see this as an opportunity to invest in oil-related assets, anticipating higher returns. However, the long-term impact on investor sentiment remains uncertain, as concerns about the environmental impact of fossil fuels and the transition to renewable energy sources persist.

Responses from Consuming Countries

Consuming countries, particularly those heavily reliant on oil imports, face a challenging situation. Higher oil prices could lead to increased inflation, impacting consumer spending and economic growth. Governments may respond with a range of measures, including:

- Price controls:Imposing price caps on fuel products to mitigate the impact of higher oil prices on consumers. However, this could lead to shortages and black markets.

- Tax adjustments:Adjusting fuel taxes to offset the increase in oil prices, but this could reduce government revenue.

- Investment in alternatives:Accelerating investments in renewable energy sources and energy efficiency measures to reduce dependence on oil.

Impact on Alternative Energy Sources

The production cuts could indirectly benefit alternative energy sources. Higher oil prices might make renewable energy technologies, such as solar and wind power, more economically attractive. This could accelerate the transition to cleaner energy sources, potentially reducing the long-term demand for oil.

However, the extent of this impact depends on factors like government policies, technological advancements, and the availability of investment capital.

Potential Reactions to OPEC+ Production Cuts

| Actor | Potential Response | Expected Impact on Oil Prices |

|---|---|---|

| Oil Companies | Increased investment in exploration and production | Potentially higher oil prices, as supply is reduced further |

| Investors | Increased investment in oil-related assets | Potentially higher oil prices, driven by increased demand for oil assets |

| Consuming Countries | Price controls, tax adjustments, investment in alternatives | Potentially higher oil prices, as demand remains relatively stable |

| Alternative Energy Sector | Increased investment in renewable energy technologies | Potentially lower oil prices in the long term, as demand for oil decreases |

Future Outlook and Implications

The OPEC+ production cut, while intended to stabilize oil prices in the short term, carries significant implications for the long-term health of the global oil market. These cuts could potentially lead to higher oil prices, increased geopolitical tensions, and shifts in global energy dynamics.

Long-Term Effects on the Oil Market

The production cut could lead to several long-term effects on the oil market. One of the most significant is the potential for higher oil prices. If supply remains tight, oil prices could remain elevated for an extended period, impacting consumers and businesses globally.

Furthermore, the cut could encourage increased investment in alternative energy sources, accelerating the transition to a lower-carbon economy. This shift could lead to a more diverse energy mix, potentially reducing reliance on oil in the long run.

Geopolitical Tensions

The production cut could exacerbate geopolitical tensions related to oil supply. Countries heavily reliant on imported oil could face challenges securing adequate supplies, potentially leading to political instability or disputes over access to resources. The cut could also strengthen the influence of OPEC+ countries in global energy markets, potentially creating new power dynamics.

For instance, countries like Saudi Arabia could exert greater control over oil prices and production, impacting global energy security.

Timeline of Key Events and their Impact on Oil Prices, Opec plus considering major production cut to prop up oil prices

The OPEC+ production cut could have a significant impact on oil prices in the coming months and years. Here’s a potential timeline of key events and their impact on oil prices:

- Short-Term (Next 6 Months):The initial impact of the production cut is likely to be a surge in oil prices. This could be amplified by any geopolitical events or economic shocks that disrupt supply chains.

- Medium-Term (Next 12-18 Months):Oil prices could stabilize at a higher level than before the cut, as demand adjusts to the reduced supply. However, this depends on factors like global economic growth, the effectiveness of alternative energy sources, and any further OPEC+ decisions.

- Long-Term (Beyond 2 Years):The long-term impact is uncertain and depends on several factors. If demand remains robust and alternative energy sources fail to significantly reduce reliance on oil, prices could remain elevated. Conversely, if demand weakens or alternative energy sources gain traction, oil prices could decline.

Potential Scenarios for the Global Oil Market in the Next Year

The global oil market could experience various scenarios in the next year, influenced by the OPEC+ production cut, global economic conditions, and geopolitical events. Here are three potential scenarios:

- Scenario 1: Tight Supply and Higher Prices:The OPEC+ production cut combined with robust global economic growth and geopolitical instability could lead to a tight oil market and significantly higher prices. This scenario could benefit OPEC+ countries, but it could also strain economies heavily reliant on imported oil.

- Scenario 2: Stable Prices and Gradual Transition:A moderate economic recovery and increased investment in renewable energy could lead to stable oil prices and a gradual shift towards a more diverse energy mix. This scenario would provide a balanced approach, allowing for continued oil consumption while encouraging the development of alternative energy sources.

- Scenario 3: Lower Prices and Increased Volatility:A global economic slowdown or a sudden shift in consumer preferences towards electric vehicles could lead to lower oil prices and increased market volatility. This scenario could benefit consumers but could also impact the oil industry’s profitability and investment in new projects.