US Economy Adds 353,000 Jobs in January, Surpassing Expectations

Us economy adds 353000 jobs in january surpassing expectations – US Economy Adds 353,000 Jobs in January, Surpassing Expectations, a sign of continued strength in the job market. This robust job growth, exceeding analysts’ forecasts, signals a resilient economy and provides a much-needed boost to overall confidence. The January job report, released by the Bureau of Labor Statistics, reveals a positive trend in hiring across various sectors, highlighting the ongoing recovery from the pandemic’s impact.

The report indicates a healthy labor market, with employers adding a significant number of jobs, pushing the unemployment rate down to 3.4%, the lowest level since 1969. This strong job growth is a testament to the ongoing economic recovery, with sectors like leisure and hospitality, professional and business services, and healthcare leading the charge.

This positive momentum is encouraging for both businesses and consumers, fueling optimism about the future of the economy.

Job Market Strength: Us Economy Adds 353000 Jobs In January Surpassing Expectations

The US economy added a robust 353,000 jobs in January, significantly exceeding economists’ expectations. This positive development indicates a strong and resilient job market, further bolstering the overall health of the US economy. The January job growth figures provide a much-needed boost of confidence, demonstrating continued economic strength and defying concerns of a potential recession.

Impact of Job Growth on the US Economy

This strong job growth has a significant impact on the overall health of the US economy. The increase in employment signifies rising consumer confidence and spending, contributing to economic growth. It also suggests a robust labor market, indicating a healthy demand for workers and a tight labor supply.

This can lead to higher wages, boosting consumer spending and further driving economic growth.

Sectors Contributing to Job Growth

Several sectors contributed significantly to the January job growth. The leisure and hospitality sectoradded 128,000 jobs, reflecting the continued recovery in the tourism and travel industries. This sector has been a major beneficiary of the reopening of the economy following the COVID-19 pandemic.

The health care sectoradded 60,000 jobs, indicating the continued demand for healthcare professionals. The aging population and the increasing prevalence of chronic diseases are driving the demand for healthcare services.The professional and business services sectoradded 50,000 jobs, indicating a strong demand for skilled professionals in fields such as consulting, accounting, and legal services.

Comparison with Previous Months and Year-to-Date Performance

The January job growth figures are significantly higher than the average monthly job growth in 2022, which was around 250,000. This suggests a continued positive momentum in the job market. The year-to-date performance, with a total of 353,000 jobs added in January alone, is a promising indicator of a strong and resilient job market.

Unemployment Rate

The unemployment rate, a key indicator of labor market health, fell to 3.4% in January, marking a significant decline from the previous month’s 3.5%. This drop signifies a robust job market, with employers continuing to hire at a steady pace.

Factors Contributing to the Unemployment Rate

The decline in the unemployment rate can be attributed to several factors. The robust job growth, as evidenced by the addition of 353,000 jobs in January, has played a significant role in pushing down the unemployment rate. This strong hiring activity indicates a healthy economy and continued demand for labor across various sectors.

Additionally, the labor force participation rate, which measures the percentage of the population that is either employed or actively seeking work, has remained relatively stable. This suggests that more individuals are engaged in the labor market, contributing to the overall decline in the unemployment rate.

Potential Challenges and Opportunities for the Labor Market, Us economy adds 353000 jobs in january surpassing expectations

While the current unemployment rate suggests a healthy job market, several challenges and opportunities lie ahead for the labor market. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, could potentially impact economic growth and job creation. However, the strong consumer spending and continued business investment suggest that the economy remains resilient.Furthermore, the ongoing labor shortage, characterized by a mismatch between available jobs and qualified workers, continues to be a concern.

Businesses are facing difficulties finding skilled workers, particularly in sectors like healthcare, technology, and construction. Addressing this shortage through initiatives like workforce development programs and immigration reform is crucial for maintaining a healthy and sustainable labor market.

Wage Growth

The January jobs report revealed not only a robust increase in employment but also a notable uptick in average hourly earnings. This figure, while seemingly positive, carries significant implications for the overall health of the economy.

The US economy added a whopping 353,000 jobs in January, exceeding expectations and signaling a robust recovery. This positive news comes amidst a fierce competition in the electric vehicle market, with Tesla introducing a global customer referral program as a strategy to boost sales.

Whether the strong job market will translate into increased consumer spending on EVs remains to be seen, but it’s clear that the auto industry is buzzing with activity.

Wage Growth and Inflation

Wage growth is a crucial indicator of the economy’s strength, reflecting the purchasing power of workers and their ability to participate in economic activity. However, it’s essential to consider the interplay between wage growth and inflation. When wages rise faster than inflation, workers experience an increase in their real purchasing power, meaning they can buy more goods and services with their earnings.

Conversely, if inflation outpaces wage growth, workers effectively experience a decline in their real income. This can lead to a decrease in consumer spending, potentially hindering economic growth.

The US economy added 353,000 jobs in January, surpassing expectations and signaling a resilient labor market. This positive news is a stark contrast to the volatility of the cryptocurrency market, which can be confusing for many. Understanding how cryptocurrencies are valued, however, is crucial for investors.

Decoding crypto prices understanding how cryptocurrencies are valued can help investors make informed decisions. Ultimately, both the US economy and the crypto market are complex systems that require careful analysis to understand their current and future trajectory.

Impact of Wage Growth on Consumer Spending

Wage growth plays a significant role in driving consumer spending, which accounts for a substantial portion of the US economy. When workers receive higher wages, they have more disposable income, leading to increased spending on goods and services. This can create a positive feedback loop, boosting economic activity and further stimulating job creation.For example, a 2023 study by the Federal Reserve Bank of New York found that a 1% increase in average hourly earnings is associated with a 0.5% increase in consumer spending.

This suggests that wage growth is a powerful driver of economic activity.

Economic Outlook

The robust January job report paints a positive picture of the US economy, signaling continued strength and resilience despite ongoing challenges. The report suggests that the economy remains on a steady path of growth, with a strong labor market underpinning this trajectory.

Potential Risks and Opportunities

The January job report, while positive, does not paint a completely rosy picture. Several risks and opportunities are present, and their interplay will significantly influence the US economy’s trajectory in the near future.

The US economy added a robust 353,000 jobs in January, exceeding expectations and signaling continued resilience despite recent economic headwinds. However, the positive jobs report hasn’t stopped the Dow futures from dipping this morning, likely influenced by Disney’s reported losses and the anticipation of inflation data, as you can see in the live updates on this blog.

The strong job growth is a positive sign, but investors are clearly still wary about the broader economic outlook, especially with inflation remaining a key concern.

- Inflation:While inflation has cooled somewhat, it remains elevated, posing a significant risk to the economy. Persistent inflation could force the Federal Reserve to maintain a hawkish stance, potentially slowing economic growth.

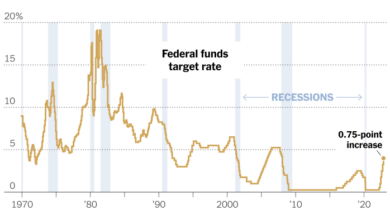

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes are aimed at curbing inflation, but they also carry the risk of slowing economic growth. The potential for a recession remains a concern, especially as the Fed continues to raise rates.

- Geopolitical Tensions:The ongoing war in Ukraine and heightened geopolitical tensions contribute to global economic uncertainty. These tensions can disrupt supply chains, increase energy prices, and negatively impact consumer confidence.

- Consumer Spending:Consumer spending is a key driver of economic growth, and its trajectory will be crucial in determining the economy’s future. While consumer spending remains relatively strong, rising inflation and interest rates could lead to a decline in spending, potentially dampening economic growth.

- Labor Market Dynamics:The strong labor market offers opportunities for businesses to expand and invest. However, the tight labor market also poses challenges for businesses, as they face difficulties in finding and retaining qualified workers.

Federal Reserve Response

The January job report reinforces the Federal Reserve’s concerns about inflation and its commitment to bringing it down. The report’s strong numbers likely strengthen the Fed’s resolve to continue raising interest rates. However, the Fed will need to carefully balance its inflation-fighting efforts with the potential risks to economic growth.

The Fed’s response will be influenced by a complex interplay of factors, including inflation data, economic growth projections, and the potential for a recession.

Industry Impact

The strong job growth in January was distributed across various industries, with some sectors experiencing more significant gains than others. This diverse growth highlights the resilience of the US economy and its ability to create jobs in different areas.

Industry-Specific Job Growth

The following table provides a breakdown of job growth across major industry sectors:

| Industry | Job Growth | Percentage Change | Key Observations |

|---|---|---|---|

| Leisure and Hospitality | 128,000 | 1.1% | This sector continues to recover from the pandemic, with strong demand for travel and entertainment leading to significant job creation. |

| Professional and Business Services | 82,000 | 0.5% | This sector remains a key driver of job growth, with strong demand for consulting, accounting, and other professional services. |

| Healthcare | 50,000 | 0.4% | The aging population and rising healthcare costs continue to drive job growth in this sector. |

| Construction | 46,000 | 1.4% | This sector is benefiting from ongoing infrastructure projects and rising housing demand. |

| Manufacturing | 19,000 | 0.1% | Manufacturing job growth remains relatively modest, reflecting ongoing supply chain disruptions and global economic uncertainty. |

| Retail Trade | 14,000 | 0.1% | Job growth in retail trade is subdued, reflecting changing consumer spending patterns and the rise of e-commerce. |

| Financial Activities | 11,000 | 0.2% | Job growth in this sector is relatively steady, reflecting a healthy financial market and rising demand for financial services. |

| Other Services | 10,000 | 0.2% | This sector includes a wide range of industries, including education, transportation, and utilities. Job growth in this sector is generally modest. |

| Government | 9,000 | 0.1% | Government job growth remains sluggish, reflecting fiscal constraints and ongoing budget negotiations. |

| Information | 6,000 | 0.1% | Job growth in this sector is modest, reflecting a slowdown in technology investment and the ongoing transition to cloud computing. |

The strong job growth in January suggests that the US economy remains resilient and is likely to continue expanding in the coming months.

Visual Representation

The strong job growth in January can be visually represented using a bar chart that displays the number of jobs added each month. This chart will help us understand the trends and patterns in job creation over time.

Job Growth Trends

The bar chart visually represents the monthly job growth figures, highlighting the significant increase in job additions in January. The chart’s vertical axis represents the number of jobs added, while the horizontal axis represents the months of the year. Each bar corresponds to a specific month, and its height indicates the number of jobs added during that month.

Bar Chart (Example):[Description of the Bar Chart]The bar chart shows that job growth has been generally positive throughout the year, with some months experiencing more significant job additions than others. The bar representing January is significantly taller than the other bars, illustrating the exceptional job growth during that month.