Dow Milestone, Earnings Reports: Shaping Stock Market Direction

Stock market update earnings reports influence direction amidst dow milestone – The Dow Jones Industrial Average recently hit a historic milestone, sparking conversations about its impact on investor sentiment and the broader market. This milestone, coupled with the ongoing influence of corporate earnings reports, is creating a dynamic landscape for stock market performance.

As investors digest these factors, the market’s direction remains in flux, prompting us to delve into the intricacies of this complex interplay.

Recent earnings reports have been a key driver of market movement, with certain sectors and companies experiencing significant gains or losses based on their financial performance. Positive earnings surprises have often led to stock price increases, while negative surprises have resulted in declines.

This interplay between earnings reports and market direction highlights the importance of fundamental analysis and understanding the underlying health of individual companies and the overall economy.

Dow Milestone Impact: Stock Market Update Earnings Reports Influence Direction Amidst Dow Milestone

The recent surge in the Dow Jones Industrial Average (DJIA) has pushed it to a historic milestone, marking a significant achievement for the US stock market. This milestone has generated considerable buzz and speculation, with many investors wondering about its implications for the future.

Psychological Impact on Investor Sentiment, Stock market update earnings reports influence direction amidst dow milestone

The psychological impact of milestones on investor sentiment is a complex and often debated topic. While the milestone itself doesn’t directly impact the underlying fundamentals of the market, it can significantly influence investor psychology. The achievement of a new high can instill a sense of confidence and optimism, potentially encouraging further investment and driving the market higher.

The stock market’s recent direction has been influenced by a combination of factors, including strong earnings reports and the Dow Jones Industrial Average hitting a new milestone. However, the market took a step back today as investors eagerly await the release of Nvidia’s earnings report and the minutes from the Federal Reserve’s latest meeting.

These events, as highlighted in this article , could provide further insights into the future trajectory of the market, making it a crucial week for investors.

This phenomenon is often referred to as the “momentum effect.”

“The Dow hitting a new high is a psychological boost for investors, who may be more inclined to buy stocks when they see the market performing well.”

[Source

Financial Expert]

Conversely, the achievement of a milestone can also trigger a sense of complacency or overconfidence, leading to a “sell-the-news” reaction. Investors may perceive the milestone as a peak and believe the market is due for a correction.

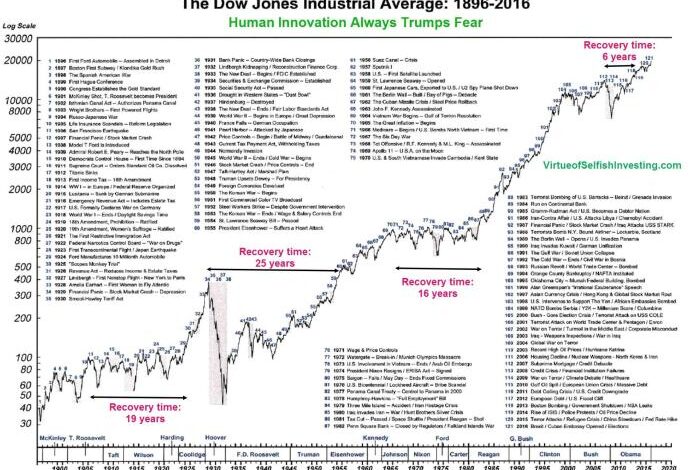

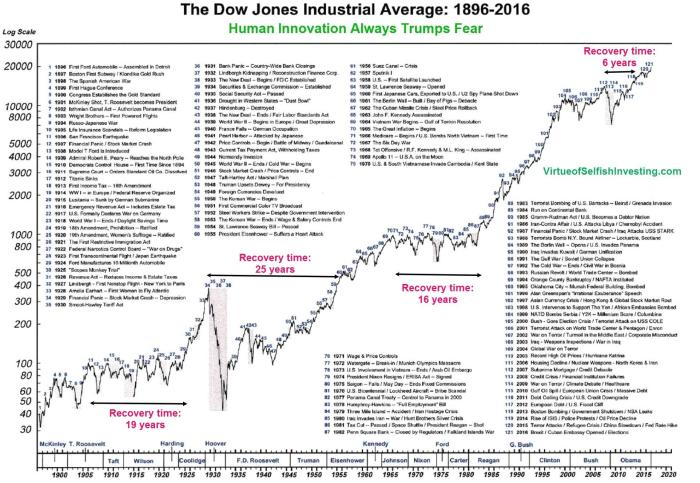

Historical Perspective on Milestone Impact

Throughout history, the DJIA has reached numerous milestones, each with its own unique impact on the market. Some milestones have been followed by extended periods of growth, while others have preceded corrections or bear markets. For example, the DJIA surpassed the 10,000-point mark in 1999, followed by a period of significant growth in the late 1990s, culminating in the dot-com bubble.

The stock market’s direction is heavily influenced by earnings reports, and the recent Dow milestone is a testament to that. While investors digest those figures, it’s worth noting the positive impact of global trade agreements like the one forged between the EU and New Zealand, projected to increase bilateral trade by 30%.

This kind of economic collaboration can boost confidence and create opportunities for growth, factors that ultimately feed back into the stock market’s performance.

However, the DJIA reached 14,000 in 2007, shortly before the financial crisis of 2008.It is crucial to note that the impact of milestones on market behavior is often influenced by other factors, such as economic conditions, interest rates, and geopolitical events.

While milestones can serve as psychological markers, they should not be interpreted as predictors of future market performance.

Earnings Reports Influence

Earnings reports play a pivotal role in shaping the direction of the stock market, influencing investor sentiment and driving stock price fluctuations. These reports provide a snapshot of a company’s financial health, revealing its profitability, revenue growth, and future prospects.

Investors closely scrutinize these reports to gauge a company’s performance and make informed investment decisions.

Impact of Earnings Reports on Stock Prices

Earnings reports can significantly impact stock prices, depending on whether they meet or exceed analysts’ expectations.

- Positive Earnings Surprises:When a company reports earnings that are higher than anticipated, it generally signals strong financial performance and positive future prospects. This often leads to an increase in stock price as investors become more optimistic about the company’s growth potential.

For example, if a tech company reports revenue growth exceeding expectations, investors might perceive this as a sign of strong product demand and increased market share, leading to a surge in stock price.

- Negative Earnings Surprises:Conversely, when a company reports earnings that fall short of expectations, it can trigger a decline in stock price. This suggests that the company may be facing challenges, such as declining sales, increased costs, or competitive pressures. Investors might become less confident in the company’s future prospects, leading to a sell-off.

For instance, if an automotive manufacturer reports a decline in sales due to supply chain disruptions, investors might interpret this as a sign of weakness and reduce their holdings, resulting in a drop in stock price.

Key Sectors Influencing Market Direction

Specific sectors often exhibit heightened sensitivity to earnings reports, driving significant market movements.

- Technology Sector:The tech sector is known for its rapid innovation and growth potential. Earnings reports from leading tech companies like Apple, Microsoft, and Amazon can have a substantial impact on the overall market direction. Strong earnings from these companies can boost investor confidence in the sector, leading to broader market gains.

The stock market’s direction is heavily influenced by earnings reports, especially when the Dow hits milestones. But sometimes, external factors like the weather can throw a wrench into the mix. Take the recent dip in Bitcoin’s hash rate, for example, which was directly affected by the Texas freeze as reported by The Venom Blog.

These kinds of events can have a ripple effect on the market, reminding us that even with strong earnings, unforeseen circumstances can still influence the overall direction of the markets.

Conversely, disappointing earnings from tech giants can trigger a sell-off, particularly if it signals broader concerns about the tech industry’s growth prospects.

- Energy Sector:The energy sector is highly sensitive to global economic conditions and commodity prices. Earnings reports from oil and gas companies can significantly influence market sentiment, especially during periods of volatility in oil prices. Strong earnings from energy companies, driven by higher oil prices or increased production, can signal a positive outlook for the broader economy and drive market gains.

However, weak earnings from energy companies, often attributed to declining oil prices or operational challenges, can create concerns about economic growth and trigger market downturns.

Market Volatility and Direction

The stock market is a dynamic and unpredictable entity, constantly fluctuating in response to a myriad of factors. Understanding the drivers of market volatility and the forces shaping its direction is crucial for investors seeking to navigate the complexities of the financial landscape.

Current Market Volatility and Its Drivers

Market volatility, often measured by the VIX index, is a reflection of the degree of uncertainty and risk perception in the market. Several factors can contribute to increased volatility, including:

- Economic Data Releases:Unexpected economic indicators, such as inflation reports, employment figures, and manufacturing data, can trigger market reactions. For instance, a higher-than-expected inflation reading could lead to increased volatility as investors adjust their expectations for interest rate hikes.

- Geopolitical Events:Global events like wars, political instability, and trade tensions can significantly impact market sentiment and volatility. The ongoing conflict in Ukraine, for example, has created uncertainty and contributed to market fluctuations.

- Interest Rate Changes:Central banks’ decisions on interest rates play a vital role in shaping market direction. Rising interest rates can make borrowing more expensive, potentially slowing economic growth and impacting corporate earnings, thus leading to increased volatility.

- Corporate Earnings Reports:Companies’ financial performance, as reflected in their earnings reports, can influence individual stock prices and overall market sentiment. Unexpected earnings surprises, both positive and negative, can trigger significant price movements.

- Market Psychology and Investor Sentiment:Market psychology, driven by factors like fear, greed, and herd behavior, can amplify volatility. When investor confidence is high, markets tend to rise, but when fear prevails, markets can experience sharp declines.

Factors Contributing to Market Direction

The direction of the stock market is influenced by a complex interplay of economic, political, and psychological factors. Some of the key drivers include:

- Economic Growth:Strong economic growth typically supports a bullish market, as companies tend to perform well and investors are optimistic about future prospects. Conversely, slowing economic growth can lead to a decline in stock prices.

- Inflation and Interest Rates:High inflation erodes purchasing power and can lead to higher interest rates, which can negatively impact corporate profits and stock valuations. Conversely, controlled inflation and low interest rates can foster economic growth and support a rising market.

- Government Policies:Fiscal and monetary policies implemented by governments can have a significant impact on the stock market. For example, tax cuts can stimulate economic activity and boost stock prices, while increased government spending can lead to higher inflation.

- Technological Advancements:Innovations in technology can create new industries and drive economic growth, positively impacting the stock market. The rise of the internet, e-commerce, and artificial intelligence, for example, has created significant investment opportunities.

- Global Economic Conditions:The performance of other major economies can influence the direction of the US stock market. For instance, a slowdown in China’s economy could negatively impact US companies with significant exposure to the Chinese market.

Potential Short-Term and Long-Term Market Trends

Predicting the future direction of the stock market is a challenging endeavor, but analyzing current data and trends can provide insights into potential short-term and long-term market movements.

Short-Term Trends

- Interest Rate Hikes:The Federal Reserve’s aggressive interest rate hikes have already impacted the market, and further increases could lead to continued volatility and potential market corrections.

- Inflation Concerns:Persistent inflation remains a concern for investors, and continued price increases could dampen economic growth and impact corporate profits.

- Geopolitical Risks:The ongoing conflict in Ukraine and tensions with China pose risks to global stability and could create market uncertainty.

Long-Term Trends

- Technological Innovation:Continued advancements in technology, particularly in areas like artificial intelligence, renewable energy, and biotechnology, are likely to create long-term growth opportunities.

- Demographic Shifts:Aging populations and growing demand for healthcare and retirement services present potential investment opportunities.

- Climate Change:The increasing focus on sustainability and climate change mitigation creates opportunities for companies involved in renewable energy, green technologies, and sustainable practices.

Economic Indicators and Outlook

The recent performance of the stock market has been influenced by a complex interplay of economic indicators, including inflation, interest rates, and unemployment. Understanding these factors is crucial for investors seeking to navigate market volatility and make informed decisions.

Inflation and Interest Rates

Inflation remains a key concern for investors and central banks alike. The Federal Reserve has been aggressively raising interest rates to combat inflation, which has a direct impact on the stock market. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate profits.

Consequently, investors may become more cautious about investing in stocks, leading to market corrections.

Unemployment

The unemployment rate is another significant economic indicator that can influence stock market performance. A low unemployment rate generally indicates a healthy economy, which can boost consumer spending and corporate profits. However, if unemployment rises, it can signal a weakening economy and potentially lead to stock market declines.

Global Economic Conditions

The global economic outlook also plays a crucial role in shaping market sentiment. Geopolitical events, such as the ongoing war in Ukraine, can disrupt supply chains, increase energy prices, and create uncertainty in the global economy. These factors can negatively impact stock markets worldwide.

The Role of Geopolitical Events

Geopolitical events, such as wars, trade disputes, and political instability, can have a significant impact on stock market performance. These events often create uncertainty and volatility, leading to investor anxiety and potentially triggering market sell-offs.

For example, the ongoing war in Ukraine has already had a significant impact on global energy markets, leading to higher prices and increased inflation.

Economic Outlook and Market Direction

The economic outlook for the coming months and years is uncertain, with a range of factors potentially influencing market direction. The Federal Reserve’s monetary policy, inflation trends, and global economic conditions will all play a role in determining the path of the stock market.

Economists are closely monitoring inflation data and the Fed’s actions to gauge the potential for a recession.

Investor Sentiment and Strategies

Investor sentiment, a gauge of market psychology, plays a crucial role in shaping market behavior. It reflects the collective mood of investors towards the market, influenced by factors like economic data, earnings reports, and geopolitical events. Understanding current investor sentiment can offer valuable insights into potential market direction.

Investor Sentiment Analysis

Investor sentiment can be assessed through various indicators, including:

- Investor Surveys:These surveys gauge the optimism or pessimism of individual investors and financial professionals. The American Association of Individual Investors (AAII) Sentiment Survey, for example, provides weekly insights into investor confidence.

- Market Breadth:The number of stocks advancing versus declining can reflect the overall market mood. A broad advance indicates positive sentiment, while a decline in advancing stocks suggests pessimism.

- Volatility:High market volatility often signals heightened uncertainty and anxiety among investors, indicating a negative sentiment. Conversely, low volatility may suggest a more relaxed and confident market.

- Options Activity:The ratio of put options (bets on declining prices) to call options (bets on rising prices) can reveal investor sentiment. A high put-to-call ratio indicates a bearish outlook.

Popular Investment Strategies

Investors employ various strategies based on their risk tolerance, investment goals, and market outlook. Here are some prominent approaches:

- Value Investing:This strategy focuses on identifying undervalued companies with strong fundamentals and long-term growth potential. Value investors aim to capitalize on market inefficiencies and buy stocks at a discount.

- Growth Investing:Growth investors prioritize companies with rapid earnings growth, often in emerging industries or sectors. This strategy emphasizes potential for significant capital appreciation.

- Momentum Investing:This strategy involves identifying stocks with strong price momentum, often those experiencing rapid price gains. Momentum investors believe that trends tend to continue.

- Index Investing:Index investors aim to track the performance of a specific market index, such as the S&P 500. This strategy provides broad market exposure and seeks to minimize active management fees.

- Passive Investing:Passive investing involves holding a diversified portfolio of assets for the long term, minimizing trading activity and relying on market returns. This approach emphasizes long-term growth and avoids active market timing.

Factors Influencing Investor Decisions

Several factors can influence investor decisions, leading to various market outcomes: