US Yields Surge, Lifting Indian Bond Yields

Global financial dynamics us yields surge prompting noticeable rise in indian bond yields – this headline encapsulates a recent trend that has sent ripples across global markets. The surge in US Treasury yields, driven by factors like inflation and the Federal Reserve’s monetary policy tightening, has had a direct impact on Indian bond yields.

This interconnectedness underscores the global nature of financial markets, where actions in one region can have significant consequences for others.

The rising US yields have created a complex scenario for investors and policymakers in India. Understanding the intricate web of factors driving this trend is crucial for navigating the evolving landscape of global finance. This blog post will delve into the intricacies of this situation, examining the causes, consequences, and potential implications for the Indian economy.

Global Financial Dynamics

The global financial landscape is currently characterized by a complex interplay of factors, including rising interest rates, geopolitical tensions, and persistent inflation. These elements are shaping market sentiment and influencing investment decisions worldwide. Understanding these dynamics is crucial for navigating the complexities of the global financial system.

The global financial landscape is experiencing a wave of volatility, with US yields surging and prompting a noticeable rise in Indian bond yields. This dynamic has put pressure on Indian businesses, and the recent news of Byju’s shocking 12 billion repayment proposal highlights the challenges faced by even the most prominent players in the Indian edtech sector.

It remains to be seen how this ripple effect will play out in the broader financial environment, as investors and analysts grapple with the implications of rising borrowing costs and potential debt restructuring in the Indian market.

Interest Rates and Monetary Policy

Central banks around the world are tightening monetary policy in response to elevated inflation levels. This involves raising interest rates, which makes borrowing more expensive and aims to curb economic activity and slow down price increases.

- The US Federal Reserve has been particularly aggressive in its rate hikes, leading to a surge in US Treasury yields.

- These higher yields have a ripple effect globally, as investors seek higher returns in US assets, putting upward pressure on yields in other countries, including India.

Monetary policy plays a pivotal role in shaping global financial dynamics. Central banks’ decisions on interest rates and other policy tools can significantly impact asset prices, currency exchange rates, and overall economic growth.

The global financial landscape is experiencing a ripple effect, with the recent surge in US yields prompting a noticeable rise in Indian bond yields. This interconnectedness underscores the global nature of financial markets. Meanwhile, the cryptocurrency world eagerly awaits the SEC’s decision on Bitcoin ETF applications, with the recent delay sparking speculation and heightened investor interest.

As these events unfold, it’s crucial to monitor the interplay between traditional finance and the emerging digital asset space, as both continue to shape the global economic landscape.

Geopolitical Events and Economic Uncertainties

Geopolitical events, such as the ongoing Russia-Ukraine conflict, contribute to global market volatility. The conflict has disrupted supply chains, fueled energy price spikes, and increased uncertainty about the global economic outlook.

The global financial landscape is in a state of flux, with the recent surge in US yields causing a noticeable rise in Indian bond yields. This has created a ripple effect across various markets, including the stock market, which saw limited movement as investors carefully analyzed economic data and the latest developments at GameStop, as highlighted in this article: stock market sees limited movement as investors analyze economic data and gamestop leadership changes.

The uncertainty surrounding these shifts in global financial dynamics has led to a cautious approach among investors, who are closely monitoring developments and their potential impact on both domestic and international markets.

- The war has also led to sanctions on Russia, further complicating global trade and investment flows.

- Other geopolitical tensions, such as the US-China trade war, also contribute to economic uncertainty and market volatility.

These events create a challenging environment for investors, making it difficult to assess risk and make informed investment decisions.

Global Market Sentiment

Market sentiment is influenced by a range of factors, including economic data, corporate earnings, and investor confidence.

- Strong economic data can boost investor confidence and lead to higher asset prices.

- Conversely, weak economic data can dampen sentiment and trigger sell-offs.

Geopolitical events and monetary policy decisions can also significantly impact market sentiment. For example, the recent surge in US yields has led to a sell-off in global bond markets, reflecting investor concerns about rising interest rates and potential economic slowdown.

US Yields Surge

The recent surge in US Treasury yields has sent ripples across global financial markets, prompting investors and policymakers to closely monitor the situation. This upward trend in yields is driven by a confluence of factors, including the Federal Reserve’s aggressive monetary tightening, a robust US economy, and increased investor appetite for risk.

Reasons for the Surge, Global financial dynamics us yields surge prompting noticeable rise in indian bond yields

The primary driver of the surge in US yields is the Federal Reserve’s commitment to combat inflation. The Fed has raised interest rates aggressively, and the market anticipates further increases in the coming months. This tightening of monetary policy makes holding US Treasuries less attractive, as investors can earn higher returns elsewhere.

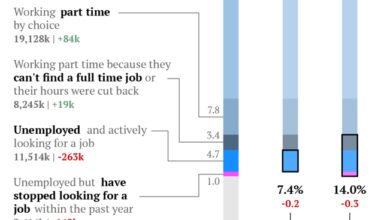

Another factor contributing to the rise in yields is the strength of the US economy. Despite concerns about a potential recession, the US economy has remained resilient, with strong consumer spending and a healthy labor market. This economic strength has bolstered investor confidence, leading to increased demand for riskier assets, including US equities, and consequently pushing down the demand for safe-haven US Treasuries.

Implications for Global Investors and Economies

Rising US yields have significant implications for global investors and economies. For investors, the higher yields offer potentially attractive returns, but also present challenges. As yields rise, the value of existing bonds falls, potentially leading to losses for bondholders.

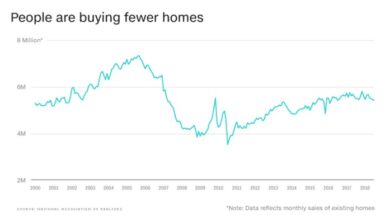

Moreover, the higher cost of borrowing can dampen investment and economic activity.For emerging markets, the rising US yields can pose particular challenges. These countries often borrow heavily in US dollars, and as yields rise, the cost of servicing their debt increases.

This can lead to currency depreciation and economic instability.

Historical Trends

The current yield environment is reminiscent of the early 2000s and the period leading up to the 2008 financial crisis. In both instances, the Fed was aggressively raising interest rates to combat inflation. However, there are also key differences.

The current economic environment is characterized by higher inflation and a more aggressive Fed, which could lead to a more volatile market.

The current yield environment is reminiscent of the early 2000s and the period leading up to the 2008 financial crisis. In both instances, the Fed was aggressively raising interest rates to combat inflation. However, there are also key differences. The current economic environment is characterized by higher inflation and a more aggressive Fed, which could lead to a more volatile market.

Impact on Indian Bond Yields: Global Financial Dynamics Us Yields Surge Prompting Noticeable Rise In Indian Bond Yields

The surge in US yields has a significant impact on Indian bond yields, influencing the cost of borrowing for businesses and individuals in India. Understanding the channels through which this impact occurs is crucial for comprehending the potential consequences for the Indian economy.

Transmission Channels

The rise in US yields affects Indian bond yields through several key channels:

- Capital Outflows:When US yields rise, investors are incentivized to move their investments from emerging markets like India to the US, seeking higher returns. This outflow of capital can lead to a depreciation of the Indian rupee, increasing the cost of borrowing for Indian businesses and individuals.

- Increased Risk Premium:As US yields rise, investors perceive emerging markets like India as riskier, demanding a higher risk premium on Indian bonds. This higher risk premium translates into higher interest rates for borrowers in India.

- Foreign Portfolio Investment (FPI) Flows:Rising US yields can deter FPIs from investing in India, as the relative attractiveness of US assets increases. This can lead to a decrease in FPI inflows, impacting the liquidity and demand for Indian bonds, potentially pushing yields higher.

Consequences for the Indian Economy

The rise in Indian bond yields can have several consequences for the Indian economy:

- Higher Borrowing Costs:Increased bond yields translate into higher borrowing costs for businesses and individuals, potentially slowing down investment and economic growth.

- Inflationary Pressures:Higher borrowing costs can lead to higher prices for goods and services, potentially fueling inflation.

- Currency Volatility:Capital outflows and increased risk aversion can lead to rupee depreciation, increasing the cost of imports and potentially impacting inflation.

Reserve Bank of India’s Measures

The Reserve Bank of India (RBI) has taken several measures to manage the impact of US yield movements on Indian bond yields:

- Intervention in the Foreign Exchange Market:The RBI has intervened in the foreign exchange market to manage rupee volatility and prevent excessive depreciation.

- Open Market Operations:The RBI has conducted open market operations to inject liquidity into the system and stabilize bond yields.

- Interest Rate Hikes:The RBI has raised interest rates to attract foreign investment and control inflation, although this can also increase borrowing costs for businesses and individuals.