SEC Bitcoin Buzz: Dollar Steady, Bitcoin Drops – Todays Financial News

Sec bitcoin buzz dollar steady bitcoin drops catch up on todays financial news – SEC Bitcoin Buzz: Dollar Steady, Bitcoin Drops – Today’s Financial News. The crypto world is abuzz with news of the SEC’s scrutiny, while the US dollar holds its ground. Bitcoin, however, is feeling the pressure, experiencing a significant drop.

This week’s market activity has left many investors wondering what the future holds for the leading cryptocurrency. Is this just a temporary dip, or is something bigger at play? Let’s delve into the factors influencing this recent market shift and explore what these developments might mean for the future of Bitcoin.

Bitcoin’s recent volatility is a key topic of discussion. The recent price drop has been attributed to a combination of factors, including the SEC’s increased scrutiny of the crypto industry, concerns about the global economic outlook, and the continued strength of the US dollar.

The dollar’s recent rise has historically been a headwind for Bitcoin, as investors tend to flock to safe haven assets during times of uncertainty. However, the impact of the SEC’s actions cannot be ignored. The regulatory landscape for cryptocurrencies is still evolving, and the SEC’s focus on enforcing existing securities laws is creating a climate of uncertainty for investors.

While Bitcoin’s previous surge was fueled by a combination of factors, including institutional adoption, increased retail interest, and the perception of Bitcoin as a hedge against inflation, these factors seem to be losing their momentum in the face of current market conditions.

The recent drop in Bitcoin’s price is a stark reminder of the inherent volatility of the cryptocurrency market.

Bitcoin’s Recent Volatility

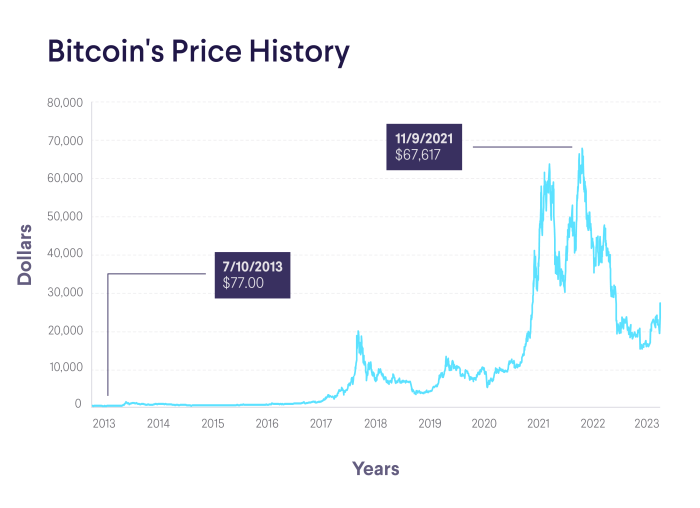

The cryptocurrency market has been on a rollercoaster ride in recent months, with Bitcoin, the largest cryptocurrency by market capitalization, experiencing significant price swings. After reaching an all-time high of over $68,000 in November 2021, Bitcoin has fallen sharply, losing more than half its value.

This volatility has left many investors wondering about the future of Bitcoin and the broader cryptocurrency market.

Reasons for Bitcoin’s Recent Drop

The recent decline in Bitcoin’s price can be attributed to a confluence of factors, including:

- Macroeconomic Uncertainty:Global economic concerns, such as rising inflation, supply chain disruptions, and the war in Ukraine, have led to increased risk aversion among investors, prompting them to sell off riskier assets like Bitcoin.

- Interest Rate Hikes:The Federal Reserve’s aggressive interest rate hikes have made traditional investments like bonds more attractive, diverting capital away from cryptocurrencies.

- Regulatory Crackdown:Increased scrutiny from regulators around the world has also contributed to the decline in Bitcoin’s price. For example, the U.S. Securities and Exchange Commission (SEC) has been cracking down on crypto exchanges and stablecoin issuers, raising concerns about the future of the industry.

- TerraUSD (UST) Collapse:The collapse of the TerraUSD (UST) stablecoin in May 2022 triggered a sell-off across the cryptocurrency market, as investors lost confidence in the stability of the crypto ecosystem.

Factors Contributing to Bitcoin’s Previous Surge

Bitcoin’s price surged in 2020 and 2021, fueled by a number of factors:

- Institutional Adoption:Large institutional investors, such as hedge funds and corporations, began to allocate a portion of their portfolios to Bitcoin, driving up demand and prices.

- Retail Investor Interest:Increased retail investor interest, driven by the accessibility of cryptocurrency exchanges and the popularity of Bitcoin as a digital gold, also contributed to the surge.

- Inflationary Concerns:As inflation soared, some investors viewed Bitcoin as a hedge against inflation, driving demand for the cryptocurrency.

Comparison to Previous Periods of Volatility

While Bitcoin has experienced significant price fluctuations in the past, the current period of volatility is particularly notable for its severity and duration. The decline from the all-time high in November 2021 has been more pronounced and sustained than previous corrections.

Impact of Regulatory News and Developments

Regulatory developments have a significant impact on Bitcoin’s price, as they can affect investor confidence and the future of the cryptocurrency market. For example, positive regulatory news, such as the approval of Bitcoin exchange-traded funds (ETFs) in the United States, can boost investor confidence and drive up prices.

Conversely, negative regulatory news, such as the SEC’s crackdown on crypto exchanges, can lead to sell-offs and price declines.

The Role of the US Dollar: Sec Bitcoin Buzz Dollar Steady Bitcoin Drops Catch Up On Todays Financial News

The US dollar’s strength and weakness have a significant impact on the price of Bitcoin. As the world’s reserve currency, the dollar’s value influences global trade, investment, and financial markets, including cryptocurrencies. Understanding this relationship is crucial for investors seeking to navigate the volatile world of digital assets.

The Relationship Between US Dollar Strength and Bitcoin’s Price

When the US dollar strengthens, it generally makes Bitcoin less attractive to foreign investors. This is because the dollar’s appreciation makes it more expensive for investors holding other currencies to buy Bitcoin. Conversely, a weaker dollar can boost Bitcoin’s price as it becomes more affordable for international investors.

For example, during periods of dollar weakness, Bitcoin’s price has often seen an increase as investors seek alternative assets to hedge against currency depreciation.

The SEC Bitcoin buzz continues, with the dollar remaining steady while Bitcoin drops. It’s a wild ride out there, so make sure you catch up on today’s financial news! While the crypto world is in a frenzy, Tesla successfully defended against monopoly claims in a repair lawsuit here.

This victory could have significant implications for the future of car repair and consumer rights. But for now, it’s back to the rollercoaster ride of the crypto market.

The Impact of the Federal Reserve’s Monetary Policy on Bitcoin

The Federal Reserve’s monetary policy plays a crucial role in influencing the US dollar’s value and, consequently, Bitcoin’s price. When the Fed tightens monetary policy, such as raising interest rates or reducing the money supply, it can lead to a stronger dollar and potentially a decline in Bitcoin’s price.

Conversely, loose monetary policy, characterized by lower interest rates and increased money supply, can weaken the dollar and potentially boost Bitcoin’s price.

Comparing Bitcoin’s Performance to Other Assets During Periods of US Dollar Strength

During periods of US dollar strength, Bitcoin’s performance has varied significantly compared to other assets. While some studies have shown a negative correlation between Bitcoin and the US dollar, other research suggests that Bitcoin’s price movements are not solely driven by the dollar’s strength.

For instance, in 2017, Bitcoin’s price surged despite a strengthening dollar, indicating that other factors, such as increasing adoption and investor sentiment, can also influence its value.

Bitcoin as a Hedge Against Inflation

Bitcoin proponents often argue that it can serve as a hedge against inflation. They point to Bitcoin’s limited supply, which is capped at 21 million coins, as a key factor in its potential to retain value during periods of economic uncertainty.

Additionally, they argue that Bitcoin’s decentralized nature and resistance to government control make it a valuable asset in an environment of increasing inflation and government intervention.

“Bitcoin is a hedge against inflation, a hedge against tyranny, and a hedge against the breakdown of the financial system.”

Andreas Antonopoulos

However, critics argue that Bitcoin’s price volatility makes it an unreliable hedge against inflation. They point to the fact that Bitcoin’s price can fluctuate wildly, making it difficult to predict its value in the long term. Furthermore, they argue that Bitcoin’s limited adoption and lack of real-world utility limit its potential as a store of value.

The SEC’s bitcoin buzz continues to dominate headlines, with the dollar holding steady while bitcoin drops. But amidst the regulatory drama, Coinbase is fighting back, drawing parallels between crypto trading and the market for baseball cards in its defense against the SEC lawsuit.

This argument could have major implications for the future of the crypto industry. So, if you’re interested in staying up-to-date on the latest financial news, keep an eye on this developing story.

Market Sentiment and Investor Behavior

The current state of Bitcoin’s price is a reflection of the complex interplay between investor sentiment, news events, and market dynamics. Understanding these factors is crucial for navigating the volatile world of cryptocurrency trading.

Impact of News and Events on Investor Confidence

News and events play a significant role in shaping investor sentiment towards Bitcoin. Positive news, such as regulatory clarity, institutional adoption, or technological advancements, can boost confidence and drive prices upward. Conversely, negative news, such as regulatory crackdowns, security breaches, or market manipulation, can erode confidence and lead to price declines.

For example, the recent announcement of a new Bitcoin ETF in the United States sparked a surge in investor interest and a significant price increase. Conversely, the collapse of the FTX exchange in 2022 triggered a wave of fear and uncertainty, leading to a sharp drop in Bitcoin’s price.

Key Indicators of Market Sentiment

Several key indicators can help gauge market sentiment and identify potential trends in Bitcoin’s price.

The SEC’s Bitcoin buzz and the dollar’s steady rise haven’t stopped Bitcoin from dropping, but there’s plenty of other financial news to catch up on. One notable move is Cathie Wood’s ARK ETF swapping out its Bitcoin strategies with Grayscale and ProShares, as detailed in this article cathie wood ark etf swaps bitcoin strategies out with grayscale in with proshares power move.

This shift reflects the ongoing evolution of the crypto landscape, which continues to offer both opportunities and challenges for investors. So, keep an eye on the market and see what other big moves are coming down the pipeline!

- Trading Volume: High trading volume often indicates strong interest and potential price volatility. Conversely, low volume may suggest a lack of interest and potentially muted price movements.

- Social Media Trends: Social media platforms, such as Twitter and Reddit, are often used by investors to share their views and discuss market trends. A surge in positive sentiment on social media can be a bullish indicator, while a rise in negative sentiment can be bearish.

- Google Trends: Google Trends data can provide insights into the level of public interest in Bitcoin. A spike in searches for Bitcoin-related terms may suggest increased investor interest and potentially higher prices.

Role of Fear, Uncertainty, and Doubt (FUD) in Bitcoin’s Price Fluctuations

Fear, uncertainty, and doubt (FUD) are common psychological factors that can significantly influence Bitcoin’s price. When investors feel fearful or uncertain about the future of Bitcoin, they may sell their holdings, driving prices down. Conversely, a lack of FUD can lead to increased confidence and higher prices.

“FUD is a powerful force in the cryptocurrency market. It can create a self-fulfilling prophecy, where negative sentiment leads to price declines, which in turn fuels further negativity.”

FUD can be spread through various channels, including social media, news outlets, and online forums. It is important for investors to be aware of FUD and to base their investment decisions on objective analysis rather than emotional reactions.

Technical Analysis of Bitcoin’s Price

Technical analysis is a method of forecasting future price movements based on past price and volume data. It uses charts and technical indicators to identify patterns and trends, and to predict where the price might move next.

Key Support and Resistance Levels

Support and resistance levels are price points where the price of an asset has historically found it difficult to break through. These levels are often used by traders to identify potential buy or sell points.

- Support Level:A support level is a price point where the price of an asset has historically found it difficult to fall below. This is because buyers tend to step in and purchase the asset at this price point, preventing it from falling further.

- Resistance Level:A resistance level is a price point where the price of an asset has historically found it difficult to rise above. This is because sellers tend to step in and sell the asset at this price point, preventing it from rising further.

Moving Averages

Moving averages are a popular technical indicator used to identify trends and potential turning points in the price of an asset.

- Simple Moving Average (SMA):The SMA is calculated by adding up the closing prices of an asset over a specific period of time and dividing by the number of periods.

- Exponential Moving Average (EMA):The EMA gives more weight to recent prices, making it more responsive to changes in the market.

MACD, Sec bitcoin buzz dollar steady bitcoin drops catch up on todays financial news

The MACD (Moving Average Convergence Divergence) is a momentum indicator that compares two moving averages of an asset’s price to identify potential buy or sell signals.

- MACD Line:The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA.

- Signal Line:The signal line is a 9-period EMA of the MACD line.

- Histogram:The histogram is the difference between the MACD line and the signal line.

Breakout or Breakdown

A breakout occurs when the price of an asset breaks through a resistance level. A breakdown occurs when the price of an asset breaks through a support level. Breakouts and breakdowns can be significant events, as they often signal a change in the trend of an asset’s price.

For example, if the price of Bitcoin breaks through a resistance level, it could signal that the market is becoming bullish and that the price is likely to continue to rise. Conversely, if the price of Bitcoin breaks through a support level, it could signal that the market is becoming bearish and that the price is likely to continue to fall.

The Future of Bitcoin

Predicting the future of Bitcoin is a complex task, given its volatile nature and the constantly evolving regulatory landscape. However, several factors suggest that Bitcoin could play a significant role in the global financial system in the years to come.

Expert Opinions on Bitcoin’s Long-Term Prospects

Experts hold diverse opinions on Bitcoin’s long-term prospects. Some believe that Bitcoin’s decentralized nature and limited supply make it a valuable store of value, similar to gold. Others see it as a potential competitor to traditional currencies, facilitating faster and cheaper cross-border transactions.

For example, renowned investor Tim Draper has predicted that Bitcoin will reach $250,000 by 2022, while others like Nouriel Roubini, a prominent economist, remain skeptical.

Mainstream Adoption and Bitcoin’s Price

Mainstream adoption of Bitcoin could significantly impact its price. As more businesses and individuals accept Bitcoin as a form of payment, demand for the cryptocurrency would likely increase, driving its price upwards. For example, the recent adoption of Bitcoin by major corporations like Tesla and MicroStrategy has contributed to its price surge.

Factors Driving Bitcoin’s Price Higher

Several factors could drive Bitcoin’s price higher in the future:

- Increased Institutional Investment:As more institutional investors like hedge funds and pension funds allocate capital to Bitcoin, demand would likely rise, pushing prices up.

- Growing Adoption in Emerging Markets:Bitcoin could gain traction in emerging markets with unstable currencies, offering a hedge against inflation and financial instability.

- Technological Advancements:Improvements in Bitcoin’s underlying technology, such as faster transaction speeds and lower fees, could attract more users and investors.

- Government Regulations:Clearer and more favorable regulatory frameworks could boost investor confidence and lead to wider adoption of Bitcoin.