Dollar Gains Ground on First Day of the Year Due to Strong US Yields

Dollar gains ground on first day of the year due to strong us yields – The dollar gained ground on the first day of the year, a promising start for the currency, driven by robust US yields. This upward trend in the dollar’s value is a direct result of the rising interest rates set by the Federal Reserve, making the US currency more attractive to investors seeking higher returns.

The increased demand for US dollars, in turn, strengthens its position against other currencies.

Historically, the dollar’s performance on the first day of the year has been a mixed bag. However, the current gains are fueled by a combination of factors, including a strong US economy, the Fed’s aggressive monetary policy, and a global economic outlook that favors the US dollar.

Dollar Strength on the First Day of the Year

The dollar’s gains on the first trading day of the year are a significant event for the global financial markets. It sets the tone for the year ahead, influencing currency valuations, investment strategies, and global economic activity.

The dollar’s strength on the first day of the year, fueled by robust US yields, highlights the ongoing economic uncertainties. While the US economy seems to be holding its ground, global demand is showing signs of weakness, as evidenced by the sharp 14.5% drop in Chinese exports during July.

This decline underscores the challenges facing global trade and could further influence the dollar’s trajectory in the coming months.

Historical Performance of the Dollar on the First Day of the Year

The dollar’s performance on the first trading day of the year is a subject of much analysis and speculation. Historically, the dollar has exhibited a mixed track record, with periods of gains and losses. Examining past trends can provide insights into potential drivers of the dollar’s performance on this particular day.

- Recent Years:Over the past five years, the dollar has experienced a mixed bag on the first trading day of the year. In 2022, the dollar strengthened against a basket of major currencies, gaining about 0.5%. In 2021, it saw a slight decline, losing approximately 0.2%.

In 2020, it experienced a significant gain of over 1%. In 2019, it remained relatively flat, while in 2018, it saw a modest decline.

- Long-Term Trends:Looking at longer-term trends, the dollar has shown a tendency to appreciate in value on the first trading day of the year. This is partly attributed to factors like the “January effect,” which refers to a historical tendency for stock markets to rise in January, potentially boosting demand for the dollar.

Comparison with Previous Years’ Performances

Comparing the current gains to previous years’ performances provides context for the current situation. In 2023, the dollar’s gains on the first trading day were notably stronger than in recent years, reflecting a heightened sentiment of optimism towards the US economy.

This optimism stems from factors such as the resilience of the US economy in the face of global economic challenges, the Federal Reserve’s commitment to fighting inflation, and the ongoing strength of the US labor market.

Impact of Strong US Yields

The dollar’s strength on the first trading day of the year was largely attributed to the rise in US Treasury yields. This positive correlation between US yields and the dollar’s value is a significant factor in global currency markets. Understanding this relationship is crucial for investors and traders seeking to navigate the complexities of currency exchange.Rising US yields generally attract foreign investors seeking higher returns on their investments.

As these investors purchase US assets, they need to exchange their foreign currencies for dollars, increasing demand for the greenback and ultimately boosting its value. This phenomenon is known as the “carry trade,” where investors borrow in low-yielding currencies and invest in higher-yielding assets.

Impact of Rising Yields on Investor Sentiment

Strong US yields often signal a robust US economy and a healthy appetite for risk. This positive sentiment attracts foreign investors, further increasing demand for the dollar. Conversely, when yields decline, it may indicate concerns about the US economy’s health, discouraging foreign investment and weakening the dollar.

Historical Examples of Strong Yields and Dollar Strength

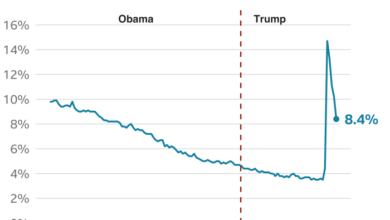

Throughout history, the dollar has tended to strengthen during periods of rising US yields. For instance, during the 2010s, the Federal Reserve’s quantitative easing program led to a decline in US yields, which weakened the dollar. However, as the Fed began to tighten monetary policy and raise interest rates in 2017, yields rose, and the dollar appreciated.

The dollar started the year strong, gaining ground thanks to rising US yields. While this is good news for those holding US currency, it’s worth noting that a stock market analyst warns of potential correction amid broadening rally expert insights , suggesting that the rally might be unsustainable.

It’s important to stay informed and make decisions based on a comprehensive understanding of market conditions, including both positive and negative factors.

“The correlation between US yields and the dollar’s value is often strong, but it’s not always a one-to-one relationship. Other factors, such as global economic conditions and geopolitical events, can also influence the dollar’s exchange rate.”

A seasoned currency trader

Factors Contributing to Strong Yields: Dollar Gains Ground On First Day Of The Year Due To Strong Us Yields

The recent surge in US yields, leading to a strengthening dollar on the first day of the year, can be attributed to a confluence of factors. These include the Federal Reserve’s aggressive monetary policy stance, robust economic data, and rising inflation expectations.

Federal Reserve’s Monetary Policy

The Federal Reserve’s aggressive monetary policy tightening has been a key driver of higher US yields. The Fed has raised interest rates by 4.25% since March 2022, with the target range for the federal funds rate now at 4.25% to 4.50%.

The dollar surged on the first trading day of the year, driven by strong US yields. This comes amidst a backdrop of robust economic activity, fueled by the continued adoption of artificial intelligence across industries. Nvidia, a key player in this technological revolution, recently announced the launch of its AI supercomputers and services, propelling its stock to new heights, as seen in this recent article.

This surge in AI adoption and the resulting growth of companies like Nvidia could further solidify the dollar’s strength in the coming months.

The Fed’s stated goal is to bring inflation back down to its 2% target. The central bank has signaled that it is prepared to continue raising rates in the coming months, even if this leads to a recession.

“We will stay the course until the job is done.”

Jerome Powell, Chair of the Federal Reserve

The Fed’s hawkish stance has convinced investors that interest rates will remain high for a prolonged period, leading to a steepening of the yield curve and higher yields across the board.

Economic Data and Inflation Expectations, Dollar gains ground on first day of the year due to strong us yields

Strong economic data releases in recent months have also contributed to the rise in US yields. The US economy has proven to be more resilient than many economists had anticipated, with strong job growth and consumer spending. This has led to expectations that the Fed will be able to maintain its aggressive monetary policy stance, even in the face of a potential recession.

Furthermore, inflation remains stubbornly high, with the Consumer Price Index (CPI) rising by 7.1% in November 2022. This has fueled concerns that the Fed may need to raise interest rates even higher than previously anticipated to bring inflation under control.

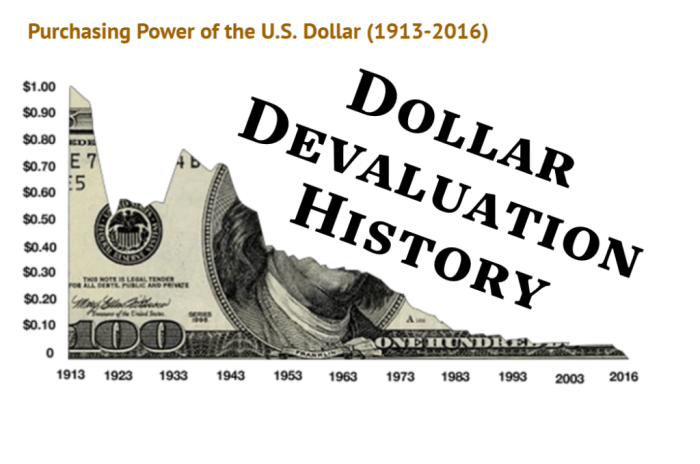

The persistence of high inflation has also led to expectations that the Fed will keep rates elevated for longer. This expectation has contributed to the rise in yields, as investors demand higher returns to compensate for the risk of inflation eroding the value of their investments.

Implications for Global Markets

A strong dollar can have significant ripple effects across global markets, impacting everything from emerging market currencies to commodity prices. Understanding these implications is crucial for investors and businesses operating in a globalized world.

Impact on Emerging Markets

A stronger dollar generally makes it more expensive for emerging market countries to service their dollar-denominated debt. This can lead to currency depreciation, as investors seek to exit these markets. Additionally, a strong dollar can make imports more expensive for emerging markets, potentially impacting inflation and economic growth.

- For example, in 2013, the “taper tantrum” saw the US Federal Reserve signal a potential reduction in its bond-buying program. This led to a sharp rise in US yields and a strong dollar, causing significant currency depreciation in emerging markets like India, Brazil, and Turkey.

Impact on Commodity Prices

Commodities are typically priced in dollars. A stronger dollar makes these commodities more expensive for buyers using other currencies. This can lead to a decrease in demand for commodities, potentially impacting prices.

- For instance, a strong dollar in 2014-2015 contributed to a decline in oil prices, as it made oil more expensive for buyers in countries with weaker currencies.

Impact on International Trade

A strong dollar can make US exports less competitive in global markets, potentially leading to a decline in exports. Conversely, it can make imports cheaper for US consumers, potentially boosting consumer spending.

- In 2015, a strong dollar contributed to a decline in US exports, as US goods became more expensive for foreign buyers.

Outlook for the Dollar

The strong start to the year for the dollar, driven by rising US yields, raises questions about the currency’s future trajectory. While the current strength is promising, several factors could influence its performance in the coming months.

Key Indicators and Their Impact

The dollar’s future trajectory will be shaped by a combination of economic indicators, global events, and policy decisions. Here’s a breakdown of some key indicators and their potential impact on the dollar: