US Futures Rise Amid Rate Cut Speculation

Today stock market update us futures maintain gains amid rate cut speculations – Today’s stock market update sees US futures maintaining gains amid speculation surrounding potential interest rate cuts. The market is buzzing with anticipation as investors weigh the possibility of the Federal Reserve easing monetary policy in response to recent economic data.

This potential shift in interest rates could have a significant impact on various sectors of the stock market, influencing investor strategies and the overall market sentiment.

The recent economic data, including inflation figures and unemployment rates, has fueled speculation about a potential rate cut. Analysts are closely examining these indicators to gauge the Federal Reserve’s likely course of action. The Fed’s own statements regarding the economy and its monetary policy stance are also being scrutinized for clues about the potential timing and magnitude of a rate cut.

US Futures Gains Amid Rate Cut Speculation: Today Stock Market Update Us Futures Maintain Gains Amid Rate Cut Speculations

US futures markets are currently showing signs of optimism, with major indices like the Dow Jones Industrial Average and the S&P 500 futures trading higher. This upward trend is fueled by growing speculation that the Federal Reserve may soon consider lowering interest rates to stimulate economic growth.

Rate Cut Speculation

The recent surge in US futures markets is primarily attributed to the growing anticipation of potential interest rate cuts by the Federal Reserve. Investors believe that lowering rates could inject much-needed liquidity into the economy and boost corporate earnings. This speculation stems from a combination of factors, including:

- Recent Economic Data:Recent economic data has pointed to a potential slowdown in the US economy, with indicators like consumer spending and manufacturing activity showing signs of weakness. This has led some investors to believe that the Fed may need to ease monetary policy to prevent a more significant economic downturn.

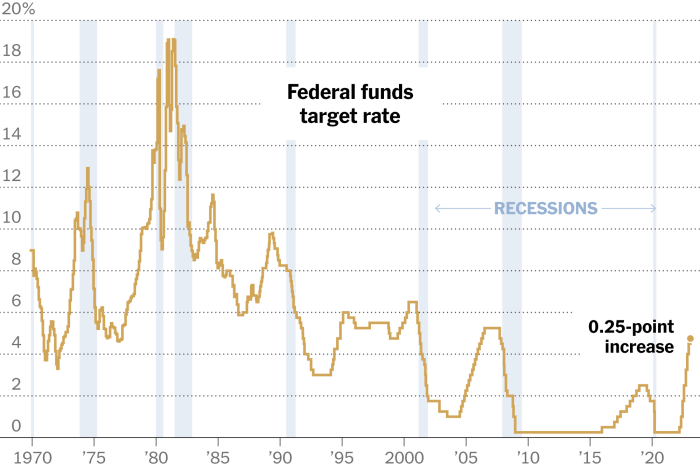

- Federal Reserve Statements:Recent statements from Federal Reserve officials have hinted at the possibility of interest rate cuts, with some suggesting that the central bank is closely monitoring economic conditions and is prepared to act if necessary. While the Fed has maintained its stance that it will remain data-dependent in its decision-making, these statements have fueled speculation among investors.

Impact on the Market

The potential for interest rate cuts has had a significant impact on the US futures markets, with investors bidding up prices on the expectation of a more favorable economic environment. This has resulted in gains across various sectors, including technology, healthcare, and financials.

For example, the tech-heavy Nasdaq 100 futures have seen particularly strong gains, driven by the potential for lower interest rates to boost growth in the sector. The expectation of a more accommodative monetary policy could also lead to increased borrowing and investment activity, further supporting the market’s upward trajectory.However, it’s important to note that the potential for rate cuts is not guaranteed.

The Federal Reserve will ultimately base its decision on a comprehensive assessment of economic data and other factors. If economic conditions improve or if inflation rises unexpectedly, the Fed may choose to maintain its current interest rate policy.

Impact of Rate Cut Expectations

The prospect of interest rate cuts by the Federal Reserve is injecting a dose of optimism into the stock market, with US futures trading higher this morning. While the market anticipates a rate cut, the magnitude and timing of such a move remain uncertain.

This uncertainty, however, is fueling speculation about the potential impact of rate cuts on different sectors of the stock market and the broader economy.

Potential Impact on Different Sectors

The potential impact of rate cuts on different sectors of the stock market is multifaceted and depends on various factors, including the specific sector’s sensitivity to interest rates, its growth prospects, and its exposure to global economic conditions.

- Growth-oriented sectors, such as technology and consumer discretionary, tend to benefit from lower interest rates as they often rely on borrowing to fund their growth initiatives. A rate cut could provide these sectors with cheaper access to capital, fueling further expansion and potentially leading to higher stock valuations.

- Interest-sensitive sectors, such as utilities and real estate, are often negatively impacted by rising interest rates. Conversely, a rate cut could provide a boost to these sectors, as lower borrowing costs can make investments more attractive and stimulate demand.

- Cyclical sectors, such as industrials and materials, are often closely tied to the overall health of the economy. A rate cut could signal that the Fed is trying to stimulate economic growth, potentially leading to increased demand for goods and services within these sectors.

Implications for Investors and Businesses

Lower interest rates can have significant implications for both investors and businesses.

It’s interesting to see US futures holding gains today, especially with speculation about rate cuts swirling around. This, however, contrasts with the strengthening US dollar, which seems to be gaining momentum as the Federal Reserve hints at further rate hikes, as seen in this recent article on the US dollar’s strengthening and the Japanese yen’s weakening.

It’s a reminder that the market can be unpredictable, and even with potential rate cuts, other factors can influence currency movements and market sentiment.

- Investorsmay find their fixed-income investments less attractive in a low-interest-rate environment. This could lead them to seek higher returns in the stock market, potentially driving up stock prices.

- Businessescan benefit from lower borrowing costs, allowing them to invest in new projects, expand operations, and potentially increase profitability. However, businesses that rely heavily on interest income, such as banks, may see their profits squeezed.

Expert Opinions on Rate Cut Likelihood and Timing

The likelihood and timing of a rate cut are subject to debate among economists and market analysts.

The US futures market is showing strength today, fueled by speculation about a potential rate cut. This positive sentiment is further bolstered by the impressive performance of Nvidia, which is soaring due to its surprise OpenAI partnership. This news, coupled with the upcoming Thanksgiving holiday, is injecting a healthy dose of optimism into the market, mirroring the gains we’re seeing in the futures.

For a deeper dive into Nvidia’s performance and the broader market outlook, check out this stock market update on the Venomblog.

“While the Fed is likely to cut rates in the coming months, the magnitude and timing of the cut will depend on the economic data and the inflation outlook,” said [name of economist], chief economist at [name of firm].

“The market is pricing in a rate cut in July, but there is a risk that the Fed could wait until September if the economic data shows signs of strength,” said [name of analyst], senior market strategist at [name of firm].

Market Sentiment Compared to Previous Periods of Rate Cut Speculation

The current market sentiment surrounding rate cut speculation is similar to previous periods when the Fed has signaled a potential easing of monetary policy. In 2019, for example, the Fed cut rates three times in response to slowing economic growth and trade tensions.

The stock market is showing some resilience today, with US futures holding onto gains amidst speculation about a potential rate cut. This positive sentiment comes as investors grapple with the looming return of federal student loan payments, a major financial concern for many Americans.

For a comprehensive guide on navigating this transition, check out this helpful resource: federal student loan payments resuming guide. While the student loan issue adds a layer of complexity to the market, the potential for a rate cut could provide some much-needed relief for both individuals and businesses.

This move helped to stabilize the markets and boost investor confidence. However, the current economic landscape is different, with rising inflation and geopolitical uncertainty adding to the complexity of the situation.

Key Economic Indicators

The recent economic indicators have been sending mixed signals, making it difficult to predict the Federal Reserve’s next move on interest rates. While inflation has shown signs of cooling, the labor market remains strong, raising concerns about potential wage pressures and further inflation.

Impact of Key Economic Indicators on Rate Cut Expectations

Recent economic data releases have provided a mixed picture of the US economy, making it difficult to predict the Federal Reserve’s next move on interest rates. The recent decline in inflation, coupled with signs of slowing economic growth, has fueled speculation about potential rate cuts in the near future.

However, the strong labor market and ongoing wage pressures continue to raise concerns about potential inflationary pressures, which could prevent the Fed from easing monetary policy.

Relationship Between Economic Indicators and Stock Market Performance, Today stock market update us futures maintain gains amid rate cut speculations

Economic indicators play a crucial role in shaping stock market performance. Strong economic growth, low inflation, and a healthy labor market generally lead to positive stock market returns, as investors become more confident about the future prospects of companies and the overall economy.

Conversely, weak economic indicators, such as high inflation, rising unemployment, and slowing GDP growth, tend to negatively impact stock market performance.

Key Economic Indicators

The following table summarizes key economic indicators and their impact on rate cut expectations and stock market performance:

| Indicator | Value | Interpretation | Impact on Rate Cut Expectations | Impact on Stock Market Performance |

|---|---|---|---|---|

| Consumer Price Index (CPI) | 3.0% (YoY) | Inflation has slowed but remains above the Fed’s target of 2%. | Supports potential rate cuts, but ongoing wage pressures may limit the Fed’s ability to ease policy. | Positive, as lower inflation generally boosts investor confidence. |

| Unemployment Rate | 3.7% | The labor market remains tight, indicating strong demand for labor. | Raises concerns about potential wage pressures and further inflation, making rate cuts less likely. | Mixed, as a strong labor market is generally positive, but potential wage pressures can lead to higher inflation, which could hurt stock market performance. |

| Gross Domestic Product (GDP) | 2.0% (QoQ) | Economic growth has slowed in recent quarters. | Increases pressure on the Fed to ease monetary policy to stimulate growth. | Negative, as slower economic growth typically leads to lower corporate earnings and reduced investor confidence. |

Global Market Influences

The US stock market is not an isolated entity; it is intricately connected to global economic events and geopolitical tensions. Understanding these influences is crucial for investors seeking to navigate market volatility and make informed decisions.

International Markets and Central Bank Policies

International markets play a significant role in shaping market sentiment. When economies outside the US experience growth or decline, it can impact US companies with global operations. For instance, a weakening Euro can negatively affect US companies exporting goods to Europe.

Conversely, a strengthening Euro can benefit US companies importing goods from Europe.Central bank policies also have a substantial impact. When the Federal Reserve lowers interest rates, it can stimulate economic growth and potentially lead to higher stock prices. However, if other major central banks, like the European Central Bank or the Bank of Japan, maintain tighter monetary policies, it can create a divergence in interest rates and impact currency exchange rates, ultimately influencing the US stock market.

Potential Spillover Effects from Other Major Economies

The US stock market is susceptible to spillover effects from other major economies. For example, a recession in China, a significant trading partner for the US, could disrupt global supply chains and negatively impact US companies reliant on Chinese exports.

Conversely, strong economic growth in the Eurozone could boost demand for US goods and services, benefiting US companies.

Summary of Key Global Market Influences

| Global Market Influence | Potential Impact on US Stock Market |

|---|---|

| Economic Growth in Major Economies (China, Eurozone, Japan) | Strong growth in major economies can boost demand for US goods and services, benefiting US companies. Conversely, a slowdown in major economies can negatively impact US companies with global operations. |

| Geopolitical Tensions (Trade Wars, Conflicts) | Geopolitical tensions can create uncertainty and volatility in the market, impacting investor sentiment and potentially leading to market declines. |

| Central Bank Policies (Interest Rates, Currency Exchange Rates) | Divergence in interest rates between major economies can impact currency exchange rates and influence the US stock market. |

| Commodity Prices (Oil, Gold) | Fluctuations in commodity prices can impact the profitability of companies involved in the production or consumption of those commodities, affecting their stock prices. |

Investor Sentiment and Strategies

Investor sentiment is a key driver of market movements. It reflects the overall mood and expectations of investors towards the stock market. Currently, investor sentiment is cautiously optimistic, driven by the anticipation of rate cuts. However, underlying concerns about inflation and economic growth remain.

Common Investment Strategies

The prospect of rate cuts has led to a shift in investment strategies. Many investors are moving towards assets that are expected to benefit from a lower interest rate environment.

- Growth Stocks:These companies are expected to experience high growth rates in the future, making them attractive in a low-interest rate environment. Examples include technology companies, consumer discretionary firms, and healthcare companies.

- Emerging Markets:These markets tend to perform well when interest rates are low, as they benefit from increased capital flows. Examples include China, India, and Brazil.

- High-Yield Bonds:These bonds offer higher interest payments but carry a higher risk. However, their attractiveness increases when interest rates decline.

Expert Advice for Navigating the Market

Experts recommend a balanced approach to investing in this environment.

- Diversify your portfolio:Spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk.

- Consider your risk tolerance:Invest in assets that align with your risk profile. If you are risk-averse, focus on low-risk investments like bonds. If you are willing to take on more risk, you can allocate a larger portion of your portfolio to stocks.

- Focus on long-term goals:Don’t let short-term market fluctuations distract you from your long-term investment objectives. Stay disciplined and stick to your investment plan.

Investor Capital Flow Chart

The following chart illustrates the flow of investor capital across different asset classes in the current market environment.

- Equity:Investors are shifting towards growth stocks and emerging markets, driven by the anticipation of rate cuts. This is reflected in the inflow of capital into these sectors.

- Fixed Income:The decline in interest rates is making high-yield bonds more attractive, leading to an increase in capital flows into this asset class. However, concerns about inflation are causing some investors to remain cautious.

- Real Estate:The prospect of lower interest rates is expected to boost the housing market, attracting capital flows into this sector. However, rising inflation and higher borrowing costs may limit this growth.