US Stock Market Opens Lower Amidst Awaited Jobs Data

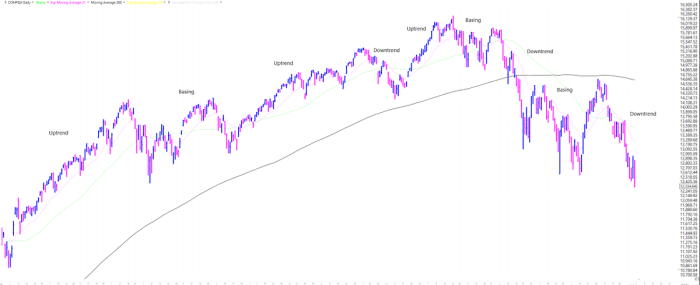

US Stock Market Opens Lower Amidst Awaited Jobs Data, a sign that investors are holding their breath before the release of crucial economic indicators. The market’s downward trend reflects a cautious sentiment, with investors weighing the potential impact of the upcoming jobs report on future economic growth.

This cautious approach is understandable, as the jobs data is expected to provide insights into the health of the US economy, which could influence the Federal Reserve’s future monetary policy decisions.

The market’s performance in recent days has been influenced by a confluence of factors, including rising inflation, interest rate hikes, and concerns about a potential recession. Investors are closely watching these indicators to gauge the trajectory of the economy and adjust their investment strategies accordingly.

Market Overview

The US stock market opened lower today, reflecting investor caution ahead of the release of crucial jobs data. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all declined in early trading, signaling a potential shift in market sentiment.The market’s downward trend can be attributed to several factors.

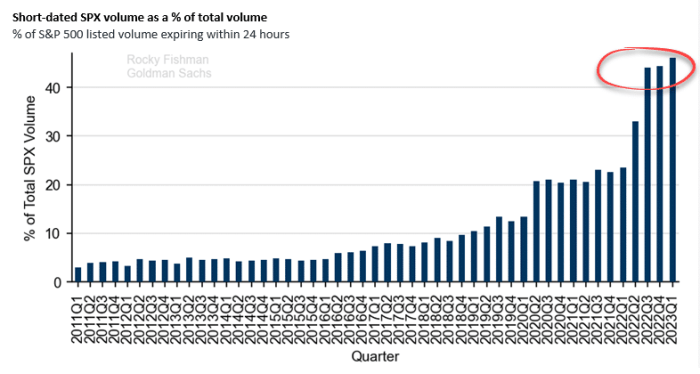

Firstly, investors are closely monitoring the Federal Reserve’s stance on interest rates. The recent rise in inflation has fueled speculation that the Fed might accelerate its rate hike cycle, which could impact corporate earnings and economic growth. Secondly, recent economic indicators have shown mixed signals, raising concerns about the strength of the US economy.

The US stock market opened lower today, with investors anxiously awaiting the release of the latest jobs data. This comes as Wall Street is also keeping a close eye on the Federal Reserve’s upcoming decision on interest rates, which could have a significant impact on market sentiment.

You can read more about the Fed’s decision and its potential implications for the market in this recent article: stock market update wall street eyes fed decision with modest gains. The jobs report, which is expected to provide insights into the strength of the labor market, is likely to be a key driver of market direction in the coming days.

For example, the manufacturing sector has shown signs of weakness, while consumer spending remains relatively strong.

Historical Context

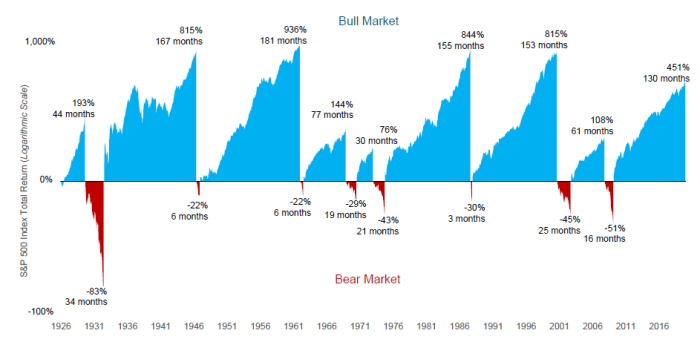

Historically, the stock market has often exhibited volatility around the release of jobs data. The monthly employment report, released by the Bureau of Labor Statistics, provides insights into the health of the labor market, which is a key driver of economic growth.

Strong job numbers tend to boost investor confidence, leading to market gains. Conversely, weak job data can trigger market declines as investors worry about the potential impact on corporate profits and consumer spending.

Awaiting Jobs Data: Us Stock Market Opens Lower Amidst Awaited Jobs Data

The stock market opened lower today, with investors awaiting the release of the crucial jobs data for the month. This report, expected later this week, is a key indicator of the health of the US economy and often influences market sentiment and trading activity.

The US stock market opened lower this morning, as investors awaited the release of crucial jobs data. However, the market quickly rebounded after the data revealed a mixed picture, with some positive signs but also hints of ongoing economic challenges.

For a more in-depth analysis of the market’s reaction to the jobs report, including the rally in stocks and the retreat in bond yields, check out this insightful piece from The Venom Blog: stocks rally bond yields retreat amid mixed jobs data market analysis.

The overall sentiment remains cautious, but the initial downward trend seems to have reversed for now, suggesting that investors are still optimistic about the long-term outlook.

The Significance of Jobs Data

The jobs report, specifically the nonfarm payrolls number, is a widely watched economic indicator. It provides insights into the strength of the labor market, a crucial component of economic growth. A strong jobs report, showing significant job creation and low unemployment, can boost investor confidence and lead to increased stock market activity.

Conversely, a weak jobs report, indicating job losses or a slowdown in hiring, can trigger concerns about economic growth and potentially lead to market declines.

Impact of Jobs Data on Investor Sentiment and Trading Activity

Investors closely analyze the jobs data to assess the overall health of the economy. Strong job growth suggests robust consumer spending and a healthy economy, potentially leading to increased investment and a bullish market. Conversely, weak job growth raises concerns about economic weakness, which can lead to risk aversion and a pullback in the market.

Historical Correlation Between Job Data Releases and Market Movements

Historically, there has been a noticeable correlation between jobs data releases and market movements. For instance, in the past, strong jobs reports have often been followed by market rallies, while weak reports have sometimes triggered market declines. However, it’s important to note that this correlation is not always straightforward, and other factors can also influence market movements.

Key Economic Indicators

While the jobs report takes center stage, other economic indicators are also playing a significant role in shaping the market’s direction. These indicators provide valuable insights into the overall health of the economy and can influence investor sentiment.

Inflation and Interest Rates

Inflation remains a key concern for investors, as rising prices can erode corporate profits and consumer purchasing power. The Federal Reserve has been aggressively raising interest rates to combat inflation, and the impact of these rate hikes on the economy is a subject of much debate.

Higher interest rates can make it more expensive for businesses to borrow money, potentially slowing down economic growth.

On the other hand, rising rates can also attract investors to fixed-income securities, potentially diverting capital away from the stock market. The Fed’s monetary policy decisions will continue to be closely watched by investors as they try to gauge the future path of inflation and interest rates.

Consumer Spending

Consumer spending accounts for a significant portion of the US economy, making it a crucial indicator of economic health. Consumer confidence and spending patterns can be influenced by factors such as inflation, employment, and interest rates.

The US stock market opened lower today, reflecting investor anxiety ahead of the crucial jobs data release. While the market waits for those numbers, it’s a good time to explore alternative avenues for growth, like the profitable low investment business ideas unlocking high returns that are gaining traction.

These ventures offer a unique opportunity to build wealth without relying on traditional market fluctuations. The jobs report will likely influence market sentiment, but it’s important to remember that diversification and strategic planning are key to navigating any economic climate.

Strong consumer spending typically supports economic growth and corporate earnings, which can be positive for the stock market.

However, if consumer spending weakens due to economic uncertainty or rising prices, it can have a negative impact on businesses and the broader economy.

Comparison with Previous Periods

The current economic climate bears some similarities to previous periods of market volatility, such as the 2008 financial crisis and the early stages of the COVID-19 pandemic. However, there are also some key differences.

- The current inflationary environment is unlike anything we’ve seen in decades, and the Fed’s aggressive rate hikes are unprecedented in recent history. This creates a unique set of challenges for investors and businesses alike.

- The global economy is facing a number of headwinds, including the ongoing war in Ukraine, supply chain disruptions, and rising energy prices. These factors add to the uncertainty surrounding the economic outlook.

Sector Analysis

The market’s opening decline has impacted various sectors, with some experiencing more significant drops than others. This sector-specific performance reflects the influence of industry trends, economic factors, and investor sentiment.

Impact on Technology Sector, Us stock market opens lower amidst awaited jobs data

The technology sector, often considered a bellwether for the broader market, has been particularly affected by the opening decline. The sector’s sensitivity to economic uncertainty, coupled with recent concerns about rising interest rates and potential slowing growth, has contributed to its weakness.

The decline in technology stocks is likely driven by concerns about their valuations and future earnings potential in a potentially less favorable economic environment.

Energy Sector Performance

The energy sector, on the other hand, has shown relative resilience despite the overall market downturn. The sector has benefited from the recent surge in oil prices, driven by global supply constraints and increased demand. The ongoing geopolitical tensions and the global energy crisis have further supported the energy sector’s performance.

However, the sector’s future performance will likely depend on the evolving geopolitical landscape and the trajectory of oil prices.

Consumer Discretionary Sector

The consumer discretionary sector, encompassing industries like retail, automotive, and travel, has also experienced a decline. The sector’s performance is closely tied to consumer spending patterns, which are susceptible to economic fluctuations. Concerns about inflation and rising interest rates have dampened consumer confidence, leading to a pullback in discretionary spending.

The sector’s future performance will depend on the trajectory of inflation and the extent to which consumer confidence recovers.

Investor Sentiment

The stock market’s opening dip reflects a cautious investor sentiment, with the upcoming jobs data release looming large. While risk appetite remains subdued, investors are closely watching for clues about the Federal Reserve’s future monetary policy decisions.

Impact of Recent Events

The recent events and news headlines have significantly influenced investor confidence. The ongoing geopolitical tensions, particularly the war in Ukraine, have created uncertainty about global economic growth and supply chain disruptions. Additionally, the persistent inflation and rising interest rates have raised concerns about the potential for a recession.

Investor Strategies

Given the current market conditions, investors are adopting a range of strategies to navigate the volatility. Some investors are opting for a defensive approach, favoring sectors like healthcare and consumer staples, which are considered more resilient in economic downturns. Others are seeking growth opportunities in sectors like technology, which are expected to benefit from long-term trends like digital transformation.

“Investors are seeking to balance risk and reward, with a focus on preserving capital and generating returns in a challenging environment.”