OPEC Cuts Oil Output, Impacting Global Prices

OPEC approves additional oil output cuts impacting global prices, sending shockwaves through the energy markets and raising concerns about the potential economic fallout. This move, a direct response to shifting global dynamics and the ongoing energy crisis, is poised to significantly impact oil prices, inflation, and the global economy as a whole.

The Organization of the Petroleum Exporting Countries (OPEC) has a long history of influencing global oil prices. By controlling a significant portion of the world’s oil production, OPEC’s decisions have a direct impact on the global energy landscape. This latest move, to cut oil output, is expected to further tighten supply, driving prices higher and potentially leading to economic instability.

OPEC’s Decision and its Context

The Organization of the Petroleum Exporting Countries (OPEC) has announced further reductions in oil production, a move that has sent shockwaves through global energy markets. This decision comes at a time of heightened uncertainty and volatility, with the global economy grappling with inflation and geopolitical tensions.

Rationale for Oil Output Cuts

OPEC’s decision to cut oil output is driven by a desire to maintain market stability and support oil prices. The cartel aims to strike a balance between supply and demand, ensuring that oil prices remain at a level that is profitable for its member countries.

This strategy is rooted in OPEC’s long-standing objective of maximizing revenue from oil exports.

Historical Overview of OPEC’s Oil Production Adjustments, Opec approves additional oil output cuts impacting global prices

OPEC has a history of adjusting oil production to influence global prices. In the past, the cartel has implemented both production cuts and increases to address market imbalances.

- In 2008, OPEC reduced production in response to the global financial crisis, which led to a sharp decline in oil demand. This move helped to stabilize prices and prevent a further collapse in the market.

- During the COVID-19 pandemic, OPEC and its allies, collectively known as OPEC+, implemented historic production cuts to counter the unprecedented drop in demand caused by lockdowns and travel restrictions. These cuts were instrumental in preventing a price crash and supporting the global oil market.

Current Geopolitical and Economic Factors

OPEC’s decision to cut oil output is influenced by a confluence of geopolitical and economic factors.

- The ongoing war in Ukraine has created significant uncertainty in global energy markets, leading to supply disruptions and price volatility. The war has also raised concerns about potential sanctions on Russia, a major oil producer, which could further tighten supply.

- The global economy is facing inflationary pressures, driven by factors such as supply chain disruptions, strong consumer demand, and monetary policy tightening. High inflation has eroded consumer purchasing power and dampened economic activity, impacting oil demand.

- The global energy transition towards renewable energy sources is gaining momentum, potentially leading to a decline in long-term demand for oil. However, the transition is expected to be gradual, and oil will remain a critical energy source for the foreseeable future.

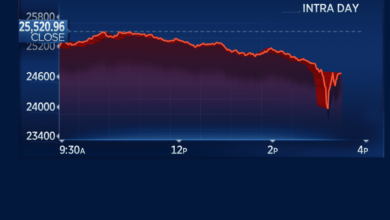

Impact on Global Oil Prices: Opec Approves Additional Oil Output Cuts Impacting Global Prices

OPEC’s decision to cut oil production will undoubtedly have a significant impact on global oil prices. The extent and duration of these price fluctuations, however, will depend on several factors, including the magnitude of the cuts, global demand, and geopolitical events.

OPEC’s recent decision to approve additional oil output cuts has sent shockwaves through the global market, impacting prices and potentially leading to increased volatility. This kind of economic uncertainty makes it even more important to consider profitable low investment business ideas unlocking high returns to secure financial stability.

By diversifying your income streams and exploring ventures with low overhead, you can potentially weather economic storms and even capitalize on market fluctuations. The impact of OPEC’s decision on global prices is a prime example of how unpredictable the market can be, making it crucial to have a solid financial plan and explore alternative income opportunities.

Short-Term Price Increases

The immediate impact of the oil output cuts is likely to be an increase in oil prices. This is because reduced supply, coupled with relatively stable demand, will create a tighter market, pushing prices upward. The magnitude of this increase will depend on the extent of the production cuts and the speed at which they are implemented.

OPEC’s decision to approve additional oil output cuts has sent shockwaves through the global market, pushing prices higher. This move comes on the heels of Saudi Arabia’s extension of its own production cut, a decision that has further fueled price surges and sparked intense market speculation.

Saudi Arabia’s move has added another layer of complexity to the already volatile oil market, leaving many wondering about the future direction of prices and the potential impact on global economies.

Long-Term Price Fluctuations

The long-term impact on oil prices is more complex and uncertain. While the initial price surge may be short-lived, sustained cuts could lead to a prolonged period of higher prices. This, in turn, could impact global economic growth and inflation.

Historical Trends

Historically, OPEC decisions to cut oil production have often resulted in short-term price increases, followed by a period of stabilization or even decline. For example, in 2008, OPEC’s decision to cut production led to a spike in oil prices, but these prices eventually fell as the global financial crisis unfolded.

Impact on Inflation and Consumer Spending

Higher oil prices can have a significant impact on inflation, as they increase the cost of transportation, energy, and other goods and services. This can lead to a decline in consumer spending, as people have less disposable income to spend on other items.

For example, the 2008 oil price spike was a major contributing factor to the global economic recession. The increase in fuel costs led to higher transportation expenses for businesses and consumers, ultimately affecting overall economic activity.

Implications for Energy Markets

OPEC’s decision to cut oil production has significant implications for the global energy market. The move is likely to impact the prices of various energy sources, influence the development of alternative energy technologies, and potentially shift demand patterns towards other oil producers.

Impact on Alternative Energy Sources

The higher oil prices resulting from OPEC’s decision could accelerate the development and adoption of alternative energy sources. This is because the increased cost of fossil fuels makes renewable energy technologies, such as solar and wind power, more economically competitive.

For instance, the rising price of gasoline could encourage consumers to invest in electric vehicles, further stimulating the growth of the electric vehicle market.

Potential for Increased Demand from Other Producers

The oil cuts could lead to increased demand for oil from other producers outside of OPEC. As global oil supplies tighten, countries seeking to fill the gap may turn to non-OPEC producers. This could potentially benefit countries like the United States, which has significantly increased its oil production in recent years.

However, it is important to note that the potential for increased demand from non-OPEC producers is subject to various factors, including geopolitical stability, production costs, and access to refining infrastructure.

OPEC’s decision to cut oil production is sending ripples through the global economy, and it’s interesting to see how these changes impact various industries. For instance, the news of daniel baldwin joins ishook 202879 might seem unrelated, but it could potentially affect the transportation sector, which is heavily reliant on fuel prices.

We’ll have to watch closely how these interconnected events unfold in the coming months.

Impact on Major Economies

OPEC’s decision to cut oil production will have significant implications for major economies worldwide, particularly the US, China, and Europe. These economies rely heavily on oil for transportation, manufacturing, and other essential sectors. The oil cuts are likely to push up energy prices, impacting inflation, economic growth, and energy security.

Impact on Energy Security and Dependence on OPEC Oil

The oil cuts will exacerbate existing concerns about energy security, particularly for countries heavily reliant on OPEC oil. For instance, the US, while a major oil producer, still imports a considerable amount of oil from OPEC countries. Higher oil prices could lead to increased dependence on OPEC, making these economies vulnerable to supply disruptions or geopolitical instability in the region.

This scenario could also incentivize investments in alternative energy sources and encourage domestic oil production, potentially reducing dependence on OPEC oil in the long term.

Potential Impact on Economic Growth and Employment

The oil cuts will likely impact economic growth and employment in various ways. Higher energy prices can increase production costs for businesses, leading to inflation and potentially slowing down economic activity. In the US, the impact on economic growth could be more pronounced as the country is a major consumer of oil.

Similarly, in Europe, where economies are more reliant on imported oil, the impact on economic growth and employment could be significant. However, the exact impact on economic growth and employment will depend on the magnitude and duration of the oil price increases, as well as the ability of businesses and consumers to adapt to higher energy costs.

Responses from Key Stakeholders

OPEC’s decision to further cut oil production has sparked a wave of reactions from key stakeholders across the globe. The move, while intended to stabilize the oil market, has raised concerns about its potential impact on energy security and economic growth.

Reactions of Major Oil-Consuming Countries

The reactions of major oil-consuming countries to OPEC’s decision have been mixed, reflecting their varying levels of dependence on oil imports and their economic sensitivities.

- The United States, a major oil producer, has expressed concerns that the cuts could exacerbate inflationary pressures and harm economic growth. The Biden administration has called on OPEC to increase production, citing the need to ensure affordable energy for consumers.

The US has also considered releasing additional oil from its Strategic Petroleum Reserve to mitigate the impact of the cuts.

- The European Union, heavily reliant on oil imports, has voiced similar concerns about the potential for price increases and economic disruption. The EU has called on OPEC to reconsider its decision and prioritize energy security in the context of the ongoing war in Ukraine.

- China, the world’s largest oil importer, has expressed its intention to maintain a stable and healthy oil market. China has also called for international cooperation to address global energy challenges, including the need to diversify energy sources and promote sustainable development.

Potential Responses from International Organizations

International organizations like the International Energy Agency (IEA) are likely to play a role in mitigating the potential consequences of OPEC’s decision.

- The IEA, a Paris-based organization that coordinates energy policy among its member countries, has already released oil from its emergency reserves in response to previous supply disruptions. The IEA could consider releasing additional oil if global oil prices rise significantly or if energy security is threatened.

- The IEA may also engage in diplomatic efforts to encourage OPEC to reconsider its decision or to find alternative solutions to address global energy challenges. The organization could also work with member countries to promote energy efficiency and diversify energy sources.

Potential for Diplomatic Tensions and Trade Disputes

OPEC’s decision has the potential to create diplomatic tensions and trade disputes between oil-producing and oil-consuming countries.

- Oil-consuming countries may consider imposing sanctions or trade restrictions on OPEC members in response to the cuts. This could lead to retaliatory measures from OPEC countries, further escalating tensions.

- The decision could also strain relationships between major economies, particularly those that are heavily dependent on oil imports. This could lead to increased competition for limited oil supplies and potentially exacerbate existing geopolitical tensions.

Long-Term Perspectives

OPEC’s decision to cut oil production has far-reaching implications for the global energy landscape, potentially reshaping the energy industry for years to come. The move could trigger a cascade of effects, influencing investment patterns, technological advancements, and the balance of power in the global energy market.

Potential for Increased Investment in Renewable Energy Sources

The oil cuts could act as a catalyst for increased investment in renewable energy sources. As fossil fuel prices rise, the economic viability of renewable energy technologies becomes more attractive. This shift in investment could accelerate the transition towards a more sustainable energy future, reducing reliance on volatile oil markets and mitigating climate change.

- The rising cost of fossil fuels makes renewable energy sources, such as solar and wind power, more competitive. This economic incentive could drive greater private and public investment in renewable energy infrastructure.

- Governments may be more inclined to implement policies that promote renewable energy development and incentivize adoption, recognizing the need for energy security and environmental sustainability.

- The increased investment in renewable energy technologies could lead to advancements in efficiency and cost reduction, further accelerating the transition towards a clean energy future.

Potential Shift in Global Energy Power Dynamics

OPEC’s decision could potentially alter the global energy power dynamics, shifting influence away from traditional oil-producing nations towards countries leading the renewable energy transition. The move could empower nations with strong renewable energy portfolios, potentially reducing their dependence on oil imports and increasing their geopolitical influence.

- Countries with substantial renewable energy resources, such as China and Germany, could gain greater leverage in the global energy market, becoming less reliant on oil imports and potentially influencing energy policies.

- The shift towards renewable energy could reduce the geopolitical influence of traditional oil-producing nations, potentially weakening their bargaining power in global affairs.

- The growing importance of renewable energy could lead to the emergence of new global energy partnerships and alliances, fostering collaboration on technology development and deployment.