Inflation, Corporate Insights: Shaping the Week Ahead

As market watch inflation figures and corporate insights set to shape the week ahead take center stage, the economic landscape is poised for a period of intense scrutiny. From the latest inflation data to the financial performance of major corporations, the coming days will be crucial for understanding the direction of the market and the impact on both businesses and consumers.

This week’s economic calendar is packed with key data releases and corporate events that will provide valuable insights into the state of the economy. Inflation remains a major concern, and the market will be closely watching for any signs of easing or acceleration.

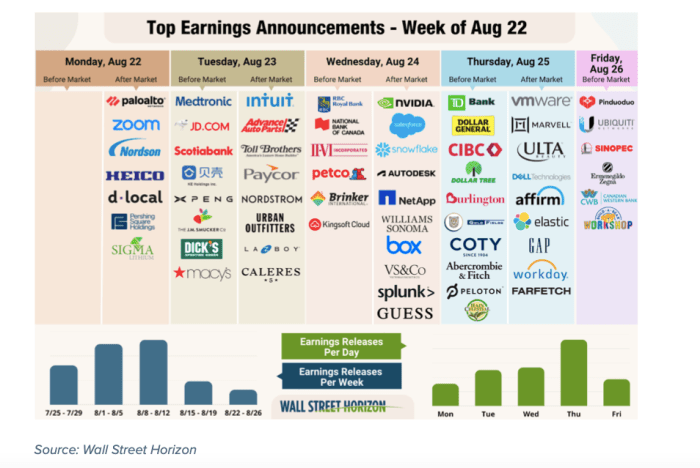

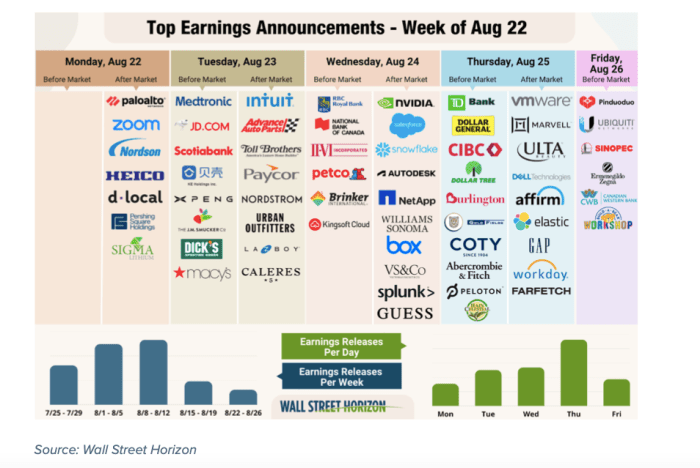

Meanwhile, corporations will be reporting their earnings, offering a glimpse into their profitability and growth prospects in the face of rising costs and shifting consumer behavior.

Market Watch Inflation Figures

The latest inflation figures released by the market watch provide crucial insights into the current economic landscape. These figures are closely scrutinized by policymakers, businesses, and consumers alike, as they offer a clear picture of the rate at which prices are rising.

Understanding the nuances of inflation is essential for making informed decisions about investments, spending, and business operations.

Impact of Inflation on the Broader Economy

Inflation’s impact on the broader economy is multifaceted. When prices rise, it can lead to a decline in consumer purchasing power, as their money buys less. This can stifle economic growth as consumers reduce spending. However, inflation can also stimulate economic activity, as businesses may increase prices to maintain profitability, leading to higher wages and increased production.

Comparison of Current Inflation Rates with Historical Trends

Comparing current inflation rates with historical trends provides valuable context for understanding the current economic situation. For instance, the current inflation rate in the United States, as measured by the Consumer Price Index (CPI), is significantly higher than it was in the years following the 2008 financial crisis.

This suggests that the current inflationary pressures are more pronounced than those experienced in the recent past.

This week, market watchers are eagerly anticipating inflation figures and corporate earnings reports, which will likely set the tone for the market’s trajectory. The news today is promising, with Wall Street opening on a positive note after a recent cooling of inflation, as reported in this article.

Whether this positive momentum can be sustained remains to be seen, as investors will be closely scrutinizing key economic indicators and corporate performance throughout the week.

Potential Implications of Inflation on Consumer Spending and Business Investment

Inflation can have a significant impact on consumer spending and business investment. Consumers may reduce their spending on discretionary goods and services if they perceive that their purchasing power is declining. This can lead to a slowdown in economic activity.

Businesses, on the other hand, may face challenges in managing their costs and maintaining profitability in an inflationary environment. They may need to adjust their pricing strategies, negotiate with suppliers, and explore cost-saving measures.

The week ahead promises a rollercoaster ride with market watch inflation figures and corporate insights setting the stage. Amidst this, regulatory pressures are adding another layer of complexity, as evidenced by the recent news that Binance.US’ affiliate has paused direct dollar withdrawals due to regulations.

This development highlights the ongoing challenges faced by cryptocurrency platforms navigating a tightening regulatory landscape, which will undoubtedly impact investor sentiment and market dynamics in the coming days.

Strategies That Businesses Are Adopting to Navigate the Inflationary Environment

Businesses are adopting a range of strategies to navigate the inflationary environment. These strategies include:

- Price Increases: Businesses may increase prices to offset rising input costs. This can help maintain profitability, but it can also lead to reduced demand from consumers.

- Cost Reduction: Businesses are looking for ways to reduce their operating costs, such as negotiating with suppliers for lower prices, streamlining their operations, and reducing waste.

- Investment in Technology: Businesses may invest in technology to improve efficiency and productivity, which can help offset rising labor costs.

- Diversification: Businesses may diversify their product or service offerings to reduce their dependence on any one market or input.

Corporate Insights

The latest earnings reports and financial performance of major corporations are providing valuable insights into the current state of the economy and the challenges businesses are facing. Inflation continues to be a major concern, impacting corporate profitability and growth prospects.

Impact of Inflation on Corporate Profitability

Inflation is eroding corporate profitability in several ways. Rising input costs, including raw materials, labor, and energy, are putting pressure on margins. Companies are struggling to pass on these increased costs to consumers, as demand remains uncertain. This is leading to a decline in profit margins, impacting overall profitability.

For example, the recent earnings reports of major retailers like Walmart and Target showed a significant decline in profit margins due to higher inventory costs and increased markdowns.

Strategic Decisions in Response to Inflation

Corporations are taking various strategic decisions to navigate the inflationary environment. Some companies are raising prices to offset rising costs, while others are focusing on cost-cutting measures to protect their margins. Some are also exploring new markets and product lines to diversify their revenue streams and mitigate the impact of inflation.

For example, companies in the consumer staples sector, like Procter & Gamble, are raising prices to maintain profitability, while companies in the technology sector, like Microsoft, are focusing on cost optimization to improve efficiency.

Potential Impact of Corporate Actions on the Economy

The actions taken by corporations in response to inflation can have a significant impact on the broader economy. If companies are forced to cut jobs or reduce investment due to declining profitability, it can lead to a slowdown in economic growth.

On the other hand, if companies are able to successfully pass on increased costs to consumers, it can contribute to higher inflation. The overall impact will depend on the specific actions taken by corporations and the response of consumers.

Market Outlook for the Week Ahead: Market Watch Inflation Figures And Corporate Insights Set To Shape The Week Ahead

The upcoming week promises a flurry of economic data releases and corporate events that will likely shape market sentiment and trading activity. Inflation remains a key concern, with investors closely watching for signs of its impact on corporate earnings and consumer spending.

Inflation’s Impact on Market Sentiment and Trading Activity, Market watch inflation figures and corporate insights set to shape the week ahead

Inflation’s influence on market sentiment is a complex and multifaceted issue. Investors are wary of rising prices, as they can erode corporate profits and reduce consumer purchasing power. This can lead to increased volatility in the markets, with investors adjusting their portfolios based on their inflation expectations.

Sectors and Industries Most Affected by Inflation

Inflation affects different sectors and industries in varying degrees.

- Energy:The energy sector is particularly vulnerable to inflation, as rising energy prices can increase production costs and impact consumer demand.

- Consumer Discretionary:The consumer discretionary sector, which includes companies that sell non-essential goods and services, is also sensitive to inflation. As prices rise, consumers may cut back on discretionary spending.

- Materials:The materials sector, which includes companies that produce raw materials such as metals and chemicals, is often affected by inflation as input costs rise.

Investment Strategies for the Current Market Environment

In the current market environment, investors may consider adopting strategies that aim to mitigate the impact of inflation.

This week’s market watch is all about inflation figures and corporate insights that will likely shape the week ahead. Keep an eye on the live updates for share market movement, with the Nifty crossing 17650, and a focus on HCL Tech and Tata Motors.

You can find the latest information on these key players here. As we move forward, it’s important to consider how these economic indicators and corporate strategies will influence the overall market trajectory.

- Value Stocks:Value stocks, which are companies with a low price-to-book ratio, can be a good investment during inflationary periods. These companies are often undervalued by the market and have the potential to benefit from rising prices.

- Dividend Stocks:Dividend stocks can provide a steady stream of income, which can help to offset the effects of inflation.

- Inflation-Protected Securities:Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), are designed to provide investors with a return that keeps pace with inflation.

Key Economic Data Releases and Corporate Events

| Date | Event | Impact |

|---|---|---|

| Monday | Consumer Confidence Index | Provides insights into consumer sentiment and spending. |

| Tuesday | S&P Global Manufacturing PMI | Measures manufacturing activity and provides insights into the health of the economy. |

| Wednesday | Federal Open Market Committee (FOMC) Meeting Minutes | Provides insights into the Fed’s thinking on monetary policy and inflation. |

| Thursday | Initial Jobless Claims | Measures the number of new unemployment claims, providing insights into the labor market. |

| Friday | Personal Consumption Expenditures (PCE) Price Index | The Fed’s preferred measure of inflation. |

Impact on Consumers

Rising inflation is a significant concern for consumers, as it erodes purchasing power and forces them to make difficult choices about their spending. The impact of inflation on consumer spending patterns, budgeting strategies, and confidence is a critical aspect of the economic landscape.

Consumer Spending Patterns

Inflation is forcing consumers to adjust their spending habits. As prices rise, they are buying less of certain goods and services, particularly non-essentials. This shift in spending patterns is evident in the declining sales of discretionary items like clothing, electronics, and entertainment.

Consumers are increasingly prioritizing essential goods like food, healthcare, and housing, which are less susceptible to price fluctuations.

Budgeting Strategies

To cope with inflation, consumers are adopting various budgeting strategies. These strategies include:

- Prioritizing Essential Spending:Consumers are focusing their spending on essential items like groceries, rent, and utilities, while reducing spending on discretionary items.

- Seeking Out Discounts and Sales:Consumers are actively searching for deals and discounts to stretch their budgets further. This has led to increased demand for coupons, loyalty programs, and price comparison websites.

- Cutting Back on Non-Essential Spending:Many consumers are reducing their spending on entertainment, travel, and dining out to save money.

- Increasing Savings:Some consumers are increasing their savings rates to build a financial cushion in case of unexpected expenses or economic downturns.

Impact on Consumer Confidence and Discretionary Spending

Rising inflation can erode consumer confidence, leading to a decline in discretionary spending. When consumers feel uncertain about the future, they tend to save more and spend less. This can create a vicious cycle, as declining consumer spending can further slow economic growth, leading to higher unemployment and further eroding consumer confidence.

Industries Most Vulnerable to Changes in Consumer Behavior

Industries that rely heavily on discretionary spending are most vulnerable to changes in consumer behavior due to inflation. These industries include:

- Retail:Clothing, electronics, and furniture retailers are particularly susceptible to changes in consumer spending, as these items are often considered non-essential.

- Travel and Hospitality:Inflation can lead to a decline in travel and tourism, as consumers cut back on vacations and leisure activities.

- Entertainment:Movie theaters, concerts, and other entertainment venues may experience a decline in attendance as consumers seek out less expensive forms of entertainment.

Shift in Consumer Preferences

Inflation can also lead to a shift in consumer preferences. As prices rise, consumers may start to favor cheaper alternatives or brands. This can create opportunities for companies that offer value-oriented products and services. Additionally, consumers may be more likely to choose products that are durable and long-lasting, as they seek to avoid frequent purchases.

Government Policies

Governments around the world are grappling with the challenge of controlling inflation, which has surged to multi-decade highs in many countries. Central banks have taken the lead in combating inflation, primarily through interest rate hikes, but governments are also playing a role through a variety of fiscal and regulatory policies.

Policy Measures to Address Inflation

Governments are employing a range of policy measures to address inflation, with the goal of reducing demand and easing price pressures. These measures include:

- Fiscal Policy:Governments can use fiscal policy to influence the economy through spending and taxation. In times of high inflation, governments may choose to reduce spending or increase taxes to reduce aggregate demand. This can help to curb inflation by slowing down economic growth.

For example, the US government implemented a series of tax cuts and spending increases during the COVID-19 pandemic, which contributed to the current inflationary pressures. To counter this, the Biden administration has proposed raising taxes on corporations and wealthy individuals, aiming to reduce the federal deficit and potentially cool down the economy.

- Price Controls:In some cases, governments may implement price controls to cap the prices of certain goods and services. This can be a controversial measure, as it can lead to shortages and distortions in the market. For example, Venezuela implemented price controls on essential goods, but this resulted in widespread shortages and black markets.

However, some countries, like India, have implemented price controls on specific commodities, such as fuel, to moderate inflation.

- Wage and Income Policies:Governments may also try to influence wage and income levels to help control inflation. For example, some countries have implemented wage freezes or guidelines to limit wage growth. While this can help to contain inflation, it can also lead to labor unrest and reduce worker morale.

- Supply Chain Interventions:Governments can intervene in supply chains to address bottlenecks and increase the availability of goods and services. This can involve measures such as providing subsidies to businesses, reducing trade barriers, or investing in infrastructure. For example, the US government has provided financial assistance to semiconductor manufacturers to boost domestic production and reduce reliance on foreign suppliers.

Effectiveness of Government Policies

The effectiveness of government policies in controlling inflation depends on a variety of factors, including the severity of the inflationary pressures, the structure of the economy, and the political climate. Some studies suggest that fiscal policy can be effective in reducing inflation, particularly when combined with monetary policy measures.

However, the impact of fiscal policy can be delayed and may not be fully felt until several months or even years after implementation.

“Fiscal policy can be a powerful tool for influencing inflation, but it must be used judiciously and in coordination with monetary policy.”

International Monetary Fund

Unintended Consequences of Government Interventions

Government interventions in the economy can have unintended consequences, such as:

- Distortions in the Market:Price controls and other regulations can create distortions in the market, leading to shortages, black markets, and inefficiencies. For example, rent control policies can lead to a shortage of rental housing, as landlords are less incentivized to invest in new properties.

- Reduced Investment:Government policies that increase taxes or regulate businesses can discourage investment, which can slow economic growth. For example, high corporate tax rates can make it less attractive for businesses to invest in new facilities or hire more workers.

- Increased Government Debt:Fiscal policies that involve increased government spending can lead to higher levels of government debt. This can put pressure on future generations to pay off the debt, potentially leading to higher taxes or reduced government services.

Comparison of Policy Approaches

Different governments have adopted different policy approaches to address inflation. For example, the US Federal Reserve has been more aggressive in raising interest rates than the European Central Bank. This reflects the different economic conditions in the two regions, as well as the different priorities of their central banks.

Future Direction of Government Policy

The future direction of government policy in response to inflation is uncertain. It will depend on a number of factors, including the trajectory of inflation, the state of the economy, and the political landscape. Some economists believe that governments will need to continue to implement policies to reduce inflation, while others believe that inflation will eventually subside on its own.