Stock Market Gains: Fed Optimism Sparks Positive Momentum

Stock market gains federal reserve optimism sparks positive market momentum sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The recent surge in stock prices can be attributed to a confluence of factors, with the Federal Reserve’s optimistic stance playing a pivotal role.

As the central bank continues to navigate the delicate balance between inflation and growth, investors are closely watching every move, interpreting each signal as a roadmap for the future of the market.

The Federal Reserve’s influence on market sentiment is undeniable, as its monetary policy decisions directly impact the cost of borrowing and the availability of credit. Recent actions, such as interest rate hikes and quantitative tightening, have been carefully calibrated to curb inflation while fostering sustainable economic growth.

This approach has instilled a sense of confidence among investors, leading to a surge in risk appetite and a subsequent rise in stock prices. However, the path ahead remains uncertain, and any shift in the Fed’s stance could significantly alter the market landscape.

Potential Risks and Challenges: Stock Market Gains Federal Reserve Optimism Sparks Positive Market Momentum

While the current market momentum is fueled by optimism surrounding the Federal Reserve’s actions, it’s essential to acknowledge that the market is not immune to potential risks and challenges. The market’s upward trajectory could be disrupted by various factors, including shifts in investor sentiment, geopolitical events, and economic uncertainties.

These factors could lead to a market correction, a sudden and sharp decline in stock prices.

Market Correction

A market correction is a decline of 10% or more in a major stock market index, such as the S&P 500. Corrections can occur quickly and unexpectedly, often driven by a combination of factors.The possibility of a market correction is always present, and it’s important to be prepared for such an event.

Investors should have a well-defined investment strategy that considers their risk tolerance and time horizon. They should also avoid panic selling during a correction, as this can exacerbate losses.

Shift in Investor Sentiment

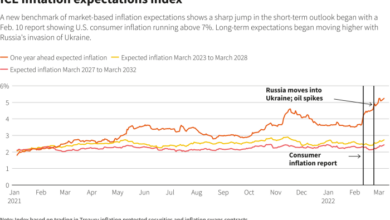

Investor sentiment can be fickle and can change rapidly. Positive sentiment can fuel a bull market, while negative sentiment can lead to a bear market.For example, in 2022, investor sentiment shifted dramatically due to concerns about inflation, rising interest rates, and the war in Ukraine.

This shift led to a significant decline in the stock market.

Geopolitical Events

Geopolitical events can have a significant impact on the stock market. These events can create uncertainty and volatility, leading to investor fear and a decline in stock prices.For example, the Russian invasion of Ukraine in 2022 led to a surge in energy prices and a decline in global stock markets.

Economic Uncertainties, Stock market gains federal reserve optimism sparks positive market momentum

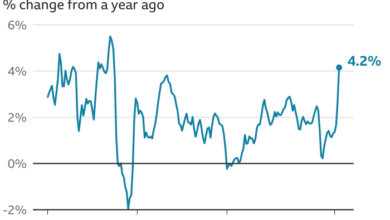

Economic uncertainties, such as rising inflation, interest rate hikes, and recession fears, can also weigh on the stock market. These uncertainties can lead to investor caution and a decline in stock prices.For instance, the Federal Reserve’s aggressive interest rate hikes in 2022 were aimed at combating inflation, but they also raised concerns about a potential recession.

This led to a decline in the stock market as investors became more cautious.

The stock market is riding high on optimism surrounding the Federal Reserve’s recent announcements, but a looming question mark hangs over the energy sector. While crude oil prices hold steady near $94 amid the Fed’s rate hike plans and the Russian export ban, as outlined in this recent article crude oil prices hold steady near 94 amid feds rate hike plans and russian export ban , the overall positive market momentum suggests investors are focusing on the broader economic picture for now.

The recent surge in the stock market, fueled by optimism surrounding the Federal Reserve’s stance, has injected a much-needed dose of positive momentum. However, it’s important to remember that global economic factors can influence market sentiment. A closer look at China’s economic challenges and their potential impact on markets can help investors navigate the current landscape.

While the Fed’s actions are encouraging, it’s crucial to stay informed about global events that could impact your portfolio.

The recent stock market gains, fueled by optimism surrounding the Federal Reserve’s stance, have created a positive market momentum. This ripple effect seems to be extending beyond traditional assets, as even the world of crypto memes is experiencing a surge in popularity, especially with the excitement surrounding Bitcoin ETFs.

Check out this article for a deeper dive into the fascinating intersection of meme culture and crypto. This broader market enthusiasm could be a sign of investors looking for opportunities beyond the traditional, and the future is looking bright for both the stock market and the world of digital assets.