Home Affordability Crisis: Americans Struggle to Meet Housing Demands

Home affordability crisis americans struggle to meet escalating income demands in housing market. This is a stark reality for many Americans today, as the cost of housing continues to soar while wages stagnate. From coast to coast, families are finding themselves priced out of the market, forced to make difficult choices between basic necessities and the dream of homeownership.

The crisis has far-reaching consequences, impacting not only individuals and families, but also the broader economy.

The reasons for this crisis are complex and multifaceted. Inflation has played a significant role, driving up the cost of building materials and labor. A shortage of available housing inventory, fueled by a combination of factors like low interest rates and a growing population, has further exacerbated the problem.

Rising interest rates, designed to curb inflation, have also made mortgages more expensive, pushing homeownership out of reach for many.

The Rising Cost of Housing: Home Affordability Crisis Americans Struggle To Meet Escalating Income Demands In Housing Market

The American dream of homeownership is increasingly out of reach for many, as the cost of housing continues to soar. This affordability crisis is a complex issue with far-reaching consequences for individuals, families, and communities.

Factors Contributing to Rising Housing Prices

Several factors have contributed to the significant increase in housing prices in recent years, making it challenging for many Americans to find affordable homes.

- Inflation:The rising cost of goods and services, fueled by factors such as supply chain disruptions and increased demand, has led to higher construction costs and increased demand for housing.

- Low Inventory:The housing market has been experiencing a shortage of available homes for sale, which has driven up prices due to limited supply and high demand. This shortage is attributed to factors such as a slowdown in new home construction and homeowners being hesitant to sell their properties due to low interest rates.

- Rising Interest Rates:The Federal Reserve’s efforts to combat inflation have resulted in higher interest rates, making mortgages more expensive and reducing the purchasing power of potential homebuyers.

Impact on Specific Cities and Regions

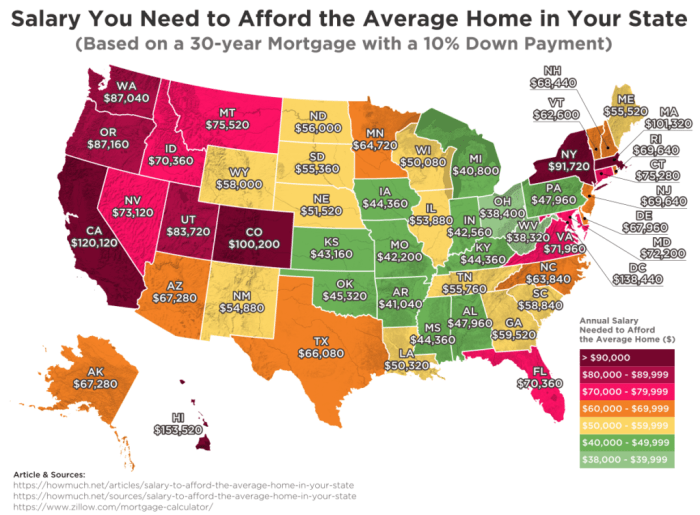

The affordability crisis is particularly acute in certain cities and regions where housing prices have skyrocketed, outpacing income growth.

- San Francisco, California:The median home price in San Francisco has surpassed $1.5 million, making it one of the most expensive housing markets in the United States. This high cost of living has forced many residents to relocate to more affordable areas.

- New York City, New York:The median home price in New York City has also reached record highs, exceeding $1 million in many neighborhoods. The high cost of housing has led to concerns about displacement and gentrification, as long-time residents struggle to afford living in the city.

- Denver, Colorado:Denver has experienced a rapid influx of new residents in recent years, driving up demand for housing and leading to a significant increase in home prices. This influx is partly attributed to the city’s strong economy and desirable lifestyle.

Median Home Price vs. Average Household Income

To illustrate the extent of the affordability crisis, it’s helpful to compare median home prices with average household income in different areas.

| City/Region | Median Home Price | Average Household Income | Price-to-Income Ratio |

|---|---|---|---|

| San Francisco, CA | $1,500,000 | $120,000 | 12.5 |

| New York City, NY | $1,000,000 | $80,000 | 12.5 |

| Denver, CO | $600,000 | $80,000 | 7.5 |

The price-to-income ratio represents the number of years of average household income needed to purchase the median home. A higher ratio indicates a less affordable housing market.

The Impact on Americans

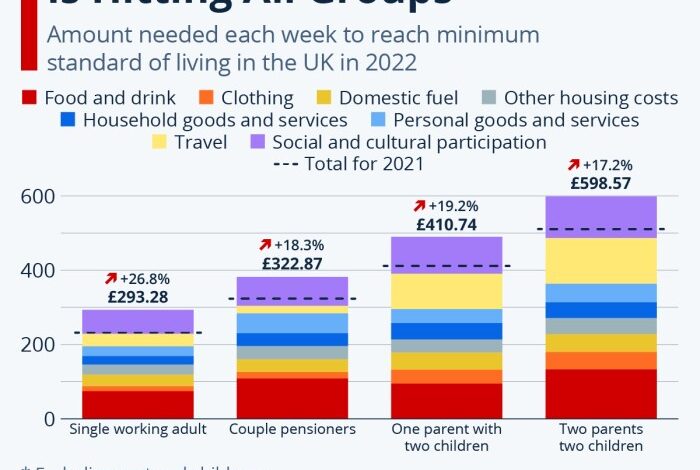

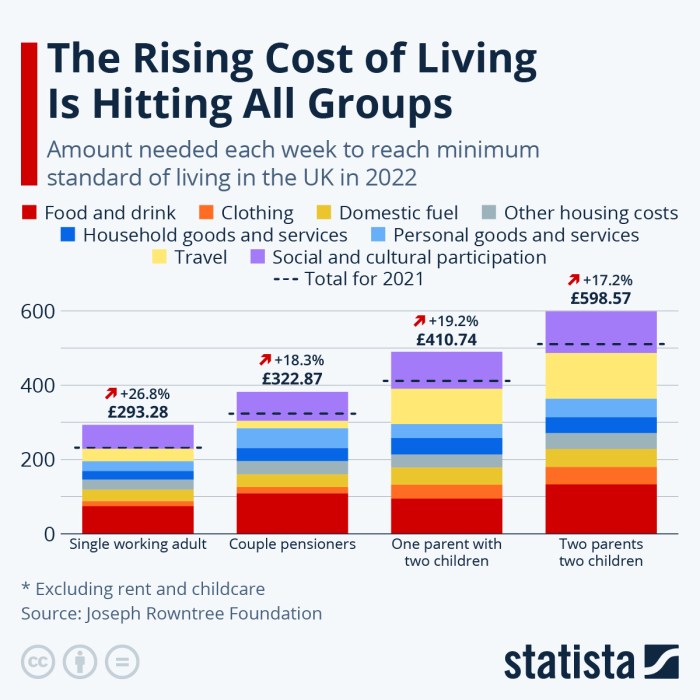

The affordability crisis has a profound impact on Americans across various demographics, creating a ripple effect that stretches beyond just housing costs. It significantly affects their well-being, financial stability, and overall quality of life.

The Challenges Faced by Young Adults

The affordability crisis poses unique challenges for young adults entering the workforce. They often face a competitive housing market with limited income and high student loan debt. Many young adults struggle to afford rent or a down payment on a home, delaying their financial independence and delaying major life milestones like starting a family.

The Challenges Faced by Families

Families, particularly those with children, are also deeply affected by the affordability crisis. Rising housing costs often strain family budgets, making it difficult to meet basic needs such as food, healthcare, and education. This financial pressure can lead to increased stress, family instability, and even homelessness.

The Challenges Faced by Low-Income Earners

The affordability crisis disproportionately impacts low-income earners, who often face a limited supply of affordable housing options. These individuals often have to make difficult choices, such as choosing between paying rent and essential expenses, or living in overcrowded and substandard housing.

The Challenges Faced by Renters, Home affordability crisis americans struggle to meet escalating income demands in housing market

Renters, who constitute a significant portion of the American population, face a challenging housing market. The rising cost of rent, combined with limited rental inventory, puts pressure on renters to find affordable housing. Many renters face the risk of displacement, eviction, or homelessness due to rising rents and limited options.

The Consequences of Unaffordable Housing

The affordability crisis has far-reaching consequences, impacting individuals and communities alike. It contributes to:* Homelessness:The lack of affordable housing is a major driver of homelessness. When people cannot afford rent or housing, they may end up living on the streets or in shelters.

Financial Stress Unaffordable housing can lead to financial stress, forcing individuals and families to make difficult choices, such as forgoing essential needs or accumulating debt.

Limited Mobility High housing costs can limit people’s ability to move for better job opportunities or educational advancement, restricting their economic and social mobility.

The home affordability crisis continues to plague Americans, with many struggling to meet escalating income demands in the housing market. While this struggle plays out on a personal level, the broader economic picture is also being affected. Check out today’s stock market news to see how Wall Street is evaluating economic data and the impact on stock performance.

Ultimately, the health of the housing market is inextricably linked to the overall economy, making it a crucial factor for both individual Americans and the broader financial landscape.

The home affordability crisis is a major concern for many Americans, as rising housing costs are outpacing wage growth. This struggle is further complicated by the current negotiations between the UAW and major car makers, as seen in this recent article auto industry update uaw negotiates contracts with major car makers.

These negotiations could impact the auto industry’s workforce, potentially affecting their ability to afford housing in a market already experiencing significant challenges.

The home affordability crisis is a real struggle for many Americans, with rising housing costs outpacing income growth. It’s a tough situation, and it’s interesting to see how the broader economic landscape is playing out, like the recent news that the US stock market opened higher amid steady yields.

While that might seem like good news, it’s hard to ignore the impact it could have on the housing market and further exacerbate the affordability issue.