Homebuyers Increasing Down Payments Amidst Tough Housing Conditions

Homebuyers increasing down payments amidst tough housing conditions is a trend that’s reshaping the housing market. With rising interest rates and a limited inventory of homes for sale, the dream of homeownership is becoming more expensive. This shift is forcing many buyers to adjust their financial strategies and save more for a larger down payment.

The current housing market is a challenging landscape for buyers. Interest rates are climbing, pushing mortgage payments higher, and the inventory of homes available for sale is dwindling. This perfect storm of factors is making it increasingly difficult for buyers to afford their dream homes, especially for first-time homebuyers.

To navigate these challenges, many buyers are choosing to increase their down payments, aiming for a larger down payment to reduce their monthly mortgage payments and potentially secure better interest rates.

Rising Down Payments

The housing market is in a state of flux, driven by a confluence of factors that have made homeownership a more challenging endeavor for many. Rising interest rates and persistent inventory shortages have created a perfect storm, pushing home prices to record highs and making it more difficult for prospective buyers to secure financing.

This has resulted in a significant increase in down payments, forcing homebuyers to adjust their financial strategies to navigate this evolving landscape.

The Impact of Rising Interest Rates

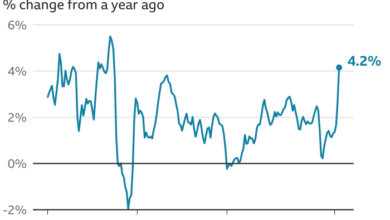

The Federal Reserve has been aggressively raising interest rates in an effort to combat inflation. These rate hikes have had a direct impact on mortgage rates, making borrowing more expensive. As a result, monthly mortgage payments have increased, pushing up the overall cost of homeownership.

This has forced many potential buyers to reassess their affordability and adjust their down payment accordingly.

The Role of Inventory Shortages

The housing market has been grappling with a chronic shortage of inventory, particularly in desirable areas. This limited supply has fueled competition among buyers, driving up prices and making it more challenging to secure a home. In this environment, sellers often favor buyers with larger down payments, as they are perceived as less risky and more likely to close the deal.

Adjusting Financial Strategies

Homebuyers are responding to these market conditions by adopting various strategies to increase their down payments:

- Saving More:Many buyers are prioritizing saving for a larger down payment, often extending their savings timeline to accumulate the necessary funds. This requires disciplined budgeting and a commitment to financial goals.

- Seeking Gifts or Loans:Some buyers are turning to family and friends for financial assistance in the form of gifts or loans to bolster their down payment. This can be a helpful strategy, but it’s important to have clear agreements and documentation in place.

- Exploring Alternative Financing:Some buyers are exploring alternative financing options, such as FHA loans or VA loans, which often require lower down payments. These programs can be a good option for first-time homebuyers or those with limited savings.

- Delaying Homeownership:Some potential buyers are choosing to delay their homeownership plans until the market conditions improve or their financial situation allows for a larger down payment. This can be a strategic move, but it also means missing out on potential equity growth and tax benefits.

It’s a tough market out there for homebuyers, with prices soaring and interest rates climbing. Many are finding themselves having to increase their down payments just to get a foot in the door. But amidst the housing struggles, there’s a bright spot: the tech world is booming, with companies like Nvidia leading the charge.

Nvidia’s recent announcement of AI supercomputers and services, which has sent their stock soaring to new heights , is a testament to the power of innovation. Perhaps this tech boom will eventually trickle down to the housing market, offering some relief to struggling buyers.

Motivations Behind Increased Down Payments: Homebuyers Increasing Down Payments Amidst Tough Housing Conditions

In today’s competitive housing market, homebuyers are increasingly opting to increase their down payments. This strategic move is driven by a combination of factors, ranging from the desire to secure a mortgage to the need for financial stability. Understanding these motivations is crucial for both buyers and lenders alike.

The current housing market is making it tough for buyers, leading many to increase their down payments to secure a mortgage. But even with larger down payments, navigating the financial complexities of homeownership can be stressful. If you’re a Wells Fargo customer, you might want to check out this article on Wells Fargo customers reporting missing deposits to ensure your finances are secure.

With the right financial strategies, you can navigate the challenges of the housing market and achieve your dream of homeownership.

First-Time Buyers vs. Repeat Buyers

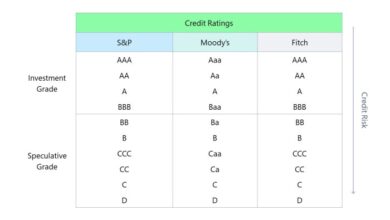

The motivations behind increased down payments differ significantly between first-time buyers and repeat buyers. First-time buyers, often facing limited savings, are driven by a strong desire to enter the housing market and achieve homeownership. They may increase their down payment to qualify for a more favorable mortgage rate or to avoid private mortgage insurance (PMI), which can add a substantial cost to their monthly payments.

It’s no surprise that homebuyers are increasing their down payments in this tough housing market. The high cost of homes coupled with rising interest rates makes it more challenging than ever to secure a mortgage. And with market volatility persisting as the S&P 500 approaches a milestone , many potential buyers are understandably hesitant to take on large financial commitments.

The current climate is forcing buyers to be more cautious and financially prepared, putting a premium on larger down payments to navigate this uncertain landscape.

Repeat buyers, on the other hand, may increase their down payments to reduce their overall debt burden, secure a lower interest rate, or gain greater financial flexibility.

Financial Planning and Stability

Increasing down payments is often a deliberate financial strategy. Buyers recognize that a larger down payment can translate into lower monthly mortgage payments, reducing their overall financial burden. This can lead to increased financial stability, allowing them to allocate more resources to other financial goals, such as retirement savings or debt reduction.

Furthermore, a larger down payment can enhance their financial security by reducing their exposure to potential market fluctuations or interest rate changes.

Impact on Housing Market Dynamics

The rising trend of larger down payments has significant implications for the overall housing market, potentially influencing home prices, sales volume, and inventory levels. This shift in buyer behavior can create both opportunities and challenges for various segments of the market, particularly first-time buyers and investors.

Impact on Home Prices

Increased down payments can exert downward pressure on home prices. As buyers commit more upfront capital, their borrowing capacity decreases, limiting their purchasing power. This reduced demand can lead to a slowdown in price appreciation, or even a decline in certain market segments.

For example, in areas where first-time buyers are a significant portion of the market, increased down payment requirements could lead to a decrease in demand for entry-level homes, resulting in price stagnation or a slight dip.

Impact on Sales Volume

The rising down payment trend can also affect sales volume. Higher down payments can act as a barrier to entry for some buyers, particularly those with limited savings. This can lead to a decrease in the number of transactions, especially in price-sensitive segments like first-time buyers or those with lower credit scores.

However, in markets with strong demand and limited inventory, increased down payments may not necessarily translate to a significant decrease in sales volume, as buyers may be willing to adjust their budgets or wait for the right opportunity.

Impact on Inventory Levels, Homebuyers increasing down payments amidst tough housing conditions

The impact of increased down payments on inventory levels is multifaceted. On one hand, higher down payments could discourage some sellers from listing their homes, as they may be less motivated to move if they anticipate a smaller profit margin.

This could lead to a tighter inventory situation, potentially pushing prices upward. On the other hand, increased down payments could also lead to a decrease in demand, which could result in more homes staying on the market for longer periods, leading to higher inventory levels.

The net effect on inventory levels would depend on the interplay of these factors, as well as the overall economic conditions and market dynamics.

Impact on First-Time Buyers

First-time buyers are often the most vulnerable to the impact of rising down payments. Higher down payment requirements can significantly increase the financial burden of homeownership, making it more challenging for them to enter the market. This could exacerbate the affordability crisis and further limit their access to homeownership.

Furthermore, increased down payments could also lead to a decrease in the availability of affordable homes, as investors may be less inclined to purchase homes with lower profit margins.

Impact on Investors

Investors may benefit from the rising down payment trend, as it could lead to a decrease in competition from first-time buyers. With fewer buyers in the market, investors may have an easier time securing properties, particularly in price-sensitive segments.

However, investors may also face challenges if the trend leads to a decrease in overall sales volume, as this could limit their investment opportunities. Furthermore, investors may need to adjust their strategies and focus on properties with higher potential for appreciation or rental income to compensate for the higher down payment requirements.

The Future of Down Payments

Predicting the future of down payments is a complex task, given the dynamic nature of the housing market and the constant evolution of financial landscapes. However, several trends and factors suggest potential shifts in down payment requirements and homebuyer behavior in the years to come.

Technological Advancements and Down Payments

Technological advancements are likely to play a significant role in shaping the future of down payments. For example, the rise of fintech companies and alternative lending platforms could offer innovative financing options, potentially lowering down payment requirements or providing access to financing for individuals who might not qualify for traditional mortgages.

- AI-Powered Credit Scoring:Advancements in artificial intelligence (AI) could lead to more sophisticated credit scoring models that consider a wider range of data points beyond traditional credit history, potentially opening doors for individuals with limited credit histories to access financing.

- Blockchain Technology:Blockchain technology could revolutionize mortgage transactions, making them faster, more secure, and potentially less expensive. This could lead to lower down payment requirements as lenders might be able to reduce their risk associated with mortgage lending.

- Digital Mortgage Platforms:Digital mortgage platforms are simplifying the mortgage application process, making it more accessible and potentially reducing the need for large down payments.

Evolving Financial Landscapes and Down Payments

The evolving financial landscape is also likely to influence down payment trends. Factors like rising interest rates, inflation, and economic uncertainty could impact homebuyer behavior and influence down payment decisions.

- Rising Interest Rates:As interest rates rise, the cost of borrowing increases, potentially pushing homebuyers towards larger down payments to reduce their monthly mortgage payments.

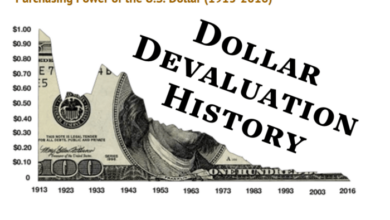

- Inflation:Inflation can erode the purchasing power of savings, making it more challenging for homebuyers to accumulate a substantial down payment. This could lead to a demand for more flexible financing options with lower down payment requirements.

- Economic Uncertainty:Economic uncertainty can make homebuyers hesitant to commit to large financial obligations like mortgages. This could lead to a preference for smaller down payments, allowing for greater financial flexibility in case of unforeseen economic challenges.

Challenges and Opportunities for Homebuyers

The future of down payments presents both challenges and opportunities for homebuyers.

- Challenge:Rising interest rates and inflation could make it more difficult for homebuyers to save for a down payment, potentially pushing them towards larger down payments or delaying their home purchase plans.

- Opportunity:The emergence of alternative lending options and innovative financing solutions could provide more flexibility and accessibility for homebuyers, potentially lowering down payment requirements or offering financing options tailored to individual needs.

- Challenge:The increasing complexity of the housing market and the constant evolution of financing options could make it more challenging for homebuyers to navigate the process and find the best financing solutions.

- Opportunity:Technological advancements and the availability of online resources could empower homebuyers with greater access to information and tools to make informed decisions about their home purchase.