Israeli Markets React: Stocks Decline, Businesses Close After Hamas Attack

Israeli markets react to hamas attack stocks decline businesses close – Israeli markets reacted swiftly and dramatically to the recent Hamas attack, with the Tel Aviv Stock Exchange (TASE) experiencing significant declines and businesses across the country forced to close or adjust operations. The initial shockwaves sent tremors through various sectors, including tourism, retail, and transportation, leaving investors and businesses grappling with the immediate and potential long-term consequences of this unprecedented event.

The attack triggered a wave of uncertainty, prompting investors to pull back from the market, leading to a sharp drop in trading volume. Businesses, particularly those in the tourism and hospitality sectors, faced immediate challenges as travel restrictions were imposed and visitors fled the country.

The ripple effect extended to other industries, with retailers reporting decreased sales and transportation services disrupted due to security concerns and closures.

Business Closures and Operational Disruptions

The Hamas attack on Israel had a profound impact on the country’s economy, forcing businesses to close or adjust operations. This disruption affected key industries, including tourism, retail, and transportation, leading to significant economic challenges.

The Israeli markets are reeling from the Hamas attack, with stocks plummeting and businesses shutting down. But amidst the chaos, a glimmer of optimism emerged with the Nvidia earnings report sparking market optimism today. However, the news is unlikely to provide much solace to those affected by the violence, as the focus remains on the humanitarian crisis unfolding in Israel.

Impact on Key Industries, Israeli markets react to hamas attack stocks decline businesses close

The attack’s impact on the tourism industry was immediate and severe. With international travel advisories and heightened security concerns, tourists cancelled their trips to Israel, leading to significant losses for hotels, airlines, and tour operators. The retail sector also suffered, as consumers reduced their spending amid uncertainty and fear.

The Israeli markets are reeling from the shockwaves of the Hamas attack, with stocks plummeting and businesses shutting down. It’s a stark reminder of how global events can ripple through financial markets, even impacting companies like Apple, which has been experiencing its own set of challenges.

Despite the buzz surrounding the iPhone 15, Apple’s stock has been on a downward trajectory in August, a trend explored in detail in this article: apples august woes from highs to correction amid china and iphone 15 buzz. The current situation in Israel highlights the interconnectedness of our world, where even seemingly unrelated events can have a profound impact on global markets.

Shopping malls and stores saw a decline in foot traffic, affecting sales and profits. The transportation industry faced disruptions as well. Public transportation systems were adjusted to enhance security, and some routes were temporarily suspended. This affected the movement of people and goods, impacting businesses that rely on efficient transportation networks.

Potential Long-Term Consequences

The economic fallout from the Hamas attack is likely to have long-term consequences. The decline in tourism could have a lasting impact on the industry, as it takes time to rebuild trust and attract visitors back. The disruptions to businesses and supply chains could lead to job losses and reduced economic growth.

The Israeli markets are in turmoil, with stocks plummeting and businesses shutting down in response to the Hamas attack. This economic instability comes at a time when the Biden administration is raising concerns about the dominance of tech giants in the stock market, as highlighted in this recent article on The Venom Blog.

It’s a complex situation, with both geopolitical events and internal market forces contributing to the current volatility.

The Israeli government has implemented measures to support businesses and individuals affected by the attack. These measures include financial assistance, tax breaks, and job training programs. However, the full extent of the economic damage and the time it will take to recover remains to be seen.

Government Response and Economic Measures

In the wake of the Hamas attack, the Israeli government swiftly implemented a series of economic measures aimed at mitigating the immediate impact and supporting the affected businesses and individuals. These measures were designed to address the disruptions caused by the attack, provide financial assistance to those who suffered losses, and bolster the country’s economic resilience.

Financial Assistance and Support Measures

The Israeli government announced a comprehensive package of financial assistance and support measures to aid businesses and individuals affected by the attack. These measures included:

- Emergency grants: The government allocated substantial funds to provide emergency grants to businesses that had to temporarily close due to the attack. These grants were intended to cover immediate expenses, such as rent, utilities, and employee salaries.

- Loan guarantees: The government also offered loan guarantees to businesses seeking to access credit to cover operational expenses or invest in recovery efforts. These guarantees reduced the risk for lenders, making it easier for businesses to secure financing.

- Tax relief: To alleviate the financial burden on affected businesses, the government introduced tax relief measures, such as deferring tax payments and reducing tax liabilities. These measures provided businesses with some breathing room during the recovery period.

- Unemployment benefits: The government expanded unemployment benefits to cover individuals who lost their jobs due to the attack. These benefits provided financial support to those who were temporarily out of work.

Global Market Reactions and International Support

The Hamas attack on Israel had a profound impact on global markets, particularly those with significant ties to the country. Financial markets experienced immediate and widespread volatility, reflecting the uncertainty and heightened risk associated with the conflict. International organizations and governments responded with expressions of solidarity and pledges of economic support for Israel.

Impact on Global Markets

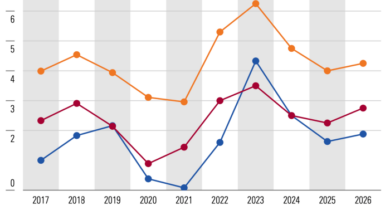

The attack triggered a significant sell-off in global stock markets, with major indexes experiencing sharp declines. The Tel Aviv Stock Exchange (TASE) was particularly affected, with the benchmark TA-35 index plummeting by over 5% in the days following the attack.

- The tech sector, a significant component of the Israeli economy, was hit hard, with companies like Intel and Nvidia experiencing notable drops in their share prices.

- Global energy markets also felt the ripple effects, with oil prices surging as investors anticipated potential disruptions to supply chains and energy production in the region.

- The Israeli Shekel depreciated sharply against major currencies, reflecting investor concerns about the economic impact of the conflict.

International Response and Support

The international community responded swiftly to the attack, with many countries condemning the violence and offering their support to Israel.

- The United States, a key ally of Israel, immediately pledged its unwavering support, providing both military and financial assistance.

- The European Union, while expressing its concern over the escalation of violence, also offered its support to Israel, emphasizing the importance of a peaceful resolution to the conflict.

- The International Monetary Fund (IMF) announced its readiness to provide financial assistance to Israel, if needed, to help mitigate the economic impact of the attack.

Long-Term Implications

The long-term implications of the attack on global financial markets and investment sentiment remain uncertain.

- The conflict could lead to increased geopolitical tensions and instability in the region, potentially impacting global trade and investment flows.

- The attack could also have a significant impact on the Israeli economy, potentially leading to a decline in economic growth and an increase in unemployment.

- Investors may become more risk-averse, leading to a decline in global stock markets and a shift towards safer assets.

Long-Term Economic Outlook and Recovery: Israeli Markets React To Hamas Attack Stocks Decline Businesses Close

The Hamas attack on Israel, while primarily a humanitarian and security crisis, has significant implications for the country’s economic future. The immediate impact is evident in the disruption of businesses, tourism, and daily life. However, the long-term economic consequences are more complex and will depend on various factors, including the duration of the conflict, the extent of infrastructure damage, and the global response.

Factors Influencing Economic Recovery

The speed and nature of Israel’s economic recovery will be influenced by a number of key factors:

- Duration and Intensity of the Conflict:A prolonged conflict will lead to greater economic damage, with a longer recovery period. The intensity of the conflict, particularly the extent of infrastructure damage and disruption of essential services, will also significantly impact the economic recovery.

- Government Response and Economic Measures:The Israeli government’s response to the economic fallout will be crucial. Measures such as financial aid to businesses, support for displaced workers, and investment in infrastructure reconstruction will be vital for a swift and sustainable recovery.

- Global Response and International Support:International support, including financial assistance, investment, and trade agreements, will be essential for Israel’s economic recovery. The global community’s response to the crisis will also impact investor confidence and economic activity.

- Business Confidence and Investment:The level of confidence among businesses and investors will play a significant role in determining the pace of recovery. Investor sentiment and the willingness of businesses to invest in new projects will be crucial for driving economic growth.

- Tourism and Travel Industry Recovery:Israel’s tourism industry, a significant contributor to the economy, will be severely impacted. The recovery of this sector will depend on the perception of safety and security among potential tourists and the effectiveness of government efforts to rebuild tourism infrastructure.

Challenges and Opportunities for Businesses and Investors

The aftermath of the attack presents both challenges and opportunities for businesses and investors in Israel:

- Challenges:

- Increased Security Costs:Businesses will likely face higher security costs due to heightened security measures, which can strain profit margins.

- Disruption of Supply Chains:The conflict can disrupt supply chains, leading to delays and shortages of essential goods and services.

- Uncertainty and Risk:The uncertain nature of the conflict creates a high level of risk for businesses and investors, making it challenging to make long-term investment decisions.

- Opportunities:

- Reconstruction and Infrastructure Development:The need to rebuild damaged infrastructure will create opportunities for construction companies and related industries.

- Technological Innovation:The conflict can also accelerate the adoption of innovative technologies, such as cybersecurity and surveillance systems, creating opportunities for technology companies.

- Government Support:The Israeli government is likely to provide financial support and incentives to businesses, particularly those involved in reconstruction and recovery efforts.