US Treasury Launches Crucial Economic Partnerships with China

Breaking news us treasury launches crucial economic and financial partnerships with china – Breaking news: the US Treasury has announced the launch of crucial economic and financial partnerships with China. This move, coming at a time of heightened geopolitical tensions, has sent shockwaves through the global financial landscape. The partnership aims to address pressing economic issues and foster greater cooperation between the two superpowers.

The announcement follows months of behind-the-scenes negotiations, highlighting a shift in approach towards US-China relations. This partnership focuses on areas of shared interest, such as trade, investment, and currency exchange, with the goal of creating a more stable and prosperous global economy.

Background of US-China Economic Relations

The economic relationship between the United States and China has evolved dramatically over the past few decades, marked by periods of intense cooperation and growing tension. From the early days of engagement to the current era of strategic competition, this dynamic relationship has profoundly impacted the global economy.

The news of the US Treasury forging key economic and financial partnerships with China is definitely a major development. It’s interesting to see how this plays out against the backdrop of the news that Byju’s, the Indian edtech giant, has proposed a whopping 12 billion dollar repayment plan to resolve its debt crisis – a move that shocked the industry.

byjus shocks with 12 billion repayment proposal indian edtech giants swift debt resolution This situation in India highlights the complexities of the global financial landscape, which will likely factor into how the US and China navigate their own partnership.

Historical Trajectory

The US-China economic relationship began in the early 1970s when President Richard Nixon initiated diplomatic relations with China. This marked a significant shift in US policy towards China, paving the way for economic cooperation. In the 1980s and 1990s, China experienced rapid economic growth, driven by its integration into the global market.

This period witnessed a surge in trade between the US and China, as American businesses sought to capitalize on China’s low-cost labor and expanding consumer market. China’s entry into the World Trade Organization (WTO) in 2001 further solidified its position as a global economic powerhouse.

The US Treasury’s new economic partnerships with China are definitely making headlines, and it’s got me thinking about the potential for similar collaborations in the blockchain space. I’m curious to see how Gavin Wood’s vision for chain mergers and acquisitions might play out in this new global landscape.

It’s exciting to imagine the possibilities of increased collaboration and innovation when countries and blockchain developers alike work together to shape the future of finance.

Shared Economic and Financial Interests

The US and China share significant economic and financial interests. Trade is a cornerstone of this relationship, with the US being China’s largest export market and China being the US’s second-largest trading partner. The US-China trade relationship encompasses a wide range of goods and services, including manufactured goods, agricultural products, and technology.

The breaking news of the US Treasury launching crucial economic and financial partnerships with China has sent ripples through the global markets. While the implications of this move are still being analyzed, it’s interesting to see how the Indian stock market is reacting.

Check out live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors for the latest on the Nifty’s performance. It’s definitely a time to watch how these developments unfold and how they might impact the global economic landscape.

Trade

- The US exports agricultural products, aircraft, and other manufactured goods to China.

- China exports manufactured goods, consumer electronics, and apparel to the US.

Investment

- US companies have invested heavily in China, particularly in manufacturing and technology sectors.

- Chinese companies have also increased their investments in the US, including in real estate, infrastructure, and technology.

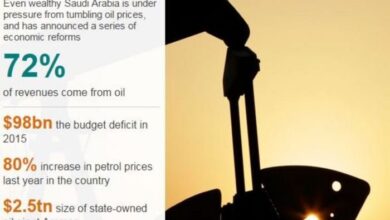

Currency Exchange

- The Chinese yuan’s exchange rate against the US dollar is a crucial aspect of the economic relationship.

- Fluctuations in the exchange rate can impact trade flows and investment decisions.

Geopolitical Context

In recent years, the geopolitical context surrounding US-China economic relations has become increasingly complex. Factors like trade wars, technological competition, and security concerns have strained the relationship.

Trade Wars

- In 2018, the US imposed tariffs on billions of dollars worth of Chinese goods, citing unfair trade practices and intellectual property theft.

- China retaliated with tariffs on US goods, escalating the trade war.

- The trade war disrupted global supply chains and hurt businesses on both sides.

Technological Competition

- The US and China are engaged in a fierce competition for technological dominance.

- This competition encompasses areas like artificial intelligence, 5G technology, and semiconductors.

- The US has implemented measures to restrict Chinese companies’ access to critical technologies, citing national security concerns.

Security Concerns

- The US has raised concerns about China’s military buildup and its assertive behavior in the South China Sea.

- The US has also expressed concerns about China’s cyber activities and its alleged theft of intellectual property.

Economic Implications: Breaking News Us Treasury Launches Crucial Economic And Financial Partnerships With China

The potential economic implications of a US-China partnership are vast and multifaceted. This partnership could have a significant impact on global economic stability and growth, trade patterns, investment flows, and the global financial system. It’s essential to carefully analyze these potential consequences to understand the broader implications for both nations and the world at large.

Impact on Global Economic Stability and Growth

A strengthened US-China partnership could contribute to global economic stability and growth in several ways. First, it could lead to a more predictable and stable global trade environment. By fostering closer cooperation on trade issues, the two nations could reduce the risk of trade disputes and protectionist measures, creating a more predictable environment for businesses and investors.

Second, the partnership could stimulate economic growth by facilitating increased trade and investment between the two countries. This could lead to new markets, opportunities for businesses, and job creation in both nations. Finally, the partnership could help to address global economic challenges, such as climate change and financial instability, by encouraging collaboration on shared priorities.

Implications for US Businesses and Consumers

The impact of a US-China partnership on US businesses and consumers is likely to be complex and multifaceted. For US businesses, the partnership could offer new opportunities for exporting goods and services to China’s vast market. It could also lead to increased investment in the US by Chinese companies, creating jobs and boosting the US economy.

However, the partnership could also pose challenges for US businesses, such as increased competition from Chinese companies and the need to adapt to new trade regulations. For US consumers, the partnership could lead to lower prices for goods imported from China, as well as a wider variety of products available.

However, it could also lead to job losses in certain sectors, such as manufacturing, as businesses relocate to China to take advantage of lower labor costs.

Impact on the Global Financial System

The potential impact of a US-China partnership on the global financial system is a topic of considerable debate. One possibility is that the partnership could lead to increased financial integration between the two countries, resulting in greater capital flows and currency exchange rate volatility.

This could create opportunities for investors, but it could also increase the risk of financial instability. Another possibility is that the partnership could lead to a shift in the global financial system, with the Chinese yuan playing a more prominent role as a reserve currency.

This could have significant implications for the US dollar’s dominance and the global financial landscape.

Political Implications

The US-China economic partnership holds significant political implications, potentially impacting bilateral relations, global governance, and the balance of power. The partnership’s success could foster greater cooperation and understanding between the two nations, while its failure could exacerbate existing tensions and lead to further geopolitical instability.

Impact on Bilateral Relations, Breaking news us treasury launches crucial economic and financial partnerships with china

The potential for improved bilateral relations is a key aspect of the US-China economic partnership. This partnership could create a platform for increased dialogue and cooperation, potentially easing tensions and fostering trust between the two nations. The shared economic interests could provide a foundation for addressing contentious issues, such as trade disputes, intellectual property rights, and human rights concerns.

Implications for Global Governance

The US-China economic partnership has significant implications for global governance and the balance of power. The partnership could potentially lead to a more multipolar world, with both countries playing a more active role in shaping global institutions and norms. However, it could also exacerbate existing power imbalances, particularly if one country gains a significant advantage over the other.

Addressing Global Challenges

The US-China economic partnership could play a crucial role in addressing global challenges like climate change and poverty. Both countries are major contributors to global greenhouse gas emissions and have significant resources to contribute to global efforts to mitigate climate change.

The partnership could also leverage their combined economic power to support developing countries and address global poverty.