High Mortgage Rates? No Problem! 3 Easy Tips to Save Big on Your Home Loan

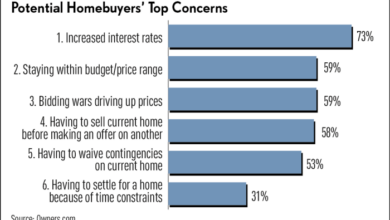

High mortgage rates no problem 3 easy tips to save big on your home loan – High Mortgage Rates? No Problem! 3 Easy Tips to Save Big on Your Home Loan – Let’s face it, homeownership in this current market can feel like a distant dream. Mortgage rates have been on a roller coaster ride, and it can feel like you’re constantly battling uphill against the odds.

But don’t despair! There are ways to navigate this challenging landscape and still achieve your homeownership goals. We’re diving into practical strategies to make your dream a reality, even with those seemingly daunting interest rates.

This guide explores the current mortgage rate environment, offering a historical perspective and shedding light on the factors driving those high numbers. But it’s not just about understanding the problem; we’re going to arm you with actionable solutions. We’ll reveal three simple yet powerful tips to save big on your home loan, complete with real-world examples and strategies you can implement right away.

From negotiating with lenders to exploring alternative financing options, we’ll cover all the bases to help you secure the best possible deal. Get ready to unlock the secrets to homeownership in this challenging market!

Financial Planning for Homeownership: High Mortgage Rates No Problem 3 Easy Tips To Save Big On Your Home Loan

Buying a home is a significant financial decision, especially in a high-rate environment. It’s crucial to plan your finances meticulously to ensure affordability and avoid financial strain. Financial planning before buying a home allows you to make informed decisions, navigate the complexities of the process, and achieve your homeownership goals.

Budgeting for Homeownership

Creating a detailed budget is essential for determining your affordability and managing your finances effectively.

- Track Your Expenses:Start by tracking your monthly income and expenses to understand your current spending habits. Use budgeting apps, spreadsheets, or financial management software to monitor your spending and identify areas for potential savings.

- Estimate Your Housing Costs:Calculate your estimated monthly mortgage payments, property taxes, homeowners insurance, and any potential HOA fees. Consider additional costs like maintenance, repairs, and utilities. Online mortgage calculators can help you estimate your monthly payments.

- Factor in Other Expenses:Remember to include other recurring expenses like car payments, student loans, credit card bills, and personal expenses in your budget. This will provide a comprehensive picture of your financial obligations.

- Create a Realistic Budget:Once you have a clear understanding of your income and expenses, create a realistic budget that allocates funds for essential needs, debt repayment, and savings.

Saving for a Down Payment

Saving for a down payment is a critical step in the homebuying process. A larger down payment can help you qualify for a lower interest rate and reduce your monthly mortgage payments.

- Set a Savings Goal:Determine the desired down payment amount based on your budget and the home price you are targeting. Consider the typical down payment requirements for different mortgage types, which can range from 3% to 20% of the purchase price.

- Automate Savings:Set up automatic transfers from your checking account to a dedicated savings account for your down payment. This ensures consistent savings and helps you reach your goal faster.

- Explore Additional Savings Strategies:Consider strategies like side hustles, reducing expenses, or selling unused items to boost your savings.

Managing Debt, High mortgage rates no problem 3 easy tips to save big on your home loan

High debt levels can impact your ability to qualify for a mortgage or secure a favorable interest rate. Managing your debt effectively is crucial for financial stability.

- Reduce Existing Debt:Prioritize paying down high-interest debt like credit cards or personal loans. This will improve your credit score and make you a more attractive borrower. Consider debt consolidation options to streamline your payments and potentially lower interest rates.

- Avoid New Debt:Refrain from taking on new debt, especially high-interest credit card debt, before and during the homebuying process. This will help you maintain a healthy debt-to-income ratio and improve your chances of securing a mortgage.

Financial Planning Tools and Resources

Numerous financial planning tools and resources can assist homebuyers in making informed decisions and managing their finances effectively.

- Budgeting Apps:Apps like Mint, Personal Capital, and YNAB (You Need a Budget) can help you track expenses, create budgets, and monitor your financial progress.

- Mortgage Calculators:Online mortgage calculators allow you to estimate your monthly payments, explore different loan terms, and compare interest rates.

- Credit Monitoring Services:Services like Credit Karma and Experian provide free access to your credit report and score, helping you monitor your credit health and identify potential issues.

- Financial Advisors:A financial advisor can provide personalized guidance on budgeting, saving, investing, and managing debt, especially in a high-rate environment.

High mortgage rates might feel like a roadblock, but don’t despair! There are ways to save big on your home loan, like negotiating a lower interest rate or exploring alternative financing options. Speaking of unexpected shifts, did you hear about Domino’s recent surprise partnership that’s changing their delivery strategy?

It’s a reminder that sometimes, a fresh approach can lead to big wins, just like finding creative solutions to navigate those high mortgage rates.

High mortgage rates got you feeling stressed? Don’t worry, there are ways to save big on your home loan! While you’re figuring out your finances, check out this interview with Vitalik Buterin, the co-founder of Ethereum, on Bloomberg Studio 10 bloombergs studio 10 ethereum co founder vitalik buterin.

It’s a great reminder that even in challenging times, there’s always room for innovation and growth, just like in the crypto world. Back to those mortgage rates, remember to shop around for the best rates, consider a shorter loan term, and make extra payments when you can.

You’ve got this!

While high mortgage rates might seem daunting, there are ways to navigate the market and snag a great deal. Remember, the key is to be informed and proactive. A recent ISM survey highlighted sluggish growth in the US services sector, indicating potential for negotiation in certain areas.

This could translate into opportunities for buyers, especially if you’re looking in a less competitive market. So, don’t let those high rates discourage you, there are still ways to save big on your home loan!