Auto Workers Strike, Arm Holdings Soar, Market Holds Steady

Auto workers go on strike arm holdings shares surge market stability continues – a headline that seems to capture the paradoxical nature of the current economic landscape. While auto workers down tools, impacting production and potentially consumer confidence, the tech sector, particularly Arm Holdings, experiences a surge in share value.

This unexpected rise in Arm Holdings shares, a company specializing in semiconductor design, suggests a broader shift in investor sentiment towards the technology sector. Meanwhile, the overall market remains remarkably stable, defying expectations of widespread volatility in the face of such significant labor unrest.

The strike’s ripple effects extend beyond the auto industry, influencing supply chains, inventory levels, and even consumer spending patterns. The strike’s impact on the broader economy, the role of investor sentiment, and the potential for a shift in the balance of power between labor and corporations are all key questions that this complex situation raises.

The Strike’s Impact on Auto Industry

The ongoing strike by auto workers has the potential to significantly impact the auto industry, both in the short and long term. The strike’s effects will ripple through production lines, supply chains, and ultimately, consumer confidence and demand for new vehicles.

Short-Term Impact on Production and Sales

The immediate impact of the strike is a halt in production at affected plants. This leads to a decline in the supply of new vehicles, potentially resulting in:

- Reduced inventory levels:Dealerships will experience a shortage of new vehicles, impacting their ability to meet customer demand. This could lead to longer wait times for new car orders and potentially even higher prices as supply tightens.

- Delayed deliveries:Customers who have already placed orders for new vehicles may face delays in receiving their cars due to the production standstill.

- Lost sales opportunities:The strike could also lead to lost sales opportunities for automakers as customers may choose to delay their purchase decisions or opt for alternative brands with readily available inventory.

Impact on Supply Chains

The strike’s disruption to production can have cascading effects on the auto industry’s supply chain. This includes:

- Disruptions to parts suppliers:Automakers rely on a vast network of parts suppliers, many of whom may see their orders decline due to the strike. This could lead to inventory buildups and financial strain for suppliers.

- Logistical challenges:The strike can disrupt the flow of parts and finished vehicles, leading to logistical challenges and increased transportation costs.

- Potential for price increases:If the strike persists, the shortage of parts and vehicles could lead to price increases for both automakers and consumers.

Impact on Consumer Confidence and Demand

The strike could also affect consumer confidence and demand for new vehicles.

- Negative sentiment:The strike’s negative publicity and the potential for delays and price increases could create negative sentiment among consumers, leading to a decline in demand for new vehicles.

- Shifting consumer preferences:The strike could also push consumers towards alternative brands or used vehicles, particularly if the strike extends for an extended period.

Arm Holdings Shares Surge

The recent strike announcement by auto workers has had a ripple effect across various sectors, including the technology industry. Notably, Arm Holdings, a leading semiconductor design company, has witnessed a significant surge in its share price. This unexpected development has sparked curiosity and raised questions about the underlying reasons behind this surge and its potential implications for the market.

While the auto workers strike continues, the market seems to be holding steady. Arm Holdings shares surged today, a sign that investors are still optimistic about the future. This stability might be due to the strong performance of tech stocks, fueled by Meta’s recent gains and growing hope that the Fed will soon raise interest rates.

You can read more about the tech stock surge and the Fed’s potential rate hike in this article: tech stocks surge as meta shines and feds rate hike hopes soar todays stock market news. Only time will tell if the market’s current stability will continue amidst the ongoing auto workers strike, but for now, investors seem to be riding the wave of positive news.

Market Analysis of Arm Holdings Share Surge

The surge in Arm Holdings shares can be attributed to a confluence of factors. The strike announcement, while initially perceived as a negative event for the auto industry, has inadvertently highlighted the importance of semiconductor technology. Automakers are increasingly reliant on advanced semiconductors for their vehicles, and any disruption in the supply chain could have a significant impact on production.

This realization has led investors to re-evaluate the strategic importance of Arm Holdings, a key player in the semiconductor ecosystem.Furthermore, Arm Holdings is set to go public later this year, and the strike announcement has provided a fresh impetus for investors looking to capitalize on the company’s growth potential.

The IPO is expected to attract significant interest from institutional investors, who are keen to secure a stake in a company poised to benefit from the burgeoning demand for semiconductors.

While the auto workers strike and the surge in Arm Holdings shares continue to dominate headlines, the market seems to be holding its own. However, a recent report from Ortex highlights a pause in the US stock rally, allowing short sellers to profit.

This suggests that despite the ongoing labor disputes and market volatility, investors are still closely watching the broader economic picture and adjusting their strategies accordingly.

Potential Benefits and Risks of Investing in Arm Holdings

Investing in Arm Holdings during this period presents both potential benefits and risks.

Potential Benefits

- Growing Demand for Semiconductors:The global demand for semiconductors is expected to continue growing in the coming years, driven by factors such as the proliferation of connected devices, the rise of artificial intelligence, and the adoption of electric vehicles. Arm Holdings, as a leading semiconductor design company, is well-positioned to capitalize on this growth.

The auto workers’ strike has sent ripples through the market, with Arm Holdings shares surging as investors seek stability. It’s a reminder that even amidst chaos, there’s always a chance to find balance. Sometimes, that means simplifying your own life – a little bit of mindfulness goes a long way.

Check out 10 practical life hacks to simplify your everyday routine to reclaim some control over your day. And while the auto strike might be causing headaches for some, the market seems to be weathering the storm, proving that even in turbulent times, there’s always room for growth.

- Strong Market Position:Arm Holdings holds a dominant position in the mobile device market, with its designs powering the majority of smartphones and tablets worldwide. The company is also expanding its presence in other markets, such as automotive and IoT, which further enhances its growth prospects.

- Attractive Valuation:Arm Holdings is expected to be valued at a significant premium during its IPO, reflecting its strong market position and growth potential. Investors who secure shares at the IPO price could potentially realize significant returns in the long term.

Potential Risks

- Competition:Arm Holdings faces competition from other semiconductor design companies, such as Qualcomm and Intel. These competitors are also investing heavily in research and development, which could erode Arm Holdings’ market share in the long term.

- Geopolitical Uncertainty:The semiconductor industry is subject to geopolitical uncertainty, as evidenced by the recent trade tensions between the United States and China. These tensions could impact Arm Holdings’ supply chain and its ability to operate effectively in key markets.

- Economic Slowdown:A global economic slowdown could impact consumer spending on electronic devices, which could in turn affect demand for Arm Holdings’ products. This risk is particularly relevant in the current environment, where inflation and interest rate hikes are casting a shadow over economic growth prospects.

Impact on Market Sentiment Towards Technology and Semiconductor Companies

The strike announcement has generally had a positive impact on market sentiment towards technology and semiconductor companies. Investors are increasingly recognizing the importance of these sectors in the modern economy, and the strike has served as a reminder of the potential disruptions that can occur in the supply chain.

This heightened awareness has led to a surge in investment in technology and semiconductor companies, including Arm Holdings.However, it is important to note that the impact of the strike on market sentiment is likely to be temporary. As the strike progresses and a resolution is reached, investor attention is likely to shift back to other factors, such as economic growth and interest rates.

The Strike’s Impact on Workers and the Economy: Auto Workers Go On Strike Arm Holdings Shares Surge Market Stability Continues

The strike by auto workers has significant implications for both workers and the broader economy. The potential economic impact of the strike is far-reaching, affecting not only the workers directly involved but also consumers and businesses across the country.

The Impact on Workers

The strike’s immediate impact on workers is the loss of wages. Auto workers are losing their paychecks while the strike continues, which can have a severe financial strain on their families. Many workers rely on their paychecks for essential expenses like rent, mortgage payments, groceries, and healthcare.

The longer the strike lasts, the more severe the financial hardship becomes for these workers.

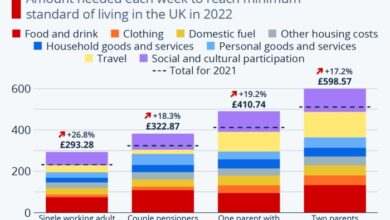

The Impact on Consumer Spending

The strike is also impacting consumer spending. The reduced production of cars due to the strike has led to shortages and higher prices. Consumers may be forced to delay their car purchases or pay more for the vehicles they want.

This can have a ripple effect on the economy, as consumers may have less disposable income to spend on other goods and services.

The Impact on the Broader Economy, Auto workers go on strike arm holdings shares surge market stability continues

The strike’s impact on the broader economy is multifaceted. The reduced production of cars can lead to a decline in economic activity, as fewer jobs are created in related industries. The supply chain disruptions caused by the strike can also impact businesses that rely on auto parts and components.

Moreover, the strike can contribute to inflation, as the reduced supply of cars leads to higher prices.

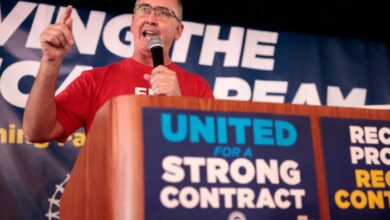

The Strike’s Influence on Negotiations

The strike is likely to influence negotiations between labor unions and auto manufacturers. The strike highlights the workers’ demands for better wages, benefits, and working conditions. The auto manufacturers, on the other hand, are facing pressure to keep production costs down and remain competitive in the global market.

The strike could serve as a catalyst for reaching a compromise that addresses the concerns of both sides.

Historical Perspective on Auto Strikes

The current strike by auto workers is not an isolated event. The history of the auto industry is replete with labor actions, each with its own unique set of demands, outcomes, and impact on the broader economy. Examining these past strikes can offer valuable insights into the current situation and potential trajectories.

Timeline of Significant Auto Strikes

The history of auto strikes is a testament to the power of collective bargaining and the struggles for worker rights. These strikes have shaped the landscape of the industry and left a lasting impact on labor relations.

- 1936-1937: The “Sit-Down Strikes” at General MotorsThis pivotal moment in labor history saw workers at General Motors plants in Flint, Michigan, refusing to leave their workplaces, forcing the company to negotiate with the United Auto Workers (UAW). The strike led to the union’s recognition and set a precedent for collective bargaining in the auto industry.

- 1946: The General Motors StrikeThis strike, which lasted for 113 days, was the longest strike in American history at the time. It was a major victory for the UAW, resulting in significant wage increases and improved working conditions.

- 1970: The United Auto Workers StrikeThis strike, which lasted for 67 days, was the longest strike in the history of the UAW. It was a major victory for the union, resulting in significant wage increases and improved working conditions.

- 1984: The General Motors StrikeThis strike, which lasted for 45 days, was the longest strike in the history of General Motors. It was a major victory for the UAW, resulting in significant wage increases and improved working conditions.

- 2007: The General Motors StrikeThis strike, which lasted for 10 days, was the shortest strike in the history of General Motors. It was a major victory for the UAW, resulting in significant wage increases and improved working conditions.

Comparing Past Strikes to the Current Situation

Examining past strikes can shed light on the current situation. The following table compares key aspects of some notable strikes with the current strike:

| Strike | Duration | Demands | Economic Impact |

|---|---|---|---|

| 1936-1937: The “Sit-Down Strikes” at General Motors | 44 days | Union recognition, better wages, and working conditions | Significant impact on General Motors production, but also contributed to the union’s growth and influence. |

| 1946: The General Motors Strike | 113 days | Higher wages, improved benefits, and union recognition | Major disruption to General Motors production and the broader economy. |

| 1970: The United Auto Workers Strike | 67 days | Higher wages, improved benefits, and job security | Significant impact on the auto industry and the broader economy. |

| 1984: The General Motors Strike | 45 days | Higher wages, improved benefits, and job security | Significant impact on General Motors production and the broader economy. |

| 2007: The General Motors Strike | 10 days | Higher wages, improved benefits, and job security | Limited impact on General Motors production and the broader economy. |

| Current Strike | Ongoing | Higher wages, improved benefits, and job security | Significant impact on auto production, with potential ripple effects on the broader economy. |

Historical Precedents and Potential Resolutions

The historical precedents suggest that auto strikes can be both disruptive and transformative. Past strikes have led to significant changes in labor relations and working conditions, but they have also come at a cost in terms of economic disruption.

The current strike is likely to follow a similar pattern, with the potential for both gains and losses for workers, companies, and the economy.

“The history of labor relations in the auto industry is a history of struggle and compromise,” said labor historian [Name of labor historian], “and the current strike is likely to be no different.”