Asian Stock Markets Stand Firm Amidst Central Bank Actions and Dollars Pause

Asian stock markets stand firm amidst central bank actions and dollars pause sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The global financial landscape has been marked by a wave of uncertainty in recent months, with central banks around the world taking decisive steps to combat inflation and manage economic growth.

Meanwhile, the US dollar has been experiencing a period of relative calm, leading to a curious dynamic in Asian markets. This article explores the intricate interplay between these forces, examining how Asian stock markets have managed to hold their ground amidst the ongoing volatility.

From the bustling trading floors of Tokyo to the vibrant markets of Hong Kong, Asian stock markets have demonstrated a remarkable resilience in the face of global economic headwinds. This stability can be attributed to a confluence of factors, including robust domestic economies, supportive government policies, and a growing investor appetite for Asian growth stories.

We’ll delve into the specifics of these factors, analyzing the recent performance of key indices and dissecting the strategies employed by investors navigating these complex markets.

Asian Stock Market Resilience

Asian stock markets have demonstrated remarkable resilience in the face of global economic uncertainties, bucking the trend of declines witnessed in other major markets. This resilience can be attributed to a combination of factors, including robust economic growth, supportive monetary policies, and strong domestic demand.

Performance of Key Indices

The performance of key Asian stock indices has been impressive, showcasing the region’s resilience. For instance, the Shanghai Composite Index, a key indicator of the Chinese stock market, has shown positive gains, driven by strong economic growth and government support for key industries.

Asian stock markets have shown resilience in recent days, weathering the storm of central bank actions and a pause in the dollar’s rally. This stability comes as investors anticipate the upcoming Fed conference on interest rates, which could have a significant impact on global markets.

For insights into how these anticipated rate decisions might influence Asian stock market trends, check out this article: asian stock market trends amid anticipation of fed conference on interest rates. Regardless of the Fed’s pronouncements, the current strength of Asian markets suggests a degree of confidence in the region’s economic prospects.

Similarly, the Nikkei 225, Japan’s benchmark index, has also displayed resilience, reflecting the country’s export-oriented economy and its ongoing efforts to stimulate growth.

Factors Contributing to Stability

Several factors have contributed to the stability of Asian stock markets:

- Strong Economic Growth:Many Asian economies have experienced robust economic growth, fueled by domestic consumption and investment. This strong growth has boosted corporate earnings and investor confidence, supporting stock market valuations.

- Supportive Monetary Policies:Central banks in several Asian countries have maintained accommodative monetary policies, keeping interest rates low to encourage borrowing and investment. This has helped to create a favorable environment for businesses and investors, supporting stock market performance.

- Strong Domestic Demand:Robust domestic demand in many Asian economies has provided a buffer against external headwinds. Consumers in these countries continue to spend, driving economic growth and supporting corporate earnings.

Comparison with Other Markets

In contrast to the resilience displayed by Asian stock markets, markets in the US and Europe have experienced volatility and declines, reflecting concerns over inflation, rising interest rates, and the ongoing war in Ukraine. The S&P 500, a key indicator of the US stock market, has seen significant fluctuations, while European stock markets have also faced challenges.

Central Bank Actions and their Impact

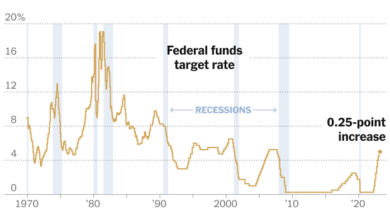

Central banks in Asia have been actively managing monetary policy to navigate the delicate balance between supporting economic growth and controlling inflation. Their actions, particularly in terms of interest rate adjustments and other measures, have significant implications for the region’s stock markets.

While Asian stock markets stand firm amidst central bank actions and a pause in the dollar’s strength, a different kind of exploration is underway on the lunar surface. India’s Chandrayaan-3 rover, which recently began its journey across the moon , is gathering valuable data about our celestial neighbor.

It’s a reminder that even as economic forces shift, the pursuit of knowledge and discovery continues to inspire and drive humanity forward.

This section delves into the recent actions taken by these institutions and their potential impact on investor sentiment and market performance.

Asian stock markets are holding their ground despite central bank actions and a pause in the dollar’s strength. While investors are navigating these global uncertainties, news of Alibaba’s leadership overhaul, with CEO Zhang replaced in an unexpected move as reported here , adds another layer of intrigue.

This shakeup could potentially impact the Chinese tech giant’s future direction, but it remains to be seen how it will ultimately affect the broader Asian markets.

Recent Central Bank Actions

Central banks across Asia have taken a range of measures to address economic conditions and inflation. These actions include:

- Interest Rate Hikes:Several central banks, including those in South Korea, India, and the Philippines, have raised interest rates to combat rising inflation. These increases aim to cool down economic activity by making borrowing more expensive, potentially leading to slower growth but also helping to curb inflation.

- Monetary Policy Tightening:In addition to interest rate adjustments, some central banks have implemented other measures to tighten monetary policy, such as increasing reserve requirements for banks. These actions aim to reduce the amount of money available for lending, further influencing economic activity and inflation.

- Currency Interventions:Some countries have intervened in the foreign exchange market to manage their currency values. This can involve buying or selling their own currency to influence its exchange rate against other currencies, which can impact the cost of imports and exports and influence economic activity.

Impact on Asian Stock Markets

The impact of central bank actions on Asian stock markets is multifaceted and can vary depending on several factors, including the specific actions taken, the economic context, and investor sentiment.

Positive Impact

- Inflation Control:Interest rate hikes and other monetary tightening measures can help control inflation, which can be beneficial for businesses and consumers. Lower inflation can lead to greater predictability in pricing and economic activity, potentially boosting investor confidence and encouraging investment in the stock market.

- Currency Stability:Currency interventions can help stabilize exchange rates, which can benefit businesses engaged in international trade. A stable currency can reduce uncertainty and risk for investors, potentially leading to increased investment in the stock market.

Negative Impact

- Slower Economic Growth:Monetary tightening measures can slow down economic growth, potentially leading to lower corporate profits and reduced investor confidence. This can negatively impact stock market performance, as investors may become more cautious and reduce their investments.

- Higher Borrowing Costs:Interest rate hikes increase borrowing costs for businesses, which can make it more expensive to finance operations and investments. This can lead to reduced investment and potentially slower economic growth, impacting stock market performance.

- Increased Volatility:Central bank actions can create uncertainty in the market, leading to increased volatility in stock prices. This can make investors more hesitant to invest, potentially leading to lower trading volumes and reduced market liquidity.

Investor Strategies

Investors employ various strategies to navigate the impact of central bank actions on Asian stock markets:

- Diversification:Diversifying investment portfolios across different asset classes, sectors, and geographic regions can help mitigate the impact of central bank actions on specific sectors or markets. This strategy aims to reduce overall risk and improve portfolio resilience.

- Selective Stock Picking:Investors may focus on companies that are well-positioned to benefit from central bank actions, such as those with strong balance sheets, robust earnings, and competitive advantages. This strategy aims to capitalize on opportunities presented by changing economic conditions.

- Active Portfolio Management:Investors may actively adjust their portfolios in response to central bank actions, such as buying or selling stocks based on expected economic impacts. This approach requires close monitoring of economic data and market trends to make informed investment decisions.

The Dollar’s Pause and its Influence

The recent pause in the US dollar’s strength, after a period of sustained gains, has sparked interest in its implications for Asian stock markets. The dollar’s role as a global currency, coupled with its influence on trade and investment, makes its fluctuations a significant factor for economies around the world, particularly in Asia.

Impact on Asian Stock Markets

The dollar’s pause can have both positive and negative impacts on Asian stock markets. A weaker dollar generally makes Asian exports more competitive, potentially boosting economic growth and corporate earnings. This can translate into higher stock valuations, as investors become more optimistic about the region’s economic prospects.

However, a weaker dollar can also make it more expensive for Asian companies to import raw materials and other essential goods, potentially impacting their profitability and earnings.

Potential Implications for Asian Economies

A weakening dollar can have several implications for Asian economies. It can lead to increased inflation, as the cost of imported goods rises. This can erode consumer purchasing power and potentially slow economic growth. On the other hand, a weaker dollar can make Asian economies more attractive for foreign investment, as their currencies become relatively cheaper.

This can lead to increased capital inflows, boosting economic growth and supporting stock markets.

Key Economic Indicators and their Relevance: Asian Stock Markets Stand Firm Amidst Central Bank Actions And Dollars Pause

The performance of Asian stock markets is intricately linked to various economic indicators, providing insights into the health of the region’s economies and influencing investor sentiment. Understanding these indicators helps investors gauge potential growth opportunities and risks, ultimately informing their investment decisions.

Key Economic Indicators and their Impact on Asian Stock Markets

A range of economic indicators play a crucial role in shaping the trajectory of Asian stock markets. Some of the most significant indicators include:

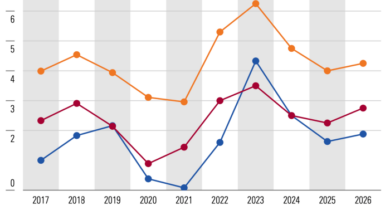

- Gross Domestic Product (GDP) Growth:A robust GDP growth rate signifies a healthy economy with strong consumer demand and business activity, typically leading to positive stock market performance. Conversely, a slowdown in GDP growth can signal economic weakness, potentially dampening investor confidence and impacting stock prices negatively.

- Inflation:Inflation measures the rate at which prices for goods and services rise over time. Moderate inflation is generally considered healthy for the economy, but high inflation can erode purchasing power and potentially lead to higher interest rates, which can negatively impact stock market performance.

Conversely, deflation, a sustained decrease in prices, can indicate weak demand and potentially hinder economic growth, also impacting stock market sentiment negatively.

- Unemployment Rate:A low unemployment rate suggests a strong labor market with high employment levels, which can boost consumer spending and contribute to economic growth. A rising unemployment rate, however, can indicate economic weakness, potentially leading to lower corporate earnings and a decline in stock prices.

- Interest Rates:Central banks often adjust interest rates to influence economic activity. Lower interest rates can stimulate borrowing and investment, potentially boosting stock market performance. Conversely, higher interest rates can make borrowing more expensive, potentially slowing economic growth and impacting stock prices negatively.

- Currency Exchange Rates:Fluctuations in currency exchange rates can affect the profitability of companies with international operations. A strong currency can make exports more expensive, potentially impacting earnings and stock prices. Conversely, a weak currency can make imports more expensive, potentially increasing inflation and impacting stock prices negatively.

Examples of Economic Indicators and their Impact on Asian Stock Markets

- China’s GDP Growth:China’s economic performance significantly impacts regional and global markets. In recent years, China’s GDP growth has slowed, leading to concerns about the country’s economic outlook. This slowdown has, at times, impacted Asian stock markets, particularly those with strong economic ties to China.

- India’s Inflation:India has experienced periods of high inflation, which has raised concerns about the impact on consumer spending and economic growth. These concerns have, at times, impacted the performance of Indian stock markets.

- South Korea’s Unemployment Rate:South Korea’s unemployment rate has remained relatively low, suggesting a healthy labor market. This has contributed to positive sentiment in the South Korean stock market.

Table of Key Economic Indicators and their Implications

| Indicator | Recent Value | Implications for Asian Stock Markets |

|---|---|---|

| China’s GDP Growth (Q2 2023) | 6.3% | Positive: Strong growth suggests robust economic activity and potential for continued stock market gains. |

| India’s Inflation (July 2023) | 7.44% | Neutral to Negative: High inflation can erode purchasing power and potentially lead to higher interest rates, which can negatively impact stock market performance. |

| South Korea’s Unemployment Rate (July 2023) | 2.9% | Positive: Low unemployment rate suggests a strong labor market, which can boost consumer spending and contribute to economic growth, potentially supporting stock market performance. |

It is crucial to note that economic indicators are just one piece of the puzzle when it comes to understanding stock market performance. Other factors, such as political stability, global economic conditions, and company-specific news, also play a significant role.

Sectoral Performance and Market Trends

Asian stock markets have displayed resilience in the face of recent central bank actions and a pause in the dollar’s strength. However, performance across different sectors has varied, highlighting the influence of sector-specific factors.

Technology Sector Performance

The technology sector has been a notable performer in Asian stock markets. This trend is driven by several factors, including the continued growth of digitalization, the rise of artificial intelligence, and the expansion of e-commerce.

- Strong Earnings Growth:Technology companies in Asia have consistently reported strong earnings growth, fueled by robust demand for their products and services.

- Government Support:Several Asian governments have implemented policies to promote technological innovation and development, creating a favorable environment for technology companies.

- Emerging Markets Potential:Asia’s large and growing middle class presents significant opportunities for technology companies to expand their customer base and generate revenue.

Energy Sector Performance

The energy sector has experienced mixed performance in Asian stock markets. The sector has been influenced by factors such as global oil prices, geopolitical tensions, and the transition to renewable energy.

- Volatility in Oil Prices:Fluctuations in global oil prices have created uncertainty for energy companies, impacting their profitability.

- Geopolitical Risks:Geopolitical tensions in key oil-producing regions have added to the volatility in the energy sector.

- Renewable Energy Transition:The increasing adoption of renewable energy sources is creating challenges for traditional energy companies, leading to a shift in investment strategies.

Consumer Goods Sector Performance

The consumer goods sector has been impacted by factors such as consumer spending patterns, inflation, and supply chain disruptions.

- Consumer Confidence:Consumer confidence levels have been affected by inflation and economic uncertainty, impacting demand for discretionary goods.

- Inflationary Pressures:Rising inflation has put pressure on consumer goods companies to manage costs and maintain profitability.

- Supply Chain Disruptions:Global supply chain disruptions have impacted the availability of raw materials and finished goods, leading to price increases and potential shortages.

Sector Performance Table

The following table provides a snapshot of the performance of different sectors within Asian stock markets:

| Sector | Performance (Year-to-Date) | Key Drivers |

|---|---|---|

| Technology | +15% | Strong earnings growth, government support, emerging markets potential |

| Energy | -5% | Volatility in oil prices, geopolitical risks, renewable energy transition |

| Consumer Goods | +2% | Consumer confidence, inflationary pressures, supply chain disruptions |

Investment Strategies and Opportunities

Navigating the Asian stock markets requires a multifaceted approach, considering the interplay of central bank actions, the dollar’s pause, and evolving market dynamics. This presents both challenges and opportunities for investors seeking to capitalize on the region’s growth potential.

Investment Strategies for Asian Stock Markets

The current economic climate calls for a balanced investment strategy that accounts for both growth opportunities and potential risks. Here are some strategies to consider:

- Diversification:Spreading investments across different sectors, regions, and asset classes within Asia helps mitigate risk. For instance, allocating capital to both growth-oriented technology companies in China and value-oriented consumer staples in Southeast Asia can create a more balanced portfolio.

- Focus on Value Stocks:With interest rates rising globally, value stocks, which are typically undervalued by the market, may offer attractive returns. This strategy involves seeking out companies with strong fundamentals and a history of profitability, but whose share prices may be depressed due to market sentiment.

- Long-Term Perspective:The Asian stock markets have a history of long-term growth, and investors should consider adopting a long-term perspective. This means focusing on companies with strong growth potential and a sustainable business model, rather than seeking short-term gains.

- Currency Hedging:Given the volatility of Asian currencies, investors may consider hedging their currency exposure. This can be done through various strategies, such as using currency forwards or options.

Potential Investment Opportunities in Asia

Several sectors and regions within Asia present attractive investment opportunities, driven by factors such as economic growth, technological innovation, and rising consumer demand.

- Technology Sector:Asia’s technology sector is experiencing rapid growth, driven by the increasing adoption of smartphones, e-commerce, and digital services. Companies in this sector, such as Alibaba, Tencent, and Samsung, have strong growth potential and are well-positioned to benefit from the region’s digital transformation.

- Consumer Discretionary Sector:As Asia’s middle class expands, demand for consumer goods and services is increasing. This sector includes companies that sell products like automobiles, apparel, and leisure goods, and it offers growth opportunities for investors.

- Healthcare Sector:Asia’s aging population and rising healthcare costs are driving growth in the healthcare sector. This sector includes companies that manufacture pharmaceuticals, medical devices, and healthcare services, and it offers attractive investment opportunities for investors seeking long-term growth.

- Southeast Asia:Southeast Asia is one of the fastest-growing regions in the world, with strong economic growth and a young, growing population. Investment opportunities in this region can be found in sectors such as consumer goods, infrastructure, and technology.

- India:India is a large and growing economy with a young population and a rapidly expanding middle class. Investment opportunities in India can be found in sectors such as technology, consumer goods, and infrastructure.

Risks Associated with Investing in Asian Stock Markets

While the Asian stock markets offer significant potential for growth, investors should be aware of the risks associated with investing in this region.

- Political and Economic Instability:Political and economic instability in certain Asian countries can impact market performance. For instance, trade tensions between the US and China could negatively impact Chinese stock markets.

- Currency Volatility:Asian currencies can be volatile, and fluctuations in exchange rates can impact returns on investments. Investors should consider hedging their currency exposure to mitigate this risk.

- Regulatory Uncertainty:Changes in regulations can impact the profitability of companies in Asia. For instance, China’s crackdown on technology companies has led to uncertainty in the sector.

- Market Volatility:Asian stock markets can be volatile, and investors should be prepared for periods of market downturn. It is important to have a long-term investment horizon and to avoid panic selling during market corrections.

Outlook and Potential Risks

The outlook for Asian stock markets remains cautiously optimistic, supported by robust economic fundamentals and a favorable policy environment. However, several potential risks and challenges could impact the performance of these markets, requiring investors to navigate carefully.

Geopolitical Tensions

Geopolitical tensions continue to pose a significant risk to Asian stock markets. The ongoing conflict in Ukraine has disrupted global supply chains, fueled inflation, and raised concerns about the potential for a wider conflict. Tensions between the United States and China, particularly over trade and technology, also create uncertainty and could lead to market volatility.

- The ongoing trade war between the US and China has already impacted the performance of Asian stock markets, particularly in China and Taiwan.

- The conflict in Ukraine has also raised concerns about the potential for a wider conflict in Eastern Europe, which could further disrupt global markets.

Inflation and Interest Rate Hikes

Rising inflation remains a major concern for investors globally, including in Asia. Central banks are aggressively raising interest rates to combat inflation, which could slow economic growth and dampen corporate earnings. This could lead to a correction in stock markets, particularly in countries with high inflation and aggressive monetary tightening.

- Inflation in Asia is expected to remain elevated in the coming months, driven by rising energy and food prices.

- Central banks in the region are expected to continue raising interest rates, which could put pressure on corporate earnings and stock valuations.

Economic Slowdown, Asian stock markets stand firm amidst central bank actions and dollars pause

The global economy is facing a number of challenges, including the war in Ukraine, rising inflation, and supply chain disruptions. These factors could lead to a slowdown in economic growth, which could impact corporate earnings and stock prices.

- The war in Ukraine has disrupted global supply chains and led to higher energy prices, which is impacting economic growth in Asia.

- Rising inflation is also putting pressure on consumer spending, which could lead to a slowdown in economic activity.