US Crude Oil Stock Decline: Impact on Oil Prices, Latest Update

Us crude oil stock decline potential impact on oil prices latest update – US Crude Oil Stock Decline: Impact on Oil Prices, Latest Update has become a hot topic in the energy sector, raising concerns about the future of oil prices. The recent decline in US crude oil stock levels is a complex issue with various factors at play, including production, consumption, and global market dynamics.

This trend has significant implications for oil prices, energy costs, and the overall economy.

This decline in US crude oil stocks is not just a statistical anomaly. It reflects a dynamic interplay of forces shaping the global energy landscape. Understanding the factors driving this decline, the potential impact on oil prices, and the economic implications is crucial for investors, policymakers, and consumers alike.

US Crude Oil Stock Levels: Us Crude Oil Stock Decline Potential Impact On Oil Prices Latest Update

The recent decline in US crude oil stock levels has sparked significant interest in the energy market. Understanding the factors driving this trend is crucial for assessing its potential impact on oil prices.

Historical Data on US Crude Oil Stock Levels

The Energy Information Administration (EIA) provides comprehensive data on US crude oil stocks. Analyzing historical data reveals trends and fluctuations over time.

- For instance, US crude oil inventories have historically fluctuated between 300 million and 500 million barrels.

- The period between 2014 and 2016 witnessed a significant build-up in inventories, exceeding 500 million barrels, primarily due to increased production and weak demand.

- However, following the OPEC+ production cuts in 2017, inventories began to decline, reaching below 400 million barrels by the end of 2019.

Factors Contributing to the Decline in US Crude Oil Stock Levels

Several factors have contributed to the recent decline in US crude oil stock levels. These include:

- Increased domestic oil production: The US has witnessed a surge in oil production in recent years, driven by technological advancements in shale oil extraction. This increased production has contributed to a higher supply of crude oil, leading to a decline in inventories.

The latest update on US crude oil stock decline has the potential to impact oil prices significantly, but who knew the biggest market mover this week would be a purple, fuzzy character? The McDonald’s Grimace shake taking TikTok by storm, inspiring a bizarre faux death trend , is certainly a conversation starter, but it’s unclear how it will affect the oil market in the long run.

It’s definitely a reminder that even in the most serious of economic discussions, pop culture can have a surprising impact.

- Strong global demand: As the global economy recovers from the COVID-19 pandemic, demand for oil has increased significantly. This increased demand has drawn down inventories as refineries process more crude oil to meet the rising demand.

- Reduced imports: With increased domestic production and strong global demand, the US has become less reliant on oil imports. This has further contributed to the decline in inventories as imports have decreased.

- Strategic Petroleum Reserve (SPR) releases: The Biden administration has released significant amounts of oil from the SPR to address supply concerns and mitigate the impact of the Russia-Ukraine war. These releases have further reduced overall crude oil stock levels.

Potential Impact on Oil Prices

The decline in US crude oil stocks has the potential to impact oil prices in various ways. Understanding the relationship between oil supply, demand, and price fluctuations is crucial to analyze this impact.

Relationship Between Oil Supply, Demand, and Price Fluctuations

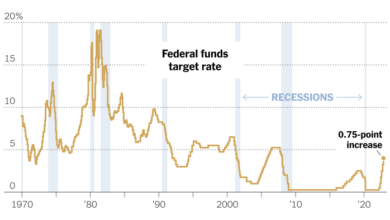

The relationship between oil supply, demand, and price fluctuations is a complex interplay of factors. When supply exceeds demand, prices tend to fall as producers compete to sell their excess oil. Conversely, when demand exceeds supply, prices rise as buyers compete for limited resources.

The law of supply and demand dictates that as the supply of a good increases, its price decreases, assuming demand remains constant. Conversely, as demand for a good increases, its price increases, assuming supply remains constant.

This dynamic is further influenced by factors such as global economic growth, geopolitical events, and technological advancements in oil production and consumption.

Historical Trends and Potential Price Scenarios, Us crude oil stock decline potential impact on oil prices latest update

Historical trends provide valuable insights into the potential impact of declining oil stocks on prices. For instance, during periods of low oil stocks in the past, prices have generally risen, reflecting the scarcity of the commodity. However, it’s important to consider the current economic landscape and other factors influencing oil prices.

The recent decline in US crude oil stockpiles is a hot topic, with analysts predicting a potential surge in oil prices. However, it’s worth remembering that the market is constantly shifting, and factors like the anticipated success of Tesla’s Cybertruck, as outlined in this article by Ark Invest , could influence consumer demand and, in turn, oil prices.

Ultimately, the impact of the crude oil stock decline remains to be seen, and the market will likely be driven by a complex interplay of factors.

For example, if global economic growth slows down, demand for oil may decline, potentially offsetting the impact of lower oil stocks. Furthermore, technological advancements in oil production, such as fracking, have increased the availability of oil, potentially moderating price increases even during periods of lower stocks.

Latest Updates and Market Sentiment

The recent decline in US crude oil stock levels has sparked a wave of speculation and analysis within the oil market. Investors and analysts are carefully scrutinizing the latest data to understand the potential impact on oil prices and the broader energy landscape.

This section delves into the latest updates on US crude oil stock levels, analyzes the current market sentiment, and explores potential future trends.

The recent decline in US crude oil stockpiles could have a significant impact on oil prices, potentially leading to an increase in the near future. Understanding the factors influencing this trend requires a deeper dive into the broader economic landscape, including the role of credit rating agencies like Fitch, Moody’s, and S&P.

These agencies play a crucial role in evaluating the financial health of companies and governments, which can directly affect oil prices. To learn more about how these agencies work and their influence on investment decisions, check out this insightful article: know all about credit rating agencies a closer look at fitch moodys and s and p for smart investments.

By understanding the interplay between these factors, we can gain a better perspective on the potential trajectory of oil prices in the coming months.

Recent Developments in US Crude Oil Stocks

The Energy Information Administration (EIA) releases weekly reports on US crude oil inventories, providing valuable insights into supply and demand dynamics. Recent data has revealed a decline in crude oil stock levels, indicating a potential tightening of supply. This decline can be attributed to several factors, including:

- Increased Demand:Stronger-than-expected global economic growth has fueled demand for oil, leading to a drawdown in inventories.

- Production Cuts:OPEC+ production cuts have also contributed to the decline in global oil supplies, further supporting price increases.

- Refining Activity:Increased refining activity in the United States has also played a role in reducing crude oil stocks.

Market Sentiment and Investor Confidence

The recent decline in US crude oil stock levels has generally boosted investor confidence in the oil market. This positive sentiment is fueled by several key factors:

- Tightening Supply:The decline in US crude oil stocks, coupled with OPEC+ production cuts, suggests a tightening of global oil supply. This scarcity is a key driver of price increases.

- Strong Demand:Robust global economic growth and a rebound in travel demand are supporting strong oil consumption, further contributing to a bullish outlook.

- Geopolitical Risks:Ongoing geopolitical tensions and uncertainties, such as the Russia-Ukraine conflict, add to the perception of supply risks and support higher oil prices.

Potential Future Trends and Market Expectations

The future trajectory of oil prices will depend on a complex interplay of factors, including:

- Global Economic Growth:A slowdown in global economic growth could dampen oil demand, potentially leading to lower prices.

- OPEC+ Production:The future of OPEC+ production cuts remains uncertain. If OPEC+ extends or deepens cuts, oil prices are likely to remain elevated.

- US Shale Production:US shale production could increase in response to higher oil prices, potentially offsetting some of the supply tightness.

Economic Implications

A decline in US crude oil stocks can have significant economic implications, impacting energy costs, inflation, and overall economic growth. These implications are felt across various industries and sectors reliant on oil, such as transportation and manufacturing.

Impact on Energy Costs

A decline in US crude oil stocks suggests a tightening supply, which can lead to higher oil prices. Increased oil prices directly impact energy costs for consumers and businesses. Higher energy costs can lead to:

- Increased transportation costs: Consumers pay more for gasoline, while businesses face higher costs for transporting goods and services. This can lead to higher prices for consumers and reduced profitability for businesses.

- Increased production costs: Businesses in energy-intensive industries, such as manufacturing, face higher production costs due to increased energy bills. This can lead to reduced production, job losses, and higher prices for consumers.

- Reduced consumer spending: Higher energy costs can reduce consumer spending power, as households allocate more of their budgets to essential energy needs. This can lead to a slowdown in economic growth.

Impact on Inflation

Higher oil prices can contribute to inflation. This is because oil is a key input in many industries, and increased oil prices lead to higher production costs, which are passed on to consumers in the form of higher prices.

Furthermore, increased transportation costs due to higher oil prices can also contribute to inflation.

For example, in 2008, the surge in oil prices was a significant contributor to the global financial crisis. The high oil prices led to increased inflation and reduced consumer spending, which ultimately slowed economic growth.

Impact on Economic Growth

Higher oil prices can negatively impact economic growth. As discussed above, higher oil prices can lead to reduced consumer spending, increased production costs, and a slowdown in investment. These factors can all contribute to a decline in economic activity.

For example, the 1973 oil crisis, caused by the OPEC oil embargo, led to a significant recession in the US economy. The high oil prices led to increased inflation, reduced consumer spending, and a decline in industrial production.

Impact on Industries and Sectors

Industries and sectors reliant on oil, such as transportation and manufacturing, are particularly vulnerable to fluctuations in oil prices. Higher oil prices can lead to:

- Reduced demand for transportation services: Higher gasoline prices can lead to reduced demand for air travel, road transport, and other transportation services. This can impact airlines, trucking companies, and other businesses in the transportation sector.

- Reduced production in manufacturing: Higher oil prices can lead to increased production costs for manufacturers, particularly those in energy-intensive industries. This can lead to reduced production, job losses, and higher prices for consumers.

Policy Responses and Market Interventions

The decline in US crude oil stocks has raised concerns about potential supply disruptions and their impact on oil prices. In response, policymakers and regulatory bodies are exploring various options to address the situation and mitigate the risks. This section will delve into potential policy responses, market interventions, and their potential effectiveness and consequences.

Potential Policy Responses

Policymakers are actively considering measures to address the decline in oil stocks. These responses aim to ensure a stable and reliable supply of crude oil while maintaining market stability.

- Strategic Petroleum Reserve (SPR) Releases:The US government can release oil from the SPR to increase supply and reduce prices. The SPR is a large stockpile of crude oil maintained by the Department of Energy, intended for use during emergencies or supply disruptions. The Biden administration has already authorized releases from the SPR in recent months, demonstrating its willingness to intervene in the market.

- Production Incentives:Policymakers could implement measures to incentivize domestic oil production. This could include tax breaks, subsidies, or streamlined permitting processes. These measures aim to increase the supply of US-produced oil, reducing reliance on imports and potentially lowering prices.

- Import Restrictions:The government might consider imposing restrictions on oil imports from certain countries. This could be a strategic move to reduce dependence on specific suppliers and increase domestic production. However, such measures could have significant economic and geopolitical implications.

Market Interventions

In addition to policy responses, market interventions can be employed to stabilize oil prices. These interventions involve direct actions to influence supply and demand dynamics.

- Strategic Petroleum Reserve Releases:As mentioned earlier, SPR releases can be a powerful tool to address short-term supply shortages and lower prices. However, frequent releases could deplete the reserve, reducing its effectiveness in future emergencies.

- Production Adjustments:OPEC+, the alliance of major oil-producing nations, can adjust production levels to influence global supply and prices. This can involve coordinated increases or decreases in output to maintain a desired price range.

- Financial Market Interventions:Central banks or regulatory bodies could intervene in financial markets to stabilize oil prices. This might involve buying or selling oil futures contracts to influence market sentiment and price levels.

Effectiveness and Potential Consequences

The effectiveness of policy responses and market interventions depends on various factors, including the severity of the oil supply shortage, the response of market participants, and potential unintended consequences.

- Effectiveness:Interventions can be effective in addressing short-term supply disruptions and stabilizing prices. However, their long-term impact may be limited, as market forces tend to reassert themselves over time.

- Potential Consequences:Interventions can have unintended consequences. For example, SPR releases could lead to lower prices in the short term, but they might also discourage domestic production and increase reliance on imports in the long term.

Global Oil Market Dynamics

The US oil market is deeply intertwined with global trends and developments. Understanding these dynamics is crucial for comprehending the factors that influence US crude oil stock levels and price fluctuations.

Global Factors Impacting US Oil Prices

The global oil market is influenced by a multitude of factors, including geopolitical events, international production decisions, and global demand patterns. These factors can significantly impact US oil prices.

- Geopolitical Events:Conflicts and tensions in oil-producing regions, such as the Middle East, can disrupt production and supply chains, leading to price volatility. For example, the ongoing conflict in Ukraine has significantly impacted global energy markets, including oil prices.

- International Production Decisions:OPEC+ (Organization of the Petroleum Exporting Countries and its allies) production quotas and decisions play a significant role in shaping global oil supply. Changes in production levels can directly influence US oil prices. For instance, OPEC+ production cuts can lead to higher oil prices globally, including in the US.

- Global Demand Patterns:Global economic growth, industrial activity, and transportation demand influence global oil consumption. A strong global economy typically leads to higher oil demand, potentially pushing prices up. Conversely, economic slowdowns or recessions can dampen demand and lead to lower oil prices.

Global Oil Market Dynamics Influencing US Crude Oil Stock Levels

Global oil market dynamics can also influence US crude oil stock levels.

- International Trade Flows:US crude oil imports and exports are influenced by global supply and demand dynamics. For example, if global oil prices rise due to supply constraints, US refiners may opt to import more crude oil, potentially leading to higher US crude oil stock levels.

- Global Production and Consumption:Changes in global oil production and consumption patterns can affect US crude oil stock levels. For instance, if global oil production increases significantly, it could lead to a surplus of oil in the market, potentially causing US crude oil stock levels to rise.