Labor Day Stock Sale: Tesla Leads Top 5 Stocks Nearing Buy Points

Labor day stock sale tesla leads top 5 stocks nearing buy points – Labor Day Stock Sale: Tesla Leads Top 5 Stocks Nearing Buy Points sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Labor Day, traditionally a time for relaxation and barbeques, has become a focal point for investors, with retailers and businesses capitalizing on the holiday weekend to attract customers and boost revenue.

This year’s Labor Day stock sale is no exception, with Tesla leading the charge, and several other top stocks approaching buy points.

This article delves into the intricacies of this year’s Labor Day stock sale, examining Tesla’s performance and exploring other promising stocks that are poised for growth. We’ll discuss key factors influencing stock performance, including market conditions, company news, and investor sentiment.

Additionally, we’ll provide insights into investor strategies for navigating this market event, highlighting the importance of thorough research and due diligence. Join us as we explore the potential opportunities and risks associated with the Labor Day stock sale.

Labor Day Stock Sale Overview

Labor Day, celebrated annually on the first Monday of September in the United States, marks the unofficial end of summer and is a time for relaxation and reflection. However, for many, Labor Day also signifies the start of the back-to-school season and the beginning of a new shopping cycle.

In the retail world, Labor Day is a significant event that often sees a surge in consumer spending and promotional activities, with retailers offering deep discounts and special deals to attract shoppers. The impact of Labor Day sales on the stock market can be multifaceted.

While some sectors, such as retail and consumer discretionary, might experience short-term volatility due to increased sales and customer activity, others, like technology or healthcare, might remain relatively unaffected. However, it is crucial to understand that the stock market is a complex ecosystem influenced by various factors, and Labor Day sales alone do not dictate the overall market direction.

Retailers’ Strategies for Labor Day Sales

Retailers and businesses strategically leverage Labor Day sales to boost revenue and attract customers. Here are some common strategies they employ:

- Deep Discounts and Promotions:Retailers often offer significant discounts on a wide range of products, from clothing and electronics to furniture and appliances. These discounts can be a powerful incentive for shoppers, especially those looking for value and savings.

- Exclusive Deals and Bundles:To enhance the appeal of their offers, retailers often introduce exclusive deals and bundles, offering additional value or savings when customers purchase multiple items.

- Limited-Time Offers:Creating a sense of urgency, retailers often implement limited-time offers, encouraging shoppers to act quickly and capitalize on the deals before they expire.

- Early Bird Specials:To attract early shoppers, retailers may offer early bird specials, providing exclusive discounts or deals to those who make purchases before a specific time or date.

- Free Shipping and Returns:To further enhance the shopping experience, retailers often offer free shipping and returns during Labor Day sales, eliminating potential barriers to purchase and encouraging customer confidence.

Tesla’s Performance in the Stock Sale: Labor Day Stock Sale Tesla Leads Top 5 Stocks Nearing Buy Points

Tesla, the electric vehicle giant, has consistently been a hot topic in the stock market. Its performance during Labor Day sales events, however, has been a mixed bag, reflecting the complex interplay of market conditions, company news, and investor sentiment.

This analysis delves into Tesla’s stock performance during previous Labor Day sales, comparing it to historical data and industry averages, and exploring the factors influencing its performance during the current sale.

The Labor Day stock sale saw Tesla leading the top 5 stocks nearing buy points, a promising sign for investors. However, it’s crucial to remember that even amid this bullish sentiment, a potential correction could be looming. As stock market analyst warns of potential correction amid broadening rally expert insights , it’s wise to be cautious and not get carried away by the hype.

Despite the potential for a correction, the overall positive momentum in the market, with Tesla leading the charge, could indicate a strong finish to the year.

Historical Performance of Tesla During Labor Day Sales

Analyzing Tesla’s stock performance during previous Labor Day sales reveals a pattern of volatility, often influenced by broader market trends and company-specific events. For example, during the 2021 Labor Day sale, Tesla’s stock experienced a surge, driven by strong demand for its electric vehicles and positive investor sentiment.

However, the 2022 Labor Day sale saw a more subdued performance, partly due to concerns about rising inflation and supply chain disruptions.

Comparison to Historical Data and Industry Averages

To understand Tesla’s performance during the current Labor Day sale, it’s essential to compare it to historical data and industry averages. Comparing Tesla’s stock performance during the current sale to its performance during previous Labor Day sales reveals a similar pattern of volatility.

However, it’s important to consider the broader market context. For example, if the overall stock market is experiencing a downturn, Tesla’s stock performance might be negatively impacted, regardless of its specific performance during the Labor Day sale.

Factors Influencing Tesla’s Stock Performance During the Current Sale

Several factors are influencing Tesla’s stock performance during the current Labor Day sale, including market conditions, company news, and investor sentiment. The current market conditions are characterized by rising interest rates, high inflation, and geopolitical uncertainty, all of which can impact investor sentiment and stock valuations.

Additionally, any company-specific news, such as production updates, sales figures, or regulatory developments, can significantly influence Tesla’s stock performance. Investor sentiment plays a crucial role, with positive news and strong demand driving up stock prices, while negative news or concerns about the company’s future prospects can lead to declines.

Top 5 Stocks Nearing Buy Points

This Labor Day stock sale offers a unique opportunity to snag some promising stocks that are nearing their buy points. While Tesla is undoubtedly a standout performer, let’s delve into five other stocks that are showing strong signs of potential growth.

With Labor Day sales in full swing, Tesla is leading the top 5 stocks nearing buy points. This strong market momentum is further fueled by a robust US economy, as evidenced by the recent May jobs report exceeding expectations with an impressive 339,000 jobs added.

This positive economic outlook could further boost investor confidence and drive up stock prices, making this Labor Day a prime opportunity for savvy investors.

These stocks are poised to capitalize on positive market trends and their own unique strengths, making them attractive additions to any portfolio.

Analysis of Top 5 Stocks

Here’s a detailed look at each stock, examining their current performance, technical indicators, and fundamental factors:

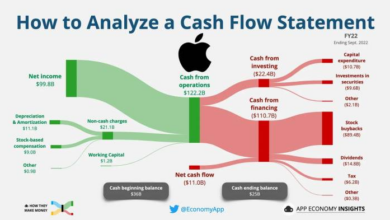

- Apple Inc. (AAPL): Apple is a tech giant known for its innovative products and strong brand recognition. The stock has been steadily climbing in recent months, supported by robust iPhone sales and a growing services business. Apple’s price-to-earnings ratio (P/E) is currently around 30, indicating a healthy valuation compared to its historical averages.

The Labor Day stock sale is heating up, with Tesla leading the charge as one of the top 5 stocks nearing buy points. This surge in interest is a reflection of the growing demand for electric vehicles and the broader shift towards renewable energy solutions.

As the world embraces a sustainable future, investing in renewable energy commodities is becoming increasingly attractive, offering a chance to capitalize on this burgeoning market. The rise of renewable energy commodities investment opportunities for a sustainable future is a topic that deserves attention, and it’s no surprise that companies like Tesla are leading the way.

With the Labor Day stock sale in full swing, it’s a great time to explore these investment opportunities and position yourself for a greener future.

With its solid financial position and consistent growth trajectory, Apple is well-positioned for continued gains.

- Amazon.com Inc. (AMZN): Amazon is a global e-commerce leader, dominating online retail and expanding into cloud computing, streaming, and more. The stock has faced some recent headwinds due to slowing e-commerce growth, but its long-term prospects remain strong. Amazon’s cloud computing division, Amazon Web Services (AWS), continues to generate significant revenue and profits.

With its dominant market share and ongoing innovation, Amazon is likely to rebound and continue its upward trajectory.

- Microsoft Corp. (MSFT): Microsoft is a technology powerhouse, known for its operating systems, cloud services, and gaming platforms. The stock has been performing well, driven by strong demand for its cloud computing platform, Azure. Microsoft’s P/E ratio is currently around 35, indicating a reasonable valuation.

With its diverse revenue streams and commitment to innovation, Microsoft is well-positioned for continued growth in the years to come.

- Nvidia Corp. (NVDA): Nvidia is a leading manufacturer of graphics processing units (GPUs), used in gaming, data centers, and artificial intelligence. The stock has surged in recent years, fueled by the growing demand for high-performance computing and AI applications. Nvidia’s P/E ratio is currently around 45, reflecting its rapid growth and high valuations.

With its strong market position and significant growth potential in AI, Nvidia is likely to remain a top performer.

- Alphabet Inc. (GOOGL): Alphabet is the parent company of Google, a dominant force in search, advertising, and cloud computing. The stock has been consolidating recently, but its long-term prospects remain bright. Google’s search engine and advertising businesses continue to generate significant revenue, and its cloud computing platform, Google Cloud, is gaining traction.

With its strong brand recognition and diverse revenue streams, Alphabet is well-positioned for continued growth.

Investor Strategies for Labor Day Sales

The Labor Day stock sale presents a unique opportunity for investors to potentially acquire quality stocks at discounted prices. However, navigating these sales effectively requires a thoughtful approach tailored to individual risk tolerance and investment goals. Here’s a breakdown of strategies to consider:

Risk Tolerance and Investment Goals

Understanding your risk tolerance and investment goals is paramount. Are you a conservative investor seeking steady growth, or are you comfortable with higher-risk investments for potentially greater returns? Are you investing for the long term or short-term gains? Your answers will guide your strategy.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock’s price. This strategy mitigates the risk of buying high and selling low, as you purchase more shares when the price is low and fewer when it’s high.

For example, you could invest $100 per week in a specific stock, buying more shares during price dips and fewer during price rises.

Buying on Dips

This strategy involves purchasing stocks when their prices decline, aiming to capitalize on temporary market fluctuations. It requires identifying stocks with solid fundamentals and a history of strong performance, expecting them to rebound in the future. For instance, if a company experiences a temporary setback due to external factors but its core business remains strong, buying on the dip could be a profitable strategy.

Focusing on Specific Sectors

Labor Day sales often feature discounted stocks across various sectors. Focusing on specific sectors that align with your investment goals can increase your chances of success. For example, if you believe in the long-term growth of the renewable energy sector, you might focus on buying stocks in companies operating in that field during the sale.

Thorough Research and Due Diligence, Labor day stock sale tesla leads top 5 stocks nearing buy points

Before making any investment decisions during the sale, conducting thorough research and due diligence is crucial. Evaluate each company’s financial performance, industry trends, competitive landscape, and management team. Consider consulting with a financial advisor for personalized guidance.

Market Outlook and Future Predictions

The Labor Day stock sale presents a unique opportunity for investors to capitalize on potential market gains. However, understanding the broader market outlook and identifying potential risks and opportunities is crucial for informed investment decisions.

Economic Indicators and Industry Trends

Several economic indicators suggest a mixed outlook for the market. While inflation has shown signs of easing, interest rates remain elevated, potentially impacting corporate earnings and economic growth. However, robust consumer spending and a strong labor market provide some optimism.

Industry trends, such as the ongoing adoption of artificial intelligence and renewable energy, offer growth opportunities for investors.

Potential Market Risks and Opportunities

Investors should consider the following risks:

- Geopolitical uncertainty:Ongoing geopolitical tensions, such as the Russia-Ukraine conflict, could create market volatility and impact global supply chains.

- Rising interest rates:Continued interest rate hikes could increase borrowing costs for businesses and consumers, potentially slowing economic growth.

- Inflation:Although inflation has eased somewhat, it remains a concern for businesses and consumers, potentially impacting spending patterns and corporate profitability.

On the other hand, potential opportunities exist:

- Value stocks:Companies with strong fundamentals and undervalued valuations could outperform in a rising interest rate environment.

- Growth sectors:Industries like technology, healthcare, and renewable energy are expected to continue growing, offering attractive investment opportunities.

- Emerging markets:Developing economies with high growth potential could offer attractive returns for investors seeking diversification.

Predictions for Top 5 Stocks and Overall Market

Predicting stock market performance is inherently challenging, but based on current trends and historical data, here are some predictions:

- Tesla:The company’s strong demand and innovative technology position it for continued growth, despite recent stock price volatility. However, competition from other electric vehicle manufacturers and potential regulatory challenges remain concerns.

- Apple:The tech giant’s strong brand, loyal customer base, and diversified product portfolio suggest continued growth, but the slowing global economy and rising competition could impact its performance.

- Amazon:The e-commerce giant’s dominance in online retail and expansion into cloud computing offer growth opportunities, but potential antitrust scrutiny and rising labor costs remain concerns.

- Microsoft:The software giant’s strong presence in cloud computing and enterprise software markets suggests continued growth, but competition from rivals like Google and Amazon could impact its market share.

- Nvidia:The semiconductor company’s dominance in the artificial intelligence and gaming markets positions it for strong growth, but potential supply chain disruptions and competition from other chipmakers could impact its performance.

Overall, the market is expected to remain volatile in the coming weeks and months, influenced by economic indicators, geopolitical events, and investor sentiment. While the Labor Day stock sale presents opportunities, investors should carefully consider their risk tolerance and investment goals before making any decisions.