US Stock Market Opens Higher Amid Steady Yields

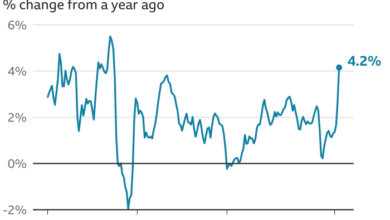

Us stock market opens higher amid steady yields latest stock market news – US Stock Market Opens Higher Amid Steady Yields: The US stock market opened higher today, driven by a combination of factors including steady yields and positive economic data. This positive sentiment comes amidst a backdrop of recent market volatility and uncertainty, suggesting a potential shift in investor sentiment.

The rise in stock prices can be attributed to several key factors, including a steady rise in Treasury yields, which has been interpreted by some investors as a sign of confidence in the economy. This stability in yields has helped to calm concerns about rising interest rates, which can negatively impact stock valuations.

Additionally, recent economic indicators, such as strong retail sales figures, have provided further evidence of a resilient economy, bolstering investor optimism.

Global Market Influences

The US stock market, like a ship navigating a global ocean, is constantly influenced by the tides and currents of international events. These events can create both tailwinds and headwinds, shaping investor sentiment and impacting the trajectory of the market.

Understanding these global influences is crucial for navigating the complexities of the stock market.

Impact of Global Events

Global events can have a profound impact on the US stock market. These events can be economic, political, or social in nature, and they can create both opportunities and risks for investors. For example, the ongoing war in Ukraine has had a significant impact on global energy prices and supply chains, leading to increased inflation and uncertainty in the US market.

International Factors Affecting Investor Sentiment

Several international factors can influence investor sentiment, impacting their decisions to buy, sell, or hold stocks. These factors include:

- Global Economic Growth:A strong global economy typically supports US stock market performance. When global growth slows down, investors may become more cautious, leading to potential market declines.

- Interest Rates:Central banks around the world set interest rates to control inflation and economic growth. When interest rates rise globally, it can make borrowing more expensive, potentially slowing economic growth and impacting US stock market valuations.

- Currency Exchange Rates:The value of the US dollar relative to other currencies can impact the attractiveness of US stocks to foreign investors. A strong dollar can make US stocks more expensive for international investors, potentially reducing demand.

- Geopolitical Risks:Global geopolitical tensions, such as trade wars or political instability, can create uncertainty and volatility in the US stock market. Investors may become hesitant to invest in a volatile environment, potentially leading to market declines.

Potential Implications of Global Events

Global events can have a range of implications for the US market, including:

- Increased Volatility:Global events can create uncertainty and volatility in the market, leading to larger price swings.

- Shifts in Investment Preferences:Investors may shift their preferences towards certain sectors or asset classes based on global events. For example, rising energy prices may lead to increased investment in energy companies.

- Changes in Economic Outlook:Global events can impact the overall economic outlook, influencing investor expectations for future growth and profitability.

- Policy Responses:Global events can trigger policy responses from governments and central banks, which can have significant implications for the US market.

Investor Behavior: Us Stock Market Opens Higher Amid Steady Yields Latest Stock Market News

The current market environment, characterized by elevated inflation and rising interest rates, has significantly influenced investor behavior. While the stock market has displayed resilience in recent months, investors remain cautious and are closely monitoring economic data and Federal Reserve policy.

Investor Sentiment and Activity

Investor sentiment has been fluctuating in recent months, reflecting the uncertainty surrounding the economic outlook. While some investors remain optimistic about the long-term prospects of the stock market, others are concerned about the potential for a recession. This mixed sentiment is reflected in the relatively low trading volumes and muted volatility observed in the market.

Impact of Investor Behavior on Market Movements

Investor behavior plays a crucial role in shaping market movements. When investors are optimistic and confident about the economy, they tend to invest more, driving up stock prices. Conversely, when investors are fearful or uncertain, they may reduce their investments, leading to market declines.

The current market environment is characterized by a delicate balance between optimism and caution, resulting in relatively subdued market movements.

Notable Trends in Investor Activity, Us stock market opens higher amid steady yields latest stock market news

- Increased Interest in Defensive Sectors:Investors have been shifting their focus towards sectors considered more resilient to economic downturns, such as healthcare, consumer staples, and utilities. These sectors tend to offer stable earnings and dividends, providing a degree of protection against market volatility.

- Rotation from Growth to Value:The recent shift in interest rates has favored value stocks over growth stocks. Value stocks, which are typically companies with lower valuations and higher dividend yields, have outperformed growth stocks in recent months.

- Increased Use of Defensive Strategies:Investors are increasingly employing defensive strategies, such as hedging and diversification, to mitigate potential losses in a volatile market. These strategies aim to reduce portfolio risk and protect against downside potential.

The US stock market opened higher this morning, buoyed by steady yields and positive economic indicators. However, global news is dominated by Iraq’s drastic action to block the Telegram app, citing concerns over personal data violations and national security, as reported in this article.

This move highlights the growing tension between digital privacy and national security, which could potentially impact global markets in the coming weeks.

The US stock market opened higher today, buoyed by steady yields and a positive outlook for the tech sector. It’s interesting to see how AI is playing a bigger role in financial markets, so if you’re looking to understand the power of this technology, check out this guide on AI.

With AI’s influence growing, it’s more important than ever to stay informed about its impact on the stock market and other areas of our lives.

The US stock market opened higher this morning, driven by steady yields and positive economic data. However, a reminder that not all news is rosy: a Massachusetts father and son were recently sentenced to prison for a $20 million lottery scam, as reported in this article.

Despite this sobering reminder, investors remain optimistic about the overall market performance.