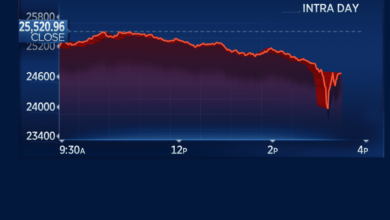

July CPI Soars: Annual Price Hikes Accelerate, Record 3.2% Rise

Annual consumer price hikes accelerate july records 32 rise – As annual consumer price hikes accelerate, July records a 3.2% rise, pushing inflation back into the spotlight. This latest surge in the Consumer Price Index (CPI) has economists and consumers alike bracing for a potential economic storm. The CPI, a crucial indicator of inflation, measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

This latest report signals a continued uphill battle against inflation, with implications that ripple through households and businesses alike.

The July CPI report paints a stark picture of escalating prices, with key components like energy and food leading the charge. This surge in inflation raises concerns about the purchasing power of consumers, particularly those on fixed incomes. Businesses, too, face mounting pressure to manage rising input costs while maintaining profitability.

The question on everyone’s mind is: how long will these price hikes persist, and what steps can be taken to mitigate their impact?

Future Outlook and Projections: Annual Consumer Price Hikes Accelerate July Records 32 Rise

Predicting the future trajectory of inflation is a complex endeavor, influenced by a multitude of interconnected factors. While recent data points to a significant surge in consumer prices, understanding the underlying drivers and potential shifts in these forces is crucial for gauging the future course of inflation.

Factors Influencing Future Inflation, Annual consumer price hikes accelerate july records 32 rise

The path of inflation in the coming months will be shaped by a combination of economic, geopolitical, and policy-related factors.

- Supply Chain Disruptions:Ongoing supply chain bottlenecks continue to exert upward pressure on prices. The war in Ukraine, labor shortages, and transportation challenges have disrupted global supply chains, making it difficult to source goods and materials, leading to higher costs.

- Energy Prices:Energy prices remain volatile and have contributed significantly to inflation.

The ongoing conflict in Ukraine has heightened uncertainty in global energy markets, potentially driving prices higher in the coming months.

- Monetary Policy:Central banks around the world are raising interest rates to combat inflation. However, the effectiveness of these measures in curbing price increases remains to be seen.

- Consumer Demand:Strong consumer demand can fuel inflation. As economies recover from the pandemic, consumer spending has surged, putting upward pressure on prices.

- Government Policies:Government policies, such as stimulus measures and trade restrictions, can also impact inflation.

Expert Opinions and Forecasts

Economists and analysts have varying perspectives on the future trajectory of inflation. Some experts believe that inflation will remain elevated for an extended period, while others anticipate a gradual moderation as supply chain issues ease and central bank policies take effect.

“We expect inflation to remain elevated in the near term, but to gradually moderate as supply chain pressures ease and monetary policy tightens.”

[Name of Economist/Analyst]

“The risk of a wage-price spiral remains a concern, which could keep inflation elevated for longer.”

[Name of Economist/Analyst]

The news about annual consumer price hikes accelerating in July, reaching a record 3.2% rise, is a stark reminder of the economic challenges we’re facing. It’s a tough time for many, and it’s hard to ignore the pressure these rising costs put on our wallets.

Meanwhile, the legal drama surrounding Elon Musk continues to unfold, with him now facing a subpoena in the Virgin Islands lawsuit against JPMorgan over the Epstein case, as reported by The Venom Blog. While this legal battle plays out, the focus for many remains on navigating the rising cost of living and finding ways to make ends meet in this challenging economic landscape.

With annual consumer price hikes accelerating to a record 3.2% in July, it’s no surprise that investors are seeking out assets that can weather the storm. Luxury goods, often seen as a safe haven during economic uncertainty, are attracting attention, and some analysts are even pointing to billionaire Ken Fisher’s recommendations for the best companies in the sector.

Investing in luxury goods stocks billionaire ken fishers recommendations and top analyst favored companies could be a savvy move in the face of these rising inflation rates, as consumers may shift their spending towards higher-quality, longer-lasting items.

With annual consumer price hikes accelerating to a record 3.2% in July, it’s more important than ever to be smart about your finances. While the rising cost of living can be daunting, it’s also a reminder to consider diversifying your income streams.

If you’re looking for a way to potentially boost your finances, you might want to explore understanding mega millions tips to increase your chances of winning. Of course, winning the lottery is a long shot, but it’s worth considering as a potential source of extra income, especially in times of economic uncertainty.

In the face of rising prices, it’s always good to have a plan to secure your financial future.