Stocks Rally, Bond Yields Retreat Amid Mixed Jobs Data

Stocks rally bond yields retreat amid mixed jobs data market analysis – Stocks Rally, Bond Yields Retreat Amid Mixed Jobs Data: The market continues to navigate a complex landscape, with recent economic data painting a mixed picture. The stock market has seen a surge in recent weeks, fueled by optimism about a potential economic slowdown and a pause in interest rate hikes.

Meanwhile, bond yields have retreated, reflecting investors’ growing concerns about the economic outlook. This dynamic backdrop is further complicated by the latest jobs report, which showed a mixed bag of signals about the health of the labor market.

This analysis delves into these developments, examining the factors driving the stock rally, the reasons behind the bond yield retreat, and the implications of the mixed jobs data for the future of the economy and financial markets.

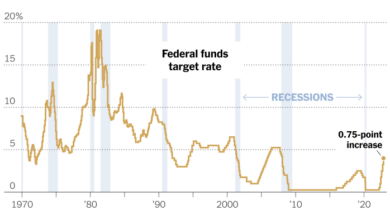

The recent stock market rally has been driven by a number of factors, including the Federal Reserve’s recent pause in interest rate hikes and a growing belief that the economy is slowing down. Investors have been particularly bullish on the technology sector, which has seen strong gains in recent weeks.

The retreat in bond yields, on the other hand, has been driven by concerns about the economic outlook and the potential for a recession. Falling bond yields are typically seen as a sign of investor risk aversion, as they indicate that investors are seeking safe haven assets.

The mixed jobs data has further complicated the picture, with some analysts suggesting that the report indicates a cooling labor market, while others believe that it is still too early to say definitively whether the economy is slowing down.

Stock Rally: Stocks Rally Bond Yields Retreat Amid Mixed Jobs Data Market Analysis

The recent stock market rally has been fueled by a combination of factors, including optimism about the economic outlook, easing inflation concerns, and continued corporate earnings growth. While some investors remain cautious about the possibility of a recession, the overall sentiment has shifted towards a more positive view.

Drivers of the Rally

The recent stock market rally has been driven by a combination of factors, including:

- Easing Inflation Concerns:Inflation has shown signs of cooling, leading to expectations that the Federal Reserve may soon pause its interest rate hikes. This has boosted investor confidence and reduced concerns about economic growth.

- Strong Corporate Earnings:Companies have continued to report strong earnings, demonstrating resilience in the face of economic challenges. This has provided further evidence of a healthy corporate sector and fueled investor optimism.

- Improved Economic Outlook:Economic data has shown signs of improvement, suggesting that the economy may be more resilient than previously anticipated. This has led to a more positive outlook for corporate profits and economic growth.

Sectors Leading the Gains

Certain sectors have seen particularly strong gains during the recent rally. These include:

- Technology:The technology sector has benefited from a rebound in investor appetite for growth stocks, driven by the potential for continued innovation and growth in areas like artificial intelligence and cloud computing.

- Consumer Discretionary:As consumer confidence improves and inflation eases, spending on discretionary goods and services is expected to increase, benefiting companies in this sector.

- Energy:The energy sector has seen strong gains, driven by high oil and gas prices and the ongoing transition to renewable energy sources.

Investor Sentiment and Risk Appetite, Stocks rally bond yields retreat amid mixed jobs data market analysis

Investor sentiment has shifted towards a more positive view, with many investors becoming more willing to take on risk. This is reflected in the strong performance of growth stocks and other riskier assets.

“The recent stock market rally has been driven by a combination of factors, including easing inflation concerns, strong corporate earnings, and a more positive economic outlook. Investor sentiment has shifted towards a more positive view, with many investors becoming more willing to take on risk.”

The market seems to be taking a cautious approach today, with stocks rallying and bond yields retreating despite mixed jobs data. This suggests a potential shift in investor sentiment, possibly fueled by the recent news that GM and Samsung SDI are joining forces to build a $3 billion electric vehicle battery plant in Indiana.

This significant investment in the EV sector could be a sign of a growing confidence in the future of sustainable transportation, which might be influencing the market’s current direction.

The stock market rallied and bond yields retreated yesterday, reacting to mixed jobs data that offered a glimmer of hope for a soft landing. However, the cautious mood is likely to persist as investors digest the implications of this mixed bag.

This sentiment is reflected in Asian markets, which are facing a cautious start as US futures slip, as you can see in this recent market update. It’s a reminder that the economic outlook remains uncertain, and the market’s reaction to future data releases could be volatile.

The stock market’s recent rally and retreat in bond yields, fueled by mixed jobs data, highlights the delicate balance between economic optimism and uncertainty. This dynamic is mirrored in the cryptocurrency world, where the differences between Bitcoin and Ethereum are becoming increasingly apparent.

While Bitcoin remains the dominant force, Ethereum’s smart contract capabilities and potential for decentralized applications are attracting significant interest, as explored in this insightful article on how ethereum is different from bitcoin. Ultimately, the future trajectory of both traditional and digital assets will likely depend on the interplay of economic indicators, investor sentiment, and technological innovation.